Updated August 09, 2023

The Iowa small estate affidavit, or affidavit for distribution of property, can be used to bypass the probate process if the value of the assets left by a decedent is less than $50,000. In Iowa, this is considered a “very small estate” that may avoid the probate process altogether. Note that Iowa also has a simplified probate process (Affidavit of Administration) available for estates not exceeding $200,000.

This procedure, however, involves certain civil proceedings and the appointment of a representative depending on the nature of the request, and it tends to be handled internally by the state government and its court system. The affidavit of distribution of property allows an heir or beneficiary to collect and distribute a “very small estate” easily and efficiently without the need for probate.

Laws

- Days after Death – Forty (40) days. According to I.C.A. § 633.356(1), forty (40) days must pass between the date of death and the use of a small estate affidavit.

- Maximum – $50,000. I.C.A. § 633.356(1) defines a very small estate as having a gross value of $50,000 or less, and it must not contain any real property.

- Social Security Number (SSN) – The decedent’s Social Security Number (SSN) must be included in the form. (I.C.A. § 633.356)

- Signing – The affidavit must be signed and sworn before a notary public.

- Statutes – A successor as defined in subsection 2 of § 633.356 may, by furnishing an affidavit prepared pursuant to subsection 3 or 8, collect property owned by the decedent.

How to File (4 steps)

- Step 1 – Wait 40 Days

- Step 2 – Gather Documents and Information

- Step 3 – Prepare Affidavit

- Step 4 – Collect the Assets

Step 1 – Wait 40 Days

Per I.C.A. § 633.356(1), a successor must wait forty (40) days before using a small estate affidavit.

Step 2 – Gather Documents and Information

You’ll need a certificate of death, which you can obtain from a county health office (Location Finder). You’ll also need a general description of the property the decedent owned that is to be paid to each successor (excluding real estate), as well as information about each successor.

Step 3 – Prepare Affidavit

Download the Affidavit for Distribution of Property and use the information you have gathered to fill it out.

Step 4 – Collect the Assets

Present the affidavit to a third party that possesses the property of the deceased, such as a bank or company, in order to gather and distribute it to each named successor. This does not have to be filed in court.

(Video) Iowa Small Estate Affidavits Explained

How to Write

Download: PDF

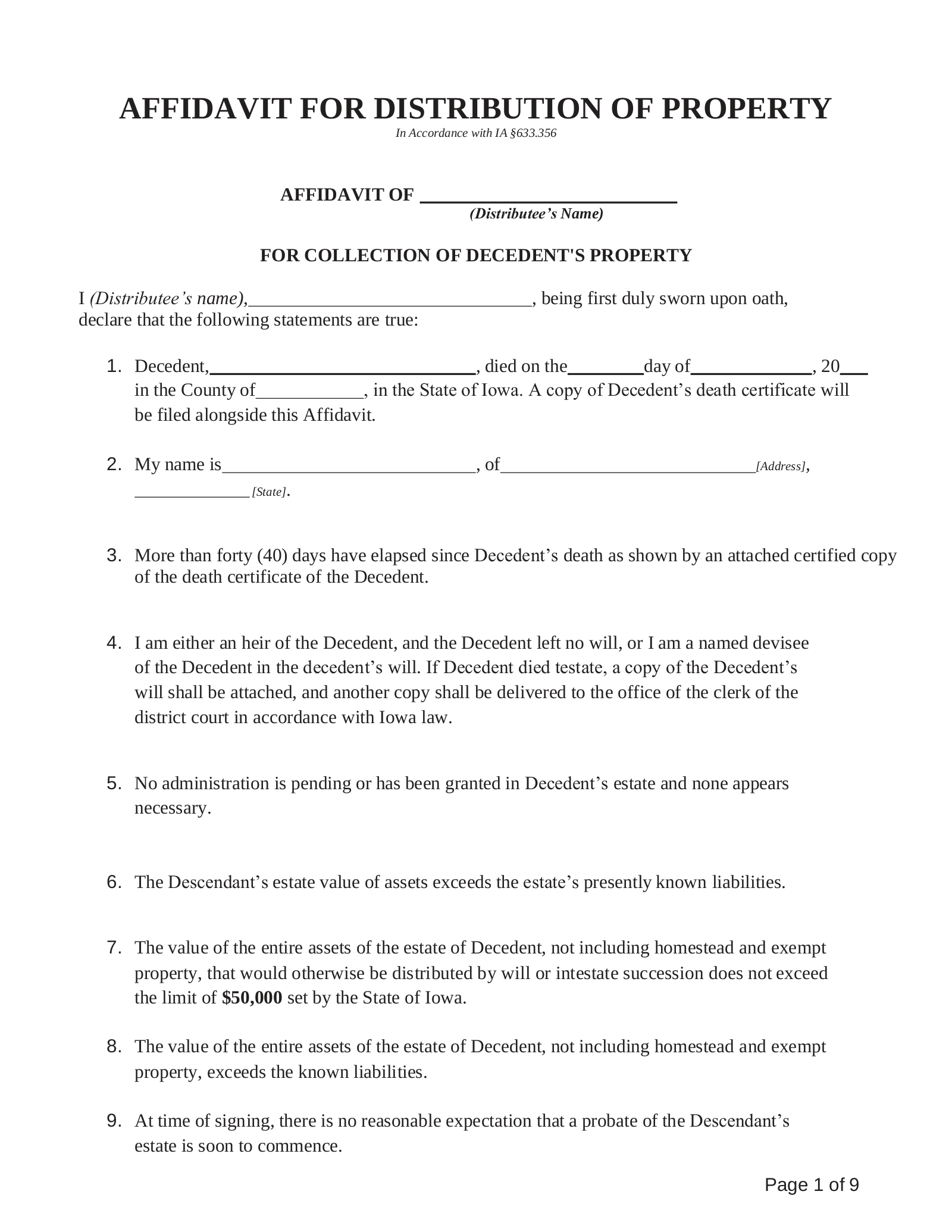

I. Affidavit Title

(1) Iowa Small Estate Distributee As Declarant. This instrument must be easily identifiable at first glance. To this effect, the full name of the Distributee issuing the statement made must be included in the title. Locate the space available in the title, then deliver a presentation of the Distributee’s full name. This will be the Party who shall be the Affiant issuing this declaration to take control of the Iowa Decedent’s small estate property.

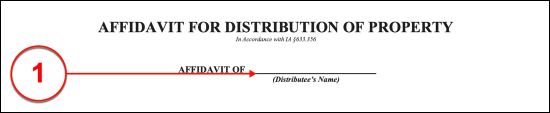

II. Statement Of Distributee Of Iowa Small Estate

(2) Distributee Name. Reproduce the full name of the Iowa Distributee in the introduction displayed.

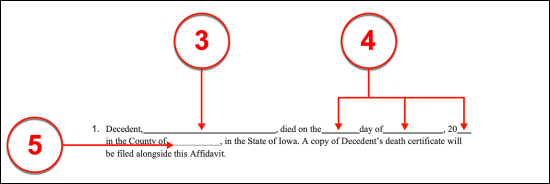

(3) Iowa Decedent Name. The Party who has passed away and whose estate is sought by the Distributee above must be identified as the Iowa Decedent. Transcribe the full name of the Deceased from his or her death certificate in Statement 1.

(4) Date Of Iowa Decedent Death. Locate the date of death that was documented on the Iowa Decedent’s death certificate. Record the exact date noted on the death certificate as the date of the Iowa Decedent’s death where requested in Statement 1.

(5) County Of Iowa Decedent Death. The County where the Iowa Decedent passed away must be furnished to complete the declaration made by Statement 1.

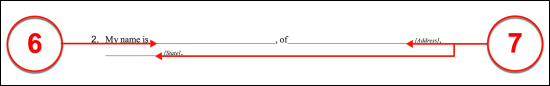

(6) Distributee As Iowa Affiant. The Iowa Distributee acting as the Affiant behind this declaration must be identified in Statement 2. Furnish the Iowa Distributee’s entire legal name where requested. This name must be presented precisely as it was recorded in this paperwork’s title and introduction and will be the Party expected to sign this instrument once it is complete.

(7) Address Of Distributee/Iowa Affiant. The home address of the Affiant behind this Iowa instrument must be documented in Statement 2 once he or she has been identified.

III. Accounting Of Iowa Small Estate Decedent Assets

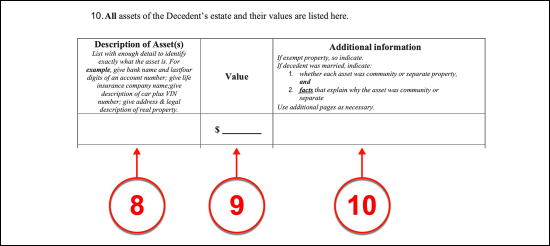

(8) Description Of Iowa Decedent Asset. This instrument shall require a complete detail of the Iowa Decedent’s assets. The first column of the table in Statement 10 requires that each of the Iowa Decedent’s assets be defined well enough to be located and claimed by the appropriate Distributee. To this effect, produce the name and a description of every asset in the Iowa Decedent’s estate in the first column. For instance, if the asset is a laptop, dispense the manufacturer, model, serial number, and (if known) any upgraded parts or personalizations. In a case where money from a financial account held by the Iowa Decedent must be defined, then a record of the concerned Financial Institution’s name, its address, the type of account held by the Iowa Decedent, and the account number must be submitted. Any real property owned by the Iowa Decedent will also need to be identified with a record of its geographical address as well as its full legal description.

(9) Value. Whether the asset that was defined in the first column is intangible (i.e. stocks, a bank account, a trust, etc.) or tangible (i.e. an automobile, a laptop, a house), its monetary worth must be recorded in the second column of the same row. For instance, if the asset is a bank account owned by the Iowa Decedent, the amount held in that account must be displayed in this column whereas if the asset is a laptop, its current market value (after ownership), must be reported as a dollar amount.

(10) Additional Information. In some cases, the Iowa Decedent’s asset may not be his or her sole property (i.e. a purchase made with a Spouse). If any additional information is needed to define the asset or its value as owned by the Iowa Decedent at the time of his or her death when discussing the concerned property, then report all such information to the third column.

IV. Documentation Of Iowa Small Estate Decedent Liabilities

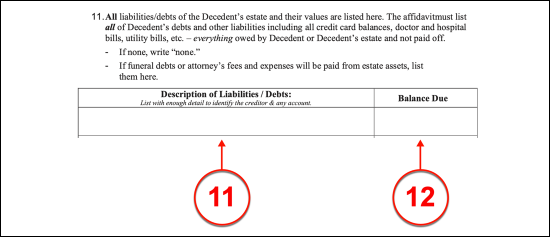

(11) Description Of Liabilities/Debts. Many Decedents will have passed away with debts that are currently held against them or may be held liable to satisfy issued and accepted financial responsibilities (i.e. the Decedent, may have credit cards, a judgement issued against him or her, may be responsible to satisfy a loan he or she co-signed, etc.). Each such liability or debt that was held by the Iowa Decedent at the time of his or her death will need to be listed in the first column of Statement 11. This column should be supplied with the name of the Creditor who Iowa Decedent must pay a debt to, the type of debt held, any relevant dates involved, and any account numbers that define the debt. If the Iowa Decedent was subject to court action, then make sure to name the court where the judgment was issued, when it was issued, and the case/trial name and number. All debts and liabilities that were held the Iowa Decedent at the time of his or her death must be documented on a separate row in this column.

(12) Balance Due. The amount that is still due to the Creditor from the Iowa Decedent must be presented in the second column. Each debt or liability of the Iowa Decedent that was listed in the previous column must be accompanied by a report on the amount still owed by the Iowa Decedent in this column and on the same row.

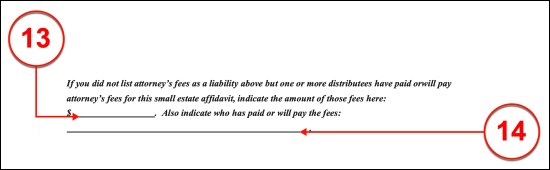

(13) Unpaid Attorney Fees. In a case where the Attorney fees needed to file this small estate affidavit have not been named above, a presentation of these fees must be made following the dollar symbol. List this attorney fee whether it has already been paid by a Distributee or exists with a promise of payment from a Distributee.

(14) Payer Of Attorney Fees. List the name of every Distrubetee who has paid or has issued a promise to pay the Attorney fees assessed for the preparation of this document.

V. Iowa Decedent Marriage And Children History

Family History #1

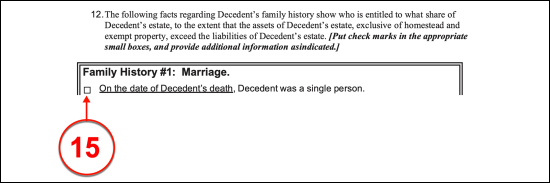

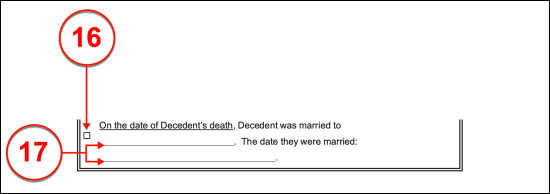

Select Item 15 Or Complete Item 16 And 17

(15) Single Iowa Decedent. The marital status of the Iowa Decedent will be of concern in this situation. Therefore, locate “Family History #1: Marriage” so that the Decedent’s marital status may be defined. If he or she was single and unmarried at the time of death then select the first checkbox. If not, and the Iowa Decedent was married, then this checkmark should be left unattended.

(16) Married Iowa Decedent. If the Iowa Decedent was married at the time of his or her death, then the second checkbox in “Family History #1: Marriage” must be selected.

(17) Iowa Decedent Spouse. Additionally, the presentation of the full name of the Iowa Decedent’s Spouse and the date the Iowa Decedent and Spouse were legally married must be supplied to complete this selection.

Family History #2

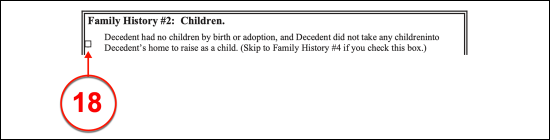

Select Item 18 Or Complete Item 19 And 20

(18) Iowa Decedent Had No Children. If the Iowa Decedent did not have any children at the time of his or her passing then the first option in “Family History #2: Children” should be tended to. This will mean that the Iowa Decedent did not have Children, did not adopt Children, and does not have any Minors living with him or her (i.e. a Ward). If this is the case then, select the first checkbox in this section then proceed to Step 22. If the Iowa Decedent was responsible for raising any Children then leave this checkbox unmarked.

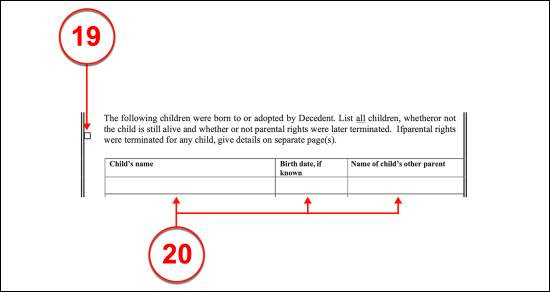

(19) Iowa Decedent Children. Select the second checkbox if the Iowa Decedent had any Children regardless of the status of the Child or the status of the Iowa Decedent’s relationship with that Child.

(20) Identity Of Iowa Decedent’s Children. Every Child of the Iowa Decedent must be identified regardless of the Child’s status. Therefore list the full name of each of the Iowa Decedent’s children in the first column, the birthdate of the named Child in the second column, then the name of the Child’s Other Parent in the third column.

Family History #3

Complete Item 21 Or Item 22 And Item 23

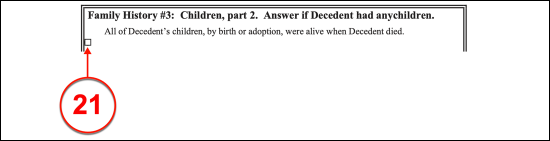

(21) All Children Of Iowa Decedent Survive. If every Child of the Iowa Decedent was alive at the time of the Decedent’s death, then indicate this by selecting the first checkbox in “Family History #3: Children Part 2.”

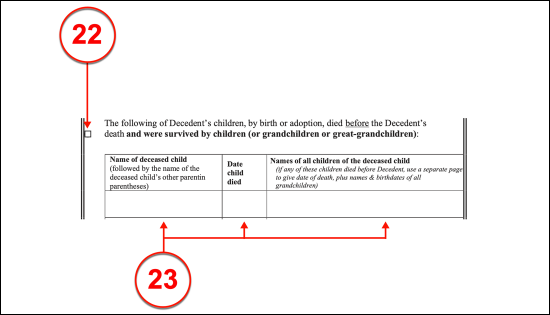

(22) Non-Surviving Children of Iowa Decedent. If the Iowa Decedent had any Children who passed away before the Decedent but were survived by their own children (i.e. Decedent’s Grandchildren) then supply a mark in the second checkbox. This selection should be made only if the deceased Children of the Iowa Decedent had children of their own.

(23) Deceased Child Of Iowa Decedent. Each Deceased Child of the Iowa Decedent who was survived by a Child (i.e. the Iowa Decedent’s Grandchild) must be identified in the first column. Thus, furnish the name of the Deceased Child of the Iowa Decedent in the first column of the table provided making sure to report the name of the other Parent of the Deceased Child in parentheses before proceeding to record the date of the Deceased Child’s death in the second column, and the name of each surviving Child of the Iowa Decedent’s Deceased Child in the third column.

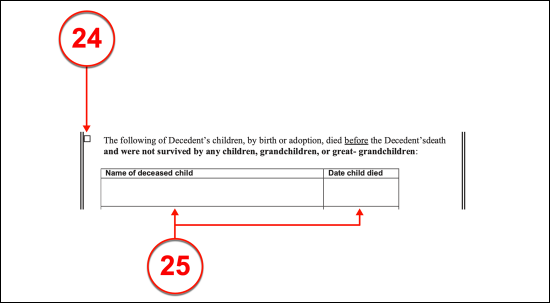

(24) Deceased Children With No Offspring. If the Children of the Iowa Decedent were deceased when the Iowa Decedent passed away and were not survived by their own Children then select the final checkbox in this section.

(25) Identity Of Deceased Iowa Decedent Children With No Offspring. Once selected, identify each Deceased Child of the Iowa Decedent by supplying his or her name and date of death to the table provided. Only Deceased Children of the Iowa Decedent that did not have children of their own may be discussed in this table.

VI. Iowa Decedent Parents And Sibling History

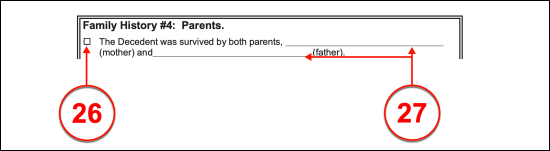

Family History #4

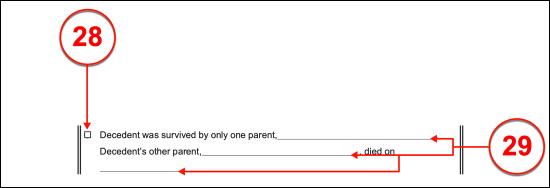

Select Item 26 Or Complete Item 27 And 28 Or Select Item 29

(26) Surviving Parents Of Iowa Decedent. If both of the Iowa Decedent’s Parents have survived the Decedent, then mark the first checkbox in “Family History #4: Parents.”

(27) Names Of Surviving Parents Of Iowa Decedent. Additionally, supply the name of the Iowa Decedent’s Mother and Father to the spaces presented (in that order).

(28) One Surviving Parent Of Iowa Decedent. If the Iowa Decedent was survived by only one Parent then select the second option to indicate that his or her parents will have a different status in “Family History #4: Parents.”

(29) Status Of Iowa Decedent Parents. This definition will require that the full name of the Surviving Parent be produced on the first blank line, the full name of the Iowa Decedent’s Non-Surviving Parent be furnished to the second blank line, and the date that the Non-Surviving Parent of the Decedent perished recorded on the third line.

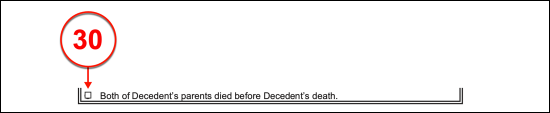

(30) No Surviving Parent Of Iowa Decedent. If the Iowa Decedent was not survived by either of his or her Parents then select the third checkbox in “Family History #4: Parents.”

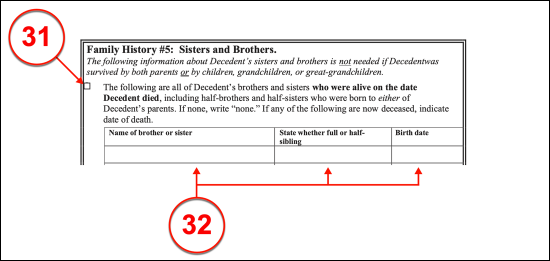

Family History #5

Select Item 31 Or Complete Item 32 And 33

(31) Iowa Decedent Survived By Siblings. IIf the Iowa Decedent was survived by any or his or her Siblings, this will need to be discussed. A Sibling (i.e. Brother or Sister) may be considered such if he or she is the Full Sibling or shares only one Biological Parent with the Iowa Deceased as a Half Sibling. If the Iowa Decedent was survived by any Siblings, select the first checkbox from “Family History #5.”

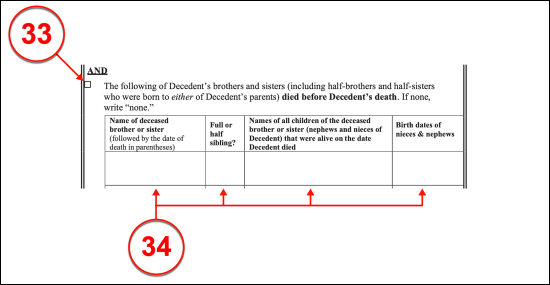

(32) Surviving Siblings Of Iowa Decedent. If the Iowa Decedent was either survived by both his or her parents or survived by any of his or her Children, Grandchildren, or Great-Grandchildren then a production of his or her Sibling’s information will not be necessary, however, if this is not the case and the Iowa Decedent was not survived by these Family Members then, produce the full name of every Sibling alive at the time of the Iowa Decedent’s death in the first column of Family History #5. Once done, indicate if the named Sibling is the Full or Half Sibling in the second column and record the Sibling’s date of birth in the third column.

(33) Non-Surviving Siblings Of Iowa Decedent. If the Iowa Decedent had any Siblings or Half-Siblings that passed away before he or she did, then select the second checkbox.

(34) Identity Of Non-Surviving Siblings. The name of every Deceased Sibling of the Iowa Decedent must be produced in the first column, an indication as to whether the Deceased Sibling was a Full Sibling or Half Sibling of the Iowa Decedent must be made in the second column, and the name every Deceased Sibling’s Offspring (i.e. Nephew or Niece) recorded in the third column. If any such Nephews or Nieces have been named in the third column, then make sure to record each one’s date of birth in the final column.

VIII. Heirs Or Distributees Of The Decedent

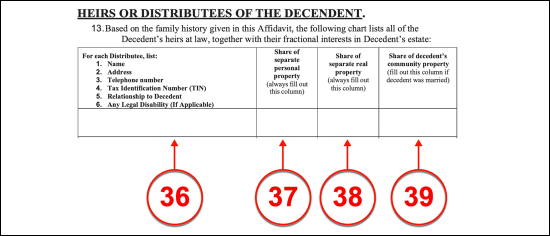

(36) Intended Distributee. The name of every Beneficiary or Heir who is entitled to any part of the Iowa Decedent’s estate (and will, thus, be considered a Distributee in this statement) must be presented in the first column of Statement 13. This Distributee (Entititled Beneficiary Or Heir) must have his or her identity supported with several pieces of information. Therefore submit a presentation of the Distributee’s home address, telephone/cell number, Tax ID Number (i.e. Social Security Number), the type of relationship the Distributee and Iowa Decedent held, and, if relevant, any disability afflicting the Distributee the first column as well. This must be a complete roster so if needed, more space may be added as needed or an attachment with the information requested by this table may be made and kept with this document.

(37) Share Of Decedent Personal Property. The share of the Iowa Principal’s personal property that is considered the sole property of the Decedent (For instance, purchased outside of marriage) expected by the Distributee should be displayed in the third column. This may be presented as a dollar amount or a percentage whichever is more appropriate.

(38) Share Of Decedent Real Property. Use the third column to report the amount or share the Iowa Decedent’s real property (real estate) that must be distributed to the concerned Beneficiary or Heir. This report should only concern real estate that was owned solely by the Iowa Decedent at the time of his or her death.

(39) Share Of Married Decedent Community Property. If the Beneficiary or Heir is entitled to property that the Iowa Decedent co-owned (i.e. with his or her Spouse), then document the amount of the Iowa Decedent’s portion of the shared property that should be released to the Distributee in the final column.

IX. Signature Of Iowa Small Estate Distributee

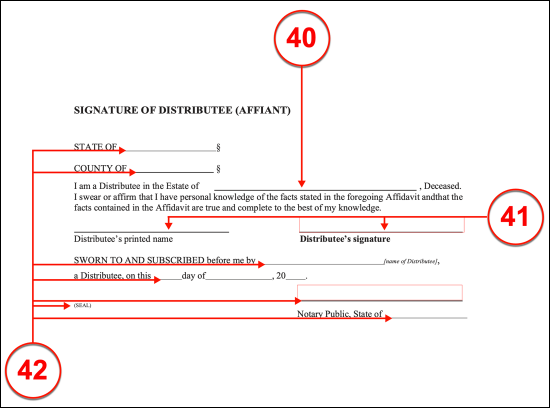

(40) Signature Statement Preparation. The full name of the Iowa Decedent must be supplied to the final statement made before the Affiant signs this document. Supply the Iowa Decedent’s name where requested.

(41) Notarized Distributee Signature. Once the information required by the statements above has been successfully produced, the Distributee acting as the Affiant must sign print and sign his or her name under the oversight of a Notary Public. This signature will verify that the above statements, to the knowledge of the Signature Affiant are accurate.

(42) Notary Participation. The Notary Public obtained for the Iowa Distributee’s signing will subject both the Affiant and this document to the notarization process. To this end, several pieces of information will be supplied by (and only by) the Notary Public overseeing the signing ranging from the date of the signing to the Notary Public’s seal of proof that the signature was notarized.

X. Affidavits And Signatures Of Two (2) Disinterested Witnesses

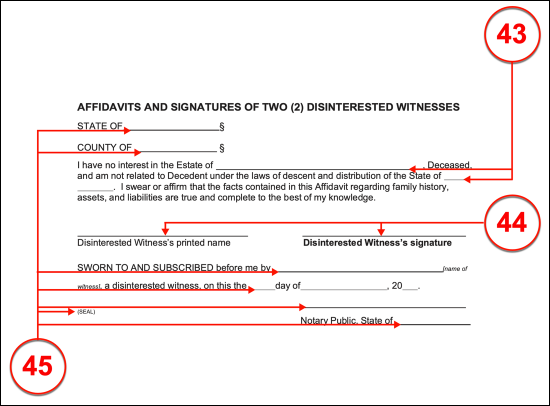

(43) Disinterested Witness Statement. The statement that must be signed by the First Witness upon observing the Affiant’s execution of this document must be prepared with the full name of the Iowa Decedent. Produce this information immediately after the phrase “…Estate Of” then continue to document the name of the concerned state (in this case “Iowa”).

(44) First Disinterested Witness Signature. Two Witnesses unrelated to the Iowa Decedent and hold no entitlements or expectations with his or her estate must serve to verify that the Distributee who has acted as the Signature Affiant signed this document. The First Witness must produce his or her printed name on the “Disinterested Witness’s Printed Name” line in the first area provided then sing his or her name on the “Disinterested Witnesss’s Signature” line provided.

(45) Notary Verification Of Disinterested Witness Signature. As with the signing of the Affiant, the First Witness’s signature should be notarized. The Notary Public on hand shall supply the final areas of this section with the information needed to verify the notarization process has been engaged successfully.

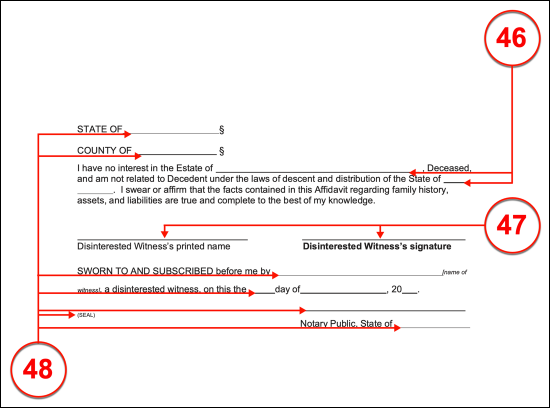

(46) 2nd Disinterested Witness Statement. Furnish the statement made with the name of the Iowa Decedent and the State that holds jurisdiction over this document.

(47) 2nd Disinterested Witness Signature. The 2nd Witness will take control of the document, then read the prepared statement. Once this act is completed, he or she must print and sign his or her name, then relinquish this paperwork to the attending Notary Public.

(48) Notarization Of 2nd Disinterested Witness Signature. The Notary Public in attendance shall proceed to subject this area to the notarization process with a record of the facts behind this signing.

(49) Law Office Of Preparation. The Attorney who has completed this document in preparation for its signing by the Affiant/Distributee must sign his or her name to final signature line.