Updated September 13, 2023

A Pennsylvania small estate affidavit is a document used to petition the Orphans’ Court for appointment as the personal representative over a deceased individual’s small estate. It can only be used for estates valued at less than $50,000. Using this form helps avoid the probate process, which can be time-consuming and costly.

Legally known as a “petition for settlement of a small estate.”

Laws

- Days After Death – No statute, although 60 days is recommended (and is required for insurance proceeds).

- Maximum Amount ($) – $50,000. This amount excludes real estate and property payable under section 3101 (relating to payments to family and funeral directors). 20 Pa.C.S.A. § 3102

- Signing – The affidavit must be signed by the affiant in the presence of a notary public. Their attorney must also sign (if they have one), and a deputy from the PA Register of Wills will sign when the affidavit is affirmed.

- Statutes – Title 20, Chapter 31, Subchapter A (Dispositions Independent of Letters)

- Where to File? Orphans’ Court Clerk’s Office

How to File (3 steps)

1. Complete the Paperwork

- Decedent’s Will (obtain a copy from the Register of Wills)

- Pennsylvania Inheritance Tax Return (REV-1500)

- Pennsylvania Small Estate Affidavit

- Petition for Adjudication/Statement of Proposed Distribution

2. File with the Court

Video

How to Write

Download: PDF

I. Title And Preliminary Information

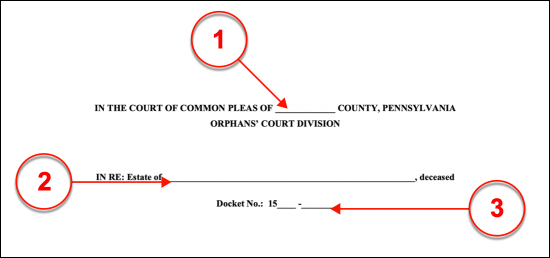

(1) Pennsylvania County Of Action. The Pennsylvania Orphan Court receiving this paperwork will need to be identified with the name of the County of its jurisdiction. Place the name of this County in the space provided in the title of this document.

(2) Name Of Pennsylvania Decedent. The Pennsylvania Decedent’s full name is required to define the concerned estate. This should be the entire legal name of the Deceased as noted on his or her government paperwork and death certificate.

(3) Docket Number. The docket number for this matter may only be obtained from the Courts of Pennsylvania. Bear in mind, it is crucial that this docket number is accurately presented since this (first) page is included to inform those receiving a copy of this affidavit of their ability to contest this action.

II. Petitioner To Pennsylvania Small Estate

(4) Header Information. Reproduce the name of the County where this petition is submitted in the title displayed on the second page then continue to record both the name of the Pennsylvania Deceased whose estate is discussed, and the docket number. This is the formal title page for the petition being made, therefore make sure this is an exact reproduction of the information supplied to the first page.

(5) Petitioner Name. Every Petitioner to the Pennsylvania Decedent’s estate must be presented as such in Paragraph 1. Furnish the name of each Party who will sign this affidavit as a petition to the courts for the control of the concerned small estate.

(6) Petitioner Address. In Paragraph 2, furnish the home address of every Petitioner named above.

(7) Petitioner Relationship With Decedent. Now that the Petitioner(s) has been introduced with his or her name and address, the relationship held by each Petitioner with the Pennsylvania Decedent must be described in Paragraph 3. A few labeled choices have been presented here. The Petitioner should place a mark in the space preceding the word “Spouse,” “Child,” “Parent,” or “Sibling” to inform Reviewers of his or her relationship to the Petitioner. If none of these accurately define how the Petitioner(s) is related to the Pennsylvania Decedent, then “Other” must be selected and the blank line that follows this label should be supplied with a description of the Petitioner’s relation to the Pennsylvania Decedent.

III. Pennsylvania Decedent

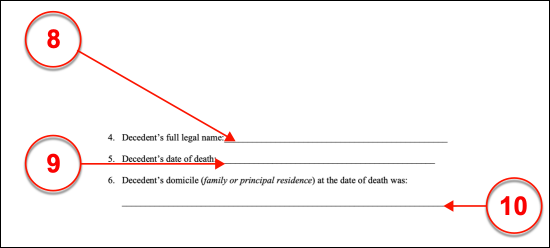

(8) Decedent’s Full Legal Name. This petition will need to name the Deceased Party who has generated the Pennsylvania small estate during the course of his or her lifetime and has passed away as a Resident of Pennsylvania. Place his or her name in the space available in Paragraph 4.

(9) Decedent’s Date Of Death. The death certificate documenting the declaration of the Pennsylvania Decedent’s cause and time of death will also contain the exact calendar date when he or she died. Document the calendar date displayed as the date of death for Pennsylvania Decedent on his or her death certificate in the Fifth Paragraph.

(10) Decedent’s Domicile. The home of the Pennsylvania Decedent must be included when identifying him or her. Therefore, provide the space in Paragraph 6 with the address of the residence where the Pennsylvania Decedent was living at the time of his or her death.

IV. Pennsylvania Decedent Will Information

(11) Pennsylvania Will Status. The Pennsylvania Decedent may have issued a will or may have passed away before formally executing one. If the Pennsylvania Decedent has executed a will then place an “X” on the line labeled “Testate” (found in Paragraph Seven) otherwise, place an “X” on the “Intestate” line to indicate that the Pennsylvania Decedent did not issue a will before his or her death.

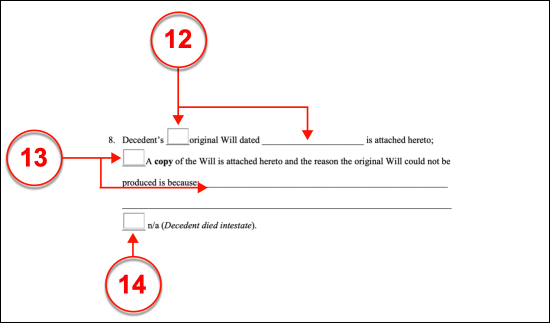

(12) Original Will. The original will issued by the Pennsylvania Decedent will have to be submitted with this document to the Orphan Courts. If the original will of the Pennsylvania Decedent will be attached then place an “X” in the first checkbox in Paragraph 8. If this choice is made, then the calendar date when the will was executed by the Pennsylvania Decedent must be furnished to the final space of this statement option.

(13) Copy Of Will. If the original will has not been attached to this petition, then a copy of it should be provided in its place. In such a case, select the second statement available in Paragraph 8. In addition to making this selection, the reason why the original will is not attached must also be submitted in the space provided.

(14) Intestate Decedent. If the Pennsylvania Decedent did not issue a will then, submit an “X” to the “N/A” checkbox.

V. Beneficiaries To Pennsylvania Small Estate

(15) Name And Address Of All Beneficiaries. Each Beneficiary who should be considered an official Distributee or Recipient of assets from the Pennsylvania Decedent’s estate will require identification in the Ninth Paragraph. For this task, list the legal name of each Beneficiary with his or her address in the space provided. Keep in mind, that even if the Pennsylvania Decedent died while intestate, certain Parties (i.e. Spouse) will be considered the Beneficiary of the Pennsylvania Decedent.

(16) Beneficiary Minors. Every Beneficiary of the Pennsylvania Decedent that is a Minor or Child must be identified in this petition. Use the space in the Tenth Paragraph to document the full name and entire home address of each Beneficiary of the Pennsylvania Decedent who is a Minor along with the full name of his or her Parent, Guardian, or Legal Representative. Note: If the Parent, Guardian, or Legal Representative of the (Child) Beneficiary maintains a separate home address than that of the Beneficiary then the home address of the (Child) Beneficiary’s Parent/Guardian/Legal Representative must also be presented.

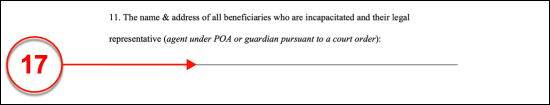

(17) Incapacitated Beneficiaries. Any Beneficiaries of the Pennsylvania Decedent who have been officially declared as mentally incapacitated, physically incapacitated, or both must be identified with this status in Paragraph 11. This process will require that a presentation of the legal name and current home address of each Incapacitated Beneficiary is produced. Since a Legal Representative from a power of attorney or a Guardian/Conservator appointed by a Court will usually be set in place for someone formally declared as incapacitated, Paragraph Eleven will also need the name and address of the Legal Representative/Guardian/Conservator assigned to each Incapacitated Beneficiary.

VI. Family Exemption Claim

(18) Family Exemption Claim Status. In some cases, a Party who was financially dependent upon the Decedent may require that funds from his or her estate be available to continue living. For instance, the Pennsylvania Decedent may have been a single parent living with his or her Child or an Elderly Relative who resides with the Decedent. If such a Survivor requires and qualifies to have funds from the Decedents estate remain available to continue living (i.e. payment of rent) then an exemption which will keep a limited amount of these funds available during any lengthy administrative processes (i.e. taxes) may have been claimed. In such a case, the “Yes” box must be marked in Paragraph Twelve and several facts will need to be presented in the following item. If not, then the “No” box in Article Twelve should be marked.

(19) Non-Spouse Claimant. If the Beneficiary is a Claimant who was not married to the Pennsylvania Decedent at the time of his or her death, then define the relationship the Claimant held with the Decedent in the space provided by Statement A.

(20) Residential Status Of Claimant. If the Claimant lived with the Pennsylvania Decedent at the time of his or her death, then deliver an “X” to the “Yes” box in Statement B. If not, then select the “No” box from this statement.

(21) Spouse Claimant. If the Claimant was married to the Pennsylvania Decedent when he or she passed away, then select the “Yes” box from Statement C by placing an “X” in it. However, if the Claimant was not the Spouse of the Decedent or has forfeited the right to this exemption, the “No” box should be selected.

VII. Pennsylvania Decedent Assets

(22) Assets Of Pennsylvania Small Estate. Paragraph Thirteen requires that every asset of the Pennsylvania Decedent’s estate is documented for review. Such a list should consist of information needed to identify, locate, access, and take control of the property making up this small estate. Therefore, (by example) the Pennsylvania Decedent’s car should be listed with its manufacturer or make, model, year, color, physical descriptions (i.e. personalized tail-fins), physical location, VIN, current odometer reading with the date this reading was taken, as well as its current market value, while an item such as an insurance payment to the estate should be defined by its Payer, policy number, the lifespan of payments, the amount of each payment, and the total of all expected payments. Make sure that this is a complete list of every asset (tangible/intangible property) of the Pennsylvania small estate even if an attachment is required to complete this function. If preferred additional space may be inserted as needed.

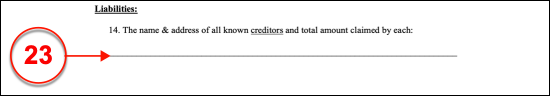

VIII. Liability On The Pennsylvania Decedent Estate

(23) Creditor Information. Many Pennsylvania Decedents will have some debt placed on their estate. All Creditors to who the Pennsylvania Decedent owed a debt should be defined with a presentation of his or her legal name and business address in Paragraph 14. If the Creditor is a Business or Financial Institution then its name as recorded with the State of its formation and operation should be presented with its corporate address. In addition to identifying the Creditor, the amount the Pennsylvania Decedent owed to each Creditor at the time of his or her death should be documented.

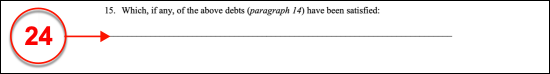

(24) Satisfied Debts. If any of the debts listed above have been satisfied before this petition is signed then, in Paragraph 15, identify this debt by naming the Creditor who has been paid, recording the account/policy number of the debt or loan, and documenting the amount that has been paid.

(25) List Of All Debts. Provide a detailed list of every debt the Pennsylvania Decedent’s estate owes (whether disputed or acknowledged) to Paragraph Sixteen. Any claimed property that resulted from this debt (i.e. an automobile obtained through a payment plan or loan) should be identified when discussing these items.

(26) Unpaid Administrative Expenses. In Paragraph Seventeen, list every unpaid administrative expense placed on this estate (i.e. court fees, attorney fees, etc.) along with any unpaid taxes. Identify each such Administrative or Government Entity that requires payment owed by the Pennsylvania Decedent’s estate to be satisfied with the reason for the debt and the total amount that must yet be paid.

IX. Pennsylvania Decedent Medical Expenses Status

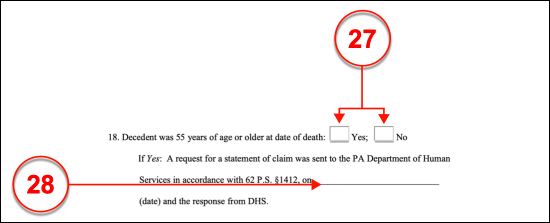

(27) Age Status Of Pennsylvania Decedent. Locate Paragraph 18 where the age of the Pennsylvania Deceased (at the time of death) will be discussed. Place a mark in the “Yes” box if the Pennsylvania Decedent was older than fifty-five years old at the time of his or her death. If he or she was younger than this, then select “No.”

(28) Date Of Request For Statement Of Claim. If the PA Department of Human Services was sent a statement of claim under 62 P.S. § 1412, then submit the date this statement was submitted.

X. Prior Satisfied Distributees

(29) Paid Distributees. Every Distributee who has received property or funds from the Pennsylvania Decedent’s small estate (after the Decedent’s death but before this petition is submitted) should be identified as such a Recipient (Distributee) in Paragraph 19. The name of each (if any) Distributee who fits this criterion must be submitted to the space provided with the amount he or she was paid from the estate.

XI. Proposed Distributees

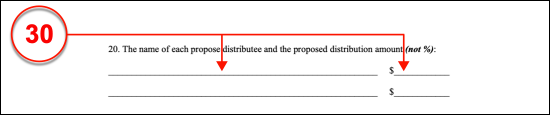

(30) Potential Distributees. The name of every Distributee that should receive payment from the Pennsylvania Decedent after this petition is approved (and as a result of this petition) should be documented in Paragraph 20 with the amount to be dispensed. Two distinct columns have been provided by this area for this purpose.

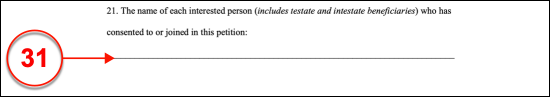

XI. Interested Consenting Beneficiaries

(31) Approving Intestate And NonIntestate Beneficiaries. All Beneficiaries who have been informed of this petition and who approve its submission to the Orphan Court should have their names documented in the Twenty-First Paragraph.

XII. Non-Interested Non-Consenting Beneficiaries

(32) Non-Approving Beneficiaries. Every Beneficiary who has no interest in this petition and/or does not approve of its submission should be presented with his or her full name in Paragraph 22.

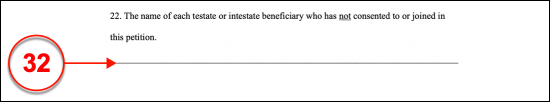

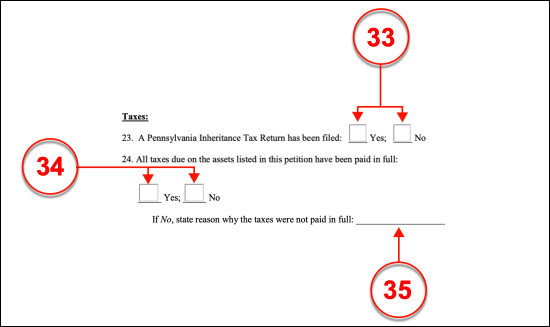

XIII. Taxes

(33) Pennsylvania Inheritance Tax Return Status. Indicate if the Pennsylvania Inheritance Tax Return for the Decedent’s estate has been filed by placing an “X” on the line labeled “Yes” or if the Inheritance Tax Return has not been filed by selecting “No.”

(34) Status of Pennsylania Inheritance Tax Payment. Deliver an “X” to the box labeled “Yes” in Article Twenty-Four if the inheritance tax for this estate has been paid or select the “No” checkbox if any amount of inheritance tax remains unpaid.

(35) Reason For Insufficient Payment. If the Pennsylvania Inheritance Tax has not been satisfied then, furnish the reason for this nonpayment in the space provided.

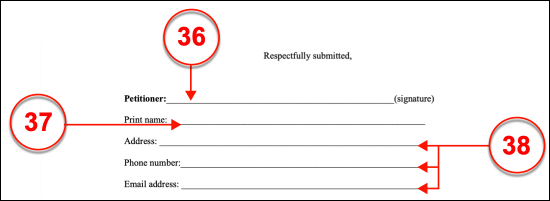

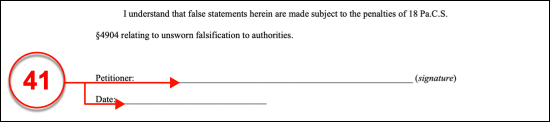

XIV. Petitioner Signature Effect

(36) Signature Of Pennsylvania Petitioner. Every Petitioner for the Pennsylvania Small Estate that is named in the First Paragraph must deliver his or her signature to this petition as proof that he or she comprehends and acknowledges the content of this petition and its attachments.

(37) Printed Name Of Pennsylvania Petitioner. Every Petitioner signing this paperwork must continue this process with a production of his or her printed name.

(38) Contact Information Of Pennsylvania Petitioner. Every Signature Petitioner to the Pennsylvania Decedent’s estate should dispense his or her telephone number and e-mail address to complete the signing process.

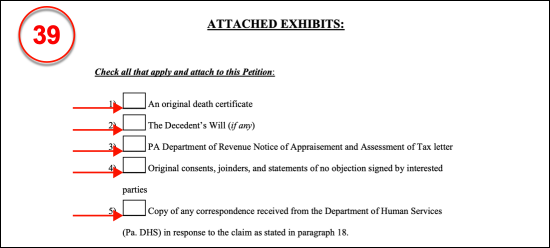

XV. Attached Exhibits

(39) All Attached Exhibits. A checklist has been provided so that each attachment to this petition can be verified as present at the time of the Petitioner’s signing. Place an “X” in each checkbox corresponding to an attachment made to this petition. For instance, to verify that the “Original Death Certificate” issued for the Pennsylvania Decedent is attached to this petition, an “X” must be presented in the first checkbox (labeled “An Original Death Certificate”).

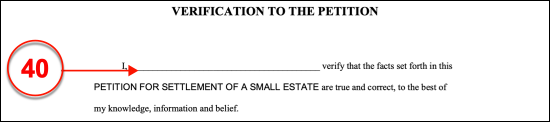

XVI. Verification To The Petitioner

(40) Petitioner Name. A verification statement that enables the Petitioner for the Pennsylvania estate to testify that he or she has researched this petition and then deemed it accurate and truthful is included in this package. Complete this verification statement by recording the full name of each Petitioner on the empty line in the first paragraph.

(41) Petitioner Signature And Signature Date. Each Signature Petitioner for the Pennsylvania estate must confirm its accuracy by signing his or her name and recording the current date.

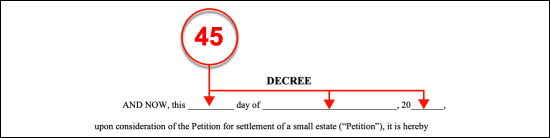

XIX. Decree

(42) Header To Decree. The decree provided will require some preparation before it can be reviewed by the Courts. Begin by completing the title with a record of the official name of the Pennsylvania County where the petition is submitted.

(43) Pennsylvania Decedent. The full name of the Pennsylvania Deceased must be supplied in the subject line.

(44) Docket Number. The docket number assigned to this matter should be furnished as requested.

(45) Decree Date. Use the first three empty lines to present the two-digit calendar day, month, and two-digit year of this decree’s effect.

(46) Pennsylvania Decedent. Furnish the name of the Pennsylvania Deceased whose estate shall be decided upon in this decree.

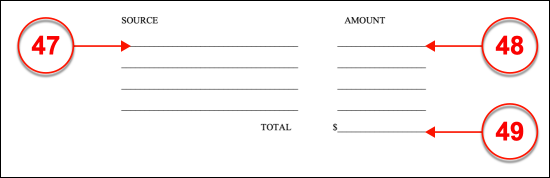

(47) Asset To Be Distributed. Every asset that has been sold or every account that has been assessed to dissolve this estate should be listed in the column labeled “Source.”

(48) Value Of Source. The money that has been obtained from this source must be documented on the corresponding line in the “Amount” column.

(49) Total Estate Amount. Notice that the “Total” amount of money obtained from these sources must be summed and presented at the bottom of the “Amount” column.

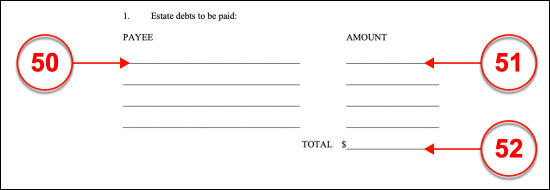

(50) Payee Of Pennsylvania Estate Asset. The legal name of each Creditor who shall be paid from the funds recorded above as well as the “Amount” that will be paid must be furnished to the table presented as the “Estate Debts To Be Paid.” Only Creditors (and not Beneficiaries) should be identified in this area.

(51) Creditor Amounts. The dollar amount(s) that will be paid to each Creditor should be documented in the adjacent column..

(52) Total Being Dispensed. Add every figure that shall be paid to a Creditor and produce this sum as the “Total” where requested.

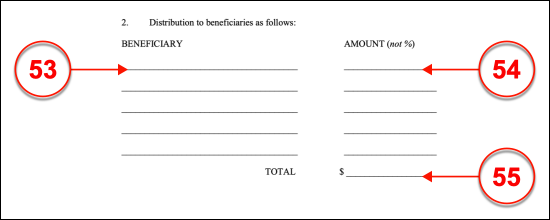

(53) Beneficiary And Expected Distribution. Every Beneficiary of the Pennsylvania Decedent who shall receive funds from the estate should be named in the “Beneficiary” column.

(54) Amount To Be Paid To Beneficiary. The dollar amount that the Beneficiary shall receive from the estate must be documented on the right of each Beneficiary’s name. A column (“Amount (Not %)”) has been supplied for this production.

(55) Total Of Beneficiary Amounts. Once each “Amount” is reported, add each to one sum, and produce the result as the “Total.”

(56) Petitioner’s Name. Furnish the full name of every Petitioner who has submitted the above paperwork by signature.

(57) Decree Confirmation. The judgment of the courts will be provided by the Court where this document was submitted. Therefore this decree can only be completed through the signature action of the Judge sitting on this matter.