Updated April 29, 2024

A Washington small estate affidavit, known as the State of Washington Affidavit of Successor, is used to expedite the probate process for an estate worth less than $100,000. In order to use this form, the decedent must have resided in the State of Washington, forty (40) days must have passed since the date of death, and all of the estate’s debts must have been paid.

Laws

- Days after Death – Forty (40) days must pass after a decedent dies before a small estate affidavit can be used.[1]

- Maximum Amount ($) – $100,000. According to state law, a small estate is defined as an estate totaling $100,000 or less.[2]

- Social Security Number (SSN) – The decedent’s Social Security Number must be submitted as part of the affidavit process.[3]

- Signing Requirements – Form must be signed in the presence of a notary public.

- Statute – Title 11, Chapter 11.62. Small Estates – Disposition of Property

How to File (7 steps)

- Pay Debts

- Wait Forty (40) Days

- Prepare Affidavit

- Notify Other Successors

- Get It Notarized

- Mail Notarized Copy

- Collect the Assets

1. Pay Debts

2. Wait Forty (40) Days

3. Prepare Affidavit

4. Notify Other Successors

Video

How to Write

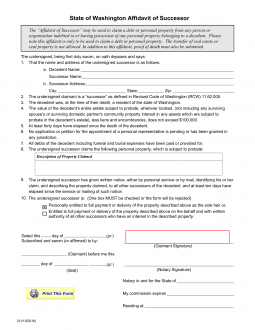

Download: PDF

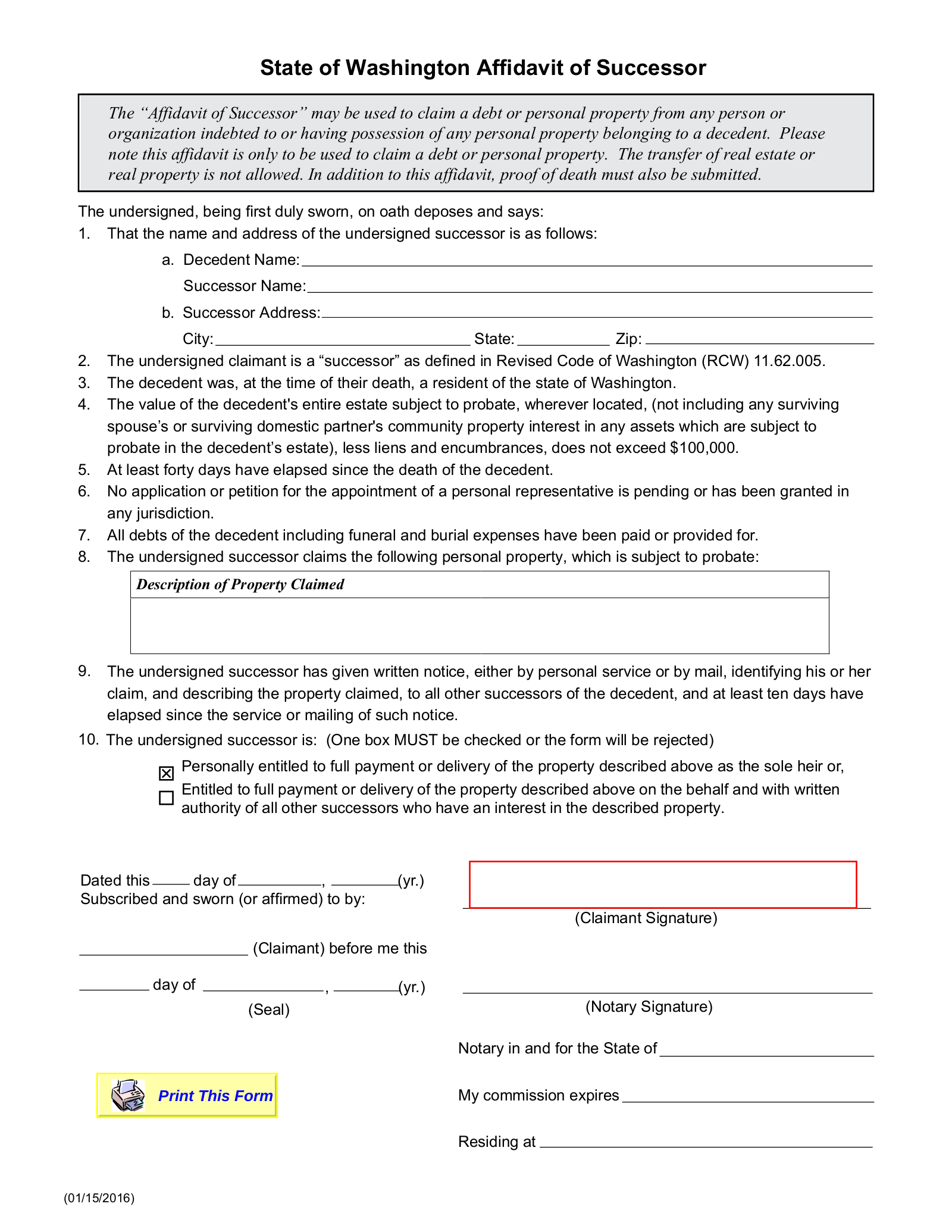

Article 1

(1) Washington Decedent Name. The identity of the Washington Deceased (Decedent) is required in the first item of Article 1. His or her death certificate should be consulted so that the Washington Decedent’s entire name can be accurately reported.

(2) Name Of Successor To Washington Decedent. The Petitioner or the Washington Successor’s name is also a requirement of this article. As the Washington Affiant, the Successor must complete this form then file it before it can be presented to obtain the property of the Washington Decedent.

(3) Successor Address. The complete address where the Washington Successor will monitor and receive all mail regarding this matter should be dispensed to complete the first article’s requirements.

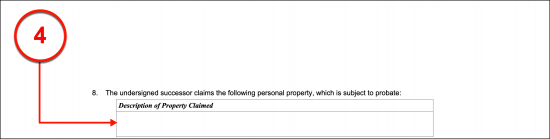

Article 8

(4) Description Of Property Claimed. The property wanted from the Washington Deceased’s estate will need to be discussed in the eighth article. This should be a complete list of all assets that are expected by the Washington Successor therefore, if needed, an attachment containing a full report may be developed so long as it is physically presented with this paperwork at all times. This inventory should be made up of the items, accounts, financial holdings, insurance payments, and cash. All information needed to identify each property should be included. For instance, if there are stocks sought by the Washington Successor, record the name of the Entity whose stock the Washington Decedent owned and the number of shares whereas a tangible item such as exercise equipment should be defined by the product name, model, and serial number.

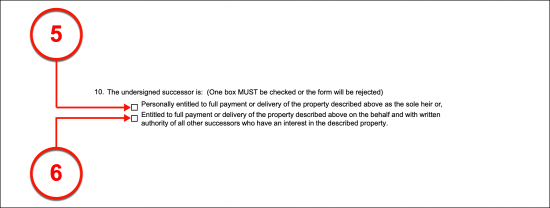

Article 10

(5) Reason For Successor Entitlement. One of two statements made in the tenth article must apply to the Successor. If the Washington Affiant is the sole Successor and no other Heirs or Successors can lay claim to the Washington Decedent’s assets, then select the first statement using the corresponding checkbox.

(6) Release To Successor. If the Washington Affiant is not the only Successor who may claim the property of the Deceased but has obtained a written release from every other Successor, Beneficiary, or Heir to file this paperwork then select the second statement.

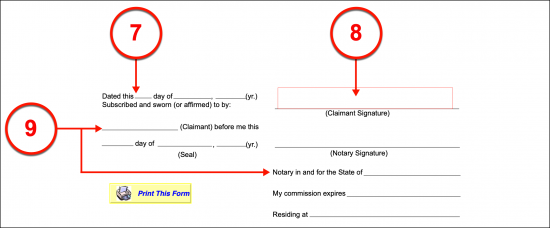

Signature

(7) Signature Date Of Claimant. The State of Washington mandates that at least forty days must pass after the death of the Decedent before this petition may be filed. The Washington Affiant will need to provide proof of his or her compliance to this statute through a dated signature that is further verified through the notarization process. When he or she is ready, the Washington Affiant (or Successor) must document the current date just before signing his or her name.

(8) Claimant Signature. The Washington Affiant must provide his or her signature as the Claimant seeking the defined assets from the Decedent’s estate.

(9) Notary Action For Washington Petition. The Notary Public working with the Washington Affiant or Claimant shall apply the notarization process to the signature required by the Claimant and will show this process in the area provided.