Updated April 29, 2024

A West Virginia small estate affidavit, also known as a ‘short form settlement’, is a form that can be used to hasten the distribution of an estate worth $50,000 or less in the State of West Virginia. After the affidavit is filed with a local probate court, the assets belonging to the estate can be distributed among successors.

Laws

- Days after Death – If the decedent left a will that named an executor, thirty (30) days must have passed since the date of death before this person can file an affidavit. If the decedent did not leave a will, sixty (60) days must have passed.[1]

- Maximum Amount ($) – $50,000. A small estate will have a fair market value of not more than $50,000.[2]

- Real Estate – Real estate interests in the State of West Virginia worth less than $100,000 may be considered part of a small estate.[3]

- Signing Requirements – Form must be signed in the presence of a notary public.

- Statute – West Virginia Small Estate Act

How to File (5 steps)

- Prepare Documentation

- Prepare Affidavit

- Get Affidavit Notarized

- File with County Clerk

- Distribute Assets

1. Prepare Documentation

2. Prepare Affidavit

4. File with County Clerk

5. Distribute Assets

Video

How to Write

Download: PDF

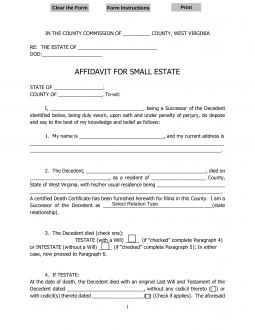

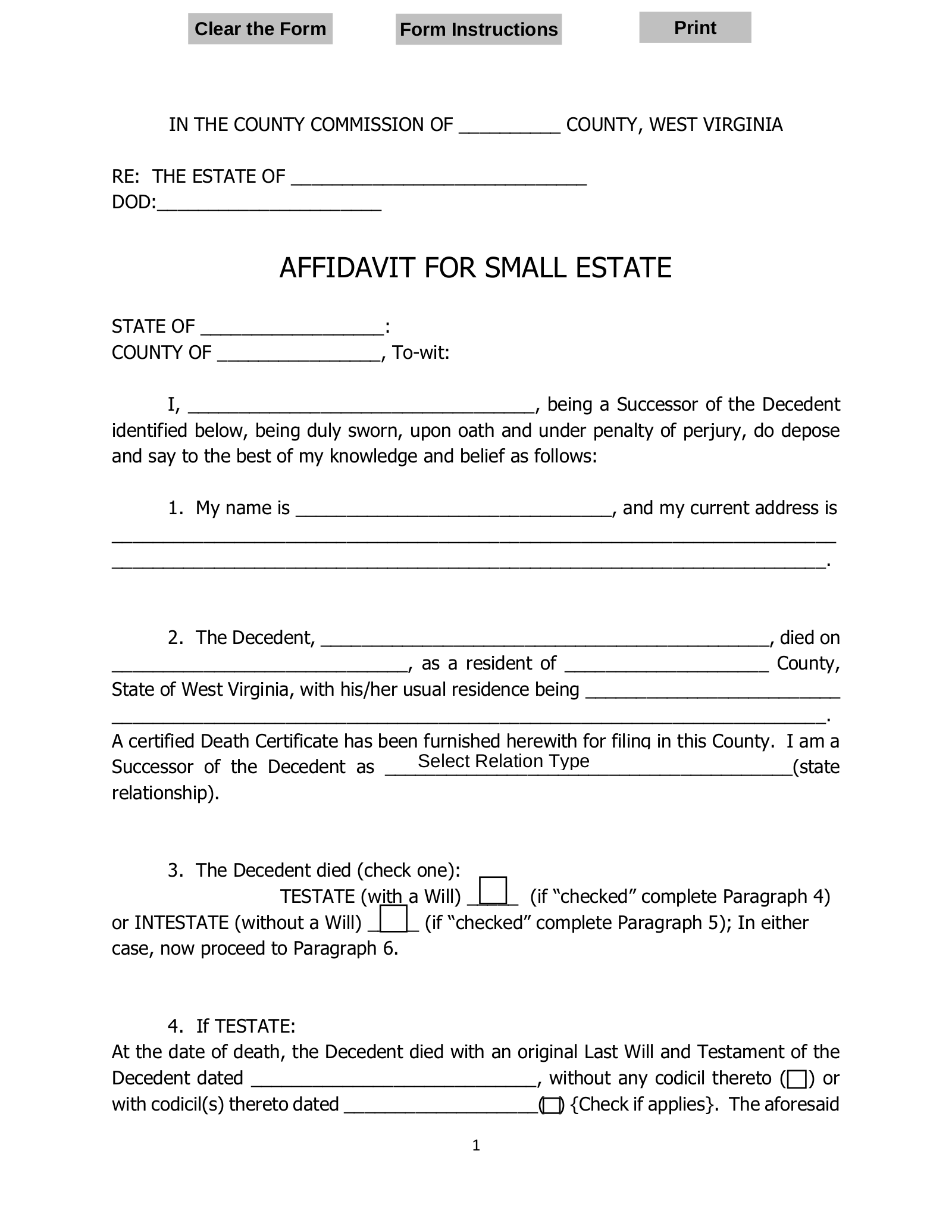

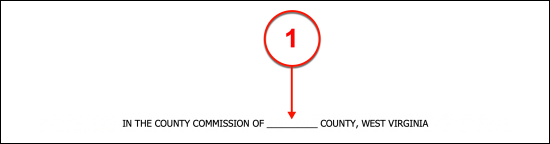

(1) West Virginia County. The West Virginia County where this action will be filed must be established in the title statement of this document. Supply this information to the space provided.

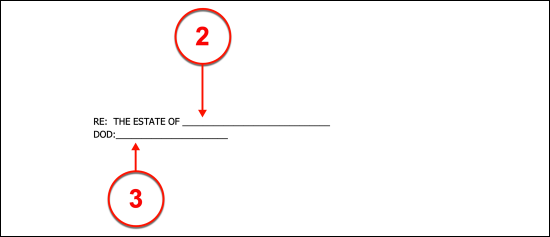

(2) West Virginia Decedent. The legal name of the West Virginia Decedent is required in the subject line of this paperwork to establish the identity of the late West Virginia Resident whose estate will be discussed.

(3) Date Of Death. Transcribe the exact date of death from the West Virginia Decedent’s death certificate to the line labeled “DOD.”

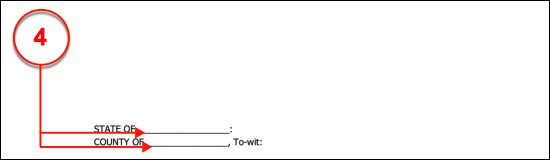

(4) West Virginia County Of Execution. Since this document will need to be notarized at the time of signing it, a couple of spaces identifying the State and County where the signature occurs have been supplied before the opening declaration. Consult with the Notary Public that will be obtained for this process as he or she may be required to report this information personally. If not, and this area may be prepared beforehand, then supply the name of the State (West Virginia) and the County where this affidavit will be executed by signature

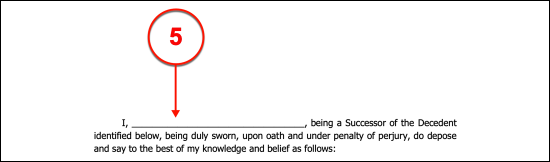

(5) West Virginia Affiant Declaration. A basic declaration at the beginning of this paperwork must be provided with the full name of the Affiant. The Affiant may be the Successor, Executor, Personal Representative, Beneficiary, or other Party with a legal claim to control or obtain assets making up the West Virginia Decedent’s estate. Bear in mind that it will be mandatory for the Affiant(s) named here to sign this document when it is complete. Similarly, any Affiant not named in this area as such will not be permitted to participate in the signature execution of this paperwork.

Article I. West Virginia Affiant Information

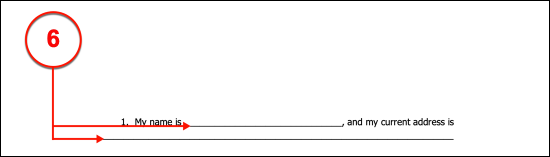

(6) West Virginia Affiant Name And Address. The West Virginia Affiant’s legal name and home address must be documented to properly identify the Party filing this petition.

Article II. West Virginia Decedent Information

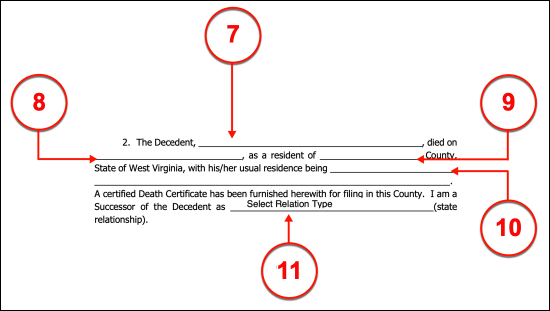

(7) Name Of West Virginia Decedent. The identity of the West Virginia Resident who has passed away must be submitted to the Second Article. This must be his or her full legal name, therefore, consult the West Virginia Affiant’s paperwork such as his or her death certificate (ideally), birth certificate, tax records, driver’s license, or passport.

(8) Date Of West Virginia Decedent’s Passing. Continue through the Second Article with a production of the calendar date of the West Virginia Decedent’s death. This information must be obtained from the Decedent’s death certificate.

(9) Residential County. Document the name of the West Virginia County where the Decedent’s residence or home is located.

(10) Home Address Of West Virginia Decedent. Furnish the entire residential address of the West Virginia Decedent’s home or domicile. This should include a record of the street address (i.e. building number, street or road, unit number), county/city, state, and zip code.

(11) Successor Relation Type. A drop-down menu has been provided so that the Affiant can quickly identify his or her relationship with the West Virginia Decedent. For instance, if the West Virginia Affiant is the Decedent’s “Son” or “Daughter” then indicate this by making the appropriate selection. If needed, this information may be manually typed or printed where it is requested.

Article III. Status Of West Virginia Decedent Will

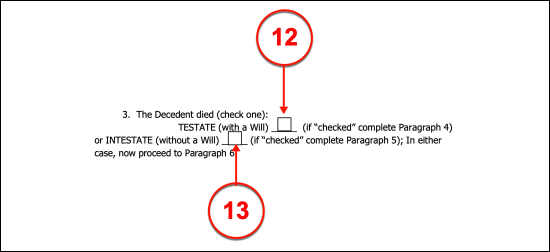

(12) Testate West Virginia Decedent. If the West Virginia Decedent has completed a will then locate the Third Article where a checkmark can be placed on the first blank line to establish the existence of the Decedent’s will.

(13) Intestate West Virginia Decedent. In a case where no will made by the West Virginia Decedent is known of, place a checkmark on the second empty line displayed in Article III.

Article IV. Testate West Virginia Decedent

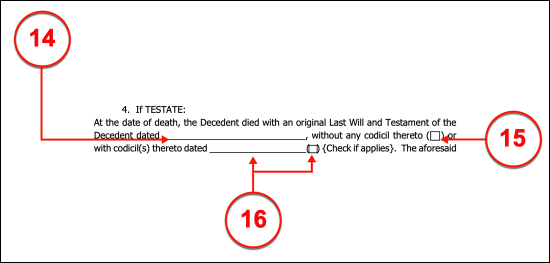

(14) Date Of Testate Decedent Will. If a will has been developed by the West Virginia Decedent then the date of that will must be documented in the Fourth Article.

(15) No Codicils To Will. Sometimes, a Decedent will have made additions or edited an original will with a codicil. If the West Virginia Decedent has not edited or changed his or her will after its execution date (as reported above) then place a checkmark in the first parentheses of this statement.

(16) Codicil(s) Information. If the West Virginia Decedent has issued one or more codicils on his or her will, then supply the execution date of the most recent codicil where requested and place a checkmark in the second set of parentheses in Article IV.

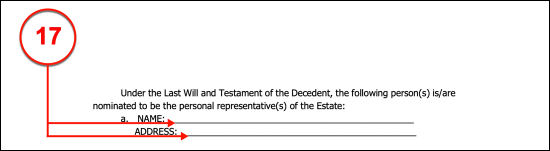

(17) Formal Representative Of Testate Decedent. The West Virginia Decedent will have named an Executor or Personal Representative to oversee how the estate will be disbursed. Thus, consult the West Virginia Decedent’s Last Will and Testament, obtain the name of the Party(ies) he or she has named as Executor or the Personal Representative responsible for overseeing the estate and its distributions, then produce this Representative (or Executor) identity as it appears in the will along with his or her address. Notice there will be enough room to report on two Executors/Representatives however if more are named in the Decedent’s Last Will and Testament, then an attachment with the remaining appointed Representatives or Executors must be made and included with this paperwork at all times.

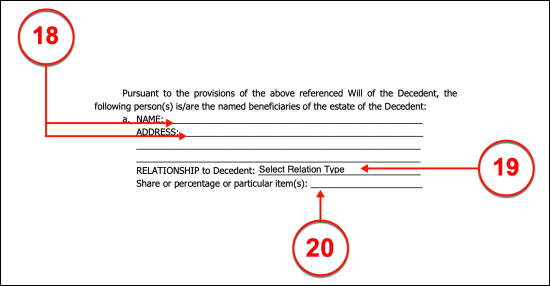

Beneficiaries Named In West Virginia Decedent Will

(18) Beneficiaries Of Testate Decedent Estate. Every Beneficiary to the West Virginia Decedent’s estate identified as such in his or her will must be discussed beginning with each Beneficiary’s name and contact information. Therefore, the name and address of each Beneficiary identified in the West Virginia Decedent’s will must be supplied where requested. Notice there will be enough space to record the information required to define multiple Beneficiaries. If this is not enough room, an attachment with the remaining Beneficiaries may be produced, titled properly, then physically presented with this petition at all times beginning with the time of signing. Make sure that all attachments made to this document are properly titled so that the section they discuss can be easily found.

(19) Relationship of Beneficiary And Testate West Virginia Decedent. Every named Beneficiary must also have his or her relationship with the West Virginia Decedent explained. Select the way the Beneficiary is related to the West Virginia Decedent through the drop-down menu available.

(20) Required Inheritance Of Beneficiary. The Last Will and Testament of the West Virginia Decedent will require that a certain share/percentage/ration or item is dispensed to the Beneficiary from the concerned estate. Produce a listing of the percentage, share, or ratio of the estate (i.e. bank accounts) the Beneficiary will inherit once the estate’s debts have been paid.

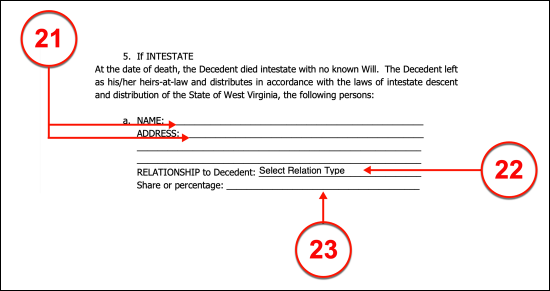

Article V. Intestate West Virginia Decedent

(21) Successor Of Intestate Decedent Estate. If no will exists for the West Virginia Decedent, then the rules of inheritance and distribution for this estate will default to the mandates of West Virginia State Law. However, the Successors set to inherit capital or property from this estate must be identified. Supply the full name and address of every Successor to the Intestate West Virginia Decedent’s estate. Be aware, that a different timeline must be followed when filing this petition for an intestate West Virginia Decedent than those for a Testate Decedent in that at least sixty days must pass since the death of the Intestate Decedent and the execution date of this petition.

(22) Successor And Intestate West Virginia Decedent Relationship. Utilize the drop-down menu to select the best choice defining how the Successor is related to the West Virginia Decedent.

(23) Successor Entitled Estate Share. The percentage or the share that the Successor will be entitled to inherit from the Intestate West Virginia Decedent’s estate must be documented to complete the Fifth Article’s requirements.

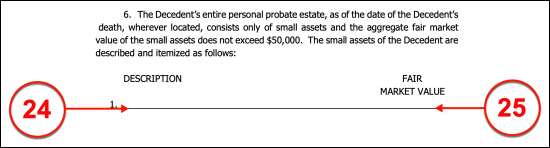

Article VI. Assets Of West Virginia Estate

(24) Asset Description. Every asset of the West Virginia Decedent’s estate must be listed in Article VI. excluding any real estate (or real property) but including any intangible property (i.e. stocks or bank accounts). If an asset is intangible such as a checking account, then the account information must be presented whereas physical items such as a laptop require documentation of their serial or manufacturer’s ID number.

(25) Fair Market Value Of Assets. In addition to defining an asset in the West Virginia Decedent’s estate, the value of its dollar worth must be supplied. For instance, the amount of money in a checking account or the dollar value of a laptop (in its current condition) on the market.

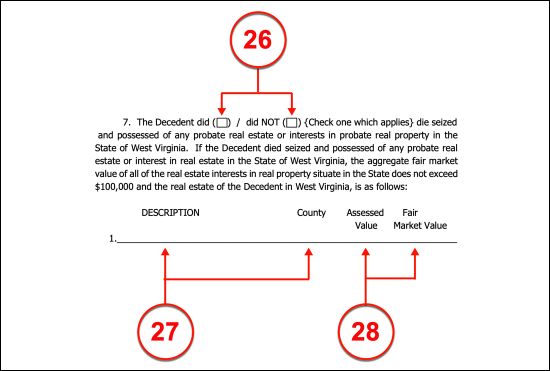

VII. West Virginia Decedent Real Property

(26) Real Property Status Of Estate. If the West Virginia Decedent owned, partially owned, or had an interest in real property or real estate, then this must be presented in this petition. If so, mark the first set of parentheses in the Seventh Article. If not, check the parentheses following the words “Did Not.”

(27) Property Description And Location. The physical address, legal description, and any other information that can describe the property (i.e. structures on the property, natural resources, etc.) should be provided to the first column of Article VII while a report on the County where the concerned real property is found should be dispensed to the second column on the same row.

(28) Value Of Property. Many would consider it wise to obtain a Real Estate Assessor to obtain the assessed value of the property however, the property can be assessed or valued independently if needed. It should be mentioned that a substantial amount of proof for any unofficial assessment may be required to verify the assessed value of the property. Produce the real property’s assessed value and fair market value to the third and fourth columns respectively.

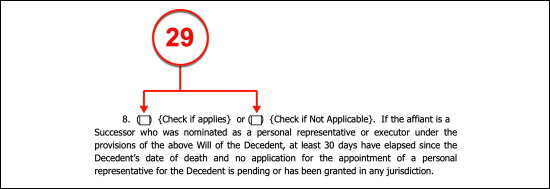

Status Of West Virginia Affiant

(29) Affiant As Successor Or Nominated Personal Representative. If the Affiant to the West Virginia Decedent’s estate is a Successor, a Personal Representative, or an Executor as named by the Last Will and Testament of the West Virginia Decedent then place a checkmark in the first parentheses of Article VIII. Otherwise, select the second parentheses if this is not the case, if no such appointment was made in the will or if less than thirty days have passed since the date of the West Virginia Decedent’s date of death and the signing of this petition.

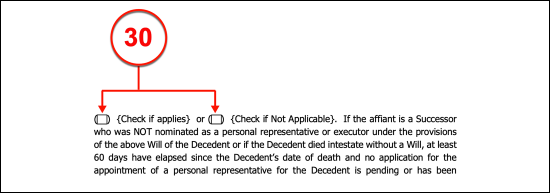

(30) Affiant As Successor Or Personal Representative Of Intestate Decedent. If the West Virginia Decedent did not have a will then at least sixty days must have passed since his or her date of death and the execution of this paperwork. If this is the case, then select the first checkbox in the alternate statement to the Affiant’s status. If this is not the case select the second parentheses with a checkbox.

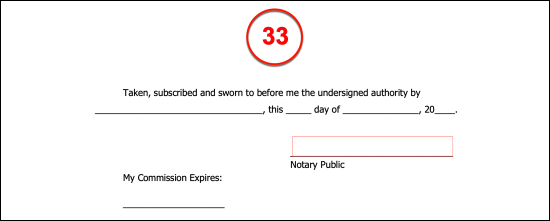

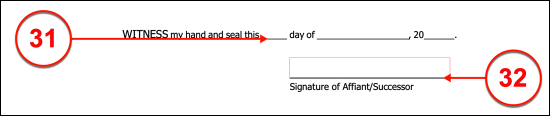

Notarized Execution Of Petition

(31) Signature Date Of West Virginia Affiant. The exact date when the West Virginia Affiant signs this document should be produced by this Party immediately before executing this paperwork.

(32) West Virgnia Affiant Signature. The West Virginia Affiant responsible for the declarations and assessments in this petition must sign his or her name to complete this petition. This action is required to take place before an actively licensed Notary Public.

(33) Notarization Of West Virginia Affiant Signing. The final area requiring attention requires the participation of the Notary Public in attendance. This is the only Party that may legally complete the notarization segment of the signature area.