Updated October 26, 2023

A Montana small estate affidavit is a legal document that gives the holder the right to collect property previously owned by a decedent, a person who has died. Also known as “Collection of Personal Property by Affidavit,” it provides a simpler, quicker alternative to the traditional probate process for transferring ownership of the decedent’s assets to heirs and successors. It is available whether or not the decedent had a will, but can be used only for certain kinds of property, and only for estates with a value smaller than a state-established maximum.

Laws

- Days After Death – More than thirty (30) days must have passed since the death of the decedent before filling out an affidavit. (MCA 72-3-1101(b))

- Maximum Amount ($) – The total value of the estate, less liens and encumbrances, must be $100,000 or less.(MCA 72-3-1101(a))

- Signing Requirements – The affidavit must be notarized.

- Statutes – Collection of Personal Property by Affidavit (Title 72, Chapter 3, Part 11)

How to File (4 steps)

1. Wait 30 Days

2. Identify Property

4. Collect the Property

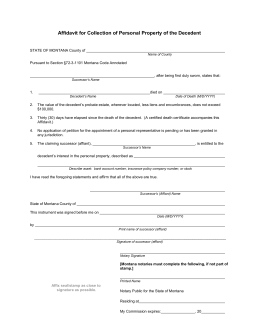

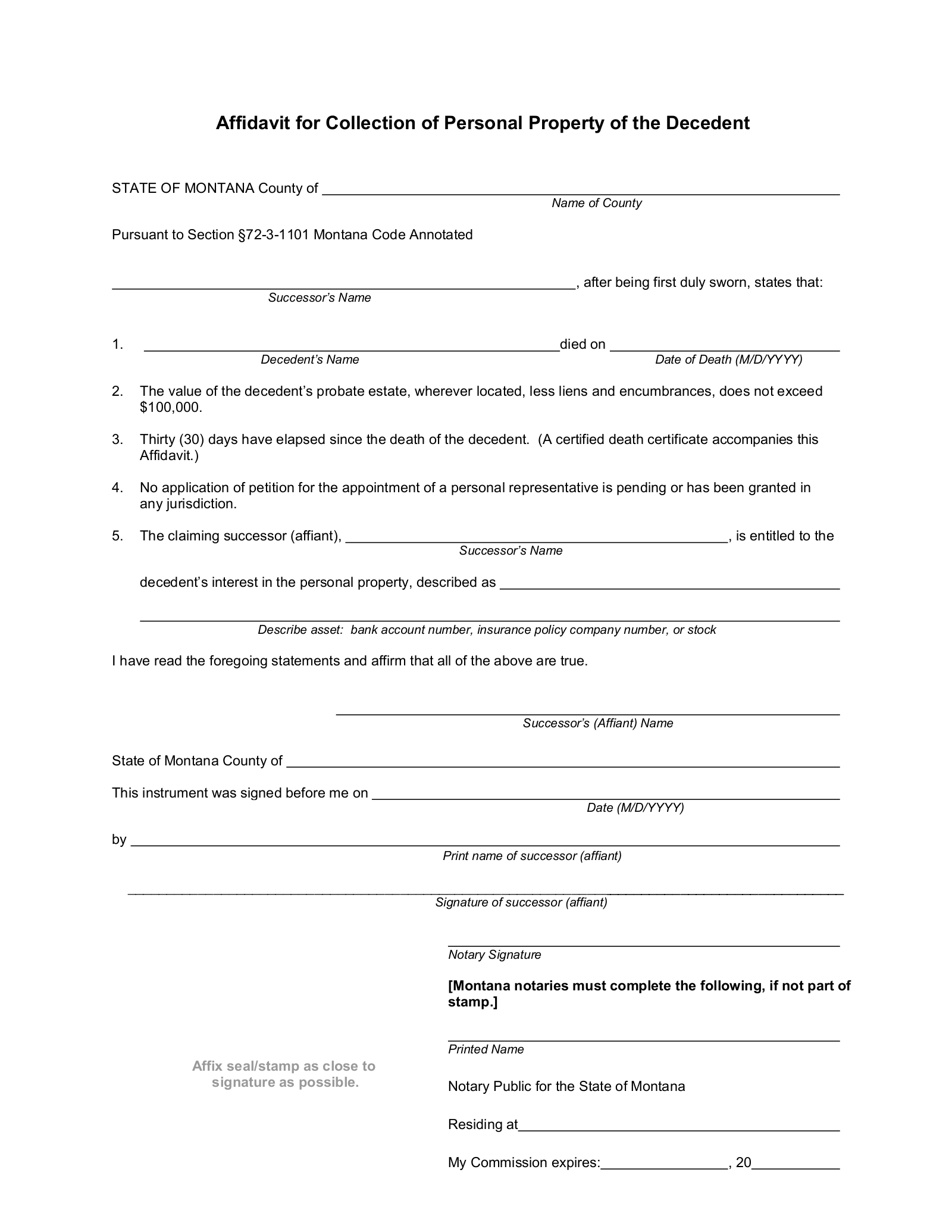

How to Write

Download: PDF

(1) Montana County Of Petition. The Montana County where this action will be engaged should be named. Typically, this will be the same County where the Montana Decedent maintained his or her home residence.

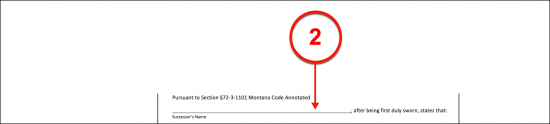

(2) Successor Name. The Successor to the Montana Decedent can use this document to lay claim to the Decedent’s property. To this end, the full name of the Successor to the Montana Decedent’s property should be dispensed as part of this petition’s opening.

(3) Montana Decedent Name. Now that the County and the Affiant are identified, the full name of the Montana Decedent is required. The first article of this petition seeks this entry.

(4) Montana Decedent Date Of Death. Transcribe the calendar date noted on the Montana Decedent’s death certificate as the day he or she died.

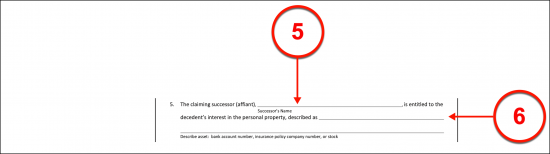

(5) Claiming Successor To Montana Decedent. The fifth article shall act to establish the Affiant’s successorship to the Montana Decedent property. Furnish the name of the Successor to this article’s language.

(6) Estate Property Being Claimed. A complete description of the Montana Decedent property expected by the the Affiant behind this paperwork will be needed to complete its purpose. Thus, produce a report of all the tangible property or intangible property (i.e. a stock or bank account) making up the Montana Decedent’s estate by documenting its description, listing any number needed to identify the asset, and its value on the current market.

(7) Successor Signature. The Montana Decedent’s Successor who is issuing this paperwork should sign his or her name as its Affiant.

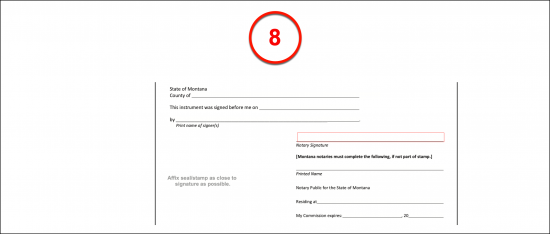

(8) Notarization. The Montana Notary Public viewing the signing will fulfill the important role of acting as its Witness. Furthermore, he or she will aid in identifying that the Affiant personally signed this document with his or her credentials and the process of notarization.