Updated September 13, 2023

A Wyoming small estate affidavit, or ‘Wyoming Affidavit of Collection of Estate Assets’, is a form that may be used to shorten the process for settling the estate of a deceased resident (decedent). Thirty (30) days must pass after the death before the affidavit can be used. As soon as the waiting period is over, a successor can use the form to collect the decedent’s property from third parties. A separate process, outlined below, applies to real estate.

Laws

- Days after Death – Thirty (30) days must have passed since the death of the decedent before the affidavit can be used. (W.S. 1977 § 2-1-201)

- Maximum Amount ($) – $200,000. The affidavit can only be used in relation to assets in Wyoming valued at less than $200,000, less liens and encumbrances. (W.S. 1977 § 2-1-201)

- Real Estate – Must get a sworn report of value by a person who has no legal interest in the estate. Petition for Decree of Distribution must be published once a week for two consecutive weeks and, within ten (10) days after the first publication of the notice, sent by first-class mail to other successors. (W.S. 1977 § 2-1-205)

- Signing Requirements – Must be signed in the presence of a notary public and filed with the county clerk’s office. (W.S. 1977 § 2-1-201)

- Statutes – Title 2, Chapter 1, Article 2. Distribution by Affidavit and Summary Procedure

How to File (7 steps)

- Obtain Death Certificate

- Wait Thirty (30) Days

- Prepare Affidavit

- Give Notice

- Get Affidavit Notarized

- File with County Clerk

- Collect the Assets

1. Obtain Death Certificate

2. Wait Thirty (30) Days

3. Prepare Affidavit

4. Give Notice

If you are claiming an interest in real estate, per § 2-1-205, you must publish notice of your application once a week for two consecutive weeks in a newspaper that circulates in the county in which you are filing your affidavit. Notice of your application must also be sent by first class mail to other successors, including the decedent’s spouse if s/he had one. Notice must be mailed no later than ten (10) days after you first publish the notice.

5. Get Affidavit Notarized

6. File with County Clerk

7. Collect the Assets

Video

How to Write

Download: PDF

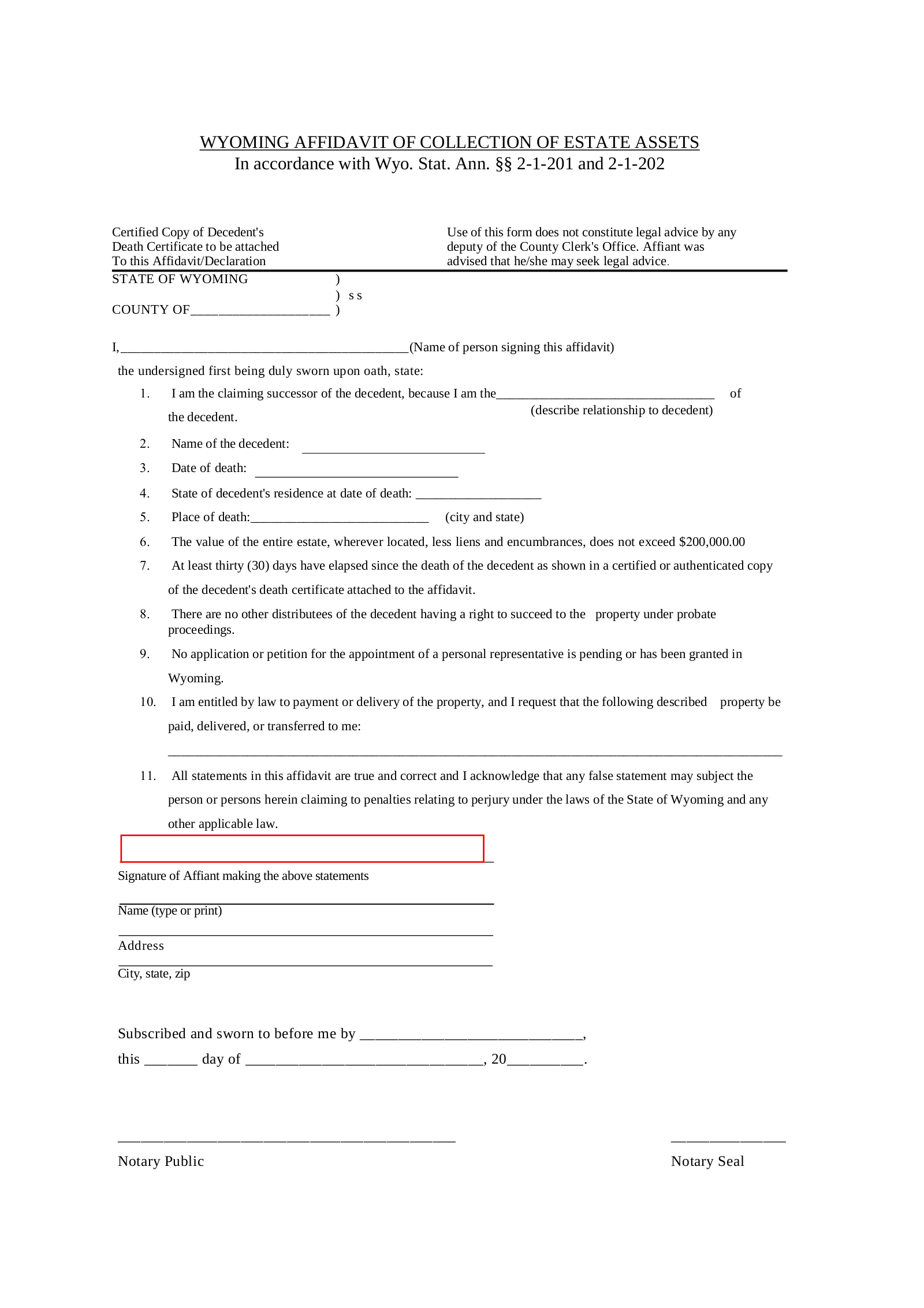

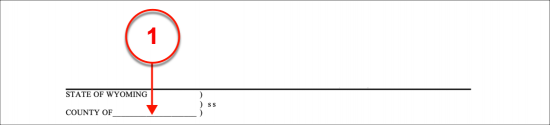

(1) Wyoming County. Identify the Wyoming County of filing at the beginning of this petition.

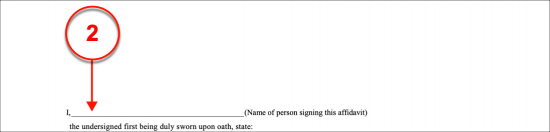

(2) Wyoming Affiant. The full name of the Wyoming Applicant must be presented.

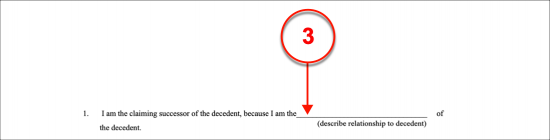

(3) Name Of Wyoming Decedent. Naturally, any Party that will be expected to release the Wyoming Decedent’s property to the Affiant upon this document’s presentation will need to make sure of the Affiant’s claim. To this end, define the Affiant’s relationship with the Wyoming Decedent.

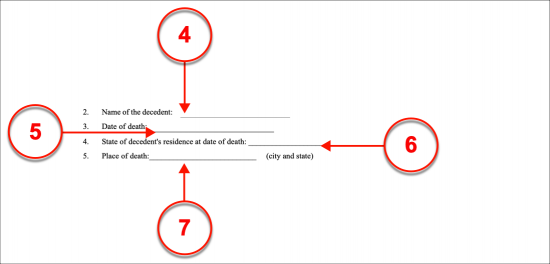

(4) Wyoming Decedent Information. After completing the introduction, continue to the first section, then formally declare the Wyoming Decedent’s identity with a record of his or her name.

(5) Date Of Wyoming Decedent’s Death. Refer to the Wyoming Decedent’s death certificate to provide a report of the calendar date that marks the day when he or she was formally declared as deceased.

(6) State Of Residence. The name of the State where the Wyoming Decedent lived at the time of his or her death should be documented.

(7) Place Of Death. Record the city and the state where the Wyoming Decedent passed away.

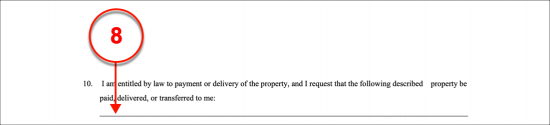

(8) Wyoming Affiant Claim. The assets the Wyoming Affiant wishes to claim from the concerned estate must be formally requested through this document. This should be done by providing an adequate description of this sought property. To this end, intangible items such as bank accounts held by the Wyoming Decedent should be defined by the Bank Name and account number where his or her funds are kept whereas tangible items should be defined by reporting such descriptions as the Manufacturer, Model, product name, and serial number.

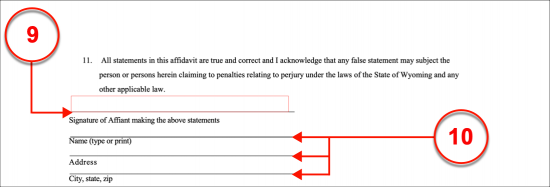

(9) Signature Of Affiant Making The Above Statements. The Wyoming Affiant will need to verify the information this petition presents as true by providing a notarized signature.

(10) Wyoming Affiant Printed Name And Address.

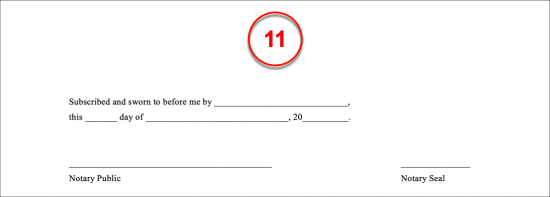

(11) Notary Public For Wyoming Affiant Signature. The Notary Public watching the Wyoming Affiant sign his or her name will verify his or her identity then notarize the signature as being observed.