Updated September 13, 2023

A Hawaii small estate affidavit can be used to bypass probate and court appearances in the distribution of a small estate. The form can be used by a successor to quickly and efficiently gather and distribute the personal property of a decedent whose estate is worth less than $100,000.

Laws

- Days after Death – Since there is no exact statute addressing a wait period, a small estate affidavit can be filled out and used at any time in the State of Hawaii.

- Maximum Amount ($) – A small estate is defined as an estate worth less than $100,000. This amount excludes motor vehicles. (H.R.S. § 560:3-1201)

- Signing – Both Form 3C-E-210 and the Motor Vehicle Small Estate Affidavit require the affiant to sign in the presence of a notary public.

- Motor Vehicles – If the decedent had a vehicle then the heirs may be able to obtain the asset immediately by filing the Motor Vehicle Small Estate Affidavit and filing it with your local DMV Office.

- Statute – Collection of Personal Property by Affidavit and Summary Administration Procedure for Small Estates

How to File (4 steps)

- Make a List of Assets

- Download and Prepare Affidavit

- Get Affidavit Notarized

- File with Appropriate Local Court

2. Download and Prepare Affidavit

Video

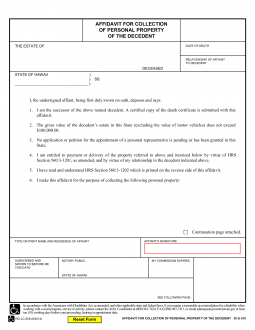

How to Write

Download: PDF

Estate

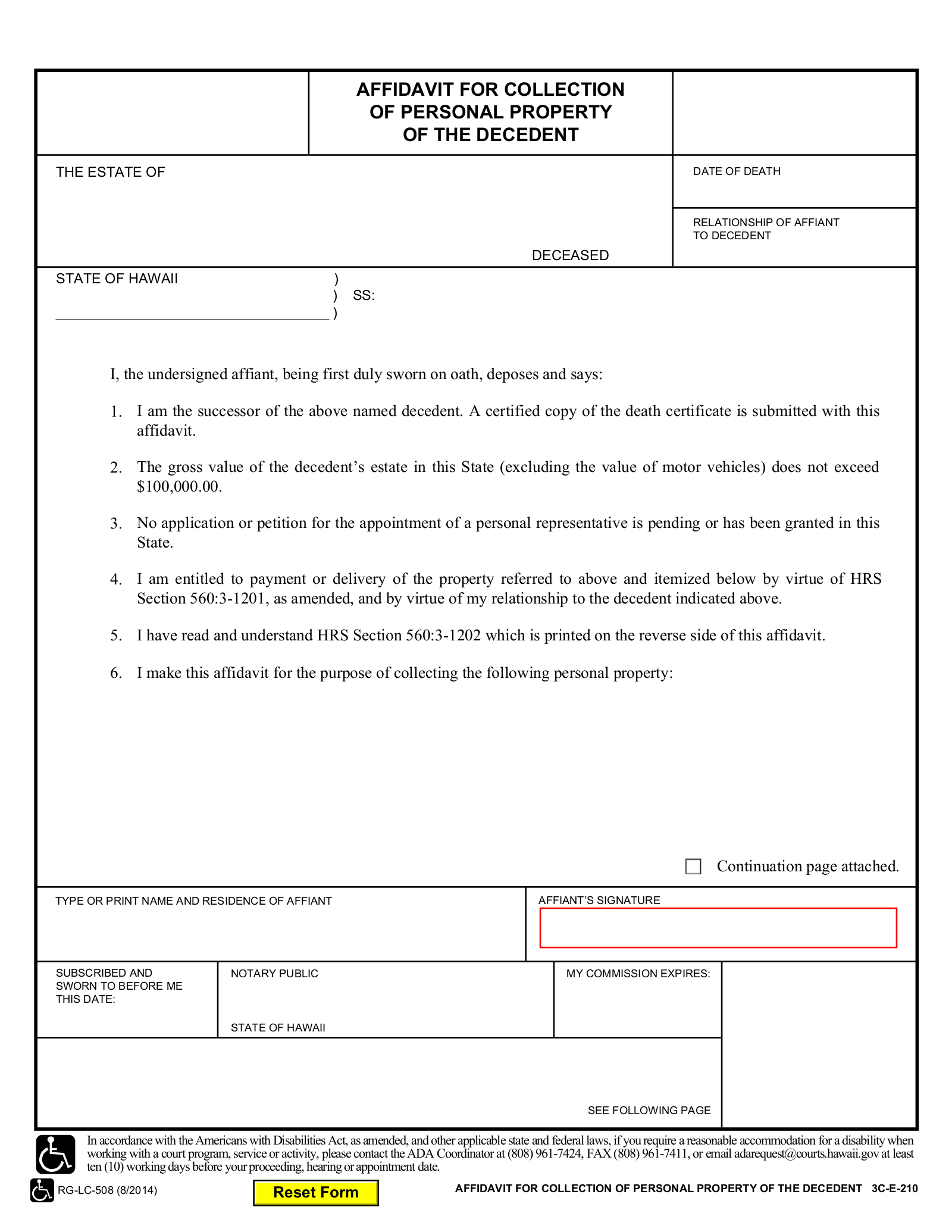

(1) Hawaii Decedent’s Identity. The entire name of the Hawaii Deceased is required to begin this form. Produce it as it appears on his or her certificate of death.

(2) Date Of Hawaii Decedent’s Death. The death certificate of the Hawaii Decedent will note several facts regarding his or her death. Locate the date the Hawaii Deceased was pronounced dead, then record it in the appropriate area.

(3) Relationship Of Affiant To Decedent. The Hawaii Affiant seeking the Decedent’s property must have a prior relationship to the Deceased. Document the nature of this relationship. In many cases, the way the Affiant is related to the Hawaii Deceased and the status of the Deceased’s Survivors will play a strong role in this petition’s eligibility.

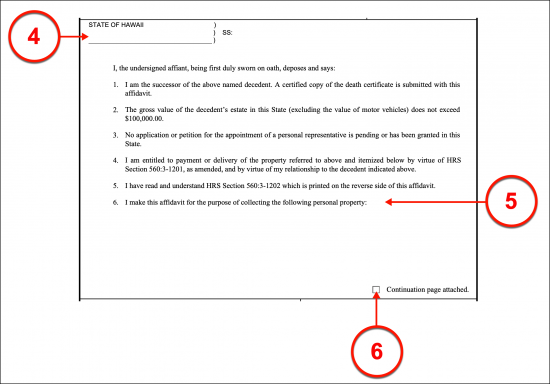

(4) County. The Affiant will need to notarize his or her signature to the document being developed. The Notary Public will need to report the County at the beginning of the notary process unless he or she will instruct the Affiant to do so. Make sure the name of the Hawaii County where this paperwork will be applied is present where required.

(5) Entitled Property From Hawaii Decedent Estate. The Affiant to the Hawaii Decedent’s estate must attest to several facts. All of which are presented for review. If true, then a catalog of the property the Affiant believes he or she is entitled to from the Hawaii Decedent’s estate must be described. Such a description must include the monetary worth of the property whether it is a physical object (i.e. electronic equipment, artwork) or intangible (i.e. stocks).

(6) Continued Report Of Assets. If more room is required for this task then select the “Continuation Page Attached” checkbox and physically attach a document with the remaining assets expected by the Affiant from the Hawaii Decedent’s estate.

Affiant Affirmation

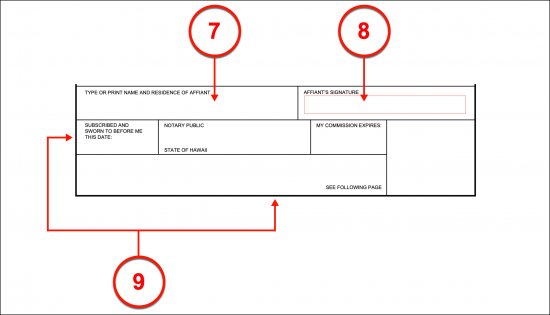

(7) Identity And Address. Once the Affiant has detailed the expected property of the Hawaii Deceased’s estate and can confirm all statements made in this paperwork are true, he or she will need to execute this petition before a Notary Public by signing his or her name. Before doing so, however, the Affiant must supply his or her printed name and residential address.

(8) Hawaii Affiant Signature. The Affiant must sign his or her name under the instructions of the Hawaii Notary Public obtained to verify that he or she is signing this document.

(9) Hawaii Notarization Of Affiant Signature. The Notary Public will be able to verify the identity of the Affiant, the date of the signing, and the County where it occurs because he or she can be easily reached for future testimony. He or she will provide this information to the form along with the exact date his o her commission expires and his or her credentials (i.e. notary seal).