Updated April 16, 2024

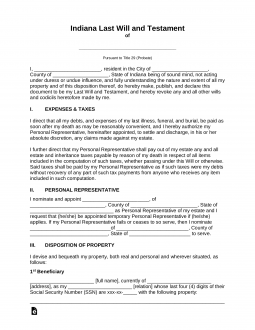

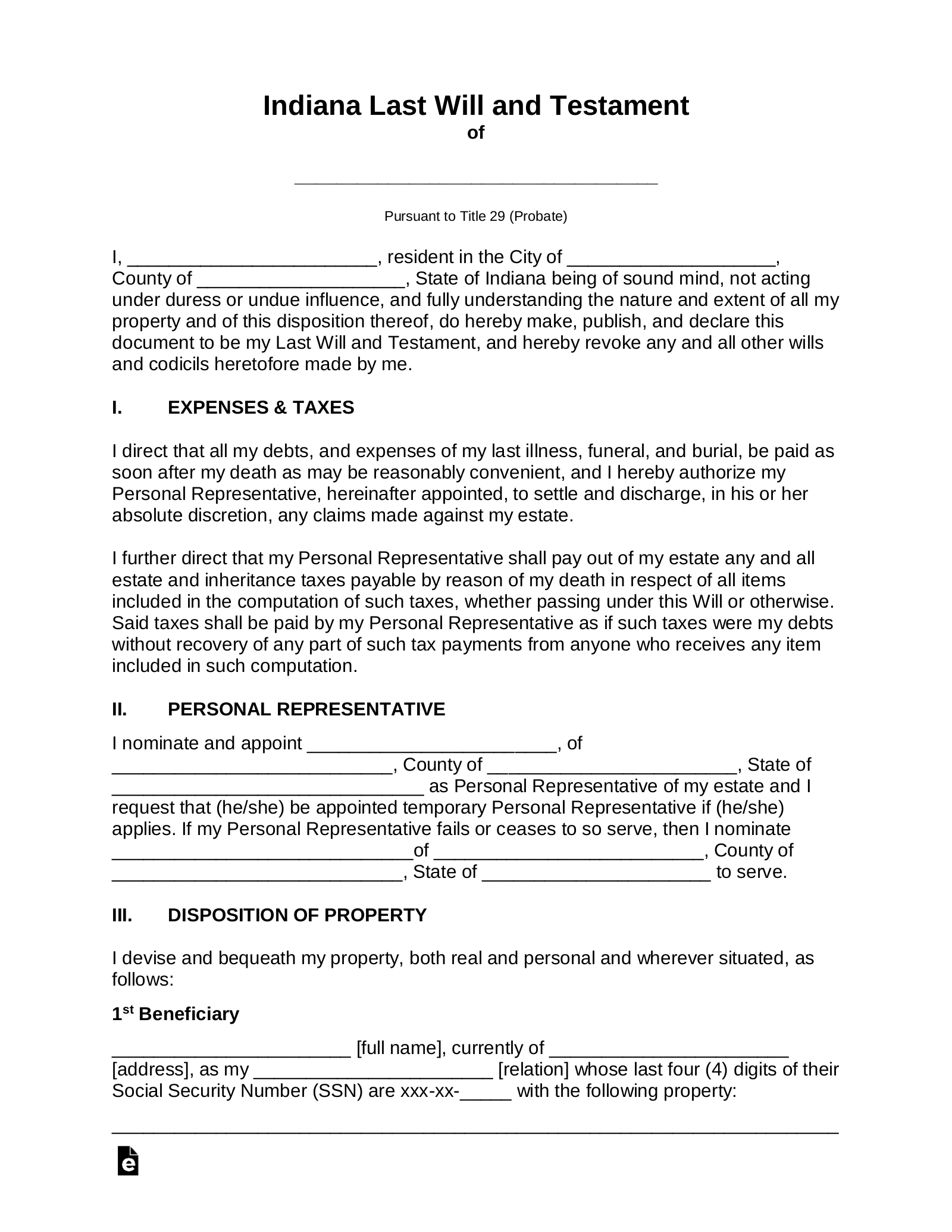

An Indiana last will and testament is a legal document used to properly distribute one’s properties among their chosen beneficiaries upon their death. The individual (“testator”) may outline detailed instructions on how their personal and real property, fiduciary assets, and even digital property are to be dispersed among their beneficiaries.

Signing Requirements

Requires the signatures of two or more witnesses.[1]

State Definition

“Will” includes all wills, testaments, and codicils. The term also includes a testamentary instrument that merely appoints an executor or revokes or revives another will.[2]

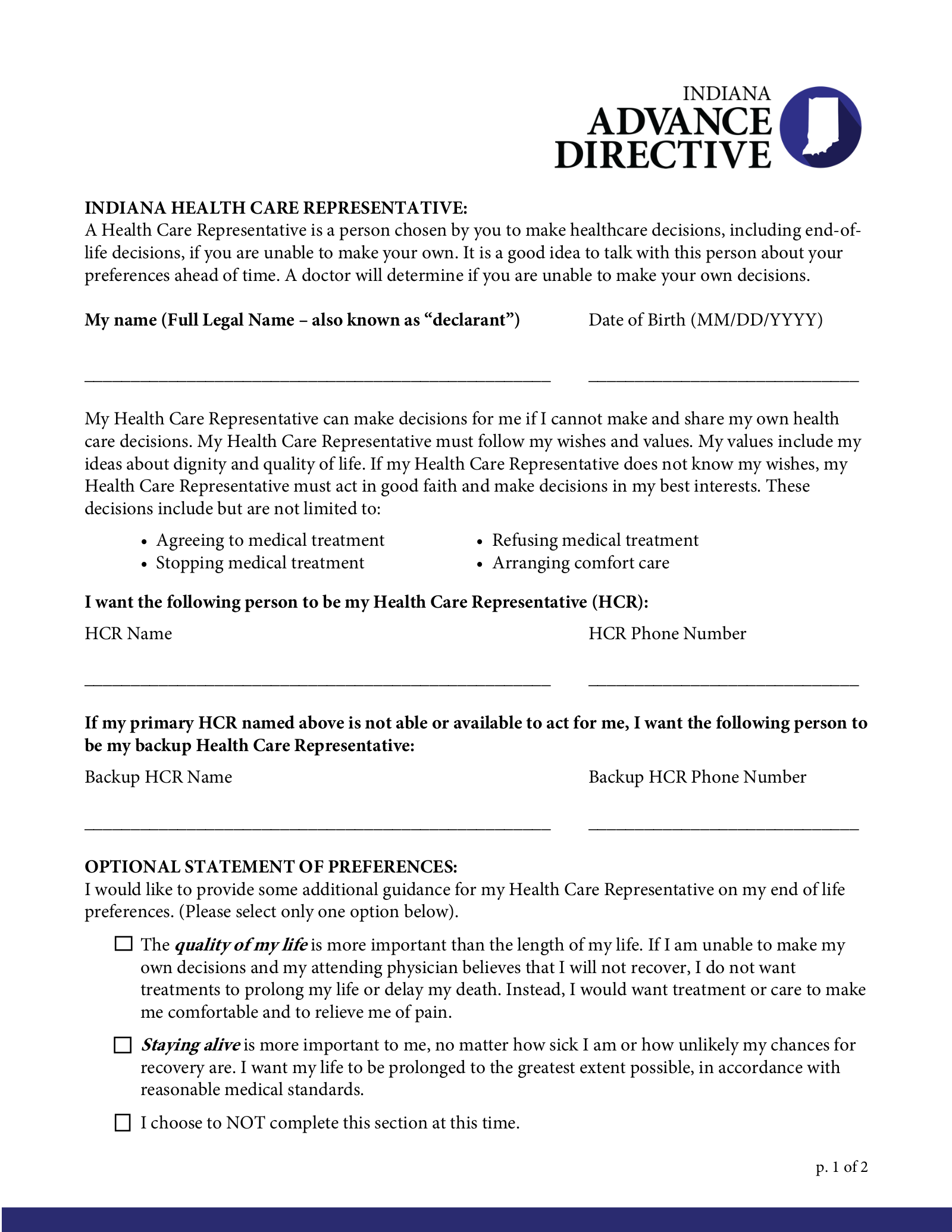

Related Forms

Download: PDF

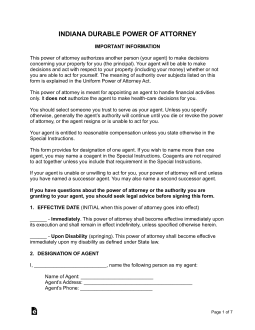

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: PDF, MS Word, OpenDocument