Updated November 15, 2023

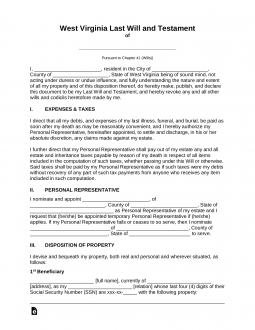

A West Virginia last will and testament is a legal document that allows an individual (“testator”) to outline their wishes for the distribution of their personal and real property, fiduciary assets, digital property, and any other property after their death. On their will, a testator can designate beneficiaries, such as family, friends, and charitable organizations.

Signing Requirements

Must be signed by the testator in the presence of at least two competent witnesses present at the same time. The witnesses must also sign the will in the presence of the testator.[1]

State Definition

“Wills” shall be valid if written and signed under the requirements of Sec. 41-1-3.[2]

Related Forms

Download: PDF

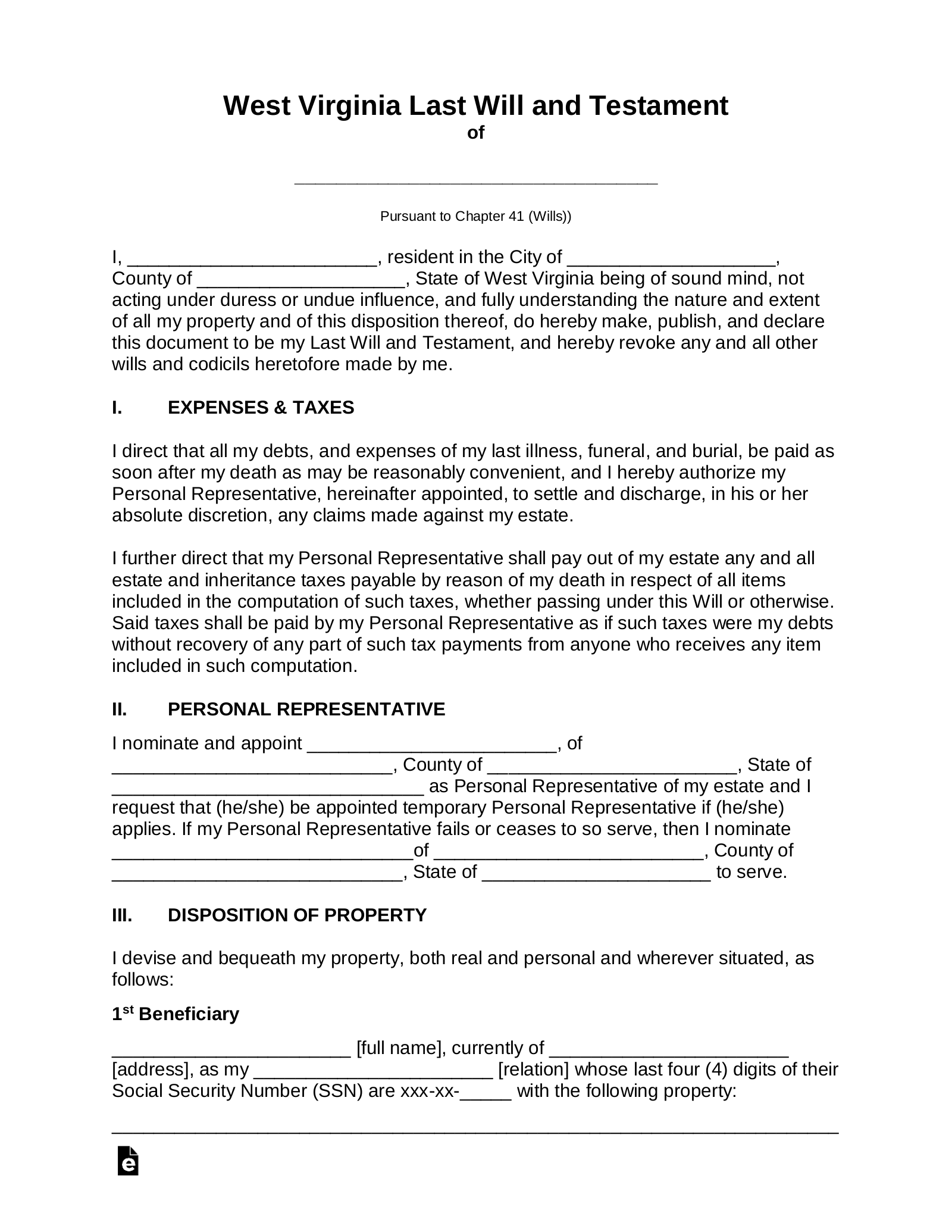

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: PDF, MS Word, OpenDocument