Updated November 27, 2023

A Massachusetts small estate affidavit is a legal document used to present a claim on the estate or part of the estate of a deceased loved one. The petitioner, or affiant, must provide detailed information about the estate, the property in question, the decedent, and any other potential heirs. This process can be used to avoid probate court in Massachusetts when the value of the estate is no greater than $25,000.

Laws

- Days After Death – Thirty (30) days (M.G.L.A. 190B § 3-1201)

- Filing Fee – $115 (M.G.L.A. 190B § 3-1201, M.G.L.A. 262 § 40)

- Maximum Amount ($) – $25,000, excluding the value of a single motor vehicle. (M.G.L.A. 190B § 3-1201)

- Signing – Both the affiant and a notary public are required to sign.

- Statutes – Collection of Personal Property by Voluntary Administration Procedures for Small Estates

How to File (3 steps)

2. Complete Documents

Gather and complete the following necessary documents:

- Copy of death certificate

- Copy of will (if it exists)

- Small Estate Affidavit

3. File With Probate Court

How to Write

Download: PDF

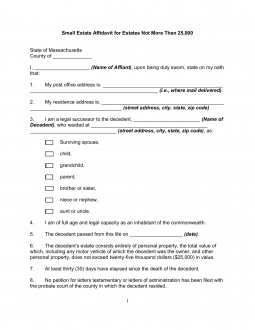

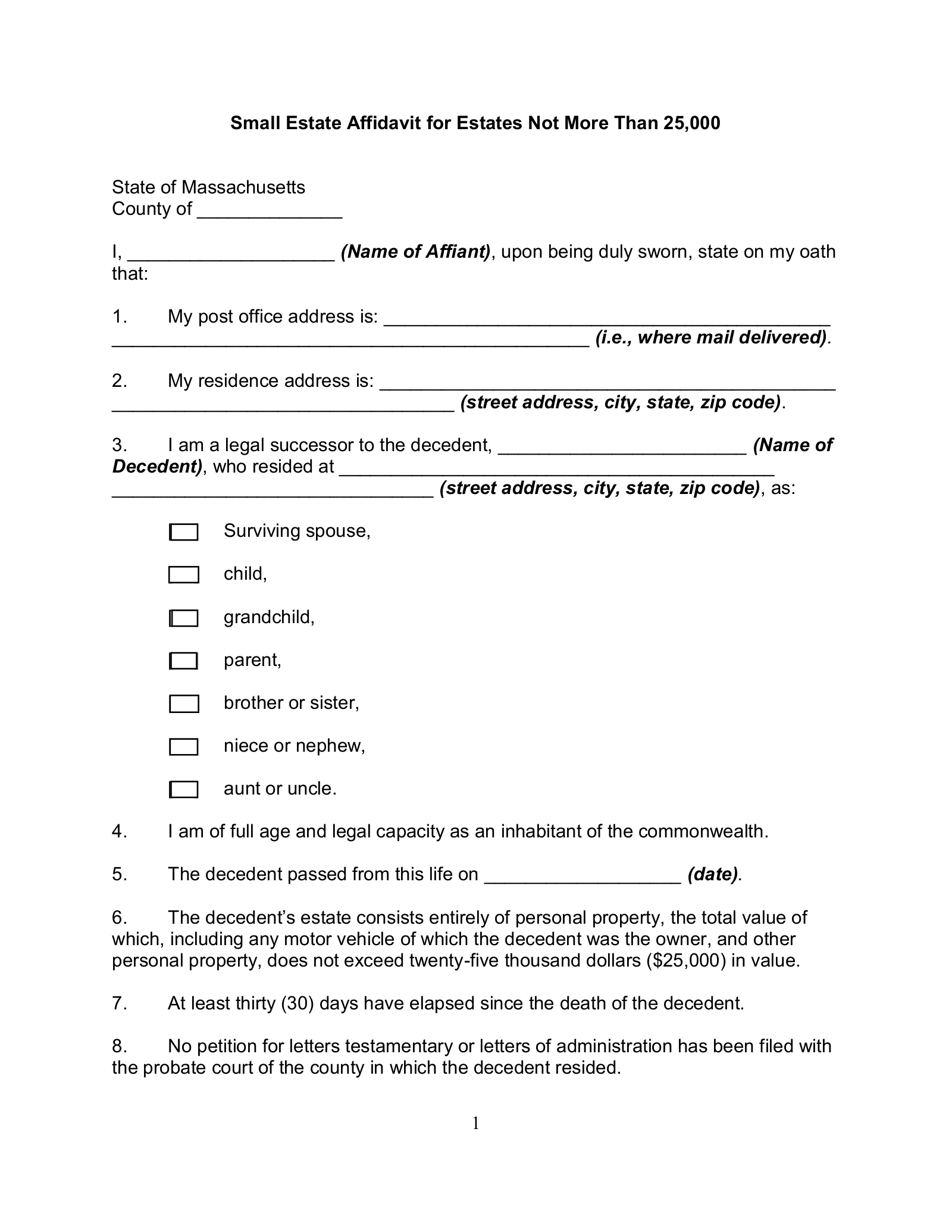

(1) Massachusetts County. Produce the name of the Massachusetts County where this petition will be filed.

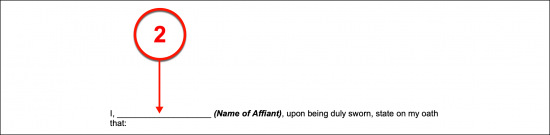

(2) Name Of Affiant To Massachusetts Estate. The Affiant to the Massachusetts Decedent’s estate should be identified as the source of this petition.

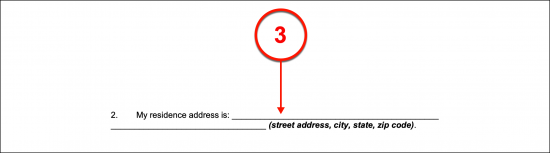

(3) Post Office Address And Residential Address. A reliable mailing address where the Affiant can be contacted is required for the second article.

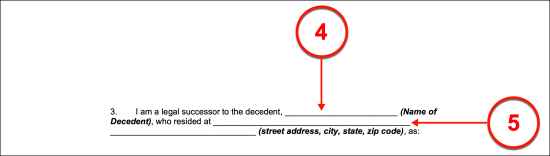

(4) Name Of Massachusetts Decedent. Dispense a record of the Massachusetts Deceased’s full name to supplement the language in Article 3.

(5) Residential Address. Once the name of the Massachusetts Decedent has been supplied, continue with a record of the home address where he or she lived.

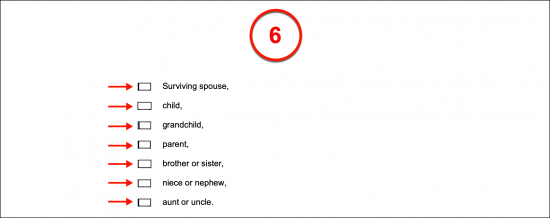

(6) Affiant Description. The Affiant to the Massachusetts Decedent’s estate must establish his or her relationship with the Deceased. One or more checkboxes can be selected to define every Affiant behind this filing. .

(7) Date Of Massachusetts Decedent’s Death. Report the date when the Massachusetts Decedent was declared (on his or her death certificate) to have died.

(8) Names And Address Of Joint Owners To Estate Property. Every Party sharing ownership of property with the Massachusetts Deceased should be documented. This requires a record of each such Co-Ower’s name and address. If there are no Co-Owners to the Massachusetts Decedent’s estate property, then verify this by writing in the word “None.”

(9) Possible Massachusetts Claimants To Intestate Will. If the Massachusetts Decedent did not have a will, then any Party who may have an equal or greater claim to the estate property of the Massachusetts Decedent should have his or her name and address presented to the twelfth article.

(10) Predetermined Successors. If the Massachusetts Decedent has named specific Parties to be Heirs to his or her property, then the name, contact information, and the property that should be delivered to the Heir must be presented in this form.

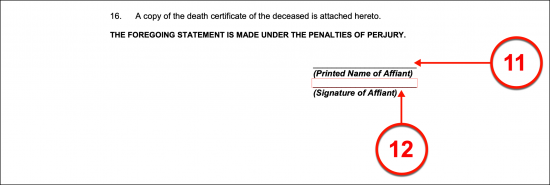

(11) Printed Name Of Affiant. The Affiant to the Massachusetts Decedent’s estate must print his or her name when it is time to sign this document to execute it.

(12) Signature Of Affiant. The execution of this paperwork requires that its Affiant sign his or her name while a Massachusetts Notary Public observes the process.

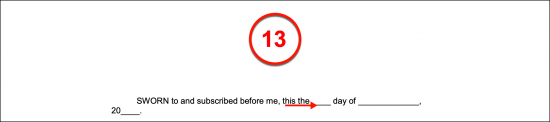

(13) Notary Action To Verify Affiant Signature. The Notary Public obtained for this signing can only complete this requirement if his or her commission is active and recognized by the State of Massachusetts. He or she will give any additional instructions necessary for the notary process then complete the area below the Affiant signature

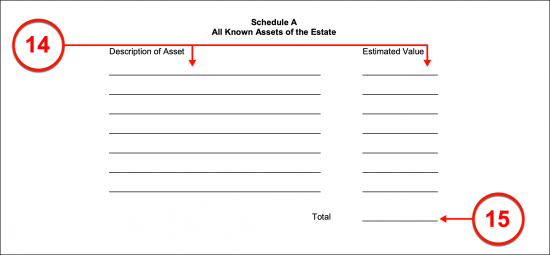

(14) Decedent Assets. Every tangible and intangible asset owned by the Massachusetts Decedent at the time of his or her death must be inventoried on the attachment provided. Additionally, the current market value of the Massachusetts Decedent’s assets must be included.

(15) Total. Add every dollar value listed as the worth of the Massachusetts Decedent’s assets to a single sum then present this total where requested.