Updated September 12, 2023

There are options when seeking a Florida small estate affidavit and looking to claim, with few court proceedings, the assets of a person who has died. One process is known as a “Disposition of Personal Property Without Administration.” Petitioners often select this option due to its ability to avoid probate administration altogether. It applies only to personal property (meaning not real property), and the estate must consist of personal property exempt under provisions of 732.402, personal property exempt from the claims of creditors under the Constitution of Florida, and nonexempt personal property the value of which does not exceed the sum of the amount of preferred funeral expenses and reasonable, necessary medical and hospital expenses of the decedent’s last illness (if those expenses were incurred during their final 60 days).

The other option is through a process known as “Summary Administration,” which does involve filing with the probate court. Though it does not avoid probate altogether, it is generally much quicker than the full probate process. This option is only available for applicable estates with a value below $75,000.

Laws

- Days After Death – No exact section of the Florida Statutes determines the number of days that must go by before filing an affidavit.

- Maximum Amount ($) – For summary administration, the process is available for non-exempt assets with a total value of less than $75,000. (F.S.A. § 735.201) For disposition of personal property without administration, the process is only available to transfer assets up to the value of final expenses incurred, accounting for funeral expenses and reasonable and necessary medical and hospital expenses of the last 60 days of the last illness. (§ 735.301). If the decedent died intestate, meaning without a will, it may not exceed $10,000. (§ 735.304) If the decedent had a will, there is no statutorily specified maximum amount. However, Florida law does give a surviving spouse or the decedent’s children has an automatic right to “exempt” property in the estate, including (i) furniture and appliances, worth up to $20,000; (ii) up to two motor vehicles that were regularly used by decedent’s family; (iii) funds kept in college savings accounts. (§ 732.402) A home lived in by the decedent is also automatically exempt. (Fla. Const., Art. X, Sec. 4)

- Publication – For summary administration, notices to creditors containing the name of the decedent, identifying information for the estate, and contact information for the court handling the petition must be published once a week for two consecutive weeks in a newspaper published in the county where the petition will be filed. If there is no newspaper there, then by means of a newspaper of general circulation in the county. The notice should contain contact information for an estate representative and the dates by which a creditor must act. (F.S.A. § 735.2063)

- Signing Requirements – Must be signed by the surviving spouse, if any, or any petitioning beneficiaries. For decedents who had a will, summary administration petitions must be signed by other beneficiaries not joining in the petition, or if not include proof that they have been noticed. (F.S.A. § 735.203). Though it may depend on the county, petitions usually require notarization.

- Statutes – Summary Administration (Chapter 735, Part I); Disposition of Personal Property Without Administration (Chapter 735, Part II)

How to File for Disposition of Personal Property (3 steps)

Petition for Disposition of Personal Property Without Administration: PDF

1. Assess Final Expenses

2. Gather Documents

3. File the Form

How to File for Summary Administration (4 steps)

Petition for Summary Administration: PDF, MS Word, ODT

1. Evaluate Assets

2. Notify Beneficiaries

3. Notify Creditors

4. File the Petition

Video

How to Write

Download: PDF

Florida Court Information

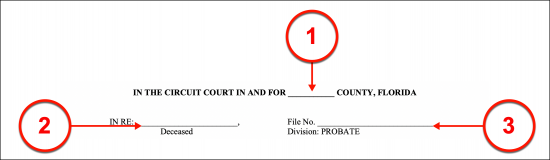

(1) County Name. The Florida County where this petition will be filed must be named at the top of the page.

(2) Name Of Deceased. Record the full name of the Florida Deceased.

(3) File Number. The file number assigned by the Florida County Court handling this petition must be presented in the header on the right-hand side.

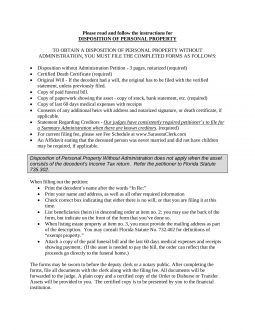

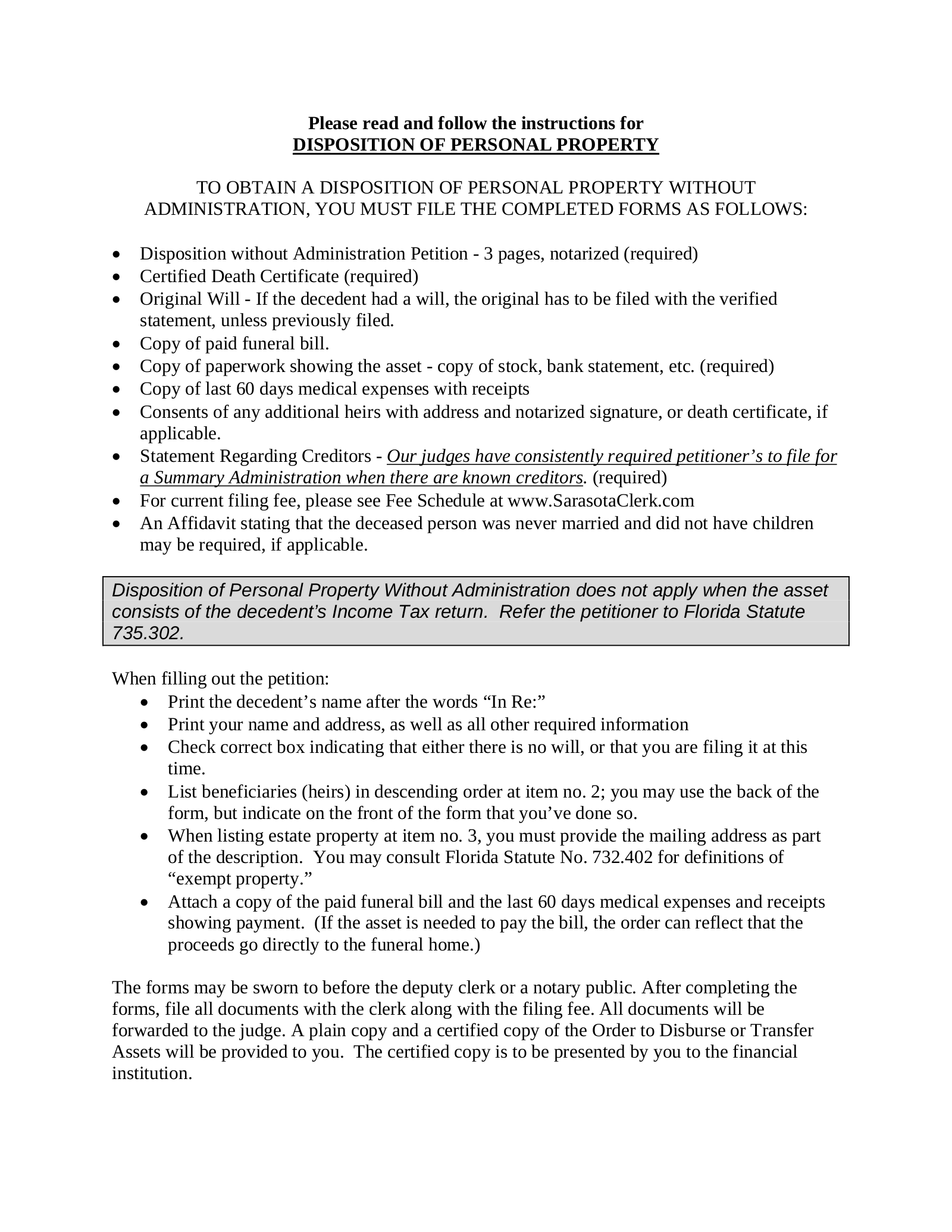

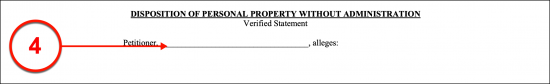

Disposition Of Personal Property Without Administration

(4) Petitioner Name. The Party filing this statement with the Florida County Clerk should be identified as the Florida Petitioner seeking to disbursement of the Florida Deceased’s assets.

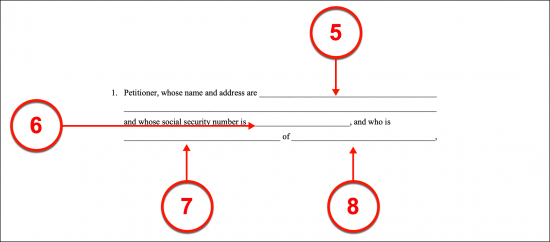

(5) Petitioner Name And Address. Section 1 requires the name and residential address of the Petitioner supplied to its content.

(6) Petitioner Social Security Number. Document the social security number of the Petitioner registering the statement being made.

(7) Petitioner Relationship To Florida Deceased. The first statement will require several additional pieces of information to supplement its language. Thus, after identifying the petitioner, describe his or her relationship to the Florida Deceased.

(8) Name Of Florida Deceased. Next, document the name of the Florida Deceased. This is the Party who has passed away and whose estate is being discussed.

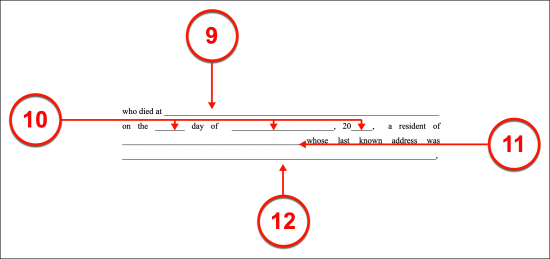

(9) Time Of Florida Decedent’s Death. The Florida Deceased’s time of death should be transcribed from the death certificate issued.

(10) Death Certificate Date Of Event. After supplying the time of the Florida Decedent’s death, record the calendar date when he or she died.

(11) Residential County Of Deceased. Dispense the name of the Florida County where the Florida Deceased maintained his or her address.

(12) Residential Address Of Deceased. Furnish the residential address of the Florida Deceased.

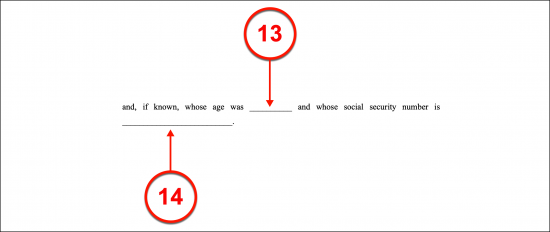

(13) Age Of Florida Decedent. Produce the age of the Florida Deceased at the time of his or her death.

(14) Social Security Number Of Florida Decedent. The social security number of the Florida Decedent should be presented to confirm his or her identity.

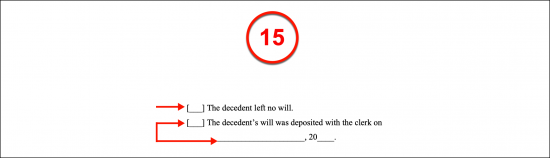

(15) Status Of Will. One of two statements should be initialed to define the will status of the Florida Deceased. If he or she did not have a will then initial the first statement presented on this subject however, if the Florida Deceased died with a will, then the second statement should be initialed and date the will was delivered to the County Clerk should be presented.

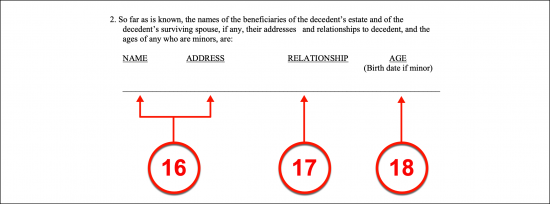

2. Beneficiary Of Florida Decedent’s Estate

(16) Name And Address Of Beneficiary. The Parties who are entitled to the Florida Deceased’s estate should be identified. Such Beneficiaries are commonly the Florida Deceased’s Spouse and/or other surviving Family Members. Document the name of every Beneficiary to the first column and his or her address to the second column.

(17) Relationship To Florida Deceased. Define how the Beneficiary is related to the Florida Deceased.

(18) Age Of Beneficiary. Document the age of every Beneficiary in the final column. If the Beneficiary is a minor, then the birth date of the Beneficiary Minor must be furnished.

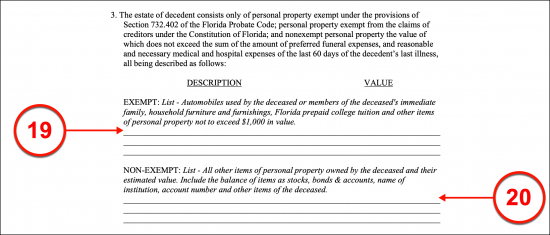

3. Personal Property Of Florida Deceased

(19) Property Exempt From This Petition. Some property of the Florida Deceased may fall under the protection of Section 732.402 of the Florida Probate Code and may not be seized through this paperwork. List every piece of estate property of the Florida Deceased that may not be obtained by Creditors of his or her estate.

(20) Non-Exempt Personal Property Of The Florida Deceased. Property of the Florida Deceased’s estate that may be petitioned through this document should be presented with the information needed to identify each one (i.e. a bank account number).

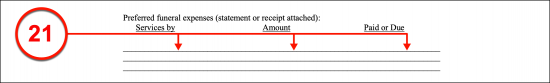

(21) Funeral Expenses Of The Florida Deceased. The type of memorial or funeral services, the dollar amount required for them, and payment status should be produced to the appropriate area.

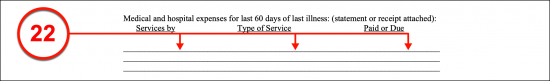

(22) Medical Expenses For Last Sixty Days. The Florida Deceased may have had medical bills accrue during the last sixty days of his or her life. Such expenses should be defined by the Party who has delivered the service, the type of medical service delivered, and the payment status.

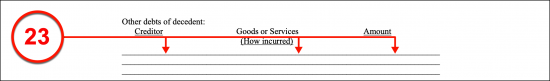

(23) Other Debts Of Decedent. Every Creditor of the Florida Deceased that has to been paid should be named in the first column of the Creditor area, the reason for the debt and the amount of the debt owed by the Florida Deceased should also be discussed.

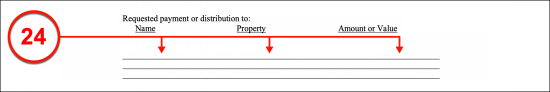

(24) Requested Payment Or Distributions Of Non-Exempt Property. The property of the Florida Deceased that has been defined as non-exempt will make up the payments this document requests or be distributed to specific Recipients. List the name of each Recipient and property that must be dispensed to the named Recipient. Once done, continue to the right to document the amount or value of the property.

(25) Additional Assets Or Debts. Any assets of the Florida Deceased or debts held against his or her estate that have not been discussed thus far should be cataloged where requested.

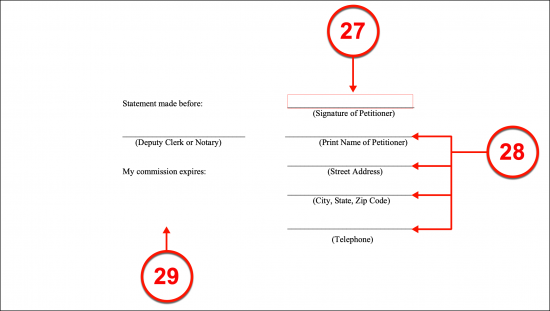

Notarized Signature

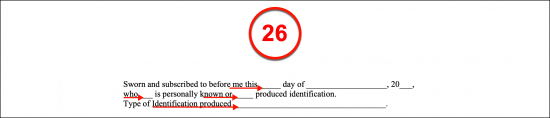

(26) Notary Participation. The Notary Public overseeing the Florida Petitioner’s signature will complete the statement provided with the date of the signing. He or she may instruct the Petitioner to sign before or after completing the signature declaration statement.

(27) Signature Of Petitioner. The Petitioner should sign his or her name when instructed to do so by the Notary Public.

(28) Printed Name And Address Of Petitioner. In addition to signing this paperwork, the Florida Petitioner must present his or her printed name, address, and telephone number.

(29) Notary Seal. The Florida Notary will complete this process with proof of notarization shown through his or her credentials and seal. Consent To Disposition Of Personal Property Court Information

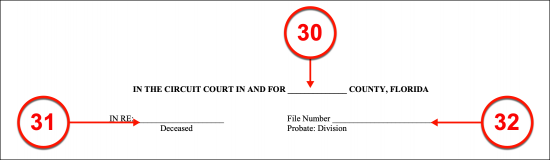

Consent Statement

(30) County Of Florida Action. Define the Florida County handling this petition.

(31) Deceased Name. Deliver the full name of the Florida Deceased to the top left of this page.

(32) File Number. Complete the header with the filing number assigned by the Florida County Court receiving this document.

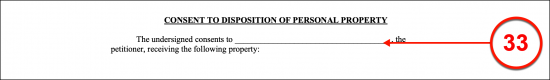

(33) Petitioner Name. The Party who is entitled to some or all of the Florida Deceased’s estate yet intends to release this right to survivorship must have his or her name presented as the Author of the consent statement made.

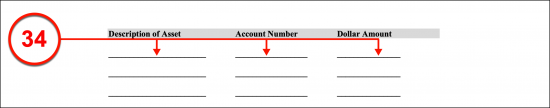

(34) Asset Information. The Florida Deceased’s property that will be released by the Consenting Party to the Petitioner must be defined. Define the asset that will be released to the first column. The account number and dollar amount of the concerned asset should also be documented using the two columns that follow.

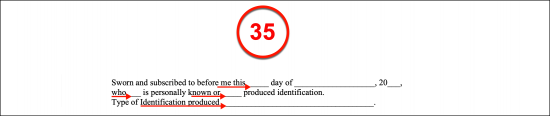

(35) Notary Action. The Florida Notary Public obtained for this document’s execution will present the date and a statement on the Petitioner or Interested Party’s identity.

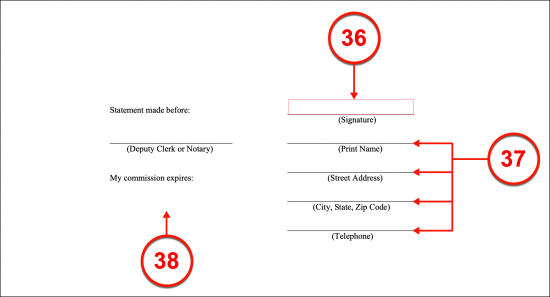

(36) Signature Of Interested Party. The release above must be signed by the Petitioner or the Interested Party making it. He or she will need to sign this document under the direction of the Florida Notary Public who has documented the Signer’s identity.

(37) Notary Completion. The Florida Notary Public will complete the notarization of this statement’s execution with a report on the expiration of the notary commission he or she holds and production of the seal needed to complete the process Affidavit Court Information(38) County. Establish the name of the County where this petition will be made.

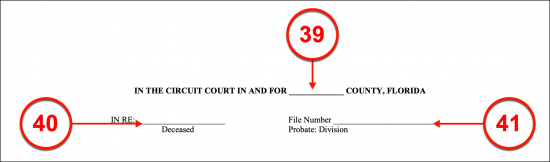

(39) Florida County. Report the County where this document will be filed.

(40) Deceased. Report the Florida Deceased Party’s full name.

(41) File Number. Document the file number that was assigned to this petition by the State of Florida.

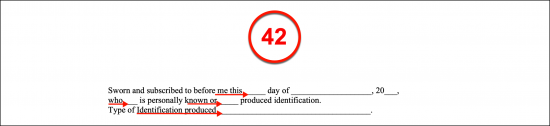

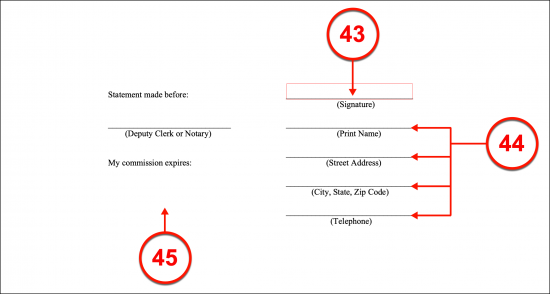

(42) Notary To Signature Action. The statements made above must be proven with the notarized signature of the Florida Petitioner. When it is time to sign this document, the Notary Public shall provide the current date and confirmation to the Petitioner’s identity to the statement on display in the signature area.

(43) Signature Of Florida Petitioner. The Petitioner who wishes to declare the information stated in this document as true must sign his or her name as testimony.

(44) Petitioner Identity And Location. The Florida Petitioner must sign his or her name as directed by the Notary Public in attendance.

(45) Notary Credentials And Seal. The Florida Notary Public will also testify through this document. He or she will self-identify then provide the notary seal as proof of that the signature notarization process has been completed.

Statement Regarding CreditorsCourt Information

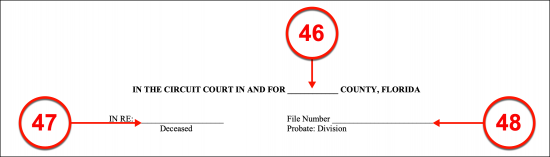

(46) Florida County. The name of the County in Florida where this statement on the Deceased’s Creditors is made should be documented.

(47) Deceased. Identify the Florida Decedent with his or her full name.

(48) File Number. The identity of this document in the Florida County where it is made will be assigned to it by the courts as a file number. Produce this file number where requested.

Statement Regarding Creditors

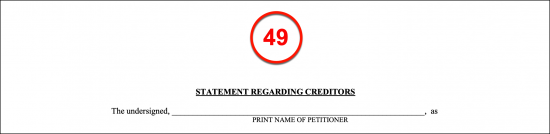

(49) Printed Petitioner Name. The name of the Petitioner filing this statement to request that the Florida Deceased’s remaining Creditors be paid must be produced.

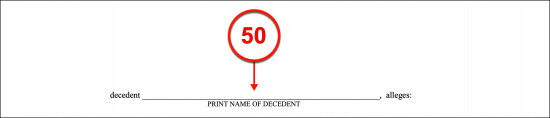

(50) Printed Name Of Decedent. Deliver the full name of the Decedent (the Florida Deceased) whose Creditors are being discussed.

(51) List Of Creditors. The name and address of every Creditor to the Florida Deceased must be delivered to this document. If there are no Creditors and this statement is meant to attest to this fact, then write in the word “None.”

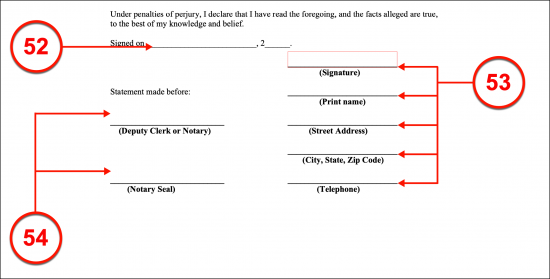

(52) Signature Date. The statement regarding Creditors must be acknowledged by the Petitioner’s signature. This act of signing must be notarized so that the identity of the Petitioner can be verified by a disinterested Party that can be easily reached in the future. The Notary Public overseeing the Petitioner’s act of signing will declare the current date and the identity of the Petitioner in the acknowledgment statement provided.

(53) Signature And Printed Name Of Petitioner. The Petitioner defining the Florida Decedent’s Creditors must sign this document before while the Notary Public observes.

(54) Notarization. After the signing, the Notary Public shall provide his or her own acknowledgment to the identity of the Petitioner by displaying the notary seal assigned to him or her and the calendar date that his or her commission expires.