Updated September 21, 2023

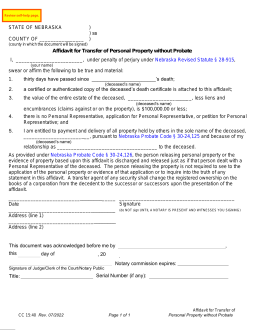

A Nebraska small estate affidavit enables the transfer of personal property from a person who has died to an heir or beneficiary, outside of the traditional probate process. The form, also known as an ‘Affidavit for Transfer of Personal Property without Probate’, allows someone entitled to the property of a decedent to collect more quickly than would otherwise be possible. There are, however, a number of limitations on the usage of the affidavit, including a state-set maximum on the size of the estate it may be used with.

Laws

- Days After Death – May be filed once thirty (30) days have passed since the death of the decedent. (Neb. Rev. St. § 30-24,125(a))

- Maximum Amount ($) – The total value of the estate, less liens and encumbrances, shall not exceed more than $100,000. (Neb. Rev. St. § 30-24,125(a)(1))

- Real Estate – If the decedent’s estate contains real property — land and fixtures — a separate form is necessary. (Neb. Rev. St. § 30-24,129)

- Vehicles/Motorboats – An individual seeking a transfer of a certificate of title to a motor vehicle, motorboat, all-terrain vehicle, utility-type vehicle, or minibike must provide the Department of Motor Vehicles with an affidavit pursuant to § 30-24,125. The DMV has published an affidavit for this specific use.

- Signing Requirements – Must be notarized.

- Statutes –Probate of Wills and Administration (Ch. 30, Art. 24), Part 12. Collection of Personal Property by Affidavit

How to File (4 steps)

2. Assess Estate

3. Fill Out the Form

How to Write

Download: PDF

(1) Name Of Nebraska County. Define the Nebraska County where this petition will be executed and filed. Place this information at the top of the page.

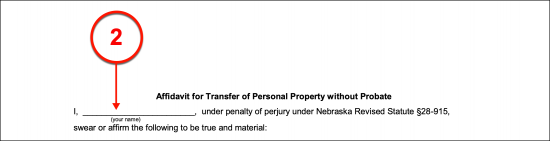

(2) Nebraska Affiant. The Nebraska Affiant will be required to produce his or her notarized signature to complete this paperwork. Therefore, deliver the full name of the Party executing this petition to the space provided.

(3) Nebraska Decedent’s Name. Verify that it has been at least thirty days since the death of the Nebraska Decedent by supplementing the declaration made in the first article with the Nebraska Decedent’s full name.

(4) Value Of Nebraska Decedent Estate Less Liens. Report the summed total of the Nebraska Decedent’s property (after the estate has paid its Creditors). It is important that this figure (the total worth of the Nebraska Decedent’s estate) is less than $100,000.00. If the total value of the Nebraska Decedent’s property exceeds $100,000.00 after the entitled Creditors have been paid, then the estate may be disqualified from being considered a small estate by the State of Nebraska and the Affiant is encouraged to seek an Attorney.

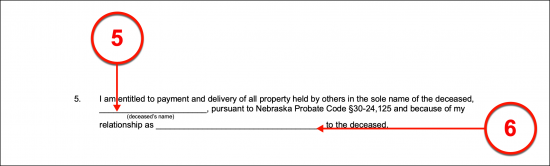

(5) Nebraska Decedent Name. The complete name of the Nebraska Decedent is required to complete the language of the fifth article.

(6) Affiant Relationship To Nebraska Decedent. The way the Affiant is related to the Nebraska Decedent should be documented.

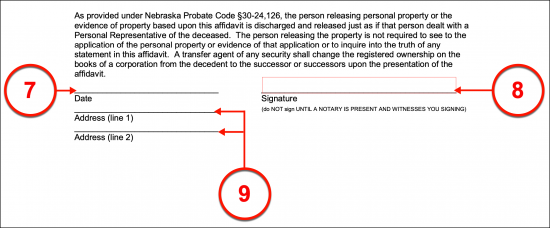

(7) Affiant Signature Date. The Nebraska Affiant must supply the current calendar date immediately before signing his or her name.

(8) Nebraska Affiant Signature. Once the current date has been established, the Nebraska Affiant must sign his or her name as a licensed Notary Public observes.

(9) Address Of Nebraska Affiant. A record of the Nebraska Affiant should also be furnished to this paperwork when he or she signs it.

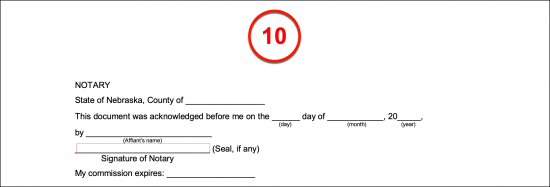

(10) Notary Public. The Nebraska Notary Public will complete the final area once he or she has engaged and completed the notarization process.