Updated April 29, 2024

A California small estate affidavit, or “Petition to Determine Succession to Real Property,” is used by the rightful heirs to an estate of a person who died (the “decedent”). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.

Laws

- Days After Death – Can only be filed forty (40) days after the date of the decedent’s death.[1]

- Maximum Amount ($) – $184,500. The Judicial Council’s determination based on the change in U.S. city average “Consumer Price Index for All Urban Consumers” became effective on April 1, 2022, and it shall apply if the decedent died on or after said date.[2]

- Real Estate – If there is real property as part of the Decadent’s estate, Form DE-160 and Form DE-161 (if necessary) are required to be attached and filed. If the heirs are only looking to transfer the real estate, with no personal possessions, Form DE-310 must be completed and filed.

- Signing Requirements – Must be notarized.[3]

- Statutes – Collection or Transfer of Small Estate Without Administration (PROB 13000-13211)

How to File (4 steps)

2. Make an Inventory

The total net amount of the estate must be less than $184,500. If less, then complete one (1) of the following:

- Form DE-221 – If the Decedent was the filer’s spouse.

- Form DE-160/GC-040 – If the Decedent was not the filer’s spouse.

The inventory list cannot include:

- Any mortgage owed, property

- Vehicles, motorcycles, and motor homes;

- Boats and any other type of vessel; and

- Any other restricted items listed in PROB § 13050.

3. Gather Documents

- Small Estate Affidavit – All heirs must sign before a notary public.

- Death Certificate (certified copy)

- Proof of Ownership (of the items on the inventory list)

- Identification (of the person filing the affidavit)

4. File at the Probate Court

Video

How to Write

Download: PDF

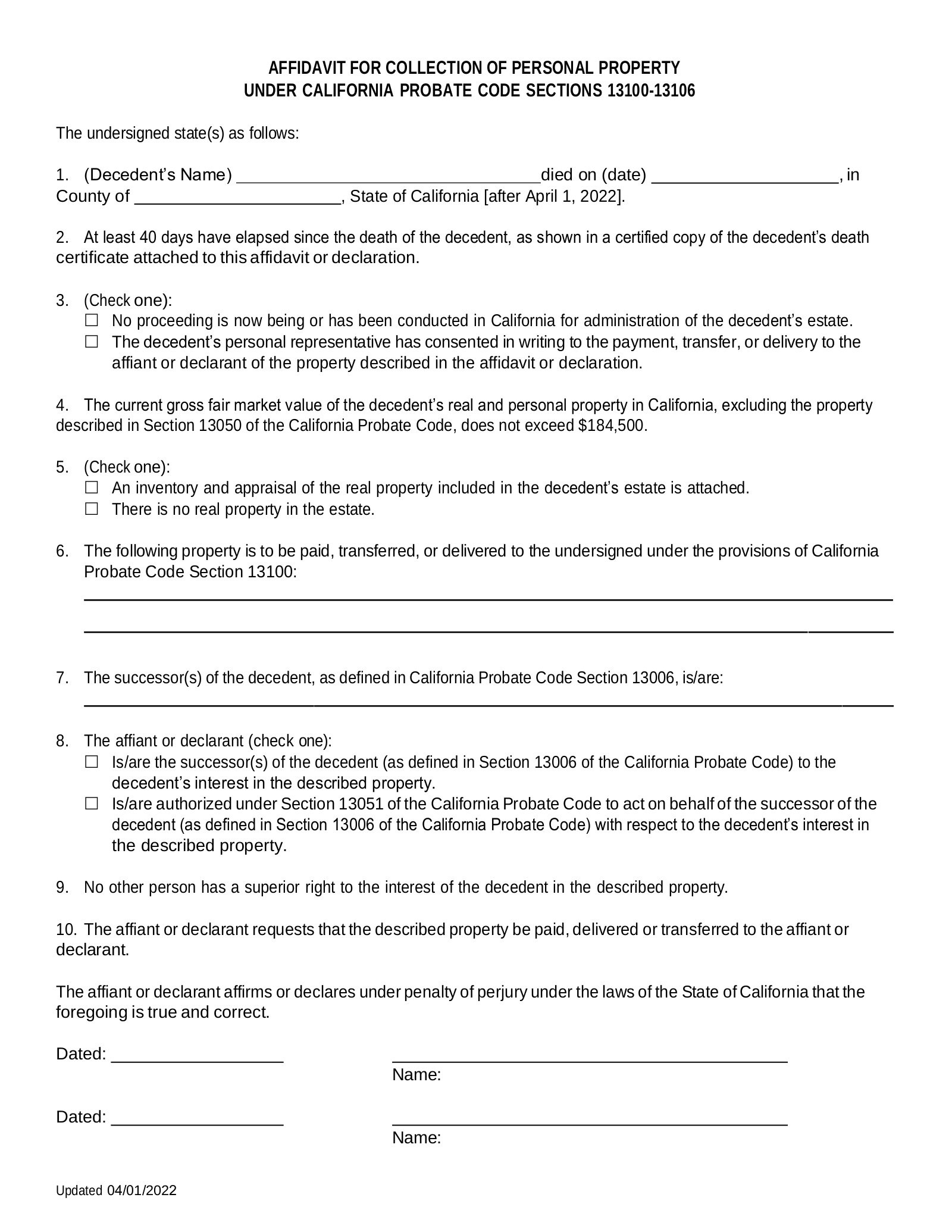

Article 1

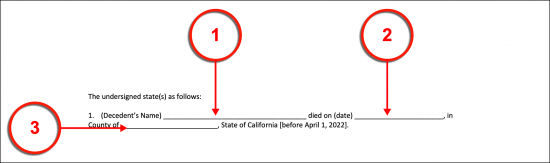

(1) Decedent’s Name. The California Decedent whose property is being discussed should be named. Thus produce the California Deceased’s complete name to the statement provided.

(2) Date Of Death. Transcribe the date when the California Decedent was pronounced dead where this information is requested.

(3) California County. The name of the California County where the Decedent died must be submitted.

Article 3

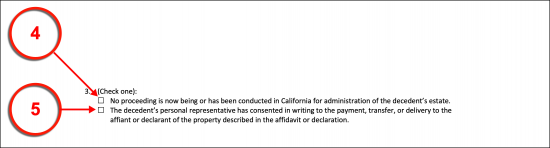

Select Item 4 Or Select Item 5

(4) No Proceedings. This document must report whether any judgments (i.e. a probate determination or judgment) have been issued in the State of California regarding the Decedent’s estate or that no administrative proceedings are currently underway. Fill in or select the first checkbox Article 3 presents to report no proceedings (probate or otherwise) concerning the Decedent’s estate have been completed or are currently active.

(5) Formal Estate Distribution. Select the second checkbox to indicate the Decedent’s Personal Representative has already consented to how the Decedent’s estate and assets will be handled.

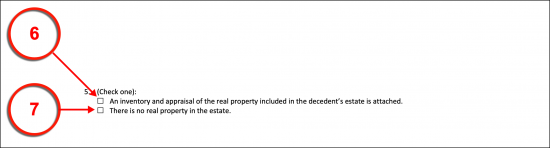

Article 5

Select Item 6 Or Item 7

(6) Real Property Appraisal. If the Decedent owned real property (i.e. a house or farm), then such property must be inventoried and appraised. If so, this information can be reported in an attachment to this form. The first checkbox statement of Article 5 must be selected as an indication that the Decedent owned real property and an attachment to this form discussing this inventory should be reviewed. If this is not the case, then leave this statement unselected.

(7) No Real Property. If more appropriate, choose the second checkbox to indicate the Decedent did not own real property at the time of death.

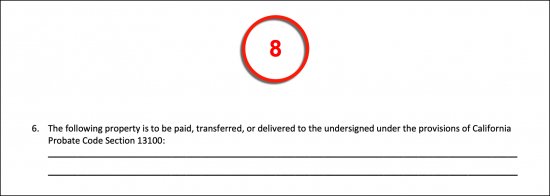

Article 6

(8) Intent Of Property Distribution. A record of any of the Decedent’s property or assets expected to be dispersed outside of probate or a written last will and testament must be documented. Use the space in the sixth article to provide this listing.

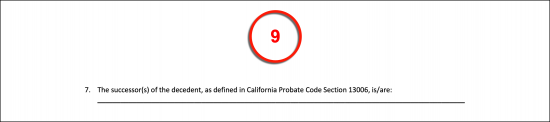

Article 7

(9) California Decedent’s Successor. Define the Successor of the Decedent as per his or her will or (in the absence of a will) the generally accepted Successor to the Decedent’s property (i.e. the Decedent’s Spouse).

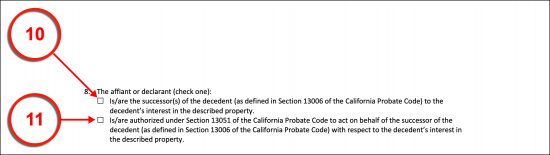

Article 8

Choose Item 10 Or Item 11

(10) Declarant As A Section 13006 Successor. Select the first statement if the Declarant behind this affidavit is the Decedent’s Successor as named by the Decedent’s will or generally accepted as such by surviving the Decedent (i.e. a Spouse).

(11) Declarant As Authorized Successor. If the Declarant is acting on behalf of the Successor, then select the second statement. For instance, if the Declarant of this affidavit is a Court-Appointed Conservator or Guardian of the Successor then select this statement’s checkbox.

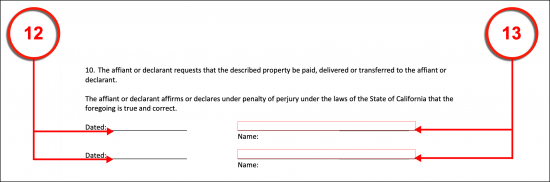

Article 10

(12) Declarant Signature Date. Before signing this document, each Declarant must enter the current calendar date to the signature area.

(13) Declarant Signature. Once the current date is supplied, each Declarant must sign his or her name.

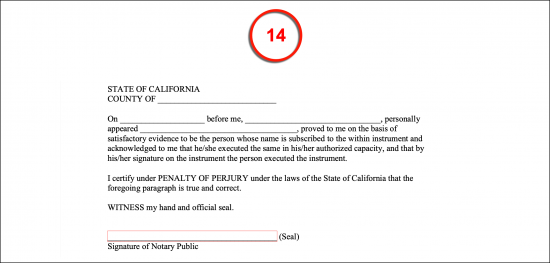

Notary Acknowledgment

(14) Affidavit Notarization. This document’s execution must be notarized to be considered complete. The California Notary Public attending this signing will control this paperwork during the notarization process then return it to the Declarant once the location of the signing, the names of the Signature Parties, and his or her credentials and seal are supplied.