Updated September 13, 2023

A Missouri small estate affidavit enables certain property of a decedent (person who has died), to pass to the decedent’s heirs or successors without going through the probate process. Also known as an “affidavit of distributees for collection of small estate,” this faster alternative is only available to estates smaller than a maximum amount established by the state. The option is available both in instances in which the decedent had a will, and those in which the decedent died intestate, meaning without a will.

Laws

- Days After Death – The affiant must wait at least thirty (30) days from the date of the decedent’s death before filing the form. (V.A.M.S. 473.097(2))

- Maximum Amount ($) – After deducting liens, debt, and encumbrances, the value of the estate cannot exceed $40,000 (V.A.M.S. 473.097(1)).

- Publishing – If the value of the estate is more than $15,000, then the estate must pay for the court of clerk to publish a notice of the filing in a newspaper of general circulation in the county where the decedent resided. (V.A.M.S. 473.097(6)(5))

- Signing Requirements – Must be notarized.

- Statutes – Probate Code, Dispensing with Administration (§§ 473.090 through 473.107)

How to File (4 steps)

2. Assess Estate Value

3. Gather Documents

4. File at the Probate Court

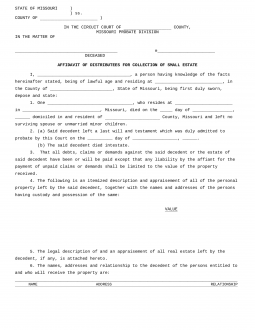

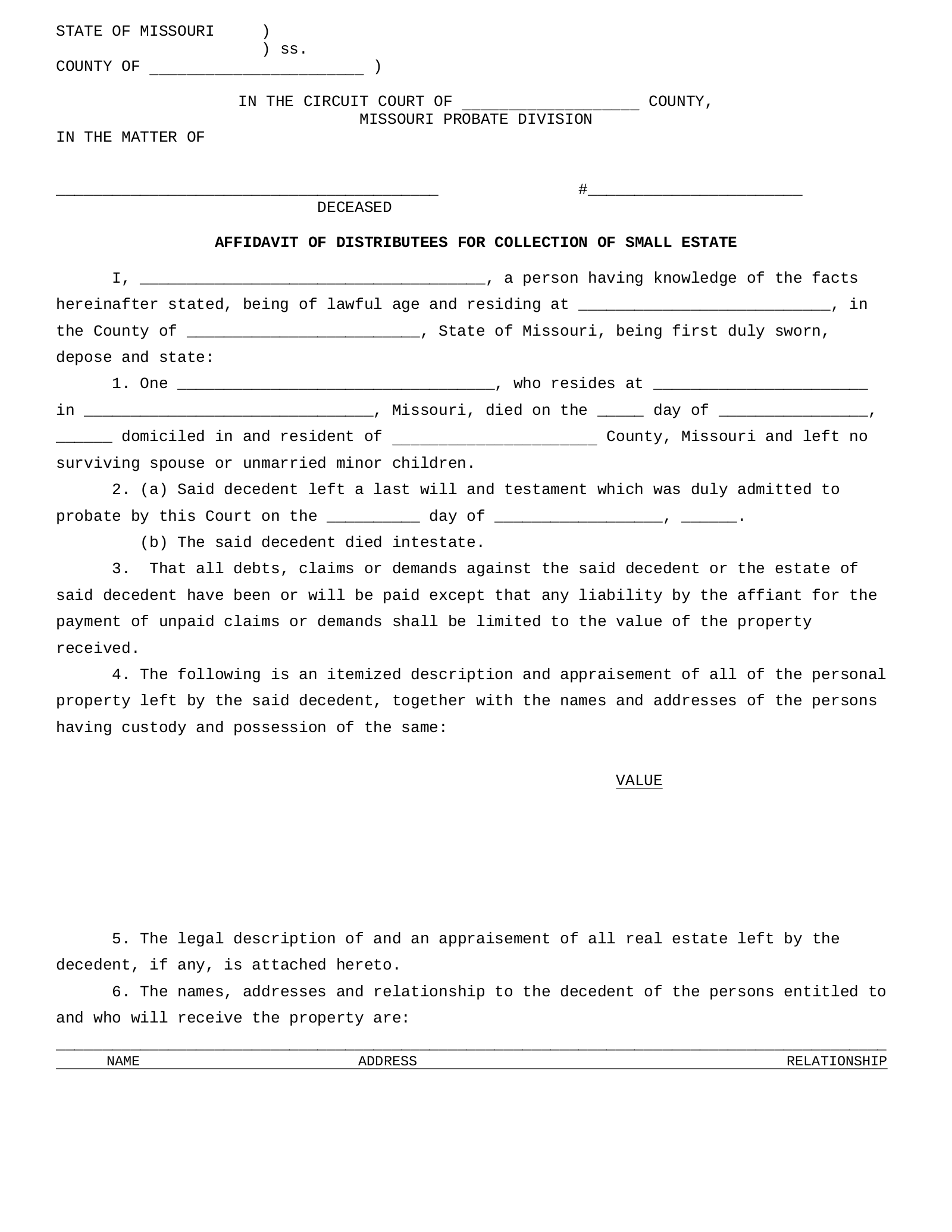

How to Write

Download: PDF

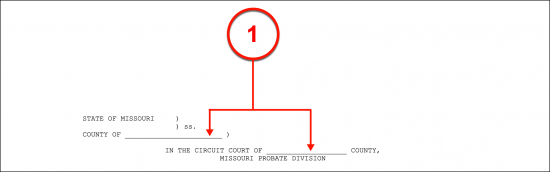

(1) Missouri County Of Action. The name of the Missouri County where this affidavit is produced and executed will need to be displayed at the beginning of this document. It should be noted that the Notary Public obtained may prefer to deliver this information in person at the time of signing.

(2) Missouri Deceased. Name the Missouri Decedent or Deceased. His or her legal name will be required as it appears on official documents such as the death certificate.

(3) Case Number. The case number given to this matter by the Missouri Probate Court of the County must be supplied.

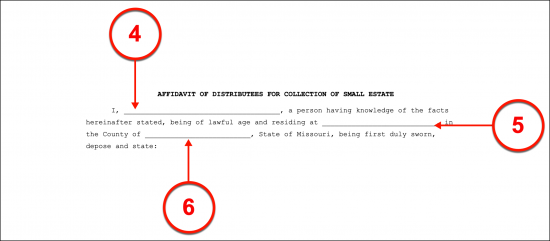

(4) Missouri Affiant To Estate. The Missouri Affiant will generally be a Successor or Representative of the Missouri Decedent. This Party will need to sign his or her name at the end of this document before a notary public in order to make it an effective petition.

(5) Address. The home address of the Missouri Affiant is necessary to identify this Party properly.

(6) Missouri County Of Affiant Residence. Document the County where the Missouri Affiant lives.

ARTICLE I

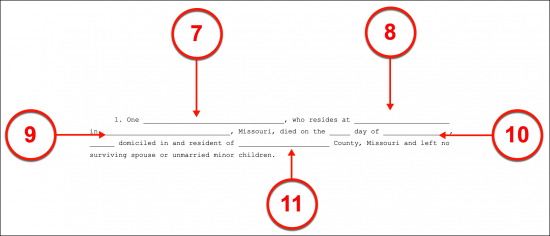

(7) Missouri Deceased Identity. Affirm the identity of the Missouri Deceased by furnishing his or her name and address to the declaration made in this document. Each item of information should be placed where it is requested.

(8) Missouri Deceased Address.

(9) Missouri Decedent Residential County.

(10) Missouri Decedent’s Date Of Death. The day when the Missouri Decedent was pronounced as dead must be at least thirty days from the date this document is notarized. Report the formal date of death from the Missouri Decedent’s death certificate.

(11) Missouri Decedent Residential County.

ARTICLE II

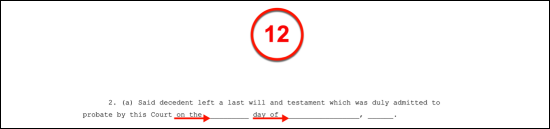

(12) Date Of Probate Submission. The date when the Missouri Decedent’s will was submitted to the probate court (if applicable) must be presented in the statement made by the second article.

ARTICLE IV

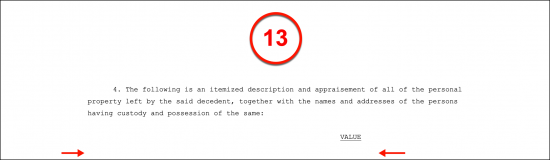

(13) Description And Value Of Missouri Decedent Property. A definition as to what property makes up the Missouri Decedent’s estate, the names and address of each piece of property’s current Owner or Controller, and the value of each piece of property should be included with the statement made by this petition.

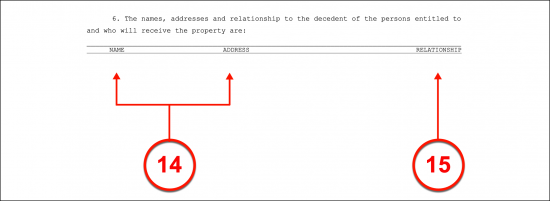

ARTICLE VI

(14) Missouri Decedent Heirs. The name and address of each Heir to the Missouri Decedent must be provided with this statement. This may be someone the Missouri Decedent has named as an Heir in his or her will or it may be a direct Survivor of the Missouri Decedent (i.e. Offspring or Spouse).

(15) Relationship With Missouri Decedent. Explain how each Heir is related to the Missouri Decedent.

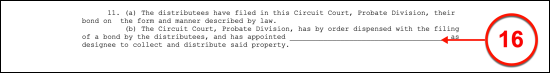

(16) Missouri Court Appointee. The formally appointed Designee to handle the disbursement of the Missouri Decedent’s property must be named.

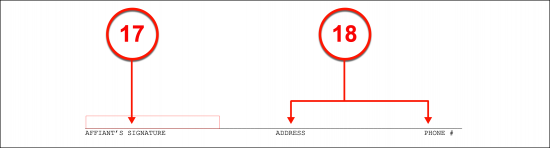

(17) Missouri Affiant Signature. The signature of the Missouri Affiant is mandatory to execute this form. Furthermore, he or she must sign this document while a licensed Notary Public observes.

(18) Missouri Affiant Address And Phone Number.

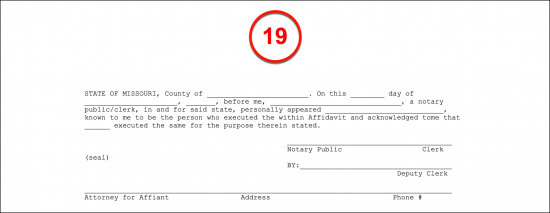

(19) Missouri Notary Public. It is imperative that this document can be verified as being signed by the Affiant. To this end, a Notary Public whose practice is recognized by the State of Missouri will verify the Affiant’s identity during the notarization process then show proof of his or her credentials where required.

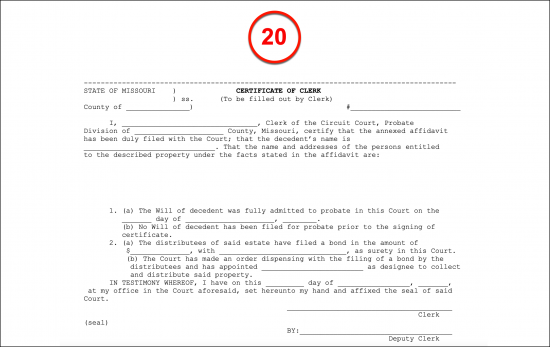

(20) Missouri County Clerk. The Missouri County Clerk where this petition is filed will complete the remainder of this document to verify its receipt and filing.