Updated April 29, 2024

A Connecticut small estate affidavit allows assets from estates worth less than a set amount of money to pass to the heirs or successors of the decedent without having to go through the traditional probate process. Doing this can allow the decedent’s survivors to use property in the estate to settle looming debts or upfront costs like funeral expenses. The small estate affidavit process, built around fling Form PC-212, is available for decedents who had a will, or those who died intestate.

Laws

- Days After Death – There is no requirement for the number of days that must have elapsed since the death of the decedent before filing. However, state law requires that courts may not act on the affidavit until at least thirty (30) days after receiving it.[1]

- Maximum Amount ($) – The total value of all personal property in the decedent’s estate may not exceed $40,000. The affidavit process is not available for estates that include real estate that was solely owned by the decedent.[2]

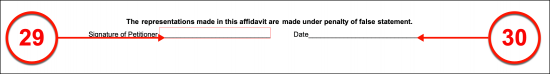

- Signing – Form PC-212 must be signed by the petitioner under penalty of false statement.

- Statutes – Chapter 802B, Part I (Settlement of Small Estates Without Probate of Will or Letters of Administration)

How to File (4 steps)

- Step 1 – Inventory Assets

- Step 2 – Fill out Form PC 212

- Step 3 – File the Forms

- Step 4 – Await Distribution

Step 1 – Inventory Assets

The person who will fill out Form PC 212 is known as the “affiant.” The affiant should first make sure that the decedent did not have any solely owned real property (land and fixtures); if the estate does include real property, it’s not eligible for the process. Then, make a list of the decedent’s personal property and add up the value to make sure it is less than $40,000.

Step 2 – Fill out Form PC 212

Form PC-212 is the affidavit itself. At the same time, fill out PC-212CI, which is a supplement to the affidavit used for confidential information about the decedent, in particular the decedent’s Social Security Number. And, depending on the decedent’s situation, it may also be necessary to fill out Form PC-212A. Under CGS § 45a-365, the decedent’s estate must first be used to settle any outstanding funeral expenses, medical bills, or costs associated with administering the estate. If these exceed whatever value was found in Step 1, then it is not necessary to fill out Form PC-212A. However, if the value of the estate is greater than the sum of these, meaning that there will be assets left over to distribute to heirs or successors, then it is necessary to fill out Form PC-212A, known as a Request for an Order of Distribution.

Step 3 – File the Forms

Connecticut allows small estate affidavits to be filed electronically here. Alternatively, the forms may also be filed in person using this Court Locator. If Filing Form PC-212 in person, make sure to have two notarized copies to submit.

Step 4 – Await Distribution

Once at least thirty (30) days have passed since the forms were submitted, the probate court will make a determination about the distribution of the decedent’s estate. If the decedent had a will, its instructions will determine distribution; if the decedent died intestate, the Connecticut intestacy rules will govern. After the court has made a determination, it will pass on its order to the Department of Administrative Services, who will be responsible for carrying out the distribution.

Video

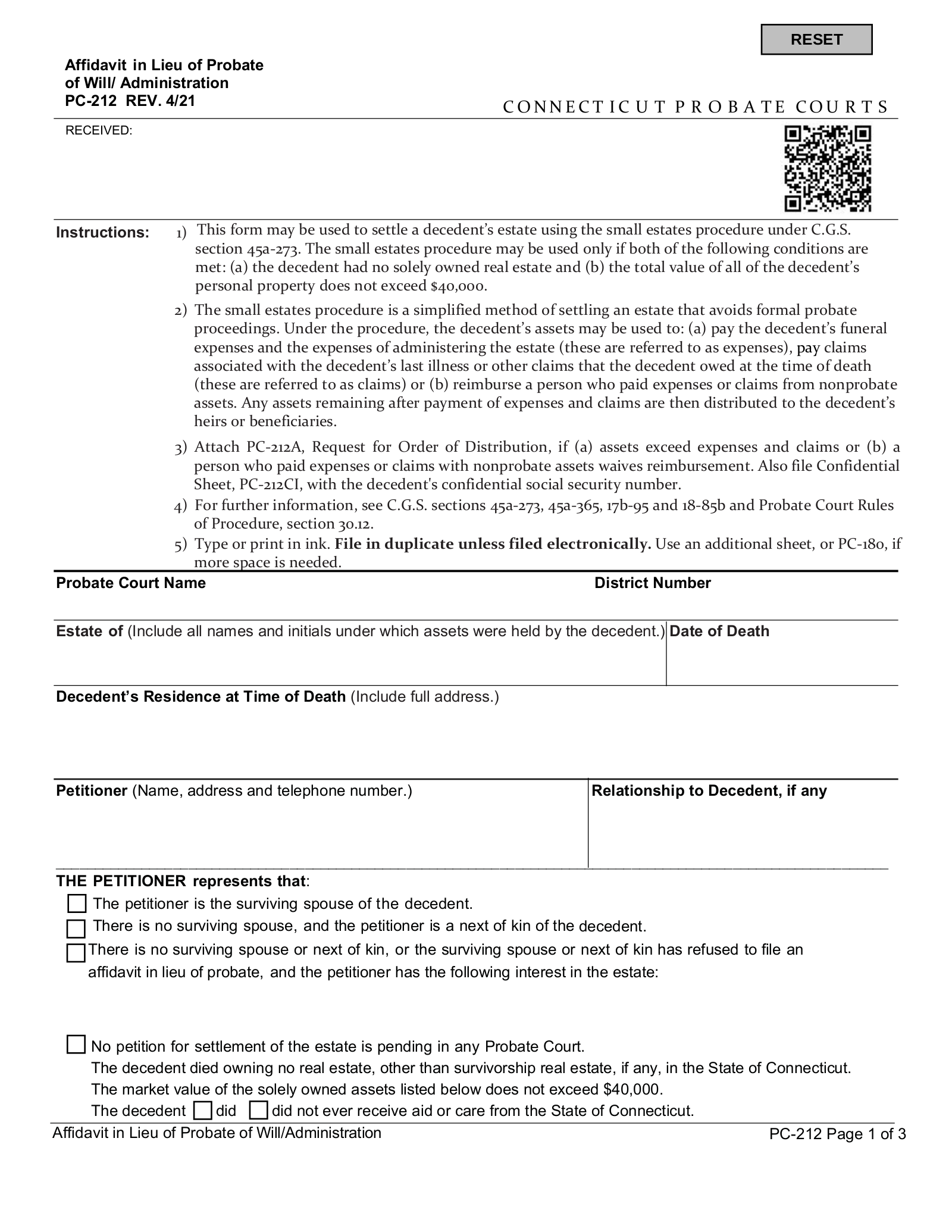

How to Write

Download: PDF

Connecticut Jurisdiction

(1) Probate Court Name. The name of the Connecticut State Court that will receive this document should be dispensed at the beginning.

(2) District Number. Present the district number defining where the Connecticut Court named above operates.

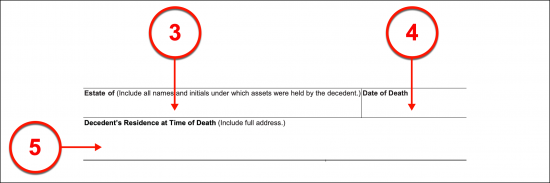

(3) Estate. The name of the Decedent, as well as any alias or Company Name used by the Connecticut Decedent should be documented. Thus, if he or she owned an (unincorporated) Company or Store, then record the name of this Business in addition to the Decedent’s full name.

(4) Date Of Death. The calendar date when the Connecticut Decedent was declared dead must be copied to the next area exactly as it appears on his or her death certificate.

(5) Decedent’s Residence At Time Of Death. The physical address where the Connecticut Decedent maintained his or her residence or home at the time of his or her death is required to aid in identifying him or her properly.

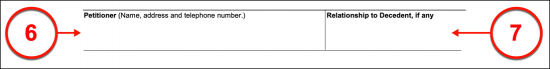

(6) Petitioner. The Party completing this form to gain the Connecticut Decedent’s estate must be identified as its Petitioner or Affiant. Each Person who is seeking the Decedent’s estate through this document must be identified as a Petitioner (or Affiant) where this information is requested. In addition to the full name of each Affiant, his or her complete address and current telephone number must be established.

(7) Relationship To Decedent, If Any. The Affiant’s relationship to the Connecticut Decedent should be summarized. If there is more than one Petitioner then make sure that the relationship held with the Decedent is recorded in coordination with the Petitioner’s name. You may use an attachment if more room is needed, but make sure it is clearly labeled and physically attached to this document before the Affiant executes this form with his or her (or their) notarized signatures.

Petitioner Status

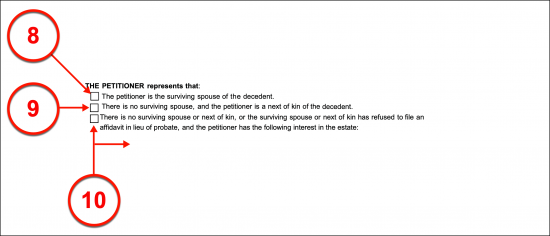

(8) Spouse As Petitioner. The reason why the Petitioner has the right to claim the Connecticut Decedent’s property or estate will bear some discussion. If the Petitioner submitting this form is the Connecticut Decedent’s Spouse then select the first checkbox statement from the list of status definitions provided.

(9) Next Of Kin Affiant. Choose the second status statement if the Connecticut Decedent did not have a Spouse and the Petitioner is the Connecticut Decedent’s next of kin.

(10) Special Petitioner Interest. If the Connecticut Affiant was not the Decedent’s Spouse or next of kin and the Connecticut Decedent does not have a Spouse or next of Kin interested in his or her estate, then the third checkbox should be selected. Naturally, this will mean that the Affiant will have a specific basis or reason to file this petition. This reason of entitlement to the Connecticut Decedent’s estate must be presented in the area provided.

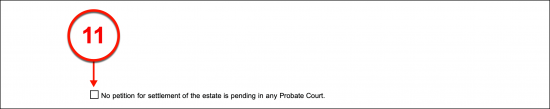

(11) Not Current Petition For Settlement. Select the fourth check box statement if there has not been a petition made for the Connecticut Affiant’s estate and there are no current motions in place or pending in Probate Court concerning the Connecticut Decedent’s property.

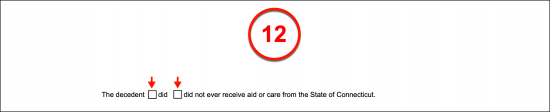

(12) Connecticut Aid. Locate the statement made containing two checkboxes. Here, it must be established whether the Connecticut Decedent received government aid from the State of Connecticut. If so, then select the “Did” checkbox. If not, choose the “Did Not Ever” checkbox from this statement.

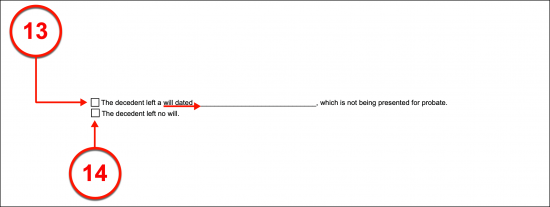

(13) Decedent Will. If the Connecticut Decedent died with a will in place that will not and has not been presented in Probate Court then select the appropriate statement’s checkbox. It is imperative that the date of the will issued by the Connecticut Decedent be documented with this statement’s selection.

(14) Intestate Decedent. Choose the checkbox corresponding to the words “The Decedent Left No Will” if he or she died intestate and no formally issued will is known of.

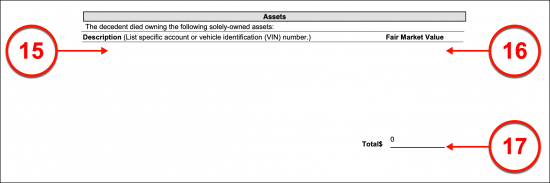

(15) Decedent Asset Estate. Naturally, the Connecticut Decedent will have had some property, although any real property or real estate would discount the eligibility of his or her estate to be acted on through this document. Each piece of property whether it is tangible or intangible must be documented. Use the “Description” column in “Assets” to list all the property in the Connecticut Decedent’s estate. This may include items such as vehicles, stocks, and any other property that was owned by the Connecticut Decedent when he or she died.

(16) Fair Market Value. The monetary worth of every asset in the Connecticut Decedent’s estate should be recorded. Use the column on the right to dispense these dollar amounts with the asset being discussed on that line.

(17) Total. Add every dollar amount recorded in the “Fair Market Value” column then document this sum as the “Total” value of the Connecticut Decedent’s estate.

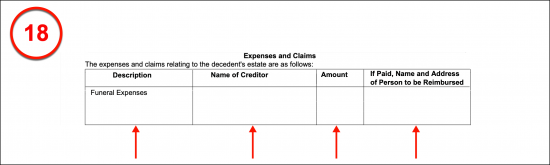

Expenses And Claims

(18) Funeral Expenses. In many cases, the Connecticut Decedent will have passed away with some debts or he or she may owe debts accrued after death. The “Expenses And Claims” made on the Connecticut Decedent’s estate must be presented in this paperwork. Several areas have been reserved for this discussion beginning with the “Funeral Expenses” row. If the Connecticut Decedent’s estate must pay for his or her funeral, then record the full name of the Funeral Home as the name of the Decedent’s Creditor in the second column and the “Amount” owed for the funeral. The final column is reserved to present any Party(ies) that have already paid the Decedent’s funeral expenses but will require reimbursement. The name of each Reimbursable Party along with the address and the amount owed as reimbursement should be presented in this column.

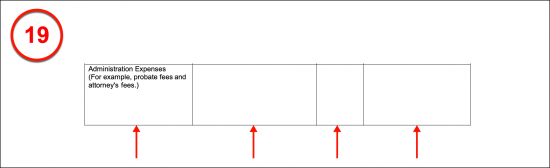

(19) Administration Expenses. The fees required by Courts, Attorneys, Coroners, and any other Party that (rightfully) bills the Connecticut Decedent’s estate must be listed by the Creditor along with the “Amount” that is owed. Use the appropriate columns to present this information in the second row. Any Reimbursable Party who has covered some or all of the Administration Expenses reported should be identified by name, address, and the amount that he or she must be reimbursed for.

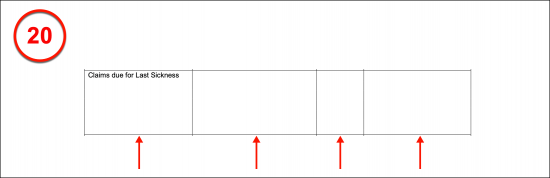

(20) Claims Due For Last Sickness. If the Connecticut Decedent’s estate owes money for his or her end-of-life medical care, then the name of the Creditor that must be paid and the amount that is owed should be presented. Use the second and third columns of the appropriate row for this report. Additionally, the fourth column requires a record of the name and address of any Party that has paid for the Connecticut Decedent’s medical expenses and wishes to be reimbursed. This must be accompanied by the amount the Reimbursee expects to be repaid.

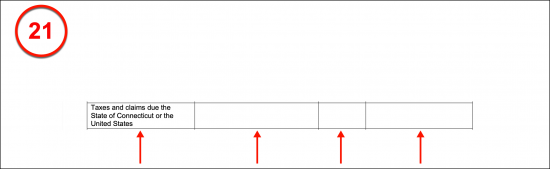

(21) Taxes And Claims Due To Connecticut. If the State of Connecticut (and any department run by the State) can make a claim on the Decedent’s estate, then it should be listed in the Creditor column. For instance, the Decedent may have agreed to pay the Connecticut Department of Revenue a certain amount from a previous judgment. If so, define the Connecticut Department acting as Creditor by name and address then record the amount the Decedent owed when he or she died. If any Party can claim that he or she has paid some or all of this debt and seeks reimbursement then record his or her name, address, and reimbursable amount.

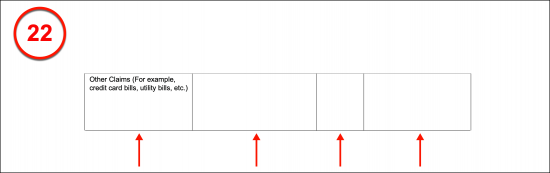

(22) Other Claims And Expenses. Any other expenses the Connecticut Decedent died owing (i.e. credit cards, car loans, utility bills) should be included by naming each Creditor along with the amount that is owed to that Creditor. The final column will allow any Reimbursable Party who has paid part or all of the amounts listed to the left to be named with his or her address and the amount that should be given to him or her as reimbursement.

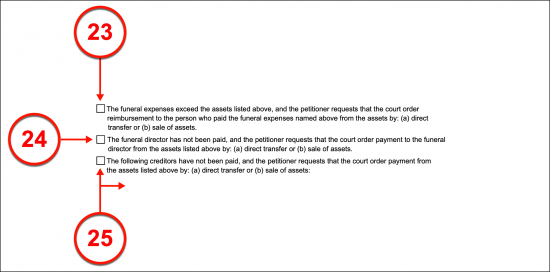

(23) Ordered Reimbursement For Excessive Funeral Expenses. The next topic shall deal specifically with the funeral payment status of the Connecticut Decedent. Select the first checkbox statement on this subject if the funeral expenses were greater than the amount of money that making up the worth of the Decedent’s estate and the Payer of the funeral wishes reimbursement made through a transfer of an asset or to receive cash as a reimbursement.

(24) Direct Payment To Funeral Director. If the Funeral Director has not been paid for the Decedent’s funeral expenses and this paperwork intends to secure this payment through the transfer of assets or a cash payment to the Funeral Director, then the second statement should be selected.

(25) Payment Directly Creditors. If the Connecticut Decedent’s Creditors should be paid directly from the estate of the Decedent then mark the third checkbox. Make sure to list every Creditor requiring payment made directly in the space provided.

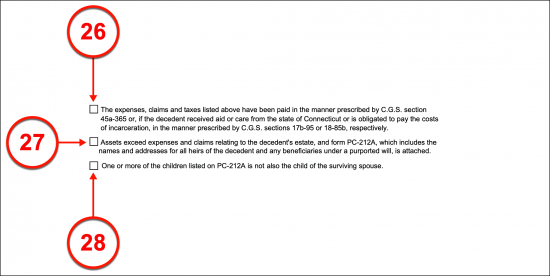

(26) State Assistance. If the Decedent received aid from the state or must pay for the cost of incarceration, then select the fourth definition to include this status.

(27) Assets Exceed Expenses. Select the second to the final status statement if the monetary worth of the Connecticut Decedent’s estate is greater than the amount of money that his or her estate must pay in debt. This requires that a list of the Decedent’s Heirs and (if available) will be attached to this document.

(28) Decedent Children. In some cases, the Affiant may be the Child of the Connecticut Decedent but not the child of the Decedent’s Spouse. Select the checkbox corresponding to the final status statement if this is the case.

(29) Signature Of Petitioner. Each Petitioner must sign his or her name to this document. If there is more than one, then the “Signature Of Petitioner” line as well as the “Date” line should be reproduced to present enough room for every Connecticut Affiant to sign his or her name to this paperwork. Make sure that any attachments named in this document are present at the time of signing.

(30) Date. The signature date when the Connecticut Affiant signs his or her name should also be submitted once the act of signing is completed.