Updated November 14, 2023

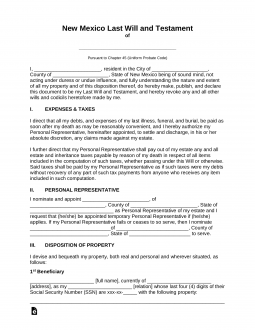

A New Mexico last will and testament is a legal document used by a testator (the person creating the will) to provide instructions on how their estate shall be distributed upon death. All aspects of the testator’s estate — such as financial accounts, fiduciary funds, life insurance policies, as well as real, personal, and even digital property — can all be bequeathed to beneficiaries as outlined on the testator’s will and carried out by the chosen executor.

Signing Requirements

Must be signed by two or more witnesses.[1]

State Definition

“Will” includes codicil and any testamentary instrument that merely appoints a personal representative, revokes or revises another will, nominates a guardian or expressly excludes or limits the right of an individual or class to succeed to property of the decedent passing by intestate succession. “Will” does not include a holographic will.[2]

Related Forms

Download: PDF, MS Word, OpenDocument

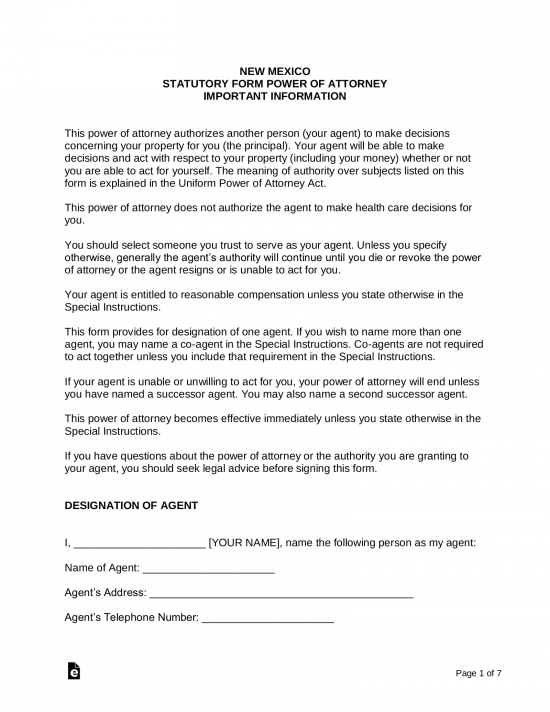

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: PDF, MS Word, OpenDocument

Download: PDF, MS Word, OpenDocument