Updated September 13, 2023

A Kentucky small estate affidavit, legally titled the ‘Petition to Dispense with Administration’ or Form AOC-830, can be used to avoid the hassles of probate while distributing the assets of a small estate. It can be used if the person who died (decedent) had $30,000 or less in assets in his or her name, even if there is no will. The petition must be signed by a surviving spouse, surviving children, or preferred creditors (or their assignees).

Laws

- Days after Death – No statute. State law does not stipulate any specific period of time must pass before an affidavit can be filed. An individual can begin the process when they are ready.

- Maximum – $30,000. (KRS § 391.030) A small estate is defined as possessing personal property or money not exceeding $30,000.

- Social Security Number (SSN) – The decedent’s Social Security Number must be included in the affidavit.

- Citizenship – Per KRS § 391.030, an “alien” may receive property as if s/he were a citizen.

- Signing – Form AOC-830 must be signed before a notary public.

- Statute – Chapter 391. Descent and Distribution. A surviving spouse or child (or even creditors) may apply to the District Court for the transfer of a decedent’s personal property. Per KRS § 395.455, a surviving spouse, surviving child(ren), or preferred creditor, can file a petition with the District Court to claim assets without administration.

How to File (4 steps)

1. Collect Information

2. Prepare Affidavit

4. File with District Court

Video

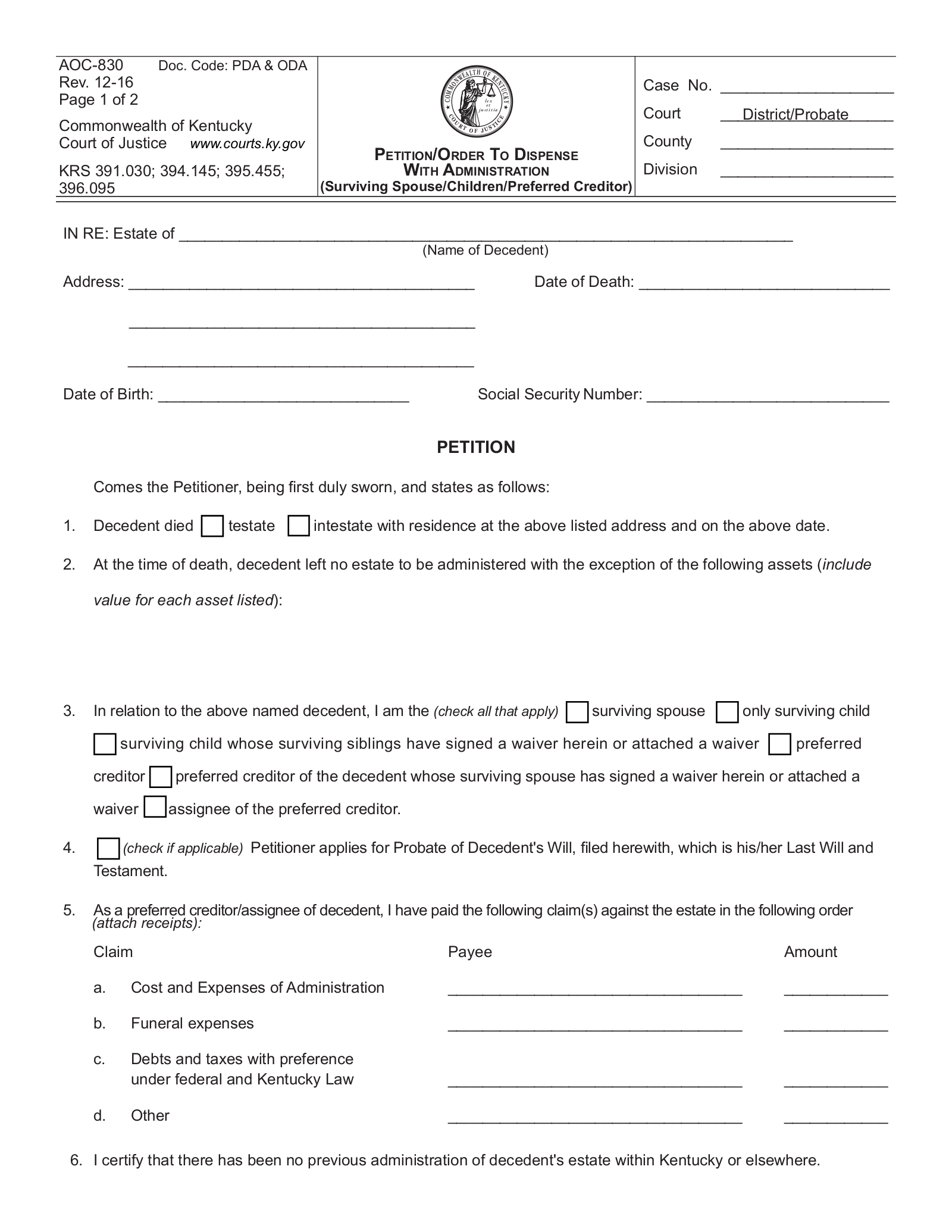

How to Write

Download: PDF

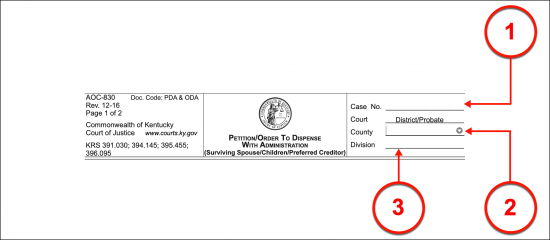

(1) Case Number Assigned By State Of Kentucky. Reproduce the case number assigned to actions for the Kentucky Decedent’s estate.

(2) Kentucky County Of Petition. The Kentucky County of the Petitioner’s action should be displayed as an introduction to this document.

(3) Kentucky Court Division. Present the Court Division that will handle this matter.

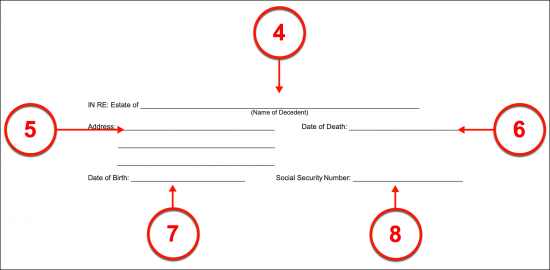

(4) Kentucky Decedent. The Kentucky Deceased must also be named during the introduction of this paperwork.

(5) Address Of Kentucky Decedent. Produce the Kentucky Decedent’s residential address.

(6) Date Of Death. The calendar date reported on the Kentucky Decedent’s death certificate as the day when he or she was formally pronounced dead must be presented in this paperwork.

(7) Date of Birth. The Kentucky Decedent’s birth date is an important instrument of identification. Produce it where requested.

(8) Social Security. Distribute the Kentucky Decedent’s social security number as a final means of identifying him or her properly.

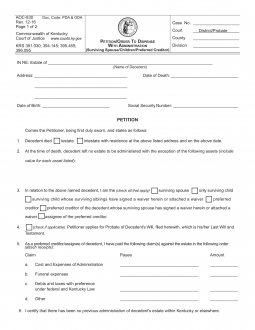

Article 1

(9) Kentucky Decedent Will Status. If the Kentucky Decedent has put a will in place by the time of his or her death then the first checkbox in Article 1 must be selected. If not then the “Intestate” checkbox should be chosen to indicate that the Kentucky Affiant died before he or she developed a will or issued one.

Article 2

(10) Kentucky Decedent’s Remaining Assets. All the Kentucky Decedent’s personal property should be identified along with its monetary value. Produce this report making sure to include intangible items such as bank accounts as well as tangible property such as electronics.

Article 3

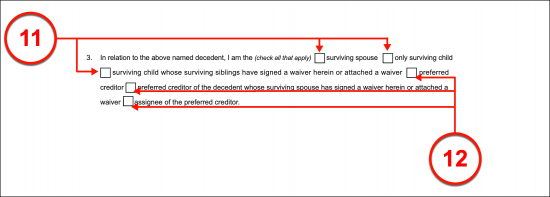

(11) Kentucky Decedent Survivor As Affiant. The Petitioner or the Affiant must define his or her status in relation to the Kentucky Decedent through this document. By selecting the appropriate checkbox the Affiant can claim to be the “Surviving Spouse” of the Decedent, his or her “Only Surviving Child,” or a “Surviving Child” who has obtained a release to complete this affidavit from his or her Siblings.

(12) Creditor As Affiant. If the Petitioner is a Creditor who has the right to seek payment from the Kentucky Decedent, then he or she may display this status by selecting the checkbox labeled “Preferred Creditor,” otherwise select the fifth box if the Affiant is a Creditor who has obtained a waiver from the Kansas Decedent’s Spouse and Children, or mark the final checkbox to indicate the Affiant is an “Assignee of a Preferred Creditor.”

Article 4

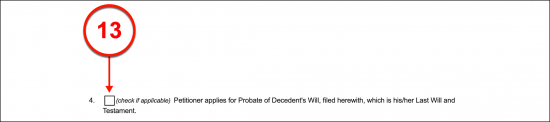

(13) Option To Apply For Probate Of Decedent’s Will. This paperwork gives the Petitioner the ability to request a formal probate process be engaged regarding the Kentucky Decedent’s will. This can be requested by selecting the checkbox in the fourth article. While this may aid in the proper application of the Kentucky Decedent’s will, the Affiant or Petitioner is encouraged to consult a qualified professional should there be any question regarding this action before making this selection.

Article 5

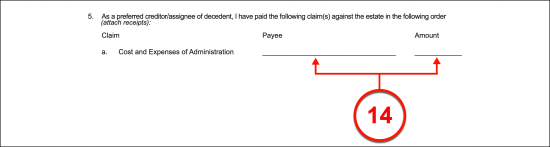

(14) Reimbursee Or Creditors Of Kentucky Decedent. If the estate of the Kentucky Decedent must reimburse or pay a specific Party for the costs or the expenses of the estate’s administration then document the identity of this Payee and the amount the estate must pay him or her.

(15) Funeral Expenses. The Kentucky Decedent’s funeral may have been paid by a Family Member, Spouse, or Interested Party that requires repayment. If so, then supply the full name and contact information of this Payee along with the amount the estate must pay him or her.

(16) Debts And Taxes Owed By Estate. List every institution or government entity that is owed money by the Kentucky Decedent’s Estate along with the dollar amount to be paid.

(17) Other. Any other debt or expense placed on the Kentucky Decedent’s estate should be dispensed. Name each liability or debt and the amount that is owed.

Article 6

(18) Affiant Request. The Affiant may request that the Decedent’s estate be dispensed directly to him or her or a Representative or Designee. If so then record the name of the Designee or Representative that the Affiant approves to receive the Kentucky Decedent’s estate on his or her behalf.

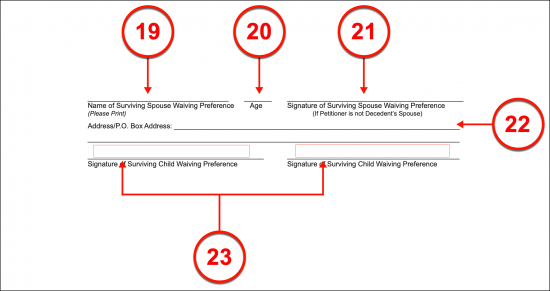

(19) Name Of Surviving Spouse Waiving Preference. If the Affiant is not the Kentucky Decedent’s Spouse and the Kentucky Decedent was married, then the Surviving Spouse must approve of this request through a signature process. Before signing this document, the printed name of the Spouse should be submitted

(20) Age Of Kentucky Affiant.

(21) Signature Of Surviving Spouse Waiving Preference. The Surviving Spouse of the Kentucky Decedent must sign this document to demonstrate that he or she approves of the Affiant’s actions.

(22) Address Of Surviving Spouse.

(23) Signature Of Child Waiving Preference. If the Kentucky Decedent is survived by a Child then he or she must also sign this paperwork to establish that the Affiant’s request will not be opposed. There is enough room for two Children of the Kentucky Affiant to provide such signature approval but if there are more than two then an attachment with the remaining approval signatures must be provided.

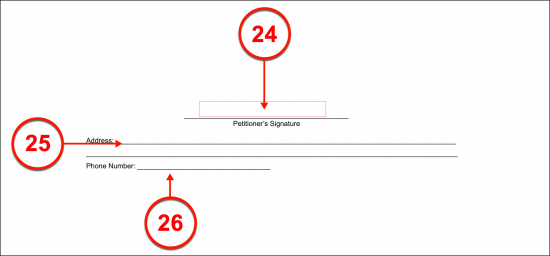

(24) Petitioner’s Signature. As the Petitioner to the Kentucky Decedent’s estate, you must sign this form in the presence of a Notary Public who is recognized by the State of Kentucky. Sign your name under the direction of the Notary obtained.

(25) Kentucky Petitioner’s Address.

(26) Phone Number Of Petitioner.

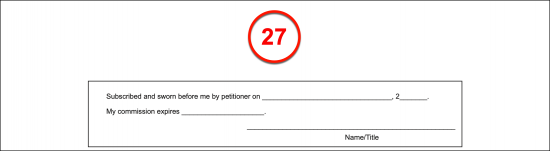

(27) Notary Public. The Notary Public attending the Kentucky Affiant or Petitioner’s signing will complete the area that immediately follows. The notarization process will be used as an instrument to verify the identity of the Kentucky Affiant.

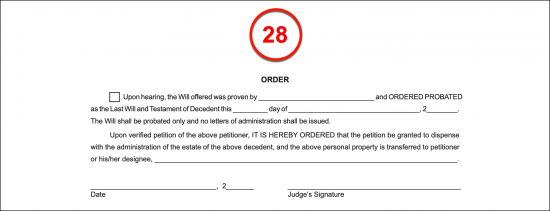

(28) Judge’s Order. The final order of the court reviewing this case will be produced only by the Kentucky Judge responsible for overseeing this case.

(29) Attorney’s Signature. If applicable, the Petitioner’s Attorney must also sign and complete the final signature area of this paperwork.

(30) Attorney Contact Information.