Updated April 18, 2024

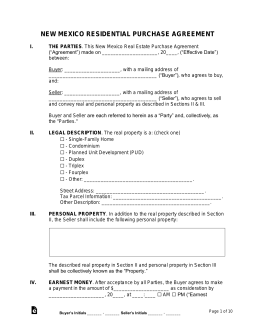

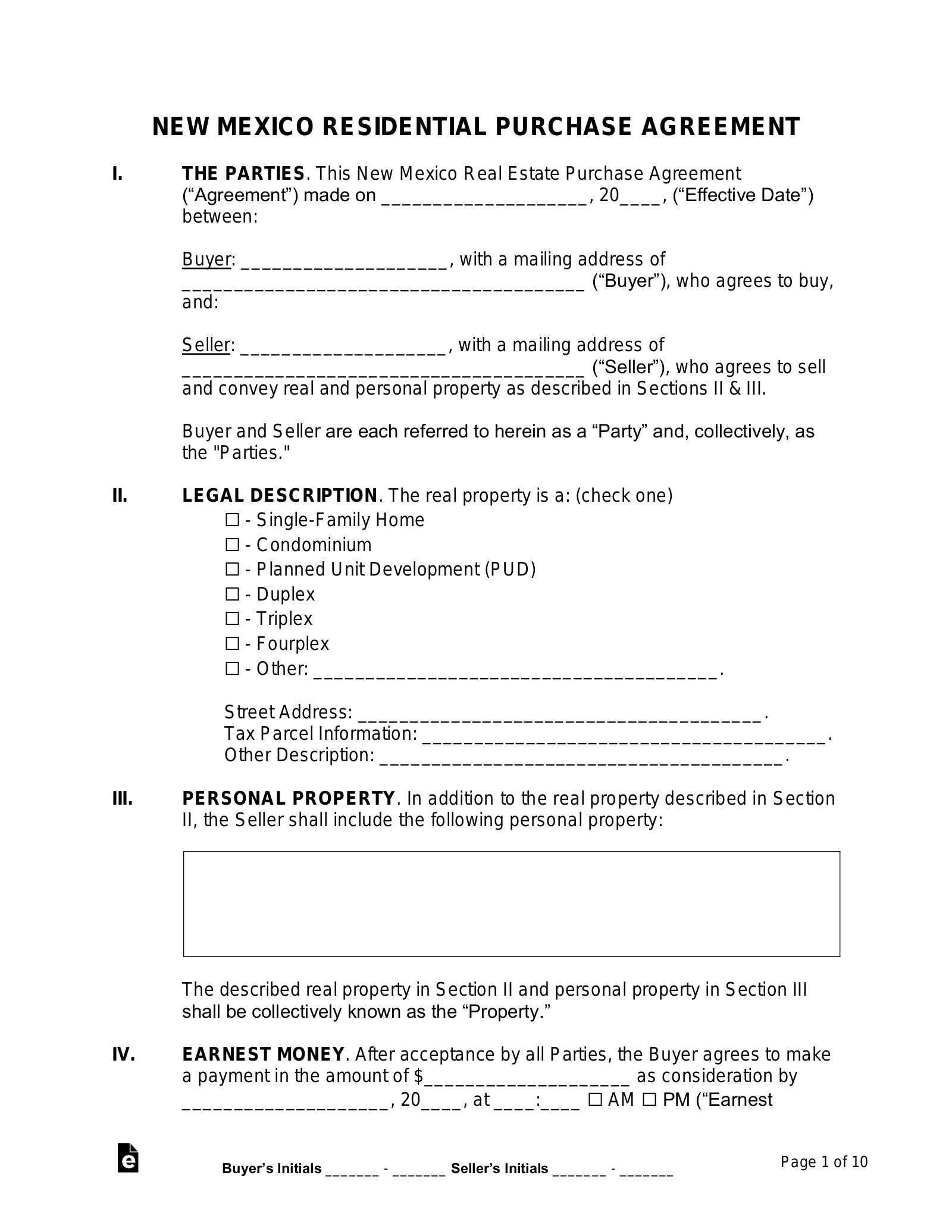

A New Mexico residential real estate purchase and sale agreement is a legal document binding the seller of a residence and the potential buyer of the property. On the form, the buyer’s monetary offer and terms will be written, as well as the date by which the offer will be closed. The seller can negotiate, accept, or refuse the offer up until the closing date.

In some instances, items such as furniture, appliances, and utilities may be included in the sale, in which case these should also be included in the agreement.

Table of Contents |

Disclosures (3)

Lead-Based Paint Disclosure – When selling a property that was constructed before 1978, sellers must provide buyers with this disclosure statement and reveal their knowledge of any lead-based paint used on the property.

Lead-Based Paint Disclosure – When selling a property that was constructed before 1978, sellers must provide buyers with this disclosure statement and reveal their knowledge of any lead-based paint used on the property.

Download: PDF

Seller’s Property Disclosure Statement – If listed with a broker, there is a requirement that any known material defects on the property must be disclosed.[1]

Seller’s Property Disclosure Statement – If listed with a broker, there is a requirement that any known material defects on the property must be disclosed.[1]

Download: PDF

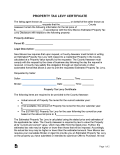

Estimated Property Tax Levy Disclosure – The seller must have a county assessor estimate the property tax levy of the property and provide a copy of the assessor’s response to the purchaser. This form must be signed by the local county assessor.[2]

Estimated Property Tax Levy Disclosure – The seller must have a county assessor estimate the property tax levy of the property and provide a copy of the assessor’s response to the purchaser. This form must be signed by the local county assessor.[2]

Download: PDF, MS Word, OpenDocument

Commercial Property

Commercial Purchase Agreement – Use this agreement to purchase or sell commercial property.

Commercial Purchase Agreement – Use this agreement to purchase or sell commercial property.

Download: PDF, MS Word, OpenDocument