Updated September 18, 2023

South Carolina bill of sale forms are used to convey personal property from a seller to a buyer in exchange for cash or trade. A bill of sale should be signed when the parties transact and the document can be used by the buyer to prove ownership. For vehicles, the seller should also provide the Certificate of Title so the buyer can register with the Department of Motor Vehicles.

Forms (4)

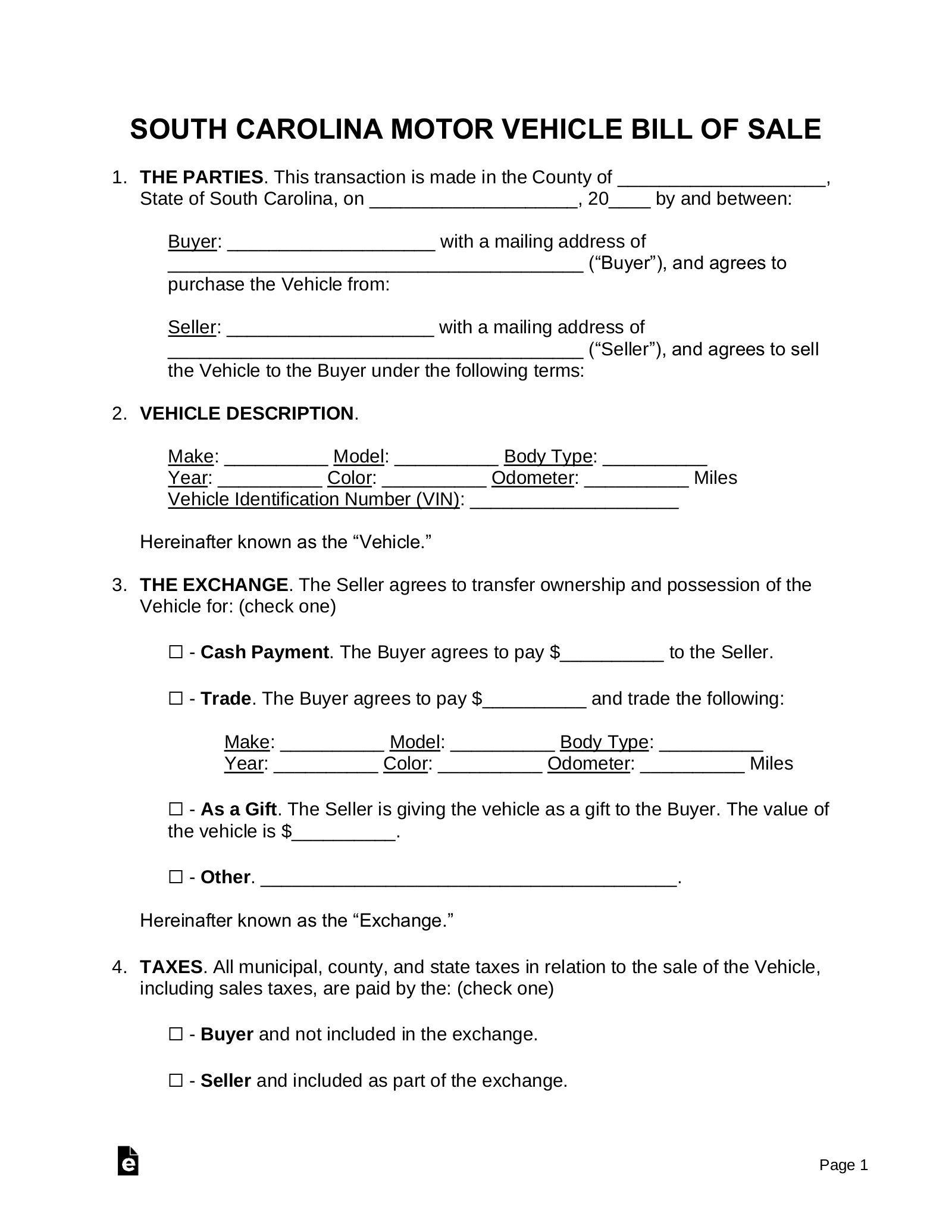

Motor Vehicle Bill of Sale – This document will provide information regarding the identification, sale, purchase, and change of ownership of a motor vehicle. This document will likely be needed to complete registration. Motor Vehicle Bill of Sale – This document will provide information regarding the identification, sale, purchase, and change of ownership of a motor vehicle. This document will likely be needed to complete registration.

Download: PDF, MS Word, OpenDocument |

Boat Bill of Sale – This document will provide information about the vessel and prove the legal sale and purchase of the watercraft/vessel. Boat Bill of Sale – This document will provide information about the vessel and prove the legal sale and purchase of the watercraft/vessel.

Download: PDF |

General Bill of Sale – This form is often used between private parties to prove the purchase and change of ownership of private property. General Bill of Sale – This form is often used between private parties to prove the purchase and change of ownership of private property.

Download: PDF, MS Word, OpenDocument |

Firearm Bill of Sale – Proves that a firearm has been legally sold, purchased, and its ownership has changed. Firearm Bill of Sale – Proves that a firearm has been legally sold, purchased, and its ownership has changed.

Download: PDF, MS Word, OpenDocument

|

Vehicle Registration Forms

- A completed Application for a Certificate of Title and Registration (Form 400)

- A title that has been signed over to you

- A valid driver’s license or ID

- Buyers that lack a South Carolina driver’s license or ID may submit Form TI-006

- Proof of payment of an infrastructure maintenance fee of five percent of the purchase price or $500, whichever is the lesser; this fee replaced the property tax once owed on the sale of vehicles taking place after July 1, 2017[1]

- A bill of sale

- Proof of insurance meeting South Carolina’s minimum automobile insurance requirements:[2]

- $25,000 for a single injury

- $50,000 for a single accident

- $25,000 for property damage

- If the buyer or seller is acting on behalf of another, a Motor Vehicle Power of Attorney

- Payment of all registration and title fees.

Boat Registration Forms

- A Watercraft/Outboard Motor Application

- A Bill of Sale

- If the boat was previously titled, the original title signed over to the buyer, or if the boat is purchased new from a dealer, the manufacturer’s statement of origin

- If the boat was previously titled in another state, a pencil tracing or photograph of the boat’s hull identification number and the motor’s serial number

- Driver’s license or state ID

- Proof of payment of all registration fees

- For boats with existing South Carolina title, proof of payment of all taxes in the form of a property tax receipt from the buyer’s county of residence

- Boats purchased that were previously titled in another state, or purchased new from a South Carolina dealer, will be assessed taxes after the registration process is completed