Updated November 14, 2023

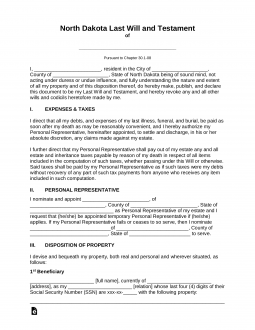

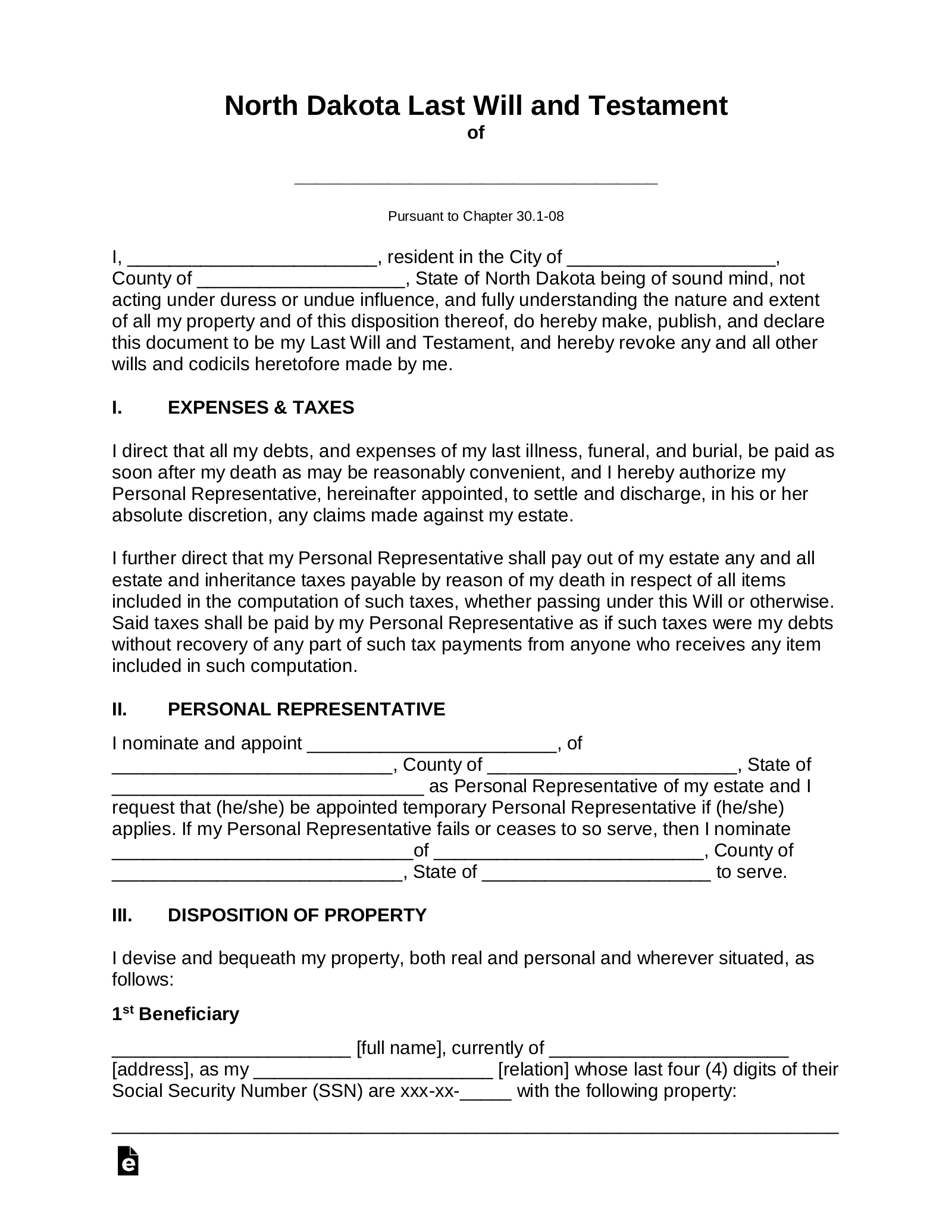

A North Dakota last will and testament is a legal document that details instructions regarding the distribution of an individual’s financial accounts, real and personal property, cash-on-hand, life insurance policies, as well as any other assets/property upon their death. Known as the “testator,” the individual’s property can be transferred upon death to designated beneficiaries, such as relatives, friends, or even charitable organizations.

Signing Requirements

Must be signed by the testator in the presence of at least two individual witnesses or a notary public.[1]

State Definition

“Will” includes codicil and any testamentary instrument that merely appoints an executor, revokes or revises another will, nominates a guardian, or expressly excludes or limits the right of an individual or class to succeed to property of the decedent passing by intestate succession.[2]

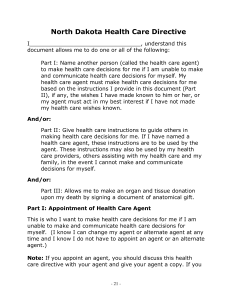

Related Forms

Download: PDF

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: PDF