Updated February 15, 2024

A Washington D.C. small estate affidavit, also known as a petition for administration of a small estate, is a legal document that can be utilized in place of probate for a small estate. In the District of Colombia, a small estate is an estate worth less than $40,000. (This amount applies to deaths after April 26, 2001.) The affidavit makes the process of distributing assets much cheaper and much quicker than it is for larger estates.

Laws

- Days after Death – No statute.

- Maximum Amount ($) – $40,000 (D.C. Code, § 20-351)

- Real Estate – Real estate interests may be considered part of a small estate. (D.C. Code, § 20–353)

- Filing Fee – Fee depends on the value of assets and ranges from no cost to $150. For a fee schedule, click here.

- Statute – Code of the District of Colombia, Title 20, Chapter 3, Subchapter VI (Small Estates)

How to File (4 steps)

1. Prepare Documentation

You’ll need a death certificate and a will if there was one, as well as a certificate confirming the will was filed. You’ll need photo identification, all bills and receipts associated with the funeral or cremation, and a written list of everything the deceased person owned at the time of death.This includes:

- Real estate;

- Bank accounts;

- Stocks;

- Bonds;

- Retirement accounts;

- Automobile titles; and

- Uncashed checks.

2. Prepare Affidavit

3. File Affidavit

4. Collect Assets

How to Write

Download: PDF

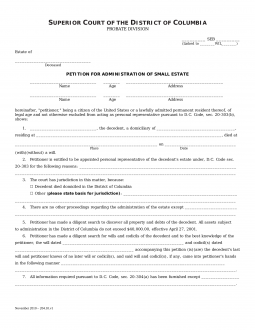

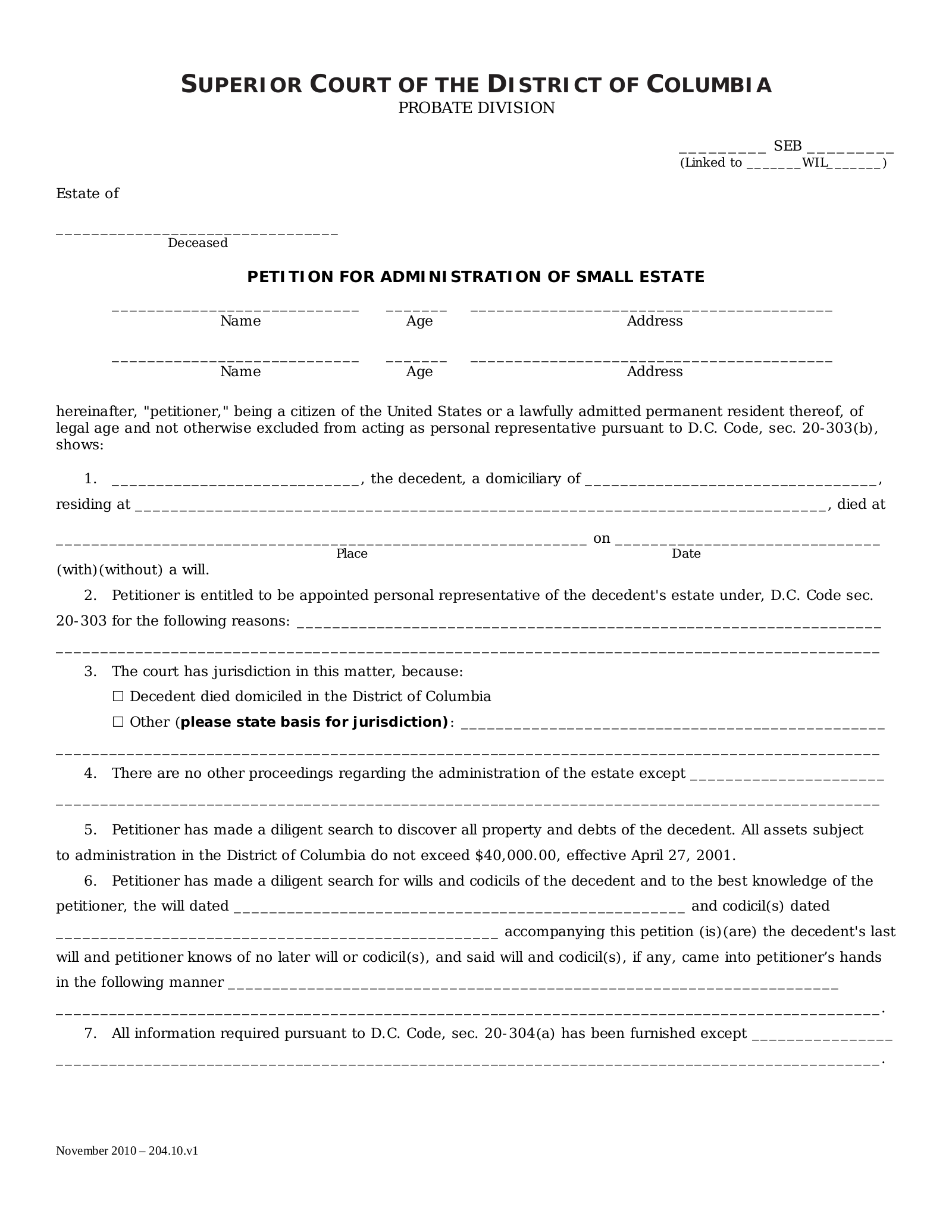

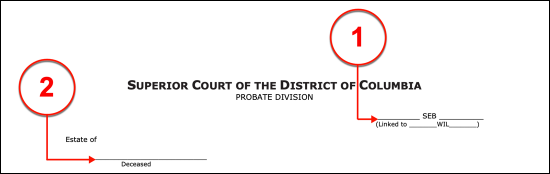

I. Header Presentation

(1) Office Requirement. The upper right-hand corner of the page calling for the “SEB” (Small Estate) will require the participation of the reviewing Court, do not submit information to this area unless directly instructed to by the Court overseeing this matter.

(2) D.C. Decedent. Identify the subject of this petition for a small estate in Washington D.C. by presenting the full name of the Washington D.C. Resident who is deceased and whose small estate is being discussed.

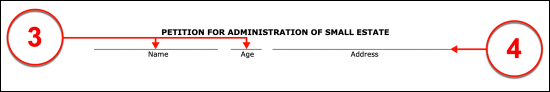

II. Petitioner For D.C. Small Estate

(3) Name And Age Of Petitioner. The legal name of the Party who is petitioning the District of Columbia Superior Court must be documented at the onset of this petition (where requested). Additionally, provide the current age of the Petition on the adjacent line. This action should be performed for each Petitioner who shall sign this document, therefore, insert an additional area or furnish an attachment with this roster if more room is required for this report.

(4) Address Of Petitioner. Furnish the full address of each Petitioner to the D.C. Decedent’s small estate.

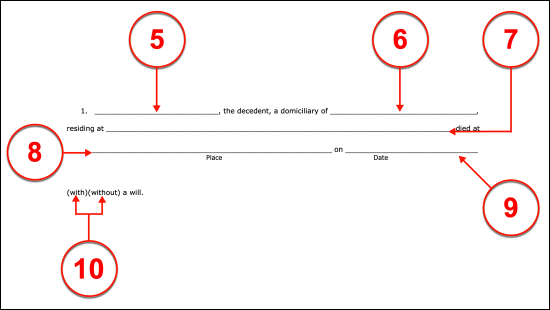

III. D.C. Decedent

(5) Name Of D.C. Decedent. The first statement made will need to be supplemented with facts defining the D.C. Decedent, starting with a production his or her entire legal name.

(6) District Of Residence. The name of the District where the D.C. Decedent lived when he or she died should be presented to the next available line.

(7) Home Address. Dispense the physical home address of the D.C. Decedent to the space that follows the phrase “…Residing At.” This information must be the address that will allow a Reviewer of this document to visit and visually inspect this residence.

(8) Place Of Death. The death certificate defining the circumstances and other facts surrounding the D.C. Decedent’s death should be reviewed. Once done, transcribe the “Place of Death” listed on the death certificate to the area labeled “Place.”

(9) Date Of D.C. Decedent Death. Conclude the first statement with a record of the calendar date the death certificate lists as the day when the Washington D.C. Decedent (officially) died

(10) Will Status. If the D.C. Deceased (or Decedent) has executed his or her will before death, then circle the word “With.” If this was not the case, and the D.C. Decedent died intestate by not issuing a will, then circle the word “Without.”

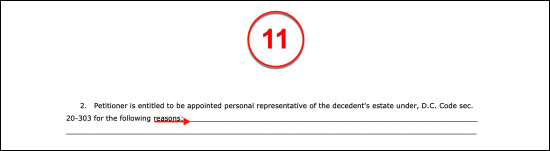

IV. Reason For Petition

(11) Establishing Petitioner Legitimacy. The right to assume the right to petition to be and to act as the Personal Representative of the D.C. Decedent’s small estate will largely depend on the manner in which the Petitioner is related to the D.C. Decedent and the order in which such a right is assigned. This information may be found by consulting the list in D.C. Code sec. 20-303. For instance, the Spouse of a testate Decedent (died with a will in place) will have priority in this assignment over the 1st Cousin of the Decedent. Consult this statute then, define the qualifications of each Petitioner named above.

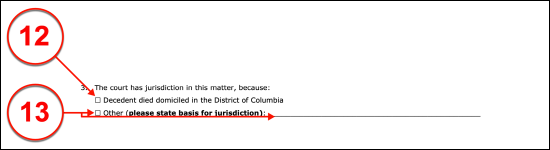

V. Verifying Court Jurisdiction

(12) Decedent Died Domiciled In District Of Columbia. The ability of the Superior Courts to review this matter must be established in this document. If the D.C. Decedent lived or maintained his or her home residence in Washington D.C. then select the first statement in the Third Article by placing a mark in the first checkbox statement.

(13) Other Reason For D.C. Court Jurisdiction. If the D.C. Decedent did not maintain his or her home residence in Washington D.C. but his or her estate still falls within the jurisdiction of the Superior Court, then select the second checkbox. In addition, present the exact basis for submitting this petition to the Superior Court.

VI. Administration Status

(14) Past Or Current D.C. Small Estate Judgements. If there are any proceedings concerning part of or all of the D.C. Decedent’s small estate currently underway or concluded with a ruling, then each such proceeding must be presented with a report on items such as the title, location, ruling court identity, and case number needed by Reviewers to (potentially) investigate this matter further.

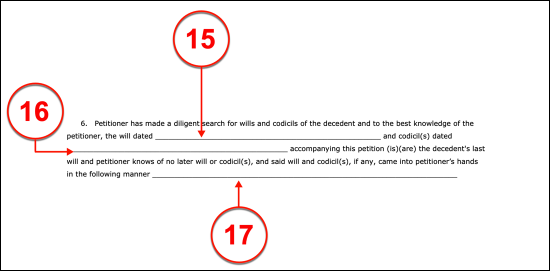

VII. D.C. Decedent Final Will

(15) Date Of D.C. Decedent Will. The calendar date when the will of the D.C. Decedent was executed or signed into effect should be documented in the Sixth Article.

(16) Date Of D.C. Decedent Codicil(s). In some cases, the D.C. Decedent may have amended his or her will with a codicil. The date of each (active) codicil must be presented in the sixth article.

(17) Manner Acquired. The source or method by which the Petitioner to the D.C. Decedent’s small estate was able to review the concerned will and its codicils must be defined in this paperwork. Thus, locate the final blank lines of Article Six and describe how the Petitioner gained access to the D.C. Decedent’s will and codicils.

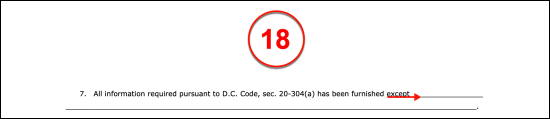

VIII. Missing Requirements (If Applicable)

(18) Missing Information. If any requirements placed on this petition have been excluded then define the missing information and present the reason for its exclusion in Article VII.

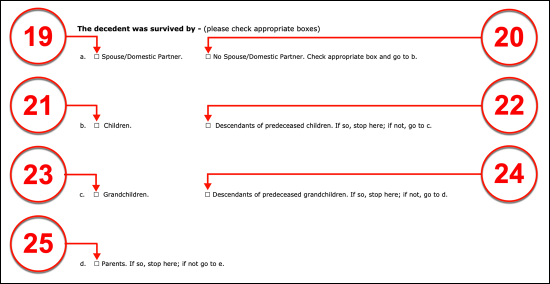

IX. Survivors Of D.C. Decedent

(19) Spouse. The Family Members that lived beyond the death of the D.C. Decedent should be documented in this petition. A checklist has been provided so that each Survivor can be defined. If the Spouse of the D.C. Decedent survived beyond his or her death, then select the first checkbox from Statement (A) and disregard the remainder of this list. If not, then review the next description in this statement.

(20) No Surviving Spouse. If the D.C. Decedent was unmarried at the time of death, then select the checkbox labeled “No Spouse/Domestic Partner” and continue to review next statement.

(21) Children. Select the first checkbox from Statement (B) if the Children of the Decedent are alive.

(22) Descendents Of DC Decedent Children. If the D.C. Decedent’s Children are alive and had Descendents of their own that are also still alive then mark the second checkbox in Statement (B). One or both of these checkboxes may be selected to accurately represent the status of the Survivors of the D.C. Decedent. If neither are selected then, continue to the next statement. If either have been selected then continue to the next section.

(23) Grand Children. Statement (C) will allow a definition to the status of the D.C. Decedent’s Grand Children. Select the first checkbox statement if the D.C. Decedent was survived by his or her Grandchildren.

(24) Descendants Of Grandchildren. Select the second checkbox in Statement (C) if the D.C. Decedent was survived by his or her Grandchildren and the Descendants of his or her Grandchildren. If either the first or second (or both) Survivor description has been selected from Statement (C) then proceed to the next section. If neither of these selections have been made, then review the next description provided.

(25) Parents. If the Parents of the D.C. Decedent are survivors of his or her death then the checkbox from Statement (D) must be marked and the next section must now be attended to. Otherwise, leave this checkbox unmarked to indicate that the D.C. Decedent was not survived by his or her Parents and continue to the next description.

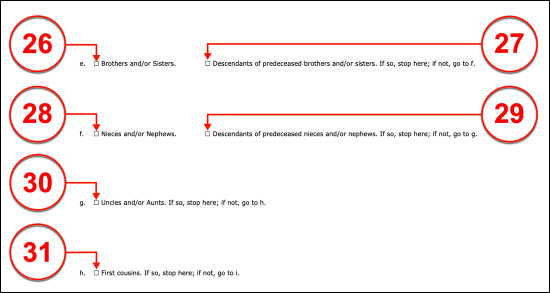

(26) Siblings. The first checkbox should be selected from Statement (E) if the D.C. Decedent was survived by his or her Brother(s) or Sister(s). If so, then the remainder of this list may be disregarded and the next section should be reviewed.

(27) Descendants Of Siblings. If the Siblings of the D.C. Decedent and their Descendants are alive at the time this petition is made then select the second checkbox from Statement (E). If either or both of these checkboxes have been selected then, do not proceed to the next statement. If the D.C. Decedent has not been survived by any of the Family Members defined by the above statements or Statement E, then continue to review this list of Survivor descriptions

(28) Nephews/Nieces. If any Nephews or Nieces of the D.C. Decedent survived his or her death, then mark the “Nephews/Nieces” checkbox found in Statement (F).

(29) Descendants Of Nephews/Nieces. If the D.C. Decedent’s Nephews or Nieces and their Descendants remain alive then select the second checkbox provided by Statement (F). If neither of these options are selected then continue to the next statement, otherwise, if either of these checkboxes have been selected continue to the next section.

(30) Uncles/Aunts. If the D.C. Decedent was survived by one or more Uncles or Aunts then, this may be presented by choosing the first checkbox from Statement (G).

(31) First Cousins. Place a mark in the first checkbox of Statement (H) if any of the First Cousins of the D.C. Decedent are alive then continue to the next section however, if this is not the case, then leave this statement unselected and review Statement (I) in the next item.

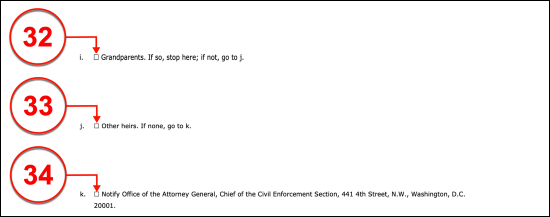

(32) Grandparents. Indicate if the Grandparents of the D.C. Decedent have survived his or her death by marking the Statement (I)’s checkbox. If not, then continue through this area to review the next item.

(33) Other Heirs. If none of the previously listed Parties have survived the D.C. Decedent but there are qualifying Heirs to the D.C. Decedent’s estate then furnish a mark to the check in Statement (J).

(34) Notify Office. If there are no Family Members, Heirs, or Beneficiaries to the D.C. Decedent that are alive, then select the checkbox in Statement (K) to inform the Attorney General.

X. Interested Parties

(35) Name Of Party. Every Party that holds a claim to a dollar amount or one or more assets from the D.C. Decedent’s estate should be identified by name in the first column.

(36) Address Of Party. Document the address of the (previously named) Party who holds a claim to any portion of the D.C. Decedent’s small estate.

(37) Relationship To D.C. Decedent. Once every interested Party has been identified with his or her name and address, the relationship this Party held with the D.C. Decedent must be defined in the third column. This relationship must be defined even if the Interested Party is a Creditor of the D.C. Decedent.

XI. Witness(es) To D.C. Decedent Wills/Codicils

(38) Signature Witnesses To D.C. Decedent Intent. The Witnesses who observed the D.C. Decedent’s execution of his or her will and (if applicable) codicils must be named in this paperwork. Use the area provided to present the full name of each such Witness.

XII. D.C. Decedent Assets And Debts

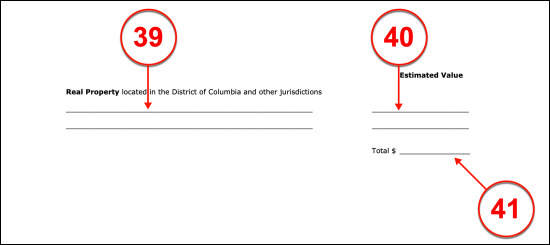

(39) Real Property And Estimated Value. While most small estates do not contain real property or real estate, an area has been provided should the concerned estate consist of real estate and remain within the District of Columbia’s maximum acceptable value (currently $40,000.00) for a small estate. Thus if the D.C. Decedent owned real property at the time of death then each piece of real estate or property should be listed with the address and legal description found on its deed. The first area in “Real Property” has been provided for this presentation. Bear in mind this applies to real property that the D.C. Decedent co-owned.

(40) Estimated Value. The value of the property as of its last assessment by the District should be recorded. If there have been any significant improvements or damages to the D.C. Decedent’s real property since its last assessment, then factor this in when providing the estimated value of the real property left by the Deceased. If the D.C. Decedent shared property ownership then record the dollar amount of the portion of the real property’s estimated value that he or she is entitled to.

(41) Total Value Of D.C. Decedent Real Property. Supply the total value of the real property on the final line of the second column. This requires that every reported value is added to produce one sum then entered (where requested) as the “Total” estimated value of the real property owned by the D.C. Decedent.

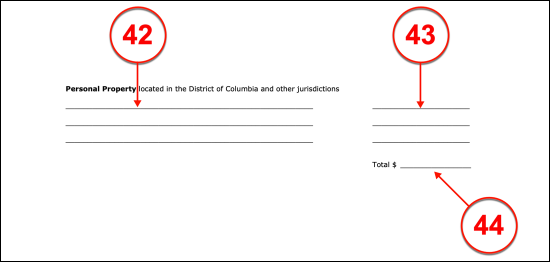

(42) Personal Property. All personal property of the D.C. Decedent will have to be defined in “Personal Property.” Bear in mind that this should be a detailed report allowing anyone reviewing this petition to locate and access the D.C. Decedent’s property. For instance, a computer that was owned by the D.C. Decedent at the time of his or her death should be listed by its Manufacturer, Mode, Type (Laptop, Desktop, etc.), O/S or operating system, technical specs (i.e. Hardrive, RAM, Video Card etc.), its serial number, and where it is currently stored or held.

(43) Estimated Value. The value of each asset named as part of the D.C. Decedent’s estate must also have its current market value reported. The second column will accept this information.

(44) Total Value Of Personal Property. Add the dollar amount entered as the value for each of the assets listed as the D.C. Decedent’s “Personal Property,” then report this result as the “Total” value of this property.

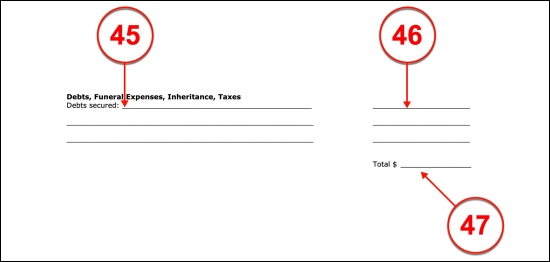

(45) Debts, Funeral Expenses, Inheritance, Taxes Of D.C. Decedent. A record of certain debts that the D.C. Decedent’s estate owes should be itemized separately. This can include items such as a loan for an automobile, taxes, and funeral expenses. Each one of these debts should be identified. Therefore, if the D.C. Decedent had an active auto loan, then the Entity that must be paid should be named along with the loan’s policy number, the date the loan was made, and the title of the paperwork binding the D.C. Decedent to its payment should be listed whereas any taxes owed should be listed by form.

(46) Amount Owed. Each debt reported should also be defined by the dollar amount the D.C. Decedent’s estate must pay

(47) Total Value Of Encumbrances. All secured debts, loans, penalties, and/or judgments held by the D.C. Decedent that require payment must be documented with a report on any collateral (property) the D.C. Decedent reserved for the Creditor should the debt go into default.

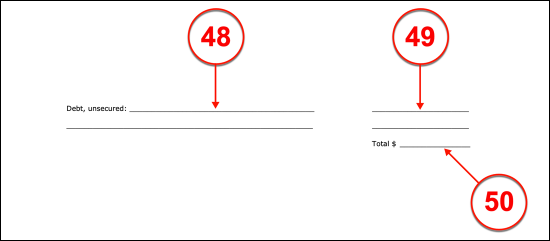

(48) Unsecured Debts. List every unsecured debt held by the D.C. Decedent at the time of his or her death by defining the Party expecting payment from the Decedent’s estate, the type of debt held by the Decedent, and any additional information (i.e. account/policy number, date of effect, etc.) to the second column of this area. Keep in mind that only debts that do not involve collateral from the D.C. Decedent should be documented here.

(49) Amount Owed For Unsecured Debts. Define the amount of money that is owed for each debt listed.

(50) Total Owed For Unsecured Debts. Add the amount owed for each unsecured debt of the D.C. Decedent and produce the “Total” where requested.

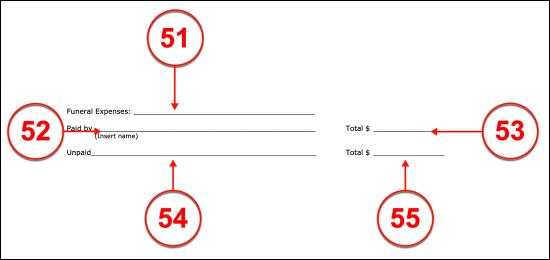

(51) Funeral Expenses. Define the total funeral expenses of the D.C. Decedent in the area reserved for this report. To do this, list the service or product that was provided and the amount of money that was charged.

(52) Payer Of Funeral Expenses. Dispense the full name of the Payer (if any) who has paid for some or all of the D.C. Decedent’s funeral expenses.

(53) Total Paid For Funeral Expenses. Record the amount of money that was paid for the D.C. Decedent’s funeral expenses.

(54) Unpaid Funeral Expenses. If there are any funeral expenses that remain unpaid, then document each service and product requiring payment.

(55) Total Owed Amount For Funeral Expenses. Furnish the total amount of money that must be paid to satisfy the remaining funeral expenses. Make sure the value entered here will be the dollar amount that will completely satisfy the unpaid funeral expenses.

(56) April 1, 1987 Condition. If the D.C. Decedent passed away before the first of April in the year Nineteen Eighty-Seven (April 1, 1987), then different regulations will affect how much inheritance tax will be owed. If so, supply the amount of Inheritance Tax that was paid where requested.

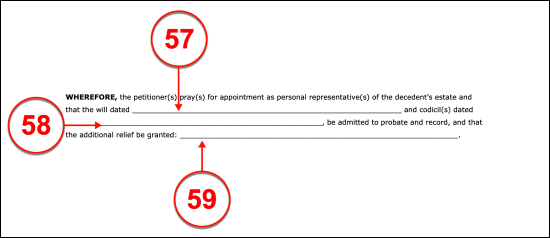

(57) Date Of D.C. Decedent’s Will. The final statement will require the execution date of the last will issued by the D.C. Decedent to be furnished to the first available line (after the words “…The Will Dated”).

(58) Date Of D.C. Decedent’s Codicil. The calendar date of every active codicil (if any) issued by the D.C. Decedent must be supplied to this statement’s language.

(59) Relief Request. If the Petitioner seeks relief on any encumbrances or procedures regarding the D.C. Decedent’s estate then, present them in the space following the words “Additional Relief Be Granted.”

XIII. Declaration Of Petitioner

(60) Signature Of Petitioner. The Petitioner for the D.C. Decedent’s estate must sign his or her name and produce his or her telephone number to the declaration statement closing the petition.

XIII. Acceptance And Consent Of Each Personal Representative.

(61) D.C. Decedent. Deliver the full name of the D.C. Decedent to complete the acceptance statement that each assigned Personal Representative of the D.C. Decedent must sign.

(62) Signature Of Petitioner. The Petitioner must acknowledge the requirements of the office he or she seeks by reading the “Acceptance And Consent…” statement provided, then signing his or her name.

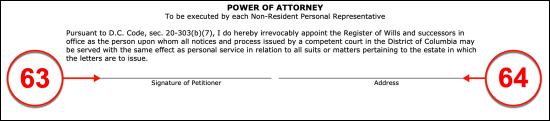

XIV. Power Of Attorney

(63) Non-Resident Petitioner Signature. If the Petitioner does not maintain a residence in Washington D.C. then any future communications or documents that must be served will need to be accepted by the Register of Wills on his or her behalf so that it may be communicated to him or her reliably. To this end, the Petitioner must sign his or her name to authorize the delivery of any official notices concerning the D.C. Decedent’s estate to the Register of Wills.

(64) Address Of Signature Non-Resident Petitioner.