Updated April 29, 2024

An Alaska small estate affidavit allows the successors of a person who has passed away to collect property of the person who died without having to go through the added time of the probate process. This option is only available for estates with a value less than a maximum established by the state legislature, and it cannot be used for estates containing real property that did not automatically transfer at the of death. The form used for this process is officially known as an Affidavit for Collection of Personal Property of Decedent, or Form P-110. Someone in possession of the property must surrender it to the holder of the affidavit, who can then deliver the property to the beneficiary to whom it is due under the decedent’s will, or to an heir if the decedent died intestate.

Laws

- Days After Death – At least thirty (30) days must have passed after the death of the decedent before Form P-110 may be filed.[1]

- Maximum Amount ($) – The total value of all vehicles owned by the decedent may be no more than $100,000; only vehicles that must be registered with the state of Alaska need to be included.[2] The total value of all other personal property owned by the decedent may not exceed $50,000; personal property that automatically passes to another, such as a joint bank account, is not included.[3] The value of any liens and debts held against any eligible personal property, including vehicles, may be deducted from the total.

- Signing Requirements – The affidavit must be notarized.

- Statutes – Collection of Personal Property by Affidavit (A.S. § 13.16.680)

How to File (4 steps)

2. Verify Eligibility

3. Identify Distribution

4. Prepare Form

Video

How to Write

Download: PDF

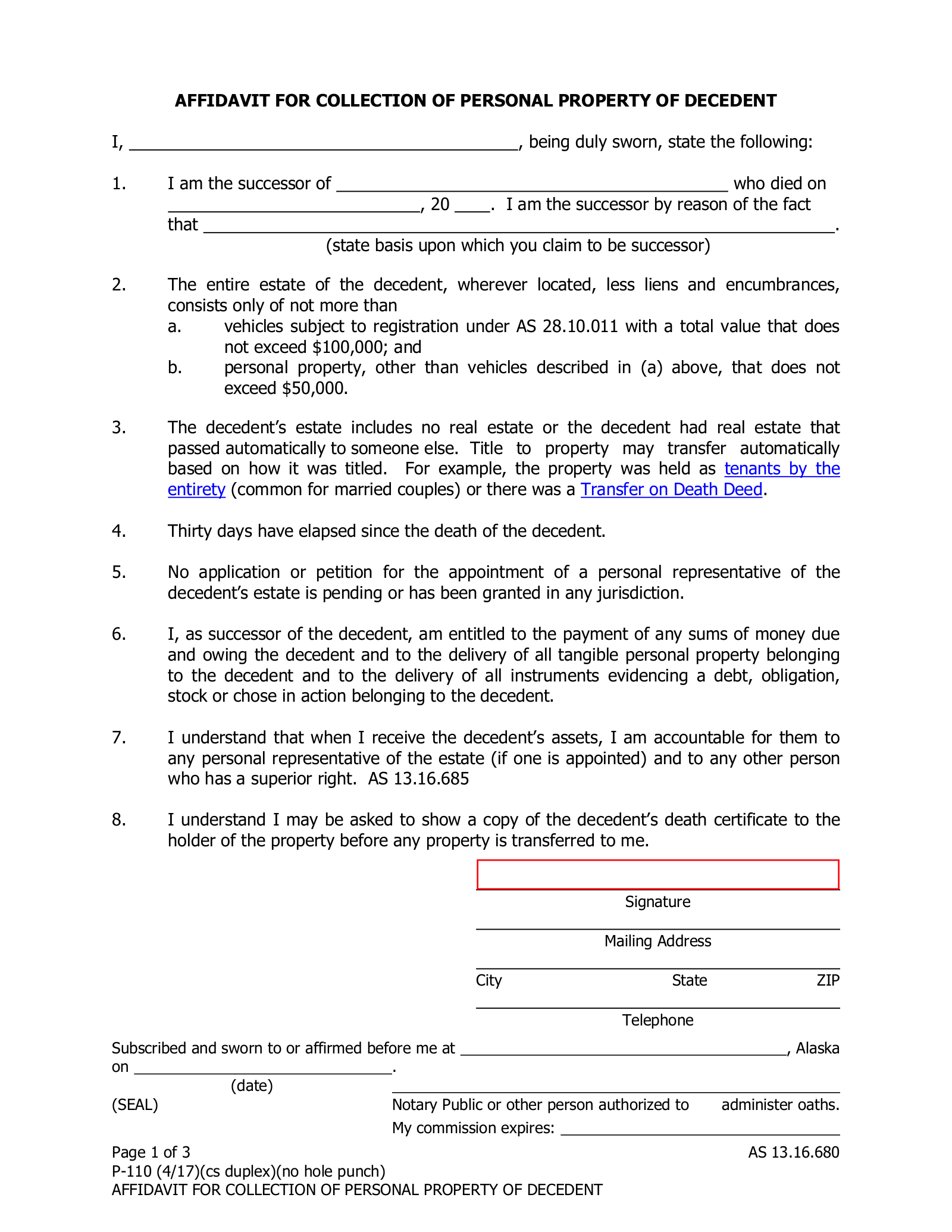

Alaska Affiant Statement

(1) Petitioning Affiant. Identify yourself as the Petitioning Party that wishes to control or seize ownership of the Alaska Decedent’s estate. You will be required to sign this document to execute it. If there is more than one Petitioner acting as the Affiant behind this paperwork then, each one must be listed in this statement.

(2) Alaska Decedent. The identity of the Alaska Decedent, or the Party whose estate is being discussed, must be established in the first statement made.

(3) Date of Alaska Decedent’s Death. Refer to the Alaska Decedent’s death certificate then deliver the formal date of death to the declaration being completed.

(4) Reason For Succession. State the basis for your petition by declaring why you have a right to control the Alaska Decedent’s estate.

Notarized Signature

(5) Alaska Affiant Signature. Sign your name to solidify your role as the Affiant completing this Alaska paperwork. You should perform your signature as a Notary Public observes you.

(6) Mailing Address And Phone Number. Furnish your contact information. Your report should consist of a reliable mailing address as well as a well-maintained telephone number. Once you have completed this act, relinquish this paperwork to the Alaska-recognized Notary Public attending your signing.

(7) Alaska Affiant Telephone Number.

(8) Notarization. The Notary Public will complete the remainder of this signature area by verifying some facts regarding the signing and displaying his or her credentials, signature, and seal.