Updated September 13, 2023

New Hampshire does not offer a small estate affidavit (through the now-defunct process of “voluntary administration”); the process was eliminated by legislation in 2006. However, a waiver of full administration affidavit offers similar benefits of simpler and quicker distribution of the assets of the estate of a decedent. The process is an option for decedents who died testate, meaning with a will, or intestate, meaning without a will, but in each case only under certain circumstances.

Laws

- Days After Death – No statute

- Maximum Amount ($) – No statute

- Signing Requirements – Must be notarized

- Statutes – Chapter 553, Waiver of Administration (§ 553.32)

How to File (4 steps)

- Verify Eligibility

- File Petition for Estate Administration

- Wait More than Six Months but Less than a Year

- File the Affidavit

1. Verify Eligibility

2. File Petition for Estate Administration

3. Wait More than Six Months but Less Than a Year

4. File the Affidavit

Video

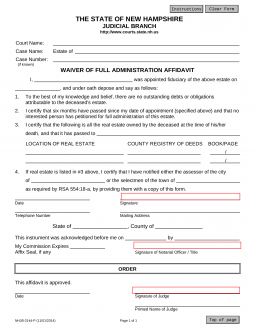

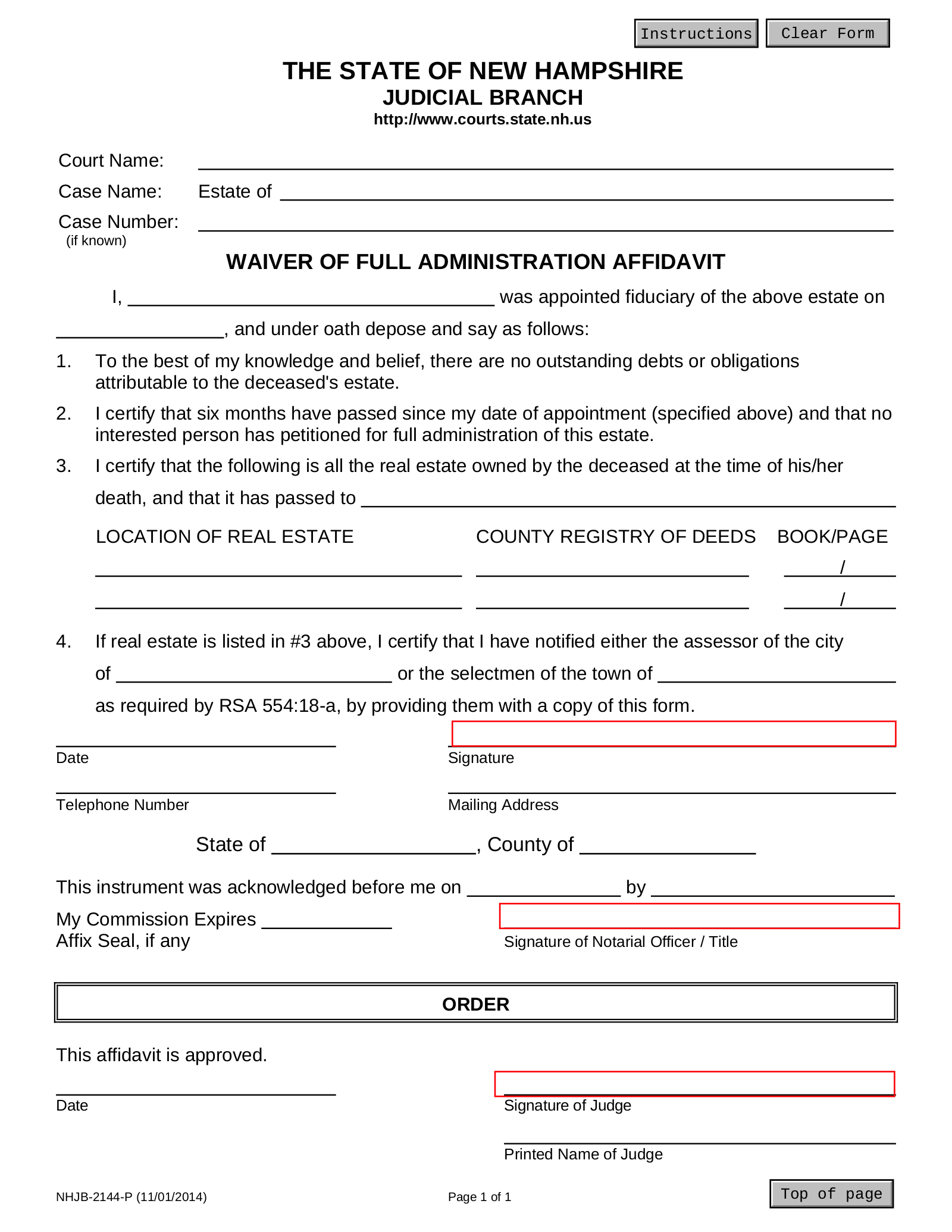

How to Write

Download: PDF

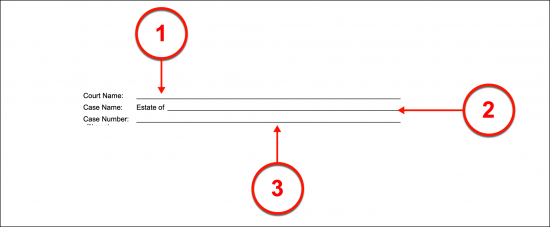

(1) New Hampshire Court Name. The name of the New Hampshire Court should be placed at the top of this document

(2) Case Name For Decedent Estate. The entire name of the New Hampshire Decedent is required.

(3) Case Number If Known. The case number assigned to the New Hampshire Decedent’s estate must be provide in the header.

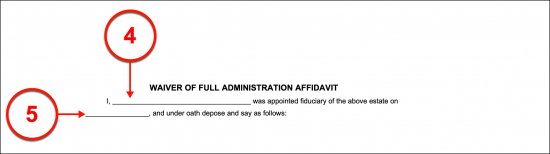

(4) New Hampshire Affiant Identity. This petition will assume that no other claims to the New Hampshire Decedent will be made and that the Affiant has already been approved to act as the New Hampshire Decedent’s Fiduciary Agent. The printed name of the New Hampshire Affiant must be dispensed to the introduction.

(5) Date Of Affiant Appointment As Decedent Fiduciary. The calendar date when the Affiant was appointed as the Fiduciary Agent for the Decedent’s estate is required to complete the introduction.

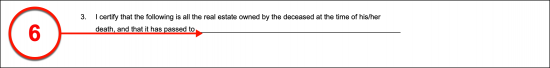

(6) Accounting For New Hampshire Decedent Real Estate. If the New Hampshire Decedent owned real estate (i.e. real property such as land, a house, etc.) then the Successor to this land must be named. Produce the name of the Successor to the New Hampshire Decedent’s real property. If the New Hampshire Decedent did not own real estate, then write in the word “None.”

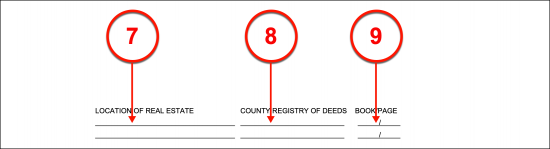

(7) Location Of Real Estate. After identifying the Successor to the New Hampshire Decedent’s real estate, the physical location of this property should be dispensed. This requires that a building, street/road, any associate unit number, city, and state be documented.

(8) County Registry Of Deeds. The parcel or plot number identifying the land in the New Hampshire County’s Registry of Deeds is required. This information may be found at the County Clerk or Registrar’s Office where the New Hampshire Decedent’s real estate is located.

(9) Book/Page. The book and the page number where the County documented this property should be dispensed.

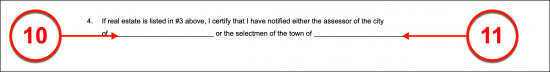

(10) City Assessor Or Town Selectman. Depending upon the location, a City Assessor or Town Selectman will require this paperwork to be filed. Produce the name of the elected Selectman or Assessor where this paperwork work will be filed as well as the name of the concerned city or town.

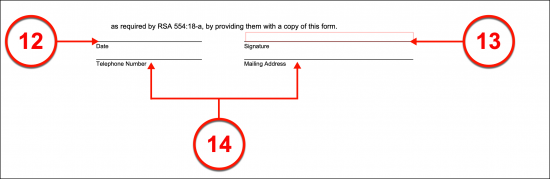

(11) New Hampshire Affiant Signature Date. The calendar date when the New Hampshire Affiant signs this paperwork is mandatory at the time of signing. Once the New Hampshire Affiant has coordinated with an appropriate Notary Public and is ready to execute this document, he or she should dispense the date.

(12) Signature Of New Hampshire Affiant. The New Hampshire Affiant will have to sign his or her name to prove the above information is correct and that he or she should take control of the New Hampshire Decedent’s remaining property.

(13) New Hampshire Affiant Telephone Number And Mailing Address.

(14) New Hampshire Notary. The Notary Public working with the New Hampshire Affiant to execute this form will provide a basic testimony regarding the signing as well as his or her seal and credentials.

(15) Judge Approval. Proof of this affidavit’s approval will be provided by the receiving New Hampshire Judge.