Updated April 02, 2024

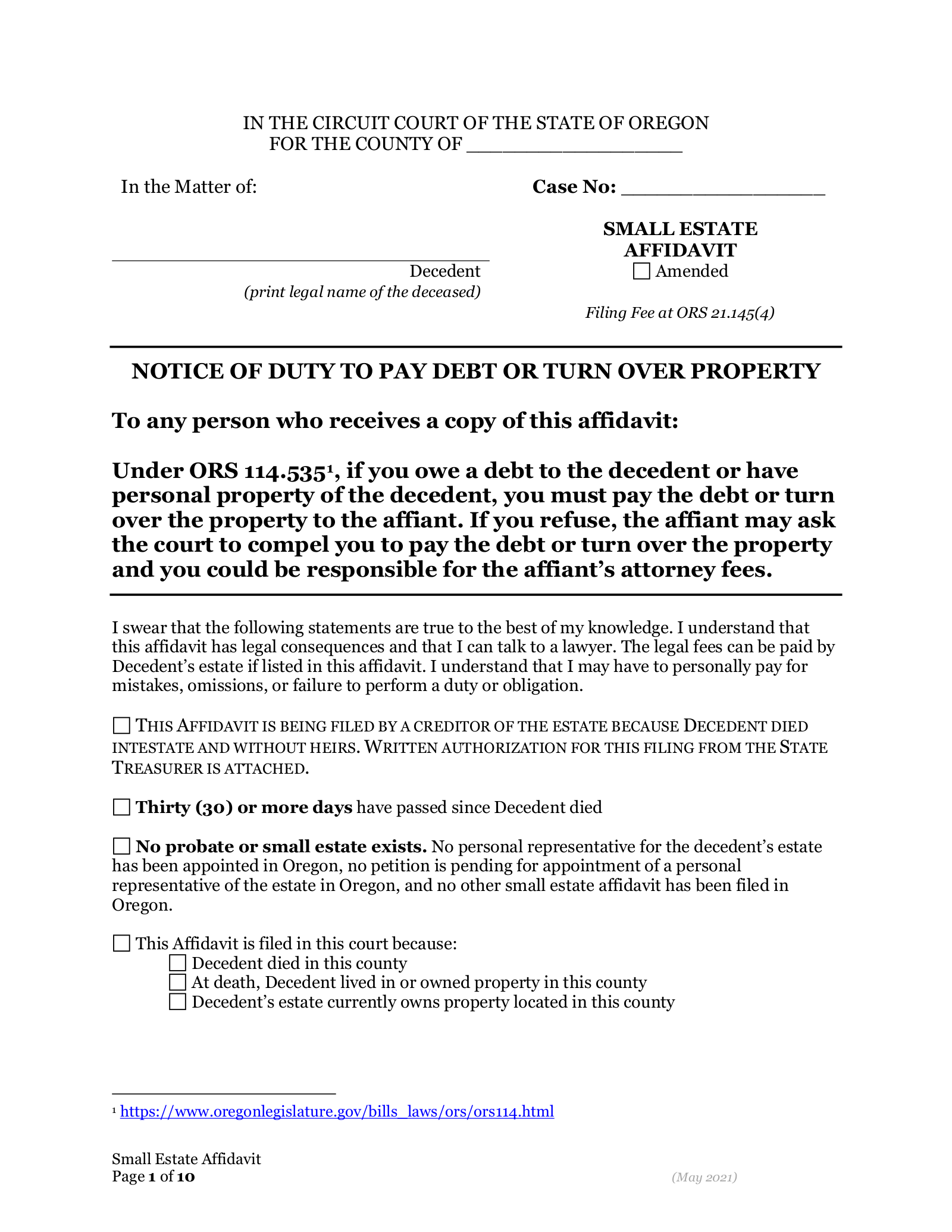

An Oregon simple estate affidavit is a document that can be used to claim property from a deceased person’s estate, so long as the estate meets certain criteria. The person completing the affidavit is known as an “affiant”, and the deceased person is known as the “decedent”. This form can be filed by a direct heir (someone who will inherit with or without a will), a devisee (someone listed in the decedent’s will), a personal representative (appointed in the decedent’s will), or a creditor seeking to settle a debt from the decedent’s estate. This excludes anyone who has been convicted of a felony or is otherwise prohibited from inheritance per ORS § 113.095.

Laws

- Days After Death – Thirty (30) days (O.R.S. § 114.515(3))

- Filing Fee – $124 (O.R.S. §§ 114.515(5) , 21.145(4))

- Maximum Amount ($) – $275,000 in total, but not more than $75,000 of the fair market value of the estate is attributable to personal property, not more than $200,000 of the fair market value of the estate is attributable to real property. (O.R.S. § 114.510(1))

- Public Assistance – If the decedent received public assistance (O.R.S. § 411.010), medical assistance (§ 414.025), or care at a public institution (§ 179.010), the Directors of Human Services and the Health Authority can file this affidavit to recoup the costs of care covered by the State of Oregon (§ 114.517).

- Safe Deposit Box – If the decedent had a safe deposit box, this affidavit cannot be filed until the contents of that box have been inventoried (O.R.S. § 708A.655).

- Signing – The affiant has to sign the form in the presence of a notary public.

- Statutes – Title 12, Chapter 114. Administration of Estates Generally

How to File (5 steps)

- Wait Thirty (30) Days

- No Personal Representative

- Complete Forms

- File With Court

- Send to Estate Recipients

2. No Personal Representative

3. Complete Forms

Gather and complete the following forms for filing:

- Affidavit of Attesting Witness/Genuine Signature (if a will exists) (113.055(1))

- Application for Deferral or Waiver of Fees & Declaration in Support (if seeking a fee waiver)

- Death Certificate (obtain from the Oregon Office of Vital Statistics)

- Order Regarding Deferral or Waiver of Fees (if seeking a fee waiver)

- Original Will (if any, no copies)

- Simple Estate Affidavit (refer to these detailed instructions provided by the state of Oregon)

4. File With Court

5. Send to Estate Recipients

Video

How to Write

Download: PDF

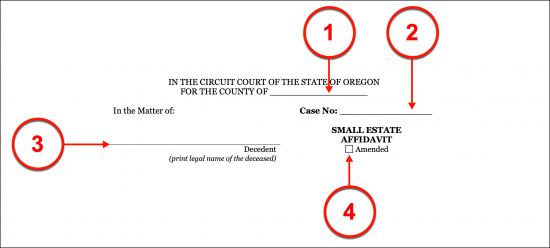

(1) Oregon County. Produce the full name of the Oregon County where this document will be filed.

(2) Case Number. The case number that was assigned by Oregon State to this estate matter is required.

(3) Oregon Decedent. Dispense the full name of the Oregon Deceased or Decedent. This must be the full legal name of the Oregon Deceased.

(4) Amended Affidavit. If a previous affidavit has been filed then select the checkbox provided to indicate that this is an amended petition

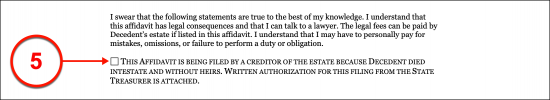

(5) Creditor Of Oregon Decedent Estate. If this document is being filed by the Oregon Decedent’s Creditor, then select the first checkbox presented in this form.

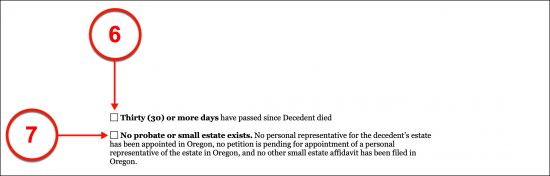

(6) Oregon Requirement Confirmation. Select the checkbox corresponding to the second statement to confirm that the Oregon Decedent was pronounced dead at least thirty days before the completion of this document.

(7) No Probate Or Simple Estate Exists. If the Oregon Decedent’s estate has not been administered or subjected to the probate process then place a mark in the checkbox attached to the third statement.

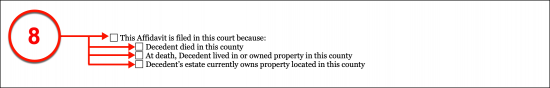

(8) Reason For Filing In Current Court. Select the fourth checkbox statement then review the choices given to present the reason for this filing. Choose the first of these options if the Oregon Decedent was pronounced dead in the County where this document is filed, select the second checkbox if the Oregon Decedent maintained a residence in the concerned County or owned property, or select the third checkbox statement if the Oregon Decedent’s estate owns property in the County where this paperwork will be filed.

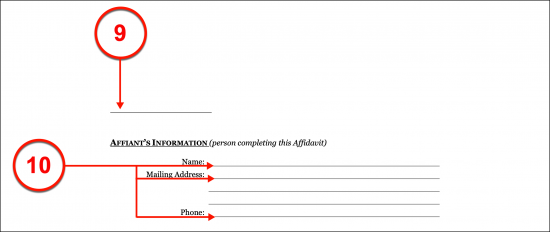

(9) Signature Of Affiant To Oregon Estate. The Oregon Affiant must sign his or her name to confirm the facts established on this page.

(10) Affiant Information. The Oregon Affiant must print his or her name, present his or her mailing address, and document his or her phone number.

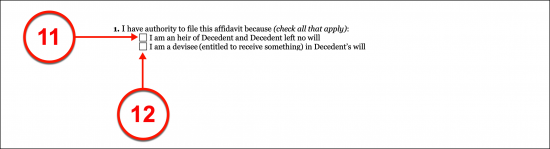

Article 1 Status Of Oregon Affiant

(11) Intestate Oregon Decedent Heir. The first statement made in Article 1 should be selected if the Affiant is the Oregon Decedent’s Heir but no will has been issued.

(12) Devisee Named In Oregon Decedent Will. If the Affiant issuing this petition is entitled to assets from the estate of the Oregon Decedent because he or she has been named in the will of the Oregon Decedent then select the second checkbox from the first article.

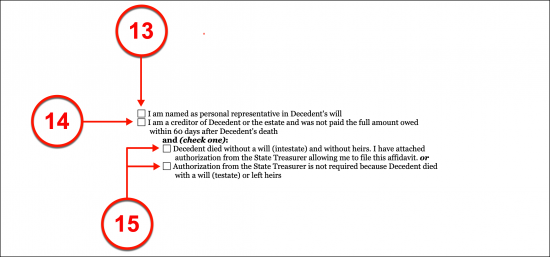

(13) Personal Representative Designated In Oregon Decedent Will. The third option in the first article should be selected if the Affiant is the Personal Representative appointed as such through the Oregon Decedent’s will.

(14) Creditor Of Oregon Decedent. If this document is being developed by a Creditor of the Oregon Decedent then the fourth statement made in Article 1 should be chosen.

(15) State Of Oregon Decedent Will. If the Creditor Affiant has obtained permission from the State Treasurer to file this document and the Oregon Decedent has not issued a will nor are there any Heirs then select the first Creditor statement available. If the Oregon Decedent has issued a will and has no Heirs then the second Creditor statement should be selected since the State Treasurer’s authorization will not be a required attachment.

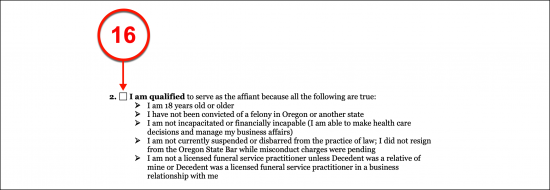

Article 2 Oregon Affiant Qualification

(16) Confirm Declarations. Several statements must be true for the Petitioner to qualify as an Oregon Affiant. To this end, the hopeful Affiant must review each statement made in the second article then produce a checkmark to the corresponding checkbox as confirmation that the statements made are accurate.

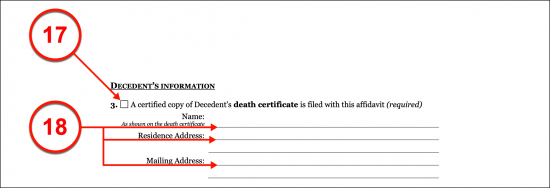

Article 3 Decedent Information

(17) Oregon Decedent Death Certificate. Place a mark in the checkbox attached to the third article to verify that a copy of the death certificate issued to mark the death of the Oregon Decedent will be attached to this affidavit.

(18) Oregon Decedent Name And Address. Produce the Oregon Decedent or Deceased’s full name and the physical address of his or her residence. If the Oregon Deceased maintained a mailing address separate from that of his or her home address, then space has been provided for this information to be presented as well.

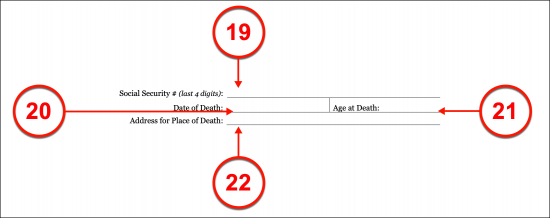

(19) Social Security Information. Supply the final four digits found in the social security number for the Oregon Decedent

(20) Established Facts Of Oregon Decedent’s Death. Furnish the date when the Oregon Decedent was declared dead.

(21) Age Of Decedent At Death. Document the age of the Oregon Decedent at the time of his or her death.

(22) Place Of Death. Produce the address where he or she has passed away (“Place Of Death”) to the areas requesting this information.

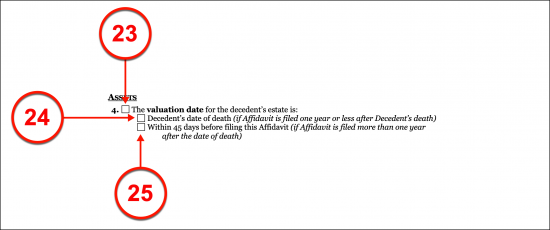

(23) Confirming The Valuation Date. Select the checkbox coupled with “Article 4” to verify the value of the estate was determined in a timely manner.

(24) Valuation Upon Oregon Decedent’s Date Of Death. Select the first statement if the Oregon Decedent’s date of death will be considered the final date when the value of the estate must have been established after its debts are accounted for.

(25) Valuation Within Forty-Five Days Of Petition. If the final date when the Oregon Decedent’s estate was assessed is within forty-five days before the date when this document will be filed then choose the second valuation statement.

Article 5 Assets Subject To Administration

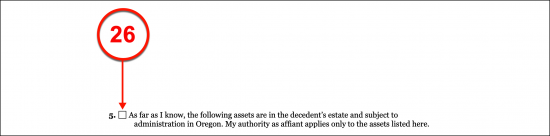

(26) Confirmation For Subject Of Action. The checkbox attached to the fifth article should be selected for the Affiant to confirm that the listing of the Oregon Decedent’s property in this document is accurately presented.

Real Property

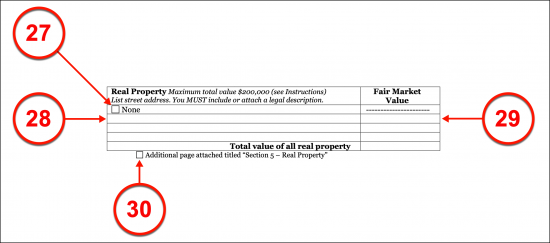

(27) No Real Property. If the Oregon Deceased (Decedent) did not own real property (real estate), then mark the box labeled “None.”

(28) Real Property Of Oregon Decedent Estate. If the Oregon Decedent owned real estate of any kind, then dispense the street address of his or her property along with its legal description in the first column of Article 5.

(29) Total Fair Market Value. Report the fair market value of the concerned real property to the second column.

(30) Continuing Report On Oregon Decedent Real Property. All of the real estate owned by the Oregon Decedent should be documented, thus if more room is required, continue on an attachment and select the “Additional Page Attached…”

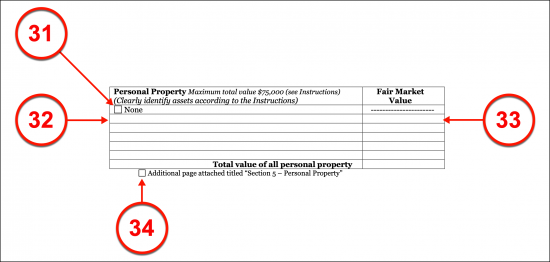

Personal Property

(31) No Personal Property. If the Oregon Decedent did not have personal property then this must be verified. To do so, select the checkbox labeled “None.”

(32) Personal Assets. If the Oregon Decedent had personal property then each of these assets should be documented. Make sure to provide a full description such as the Manufacturer of such property, its model, and serial number. If the personal property of the Oregon Decedent is intangible then provide as much information as needed to fully identify it (i.e. an account number and Entity name).

(33) Fair Market Value. Provide the estimate value of each asset listed according to the current market prices.

(34) Additional Document Attached. Select the checkbox at the end of this table an attachment listing the Oregon Decedent’s property was required to produce this report. Make sure any such document is physically attached to this one before the Affiant’s signature is made.

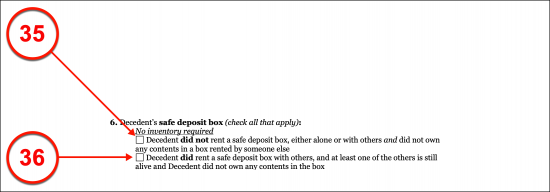

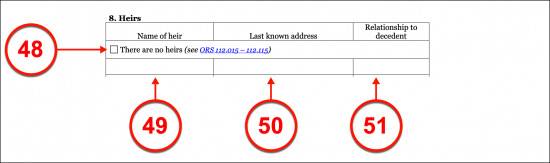

Article 6 Safe Deposit Box

No Inventory Required

(35) No Safe Deposit Box. If the Oregon Deceased did not rent or contribute to a partially owned safe deposit box, then select the first statement in Article 6.

(36) Shared Ownership Of Safe Deposit Box. Select the second checkbox if the Oregon Deceased shared a safe deposit rental with one or more Parties, has no contents in the safe deposit box, and the other Safe Deposit Renters are still alive.

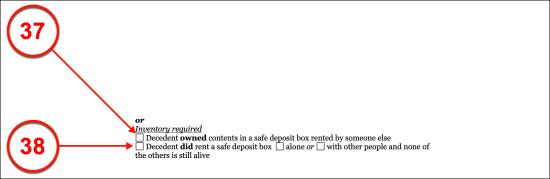

Inventory Required

(37) Owned Contents Of Safe Deposit Box. Select the appropriate checkbox statement if the Oregon Decedent owns contents in a safe deposit box rented by another Party. Be advised, this selection will require that a report on the contents held in the concerned safe deposit box by the Oregon Decedent.

(38) Status Of Oregon Decedent’s Safe Deposit Box. Inventory of the Oregon Decedent’s safe deposit box will need to be provided if he or she maintains one. If so, select the second “Inventory Required” statement to show that Oregon Decedent rents a safe deposit box either “Alone” or with other Parties that are no longer alive. Make sure to indicate the status of this rental by selecting the first or second checkbox in this statement.

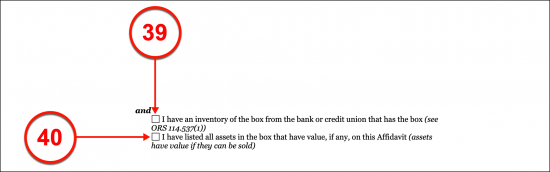

(39) Safe Deposit Box Contents. Indicate if an inventory of the Oregon Decedent’s safe deposit box stored with a bank or credit union will be attached

(40) Value Of Safe Deposit Box Contents. Mark the appropriate checkbox if a listing of all assets in the Oregon Decedent’s safe deposit box is included with this petition.

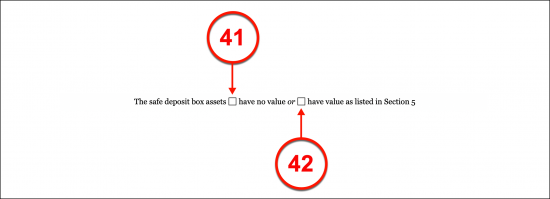

(41) Safe Deposit Box Content Values. In some cases, the contents of the Oregon Deceased’s safe deposit boxes have no true value. If so then, the first checkbox in the declaration made should be selected.

(42) Known Safe Deposit Content. If applicable, indicate that the contents of value in the Oregon Decedent’s safe deposit box have been listed in the previous article by selecting the second checkbox in this statement.

(43) Lack of Information. If the Affiant has no knowledge of any safe deposit boxes rented by the Oregon Decedent, then he or she will need to include several pledges regarding his or her discovery of any new information on this matter. This pledge can be made through a review of the final statements made on this topic then acknowledging these declarations by marking the corresponding checkbox.

Distribution Of Assets

Article 7 Status Of Oregon Decedent Will

(44) Intestate Oregon Decedent. Indicate that the Oregon Decedent died without putting a will in place by marking the first checkbox in the seventh article.

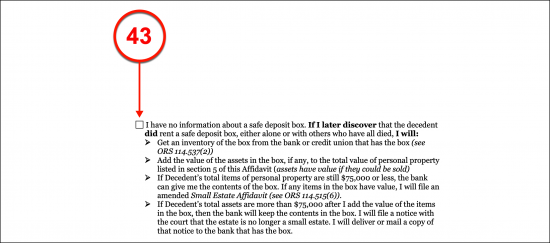

(45) Will Of The Oregon Decedent. If the Oregon Deceased issued a will before his or her death, then the second checkbox in Article 7 should be selected. This will require additional information by selecting one of the two statements that follow.

(46) Original Will Attached. If the Oregon Deceased issued a will then the original paperwork must be attached. Mark the first option if an original copy of the Oregon Decedent’s will is attached.

(47) Will Submitted In Other State. If the Oregon Deceased produced a will before his or her death but the original will not be attached to this affidavit because it was submitted for probate outside the State of Oregon, then select the second option. Note that a certified copy of the will issued by the Oregon Deceased must be attached.

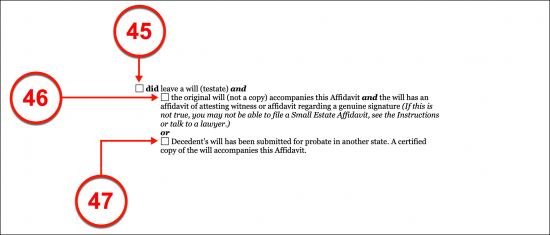

Article 8 Heirs

(48) Confirming No Heirs. If the Oregon Deceased does not have any Heirs then place a mark in the checkbox at the beginning of Article 8

(49) Name Of Oregon Decedent Heir. If the Oregon Deceased does have one or more Heirs then each must be identified in the first column of the eighth article. Make sure that each is produced on a separate row.

(50) Last Known Address Of Oregon Decedent Heir. Furnish the current address of each Heir of the Oregon Deceased.

(51) Relationship With Oregon Decedent. Dispense a record of the relationship each Heir holds with the Oregon Deceased.

(52) Attaching Additional Heirs. While a significant number of rows have been presented in the provided table, more room may be needed to present every Heir of the Oregon Deceased. If so, continue this listing on an attachment and select the “Additional Page” statement at the end of the eighth article.

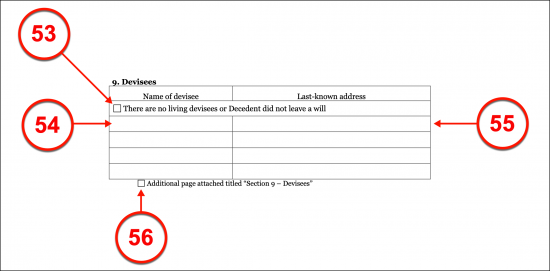

Article 9 Devisees

(53) No Devisees Of Intestate Oregon Decedent. All Devisees named to receive assets from the estate of the Oregon Deceased as per the Decedent’s will must be named. If the Oregon Decedent has not produced a will before death or if the Oregon Deceased has made a will before death but there are no known living Devisees then the checkbox attached to the statement introducing Article 9 must be marked.

(54) Name of Oregon Decedent Devisee(s). If the Oregon Deceased has made a will and one or more Devisees entitled to estate property are alive, then each one must be named and his or her most recent address recorded in the adjacent column.

(55) Address Of Oregon Decedent Devisee.

(56) Additional Devisees Attached.

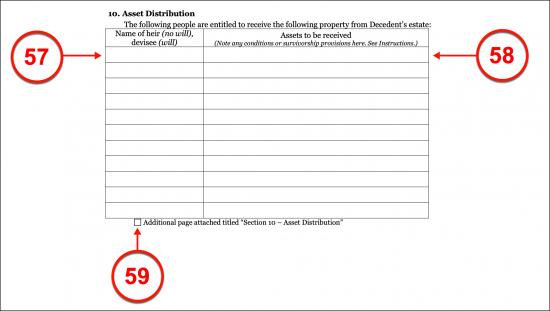

Article 10 Asset Distribution

(57) Name Of Heir Or Devisee. The assets that must be dispensed from the estate of the Oregon Deceased to his or her Heir(s) and/or Devisee(s) must be defined and formally assigned to the appropriate Party. To this end, record the name of every Heir or Devisee entitled to property from the estate of the Oregon Deceased.

(58) Asset To Be Received. Continue across every row where an Heir or Devisee is identified to produce a record of the Oregon Decedent’s property that must be distributed to him or her.

(59) Additional Pages For Section 10. If more room is required to complete the report on all Devisees or Heirs set to receive property from the Oregon Decedent’s estate, then select the checkbox at the end of the table presented and complete this report on an attachment.

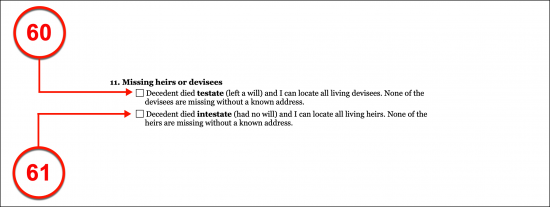

Article 11 Missing Heirs Or Devisees

(60) Accounting Of All Oregon Decedent Devisees. If all the Devisees in the Oregon Decedent’s will have been located then, select the first checkbox statement in the eleventh article.

(61) Accounting Of All Oregon Decedent Heirs. If the Oregon Decedent has not made a will before death but all his or her Heirs have been located, then the second checkbox statement should be selected from Article 11.

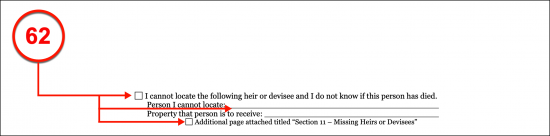

(62) Missing Decedent Devisee Or Heir. Select the third checkbox statement on display in the eleventh article if there are any Heirs or Devisees whose whereabouts are unknown and cannot be located. In this case, the name of every Devisee or Heir that cannot be found should be supplied to the space provided along with the estate assets that he or she will be entitled to receive. If additional information will be presented in an attachment make sure to mark the appropriate checkbox to indicate that another document will be presented with this one.

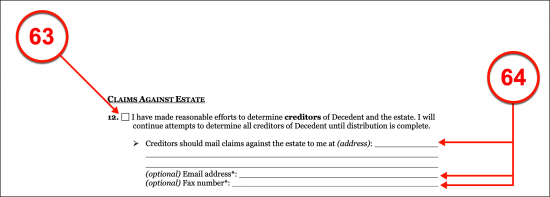

Article 12 Claims Against Estate

(63) Confirming Effort To Find Creditor(s). Produce a mark to the checkbox in Article 12 to confirm that every effort has been taken to identify Creditors of the Oregon Deceased and his or her estate.

(64) Affiant Contact Information. Furnish the legal name and address of every Creditor of the Oregon Decedent’s estate. If known, produce the email address and fax number to these Creditors.

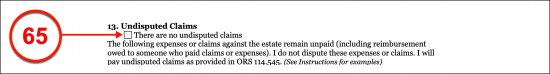

Article 13 Undisputed Claims

(65) No Undisputed Claims. Select the first checkbox in Article 13 if there are no undisputed claims or debts to the Oregon Decedent’s estate.

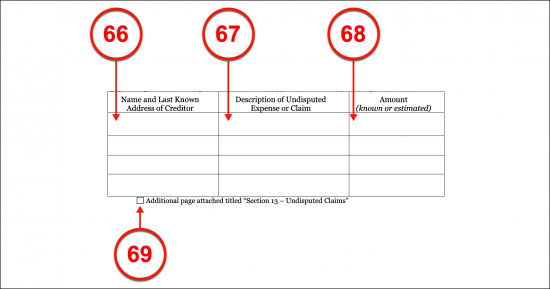

(66) Name And Address Of Oregon Decedent Creditors. Utilize the first column in the table provided to identify every Oregon Decedent Creditor by name and address.

(67) Description Of Undisputed Expense Or Claim. Define every undisputed claim held against the Oregon Decedent’s estate in the second column. Such a report should consist of items such as an account number for a loan, the physical description of his or her automobile with its VIN (vehicle identification number) under a lien, or the serial number and item description of a computer that was still being paid for at the time of the Oregon Decedent’s death. Make sure every undisputed debt is defined as fully as possible.

(68) Known Or Estimated Amount Of Debt. The final column should be used to report the amount of the concerned debt or claim on the Oregon Decedent’s estate. Make sure the dollar amount documented here applies to the debt defined by the previous two columns.

(69) Additional Undisputed Claims Attached. If more room is required to define the Creditors holding undisputed claims against the Oregon Decedent’s estate, then mark the checkbox corresponding to the attachment statement provided at the end of the table and continue this report until every undisputed claim is defined.

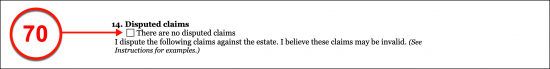

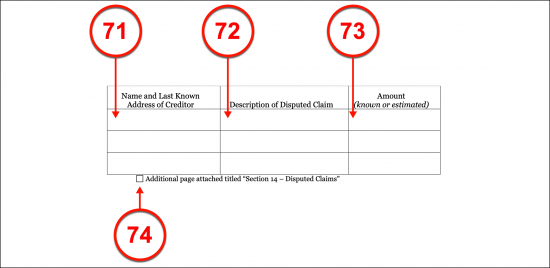

Article 14 Disputed Claims

(70) No Disputed Claims. All disputed claims by Creditors of the Oregon Decedent and his or her estate should also be identified. If, however, all claims against the Oregon Decedent’s estate are valid and undisputed, then solidify this fact by selecting the first checkbox statement in Article 14. Otherwise, if there are Creditors whose claims on the Oregon Decedent’s estate cannot be verified, are contested, or not recognized, then leave this checkbox unmarked and attend to the table provided.

(71) Creditor Information. The legal name and address of every Creditor who holds a disputed claim on the Oregon Decedent’s estate should be produced in the first column.

(72) Description Of Disputed Claim. Every disputed claim must be identified in the second column of the concerned table. The account number and description of every disputed debt should be displayed on the same row as the Creditor’s name and address.

(73) Known Or Estimated Amount Of Disputed Debts. The dollar amount that the Creditor holding the disputed debt expects as payment must be dispensed to the third column.

(74) Additional Pages. If an attachment is needed to continue the report on all disputed claims made against the Oregon Decedent’s estate, then select the checkbox attached to the second statement made in Article 14 and furnish this attachment.

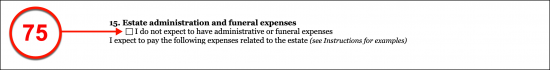

Article 15 Estate Administration And Funeral Expenses

(75) No Expected Administrative Or Funeral Expenses. Select the first checkbox displayed in Article 15 if the Oregon Decedent’s estate will not need to pay any administration or funeral expenses.

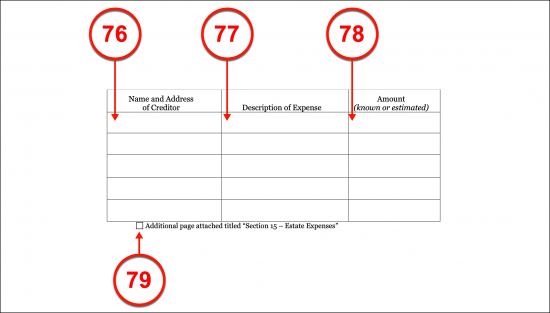

(76) Name And Address Of Creditor. If the estate of the Oregon Deceased must satisfy debts accumulated from funeral expenses or the administration of this estate, then list the legal name and address of the Party holding this type of debt in the first column.

(77) Description Of Expense. Use the second column to define the administration costs or funeral expenses that must be paid to the Creditor.

(78) Amount. Define the amount that each Creditor expects paid for estate administration or funeral costs in the final column.

(79) Additional Pages Attached. The second checkbox statement allows for an attachment to be made should more room be needed to list every debt held for the administration or funeral costs placed on the Oregon Decedent’s estate.

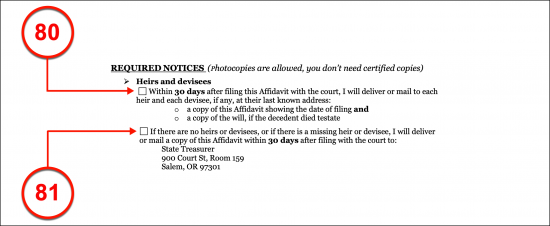

Required Notices

(80) Heir Or Devisee Targets For Affidavit Notice. The Heirs and Devisees of the Oregon Deceased will need to be notified of this paperwork with a receipt of a copy within thirty days of its filing. Place a mark in the first checkbox statement defining the status of required notices.

(81) No Heir Or Devisee. If this is not needed because there are no living Devisee or Heirs to the estate then select the second checkbox statement to indicate that a copy of this affidavit will be mailed to the State Treasurer.

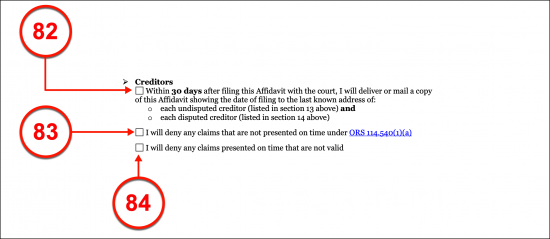

(82) Notifying Creditors. Creditors (whether holding disputed claims or undisputed claims) of the Oregon Deceased’s estate will need to be notified of this paperwork’s filing within thirty days. Select the first checkbox statement on this requirement to confirm this requirement will be met.

(83) Declarations Of Denying Creditors. If the Oregon Affiant intends to deny every Creditor who has not satisfied ORS 114.540(1)(a) with timely information then select the second statement in this section.

(84) Denying Invalid Claims. If the Oregon Petitioner intends to deny claims for payment that cannot be substantiated then produce a mark in the third statement’s checkbox

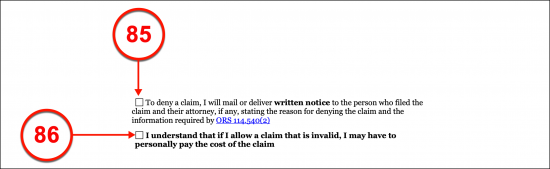

(85) Intent To Provide Mailed Notice To Creditor. Select the fourth checkbox to verify the Affiant’s intent to deny a claim by submitting a mailed written notice of this decision with an explanation (for the denial) to every Creditor who holds an invalid debt on the Oregon Decedent’s estate.

(86) Acknowledgment For Wrongful Payments. In some cases, the Affiant may designate payment from the Oregon Decedent’s estate to an invalid debt. He or she may need to replace this money in the future if the payment was made in error or if fraud was involved. The final checkbox of this area should be marked to verify the Affiant’s acknowledgment of this responsibility.

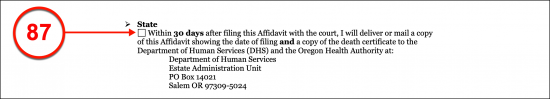

(87) State Notifications. Select the appropriate checkbox to verify that the Affiant shall send a copy of this document (after filing in the courts) and a copy of the Oregon Decedent’s death certificate to the Department of Human Services within thirty days of filing. This material must be received at the address presented in this declaration within thirty days of this paperwork’s execution date.

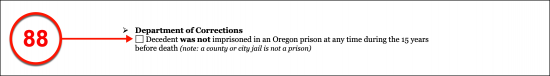

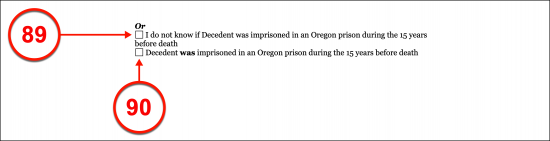

(88) No Department Of Corrections Notice. If the Oregon Decedent did not serve time in a state or federal prison within fifteen years preceding his or her death then the Department of Corrections (located in Salem, Oregon) will not need to receive a copy of this document. Select the first Department of Corrections statement if this is a case. Take note that if the Oregon Decedent only served time in a county/city jail, such notice will not be required.

(89) Required Department Of Corrections Notice. Select the second checkbox statement to declare that it is unknown whether the Oregon Decedent has served time in prison within fifteen years of his or her death.

(90) Notifying Department of Correction. If the Department of Corrections must be informed of this paperwork’s filing through a formal notice including a mailed copy of this petition to the Department of Corrections as well as a copy of the Oregon Decedent’s death certificate then, the Affiant must place a mark in the final checkbox to verify such notice will be sent.

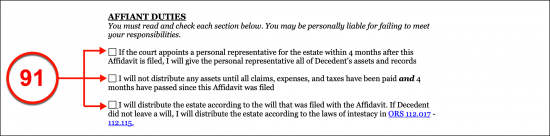

(91) Affiant Duties. The Affiant must definitively declare that he or she will perform all the duties outlined in the “Affiant Duties” section. To do so, he or she must read each statement then place a mark in the corresponding checkbox.

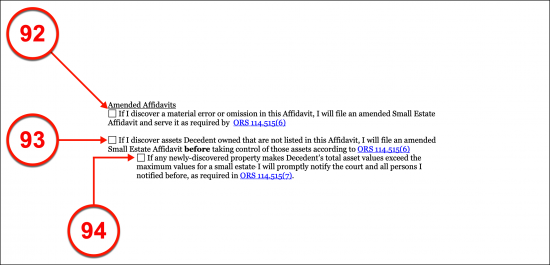

Amended Affidavits

(92) Accept Responsibility Of Due Diligence. The Affiant must attest to filing an amended affidavit regarding this estate should he or she discover that an omission or mistake regarding the Oregon Decedent’s reported information occurred in this paperwork. This declaration should be made by selecting the first checkbox statement provided.

(93) Additional Property Of The Decedent. If any additional property of the Oregon Decedent is found, then an amended Affidavit will need to be filed with the court and each Notice Recipient above must be informed of this change.

(94) Estate Exceeding Maximum Amount. If the Oregon Affiant discovers additional assets that will add enough value to the estate to disqualify the estate from being considered a simple estate then he or she must notify the courts immediately. The third checkbox must be selected by the Affiant as an acknowledgment of this responsibility.

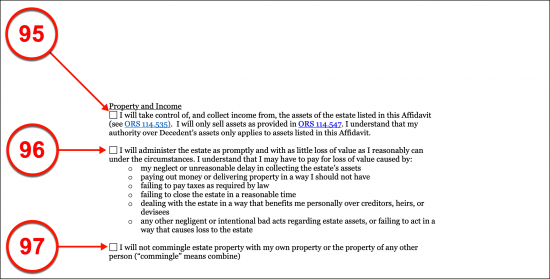

Property And Income

(95) Intent To Take Control. The Oregon Affiant must acknowledge the declaration provided to solidify that he or she will live up to the responsibility of collecting and distributing this estate in a legal manner and that only the assets that are defined in this document will be subjected to such control. This requires a selection of the first statement made in this section.

(96) Acknowledgement Of Administration Responsibilities. The second statement details the consequences to the Affiant if he or she fails to uphold the duties defined by Oregon State Law. The Affiant must read the material in this area then place a checkmark in the corresponding checkbox to show his or her acceptance of the obligation to rectify the defined failures.

(97) Separation Of Affiant And Oregon Decedent Property. The Affiant should check the box corresponding to the third statement to declare that he or she will not mix, absorb, or combine the Oregon Decedent property defined as the estate with his or her own personal property.

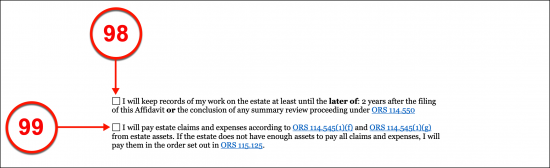

(98) Record Access. The Oregon Affiant must keep all the records surrounding this petition for two years after its filing. He or she must mark the third checkbox to make this declaration.

(99) Payment Of Estate. Some estates may not have enough assets to pay all valid debts and disbursements. Oregon State Law ORS 115.125 will dictate the order of payment in this case and must be followed by the Affiant behind this petition. He or she must select the final checkbox statement of this area to make this required declaration of intent.

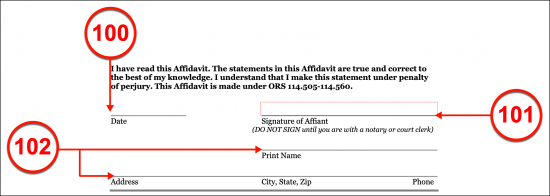

Execution Of Affiant Petition For Oregon Decedent Estate

(100) Signature Date. The Oregon Affiant must provide a record of the date that he or she signs this form on the day this action takes place. Thus, once this paperwork and its attachments have been reviewed for accuracy and the Oregon Affiant is ready to sign his or her name, he or she must document the current date.

(101) Signature Of Affiant. The signature of the Oregon Affiant must be submitted in the presence of a Notary Public. Make note that only the Parties physically signing their names to this paperwork under the observance of a Notary Public will be considered Oregon Affiants.

(102) Printed Name And Address Of Oregon Affiant.

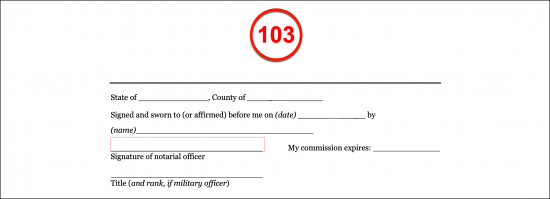

Notary Public

(103) Oregon Notary Action. The Notary Public overseeing the Affiant’s action must be recognized by the State of Oregon. He or she will verify the Affiant identity then provide proof of the notarization process where required.