Updated November 15, 2023

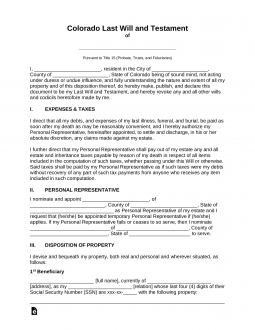

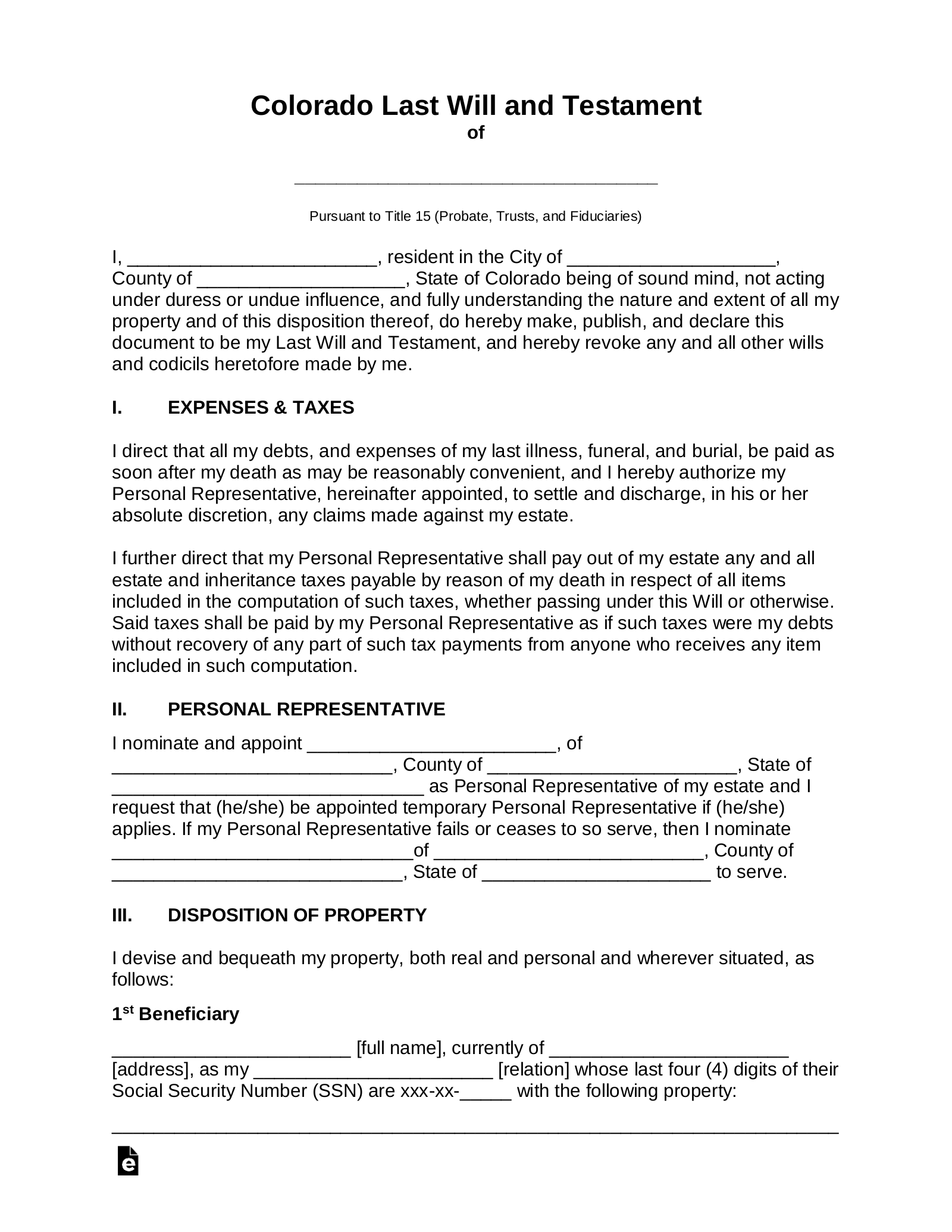

A Colorado last will and testament is a legal document that allows a testator (the person to whom the will belongs) to communicate their wishes with regard to the distribution of personal, fiduciary, or real property upon their death. Under Colorado law, a will document must be signed by the testator before two or more competent witnesses or before a notary public.

Signing Requirements

Must be signed by at least two individuals within a reasonable time after they witnessed the testator’s signing of the will. Or it can be signed before a notary public or another individual authorized by law.[1]

State Definition

“Will” includes any codicil and any testamentary instrument that merely appoints an executor, revokes or revises another will, nominates a guardian, or expressly excludes or limits the right of an individual or class to succeed to property of the decedent passing by intestate succession.[2]

Related Forms

Download: PDF

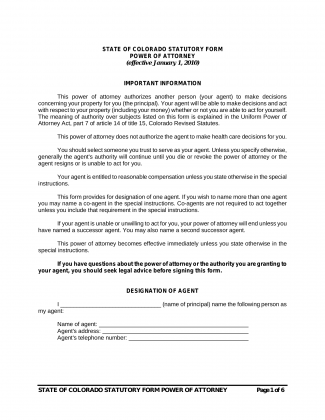

Durable Financial Power of Attorney

Durable Financial Power of Attorney

Download: PDF