Updated August 01, 2023

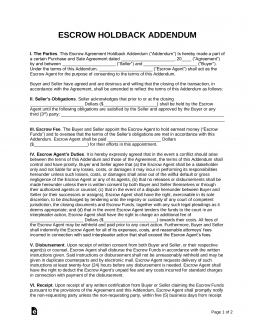

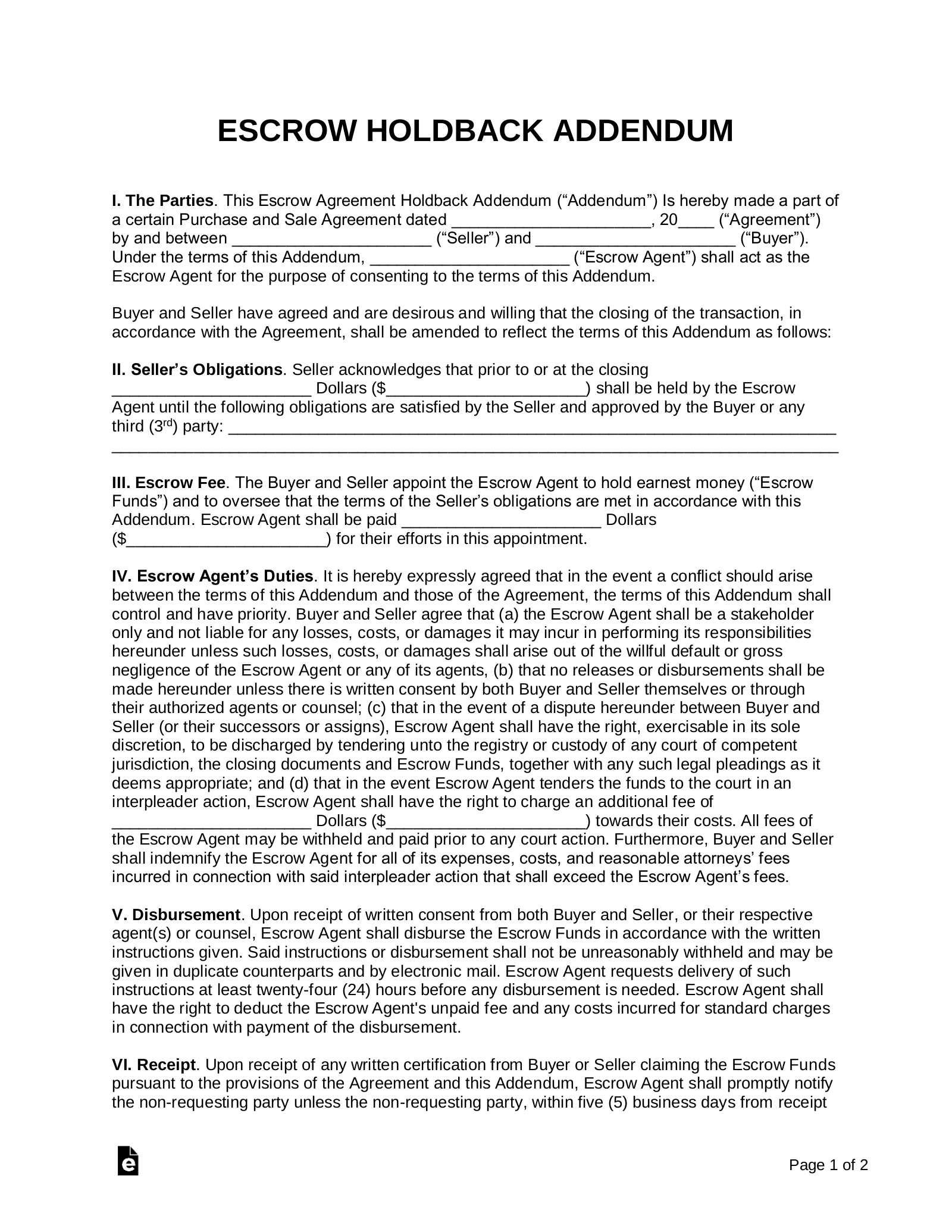

An escrow holdback agreement addendum is used to set rules for money that is “held back” until the seller of property fulfills their duties after the closing occurs. The agreement outlines work or tasks that are needed to be completed in order for the seller to collect the last payment for the purchase of their property after the closing. In most cases, the title company or other escrow company acts as an intermediary and will only release the funds to the seller upon the completion of the seller’s duties in accordance with this addendum.

Escrow Agent – The title company, lender, agent, or other third (3rd) party should act as the middle-person. It is not recommended to elect the buyer or seller to act as the intermediary or holder of the escrow funds.

Interest Earned (26 § 1.468B-7(b)(1)(iv)) – Per the Internal Revenue Service (IRS) Code, any interest accrued while money is being held in an escrow account for the purchase of property shall be paid to the benefit of the buyer.