Updated February 15, 2024

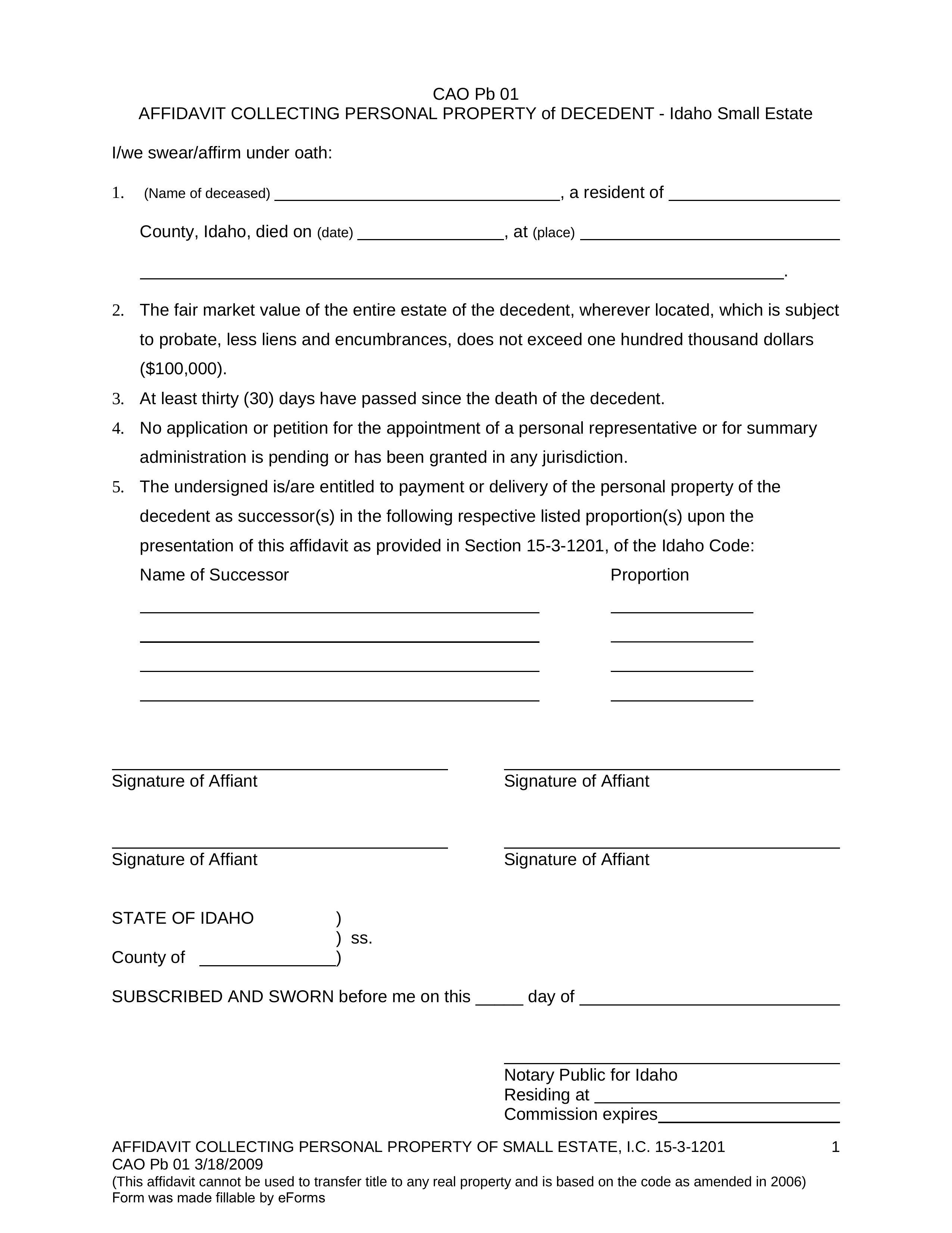

An Idaho small estate affidavit, or ‘Form CAO Pb 01’, is a legal document that can be used by the heirs or beneficiaries of a person who died and left behind an estate not exceeding $100,000. The purpose of the form is to expedite the distribution of assets and allow the successors of the deceased to bypass the probate process. The affidavit cannot be utilized until at least thirty (30) days have passed since the date of death.

Laws

- Days After Death – In the State of Idaho, a small estate affidavit can be used no sooner than thirty (30) days after the decedent dies. (I.C. § 15-3-1201)

- Maximum – A small estate is defined as having a fair market value not exceeding $100,000, less any liens and encumbrances. (I.C. § 15-3-1201)

- Motor Vehicles Only – Use Form ITD 3413 to transfer a vehicle of the decedent. This must be filed with the Transportation Department. Use this locator to find your local DMV Office.

- Statute – Part 12 of Chapter 3 of the Title 15 Uniform Probate Code, stipulates that the claiming successor is entitled to payment or delivery of property pursuant to a decedent’s will, on presentation of a signed and notarized Form CAO Pb 01.

How to File (4 steps)

1. Wait Thirty (30) Days

2. Prepare Affidavit

Video

How to Write

Download: PDF

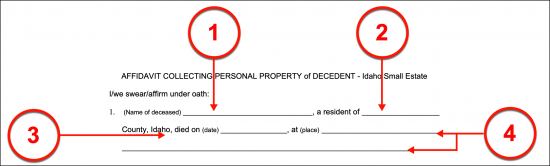

Statement 1

(1) Name Of Deceased. The full name of the Idaho Deceased must be produced. Consult his or her certificate of death to make sure this name is presented properly.

(2) Residential County Of Idaho Deceased. Input the County where the Idaho Deceased maintained his or her home.

(3) Date Idaho Deceased Pronounced Dead. Consult the Idaho Deceased’s certificate of death then deliver the exact date it documents as his or her date of death.

(4) Location Of Idaho Deceased’s Death. Dispense the location where the Deceased passed away. This information should also be found on the Idaho Decedent’s certificate of death.

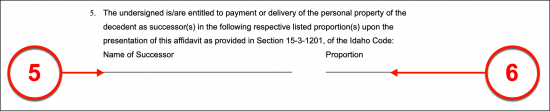

Statement 5

(5) Name Of Successor. The fifth statement of this document will require some information to be completed for the purpose of this petition. List the full name of every Person who is considered a Successor to part of the Decedent’s estate or the Successor entitled to the entirety of the Idaho Decedent’s estate (property).

(6) Proportion Of Estate. The amount that each Successor should receive from the Idaho Decedent’s estate should be presented with his or her name.

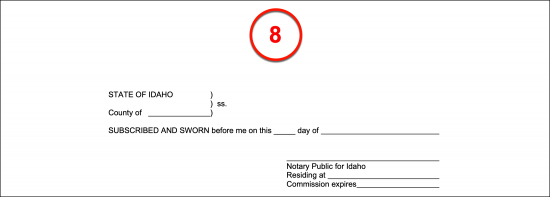

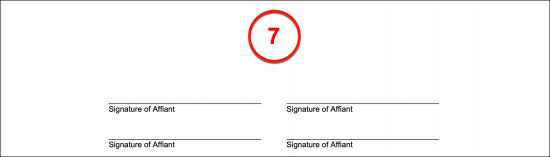

Idaho Notarized Signing

(7) Signature Of Affiant. Each Affiant that wishes to claim the statements above as his or her own must sign this document as an Idaho Notary Public observes.

(8) Idaho Notarization. The Notary Public obtained must have a license that is recognized by the State of Idaho. For instance, this document would not be considered notarized if an out-of-state Notary whose commission has expired completes it. Thus, obtain a licensed Idaho Notary Public so that he or she can engage a valid notarization process to the act of the Affiant(s) signing.