Updated November 15, 2023

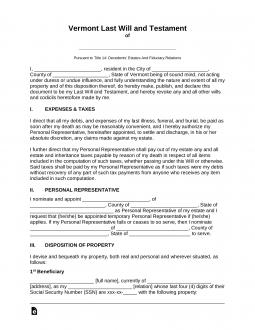

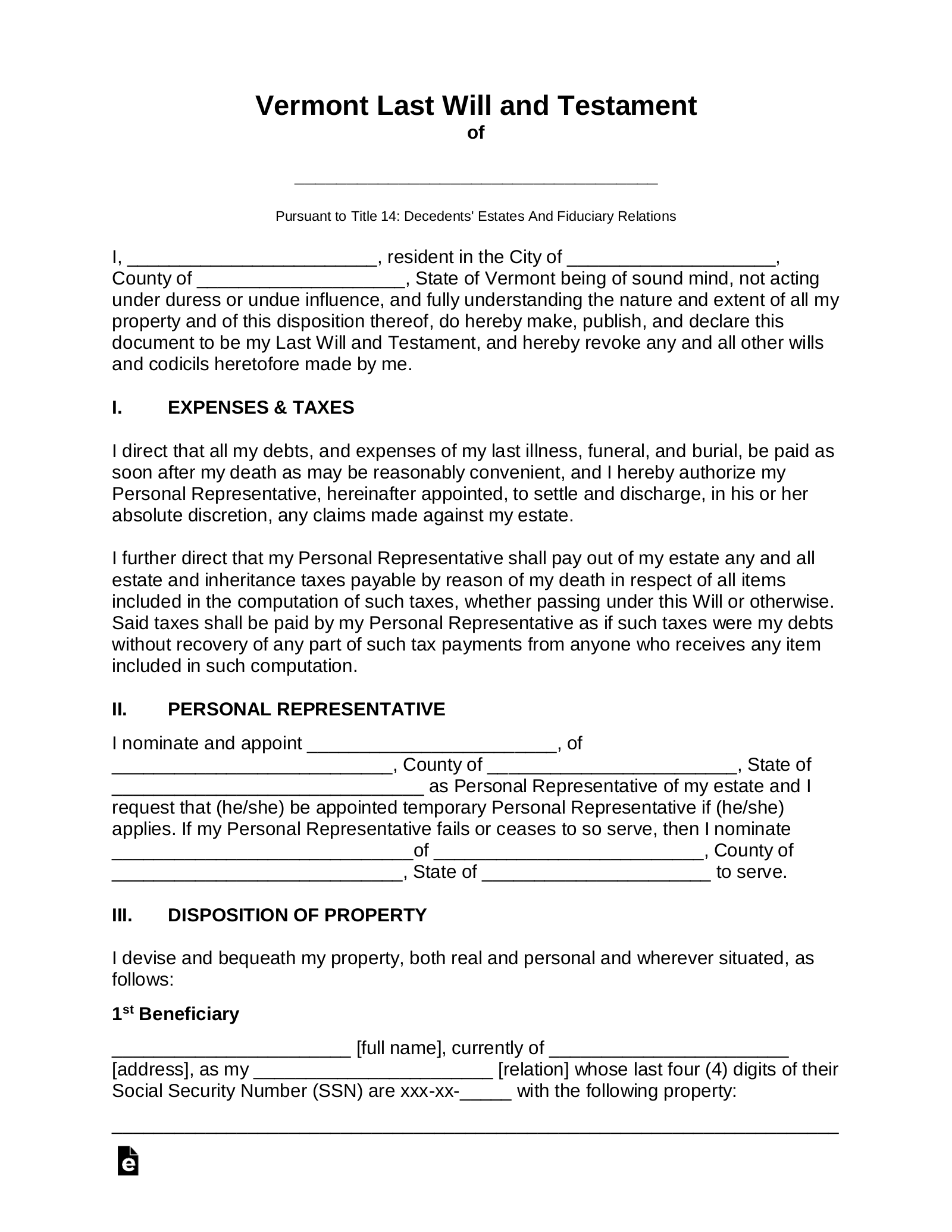

A Vermont last will and testament is a legal document that allows an individual (“testator”) to outline their wishes about the distribution of personal, fiduciary, or real property upon their death. Creating a will ensures all property left behind will be properly dispersed in accordance with the testator’s instructions among family, friends, domestic partners, charities, or whomever else the testator names as a beneficiary.

Signing Requirements

Must be signed by the testator and by two or more credible witnesses in the presence of the testator and each other.[1]

Related Forms

Download: PDF

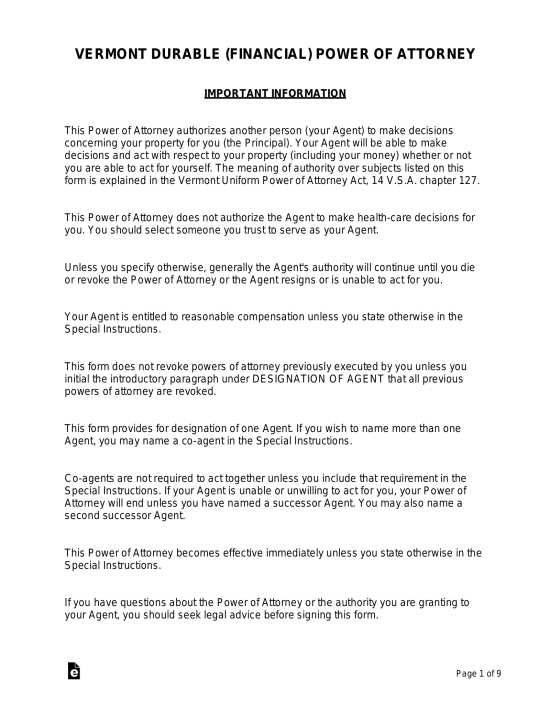

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney