Updated February 15, 2024

An employment verification letter, or proof of income, verifies the income or salary earned by an employed individual. This type of verification is commonly used when someone is seeking housing or applying for credit.

Main Purpose

An employment verification letter is primarily used to confirm an individual has a paying job.

What is Being Verified?

- Name of the employer

- Employee’s title or position

- Start date

- Pay ($)

- Status (part or full-time)

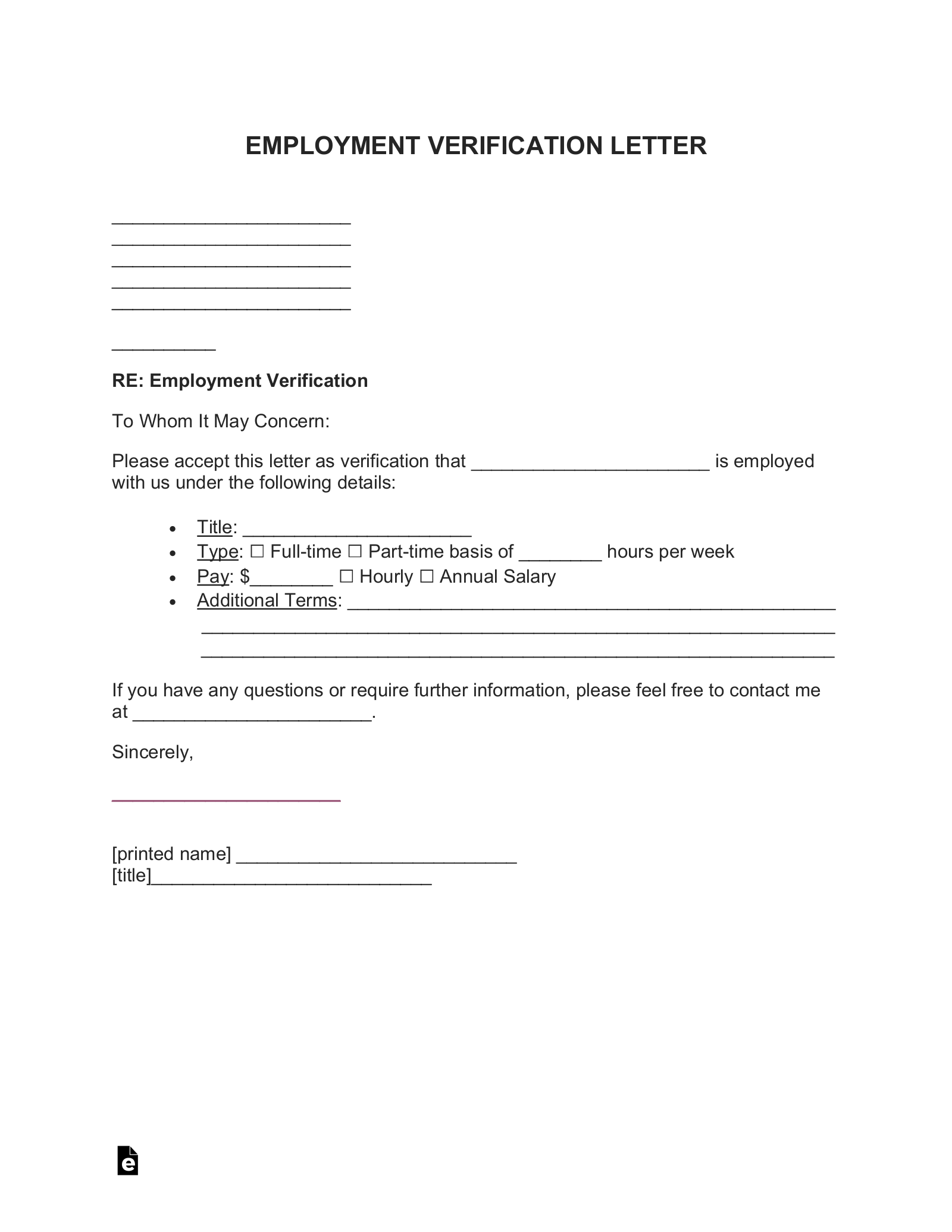

Sample

Download: PDF, MS Word, OpenDocument

EMPLOYMENT VERIFICATION LETTER

[EMPLOYER’S NAME]

[STREET ADDRESS 1]

[STREET ADDRESS 2]

[CITY, STATE]

[ZIP CODE]

[DATE]

RE: Employment Verification

To whom it may concern:

Please accept this letter as confirmation that [EMPLOYEE’S NAME] has and is employed with us under the following details:

- Title: [POSITION]

- Type: ☐ Full-Time ☐ Part-Time basis of [#] hours per week

- Pay: $[AMOUNT] ☐ per Hour ☐ Salary (annual)

- Additional Terms: [DESCRIBE]

If you have any questions or require further information, please don’t hesitate to contact me at [EMPLOYER’S PHONE].

Sincerely,

______________________

Print Name: ______________________

Title: ______________________

How to Verify Employment (5 steps)

- Look Up the Business Entity

- Call the Employer

- Obtain Past Pay Stubs

- Acquire the Past Two Years of Tax Returns

- Run a Credit Report

1. Look Up the Business Entity

Every state has a Secretary of State’s office or equivalent that allows a user to search its database to search the principals of the business entity. Request the individual in question to obtain an employment verification letter from the principal or owner of the business. After you’ve received the letter, you can check online to see if the person that signed the letter matches the company profile with the state.

Every state has a Secretary of State’s office or equivalent that allows a user to search its database to search the principals of the business entity. Request the individual in question to obtain an employment verification letter from the principal or owner of the business. After you’ve received the letter, you can check online to see if the person that signed the letter matches the company profile with the state.

Check Business Entity Status – By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

3. Obtain Past Pay Stubs

When asking for the letter, it may be best to ask for the past two pay stubs from the employer. If this is not available, then it is best to request a bank statement from the previous month from the individual. This will give you not only their income but also show their spending habits and prove that they are capable of being financially responsible.

When asking for the letter, it may be best to ask for the past two pay stubs from the employer. If this is not available, then it is best to request a bank statement from the previous month from the individual. This will give you not only their income but also show their spending habits and prove that they are capable of being financially responsible.

4. Acquire the Past Two Years of Tax Returns

Commonly, individuals are paid with cash if they are self-employed. In these instances, it is best to get, at the very least, the past two years of income taxes. Everyone in the United States is required to pay taxes to the federal government. Therefore, if the individual is making any kind of money, there will be a return on file that they can easily obtain.

Commonly, individuals are paid with cash if they are self-employed. In these instances, it is best to get, at the very least, the past two years of income taxes. Everyone in the United States is required to pay taxes to the federal government. Therefore, if the individual is making any kind of money, there will be a return on file that they can easily obtain.

- For Individuals – Request IRS Form W-2

- *Self-Employed – Request IRS Form 1040

*The requester may also ask for the individual to submit IRS Form 4506-T, which asks the federal government to verify the self-employed individual’s income from the previous year. This takes about one business day and is free.

5. Run a Credit Report

If none of the above solutions seem promising, it is best to obtain a credit report from the individual. This can be easily completed by collecting the person’s information through the Background Check Authorization Form. Once you have all the necessary information, you can perform the search through Equifax, Experian, or Transunion.

If none of the above solutions seem promising, it is best to obtain a credit report from the individual. This can be easily completed by collecting the person’s information through the Background Check Authorization Form. Once you have all the necessary information, you can perform the search through Equifax, Experian, or Transunion.

In order to ensure that the employer actually signed the letter, it is best to call during business hours. If the person that signed is not available, it is best to ask for a call-back or to ask for someone else who may be able to help with the verification.

In order to ensure that the employer actually signed the letter, it is best to call during business hours. If the person that signed is not available, it is best to ask for a call-back or to ask for someone else who may be able to help with the verification.