Updated April 29, 2024

A Texas Small Estate Affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when the estate is worth $75,000 or less and lacks a will. A successor can use the form to claim assets without undergoing a complicated court proceeding. The form must be approved, however, by the probate court in the county in which the decedent resided at the time of his/her death before it can be used to collect property.

Laws

- Days after Death – Thirty (30) days must pass after the decedent dies before the affidavit can be used.[1]

- Filing Fee – Varies by county. Find your county office to inquire.

- Maximum Amount ($) – $75,000. State law defines a small estate as being valued at not more than $75,000. This does not include homestead and exempt property.[2]

- Motor Vehicles – A separate form will entitle you to a motor vehicle. Use the Affidavit of Heirship for a Motor Vehicle to claim ownership, and file this with your local DMV Office.

- Signing Requirements – Form must be signed in the presence of a notary public and sworn by two (2) disinterested witnesses.[3]

- Statute – Estates Code, Chapter 205. Small Estate Affidavit

How to File (6 steps)

- Gather Information

- Prepare Affidavit

- Identify Witnesses

- Get Forms Notarized

- File with Probate Court

- Distribute Affidavit

1. Gather Information

The law requires you to wait thirty (30) days before you file a small estate affidavit. You can use this time to gather all the information you’ll need. Determine whether the decedent had a will; if so, you cannot use a small estate affidavit. Calculate the value of all assets (excluding homestead an exempt property) and debts. If the amount of debt is greater than the assets, you cannot use the small estate affidavit. You can find a list of exempt property in § 353.051. List each asset with enough detail to identify exactly what the asset is.Determine whether the decedent applied for Medicaid benefits on or after March 1, 2005. Also gather information about each successor and relevant family history information that proves heirship.

2. Prepare Affidavit

3. Identify Witnesses

6. Distribute Affidavit

Per § 205.004, once a judge approves the affidavit, copies should be distributed to each person who owes money to the estate, has custody of estate property, or acts as a registrar, fiduciary, or transfer agent of or for property belonging to the estate. The affidavit can now be used to collect assets from the estate.

How to Write

Download: PDF

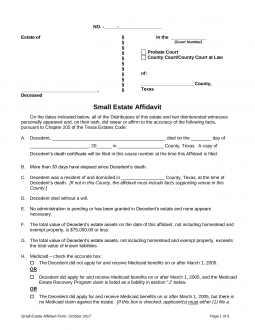

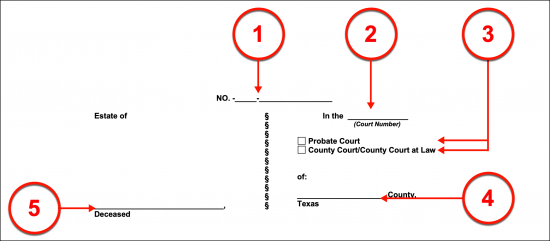

(1) File Number. The filing number assigned to the Texas Estate being discussed will be required to introduce the petition.

(2) Court Number. Furnish the Court Number that identifies the Texas Court in charge of this matter.

(3) Type Of Ruling Court. Select the checkbox option that best defines whether the Court where this form is filed is a “Probate Court” or a “County Court/County Court At Law.”

(4) Texas County. The Texas County whose Court is receiving this filing should be identified by name.

(5) Texas Deceased. The name of the Party who has died must be produced to define this estate properly.

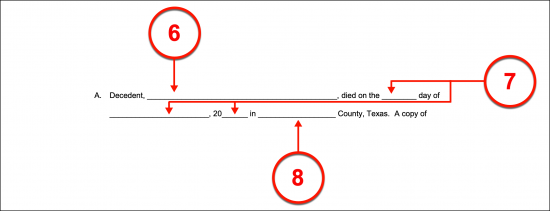

(6) Texas Decedent Name. The Texas Deceased (or Decedent) will need to be identified as part of the declaration being made to the Court.

(7) Date Of Death. Furnish the calendar date when the Texas Decedent died. This information should be obtained from the death certificate of the Texas Decedent.

(8) County Of Death. Locate the name of the County listed on the Texas Decedent’s death certificate as his or her place of death.

(9) Residential County Of Texas Decedent. The Texas County where the Decedent lived or maintained his or her home should be identified.

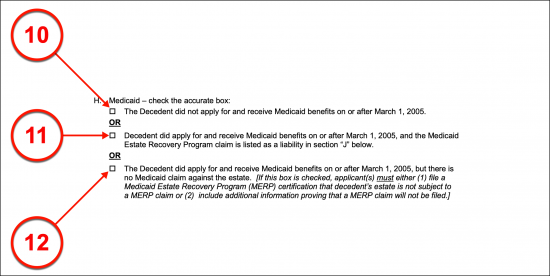

(10) Texas Decedent Non-Applicable Medicaid Status. One of three checkbox statements should be selected from Statement H. The first statement’s checkbox should be selected if the Texas Decedent neither applied for nor received Medicaid Benefits anytime starting on March 1, 2005.

(11) Applicable Statute To Texas Medicaid Status. The second statement should be selected if the Texas Decedent did receive medicaid benefits anytime after March 1, 2005 that may require the concerned estate’s Medicaid Estate Recovery Program to be satisfied.

(12) No Medicaid Claim Against Estate. Select the third status statement if the Medicaid Estate Recovery Program does not need to be satisfied even though the Texas Decedent applied/received Medicaid Benefits on or after March 1, 2005.

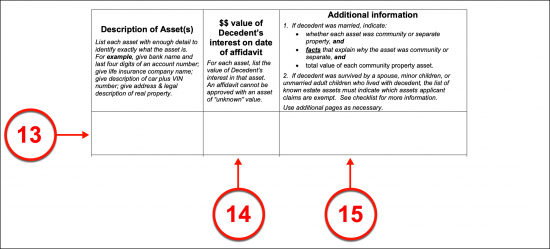

(13) Description Of Asset(s). Every asset making up the Texas Decedent’s estate must be precisely defined in the first column of Statement I. This may be an intangible or physical asset of the Texas Decedent. In either case, it must be fully defined. Therefore, a bank account would require the name of the bank as well as the account number owned by the Texas Decedent while a computer would require a record of the manufacturer, model, operating system, and serial number.

(14) Dollar Value Of Decedent’s Interest On Date Of Affidavit. The dollar value of every asset listed should be recorded. If the asset is a bank account then record the dollar amount held in that account whereas if it is a physical item then its current market value should be supplied.

(15) Additional Information. Any additional information that will aid in identifying the asset reported in the third column of the row where it is discussed.

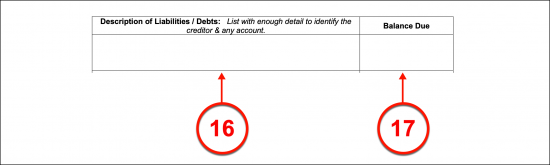

(16) Description Of Liabilities/Debts. In addition to the assets owned by the Texas Decedent’s estate, a record of all debts or liabilities that the estate is responsible to pay should be provided. Statement J will provide a basic table containing a left-hand column that requires the name and contact information to identify the Texas Decedent’s Creditor as well as an adequate description of the reason for the debt.

(17) Balance Date. The dollar amount that remains to be paid to the Creditor by the Texas Decedent should be supplied to the right-hand column.

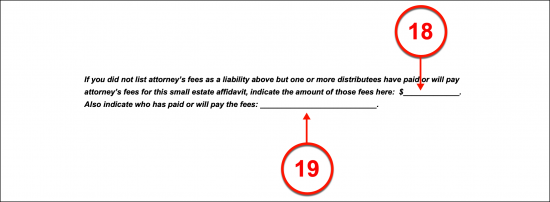

(18) Fees Due To Attorney. If there are fees due to an Attorney for this document that will be paid by a Distributee and this fee has been unaddressed, then Statement I will require the fees due to the Attorney to be listed.

(19) Payer Of Attorney Fees. The name of the Distributee who has or who shall pay the fees due to the Attorney should be documented.

Family #1 Marriage

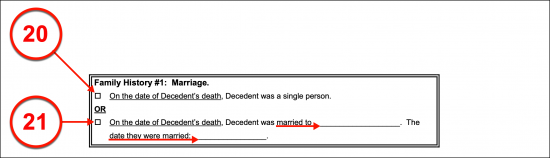

(20) Texas Decedent With No Spouse. Several topics regarding Family History must be discussed. Locate the first topic, “Marriage,” then select one of the checkboxes to indicate which statement best defines the Texas Decedent’s marriage status at the time of his or her death. Mark the first checkbox if the Texas Decedent was unmarried or considered single at the time of his or her death.

(21) Spouse Of Texas Decedent. Choose the second checkbox if the Texas Decedent was married. Additionally, a record of his or her Spouse’s name and the date when the Texas Decedent married his or her Spouse should be furnished to this choice.

Family History #2 Children

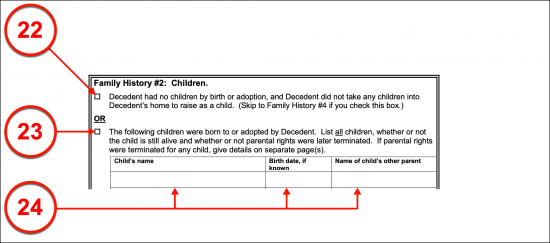

(22) Texas Decedent With No Children. The next topic of discussion will focus on the children of the Texas Decedent. If he or she did not have Children (whether by birth or adopted), then the first checkbox statement should be selected.

(23) Texas Decedent With Children. The second checkbox statement should be selected and the table provided should be completed if the Texas Decedent had any Children.

(24) Texas Decedent’s Children. Every Child of the Texas Decedent must be identified with his or her legal name in the first column. Identify each Child of the Texas Decedent in this column. List every Child regardless of whether the Texas Principal became the Parent by birth, marriage, or adoption. This list should also include any Children of the Texas Decedent who may have passed away. The second column will require the birth date of the Child, while the final column must be supplied with the name of the Child’s other Parent.

Family History #3 Part 2

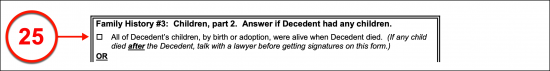

(25) Texas Decedent Surviving Children. The status of the Texas Decedent’s Children will need to be addressed. If none of the Children of the Texas Decedent were alive at the time of his or her death, then the first statement in “Family History # 3” should be selected. Bear in mind that if any Children of the Texas Decedent passed away after the Texas Decedent’s death, then an Attorney should be consulted for this area.

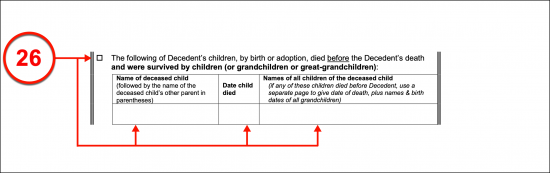

(26) Late Survivors With Offspring. If the Texas Decedent had any Children who passed away before the death of the Deceased but had Children of their own, then select the second checkbox statement. Use the table in this choice to name each of the Deceased Children, the Deceased Child’s date of death, and the names of all of the Deceased Child’s Children.

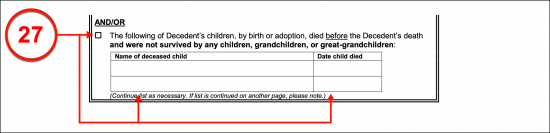

(27) Late Survivors With No Children. If no Child Survivors of the Texas Decedent had Children of their own then, select the third checkbox. The table provided for this choice requires the name of every Deceased Child of the Texas Decedent along with the formal date of death of the Deceased Child.

Family History #4: Parents

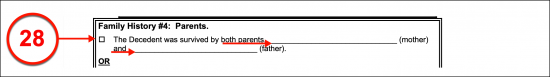

(28) Texas Decedent Survived By Parents. If the Texas Decedent’s Parents lived past his or her death then select the first checkbox in “Family History #4.” This status requires a record of the name of the Decedent’s Mother and Father supplied to the available spaces..

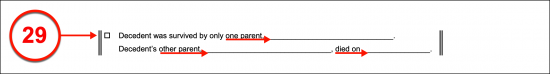

(29) Texas Decedent Survived By One Parent. Select the second statement to indicate that the Texas Decedent was survived by one Parent. This statement must be supplied with the name of the Surviving Parent, the name of the Parent who has passed away, and the date of death when the Decedent’s Parent passed away.

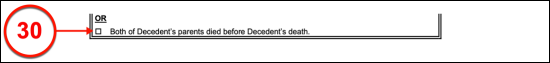

(30) No Parental Survivors Of Texas Decedent. The third checkbox should be selected if neither Parent was alive at the time of the Texas Decedent’s death.

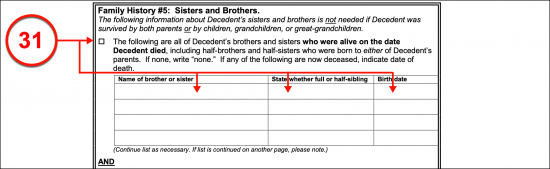

Family History #3: Sisters And Brothers

(31) Sibling Survivors Of Texas Decedent. If the Texas Decedent’s Siblings (i.e. Brothers, Sisters) are still living then select the first checkbox presented. The corresponding statement will require the name of each Sibling (whether the Sibling is a full Sibling or a Half-Sibling) and each Sibling’s birthday documented in the table provided.

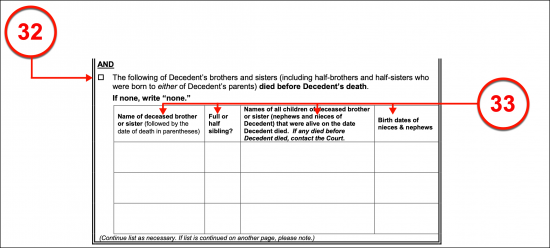

(32) Late Siblings Of Texas Decedent. The second checkbox should be selected if any of the Texas Decedent’s Siblings have passed away before the death of the Decedent.

(33) Sibling Information. The table provided in the second checkbox statement will require the name of each Sibling in the first column (whether living or dead) coupled with a Sibling’s date of death (if applicable) in parentheses, a definition as to whether the Sibling was a full Brother/Sister to the Decedent or if they only shared one Parent, the identities of every Offspring to the Texas Decedent’s late Sibling, and each Sibling’s birth date recorded in the table provided. .

Family History #6: Other

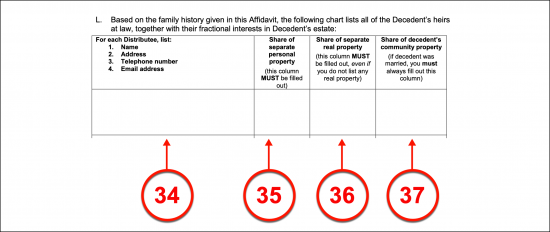

Article L

(34) Distributee Information. If the Texas Decedent died without a Surviving Spouse, Child, Grandchild, Parent, Sibling, Half-Sibling, or Niece/Nephew but had other Surviving Relatives then Statement L must be supplied with the name, address, phone numbers, and email address of these Surviving Relatives. Keep in mind that this statement does not need to be completed if the Texas Decedent died with a living Spouse, Parent, Child/Grandchild, Sibling, Step-Sibling, or Niece/Nephew.

(35) Share Of Separate Personal Property. If the first column of Statement L has been completed then the share of the Texas Decedent’s property that should be dispensed to the Surviving Relative must be reported. Separate property should be considered assets obtained and owned by the Texas Decedent independently of another Party (i.e. Spouse).

(36) Share Of Separate Real Property. List the portion of real property owned by the Texas Decedent that his or her Surviving Relative is entitled to. This column requires content even if the Texas Decedent does not own real estate (real property) therefore, if no real property is involved, write in the word “None.”

(37) Share Of Decedent’s Community Property. If the Texas Decedent had a (late) Spouse and they purchased property or real estate together, then the share of this jointly owned property that the Decedent’s estate may claim should be documented. If this is inapplicable then populate this column with the word “None” or “Inapplicable.

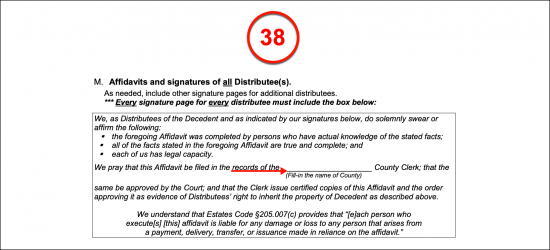

(38) Name Of County. Furnish the name of the Texas County where this petition will be filed.

Notarized Distributee Signature

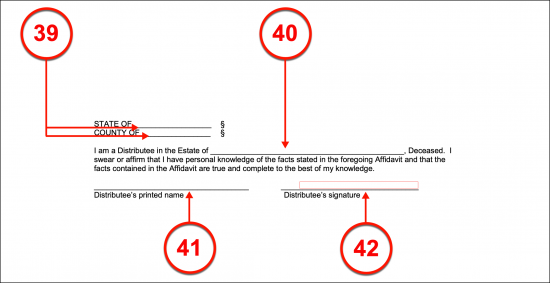

(39) State And County. The Affiant or Distributee behind this petition will be required to formally sign this document before a Notary Public. The Notary Public will document where the signature of the Texas Affiant is completed. His or her instructions should be followed during this process.

(40) Texas Decedent Name. The full name of the Texas Decedent will be needed in the statement being made. This may be supplied by the Affiant’s Attorney, the Affiant, or the Notary Public.

(41) Distributee Printed Name. The Affiant or Distributee must print his or her name before providing a signature.

(42) Distributee Signature. The Texas Affiant or Distributee should sign his or her name under the direction of the attending Notary Public. Keep in mind, only those completing this area with a notarized signature will be considered the Texas Affiant.

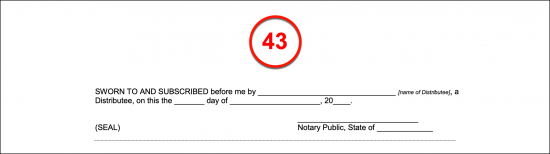

(43) Notary Action. The Notary Public working with the Affiant or Distributee must complete the notary statement provided.

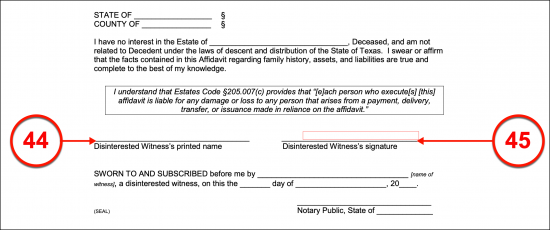

(44) Notarized Witness Signature. In addition to the notarized signature of the Affiant or Distributee, two Witnesses that can testify to watching the Affiant or Distributee signature occur must also sign this paperwork before a Notary. The first Witness will need to print and sign his or her name immediately after watching the Affiant execute his or her signature. Once the first Witness has signed this paperwork, the Notary Public will take control of this document to verify his or her signature

(45) Notarized Witness Signature. The Second Witness must also print and sign his or her name as a Notary Public observes. Both Witnesses must have watched the Affiant or Distributee behind this document to provide a notarized signature acknowledgment of this action.