Updated May 09, 2023

A verification form is a certification to prove or confirm the status of an individual. The process usually requires a third (3rd) party to provide documentation, such as a letter, as evidence. After the form has been completed, the party verifying the information requested should be signed.

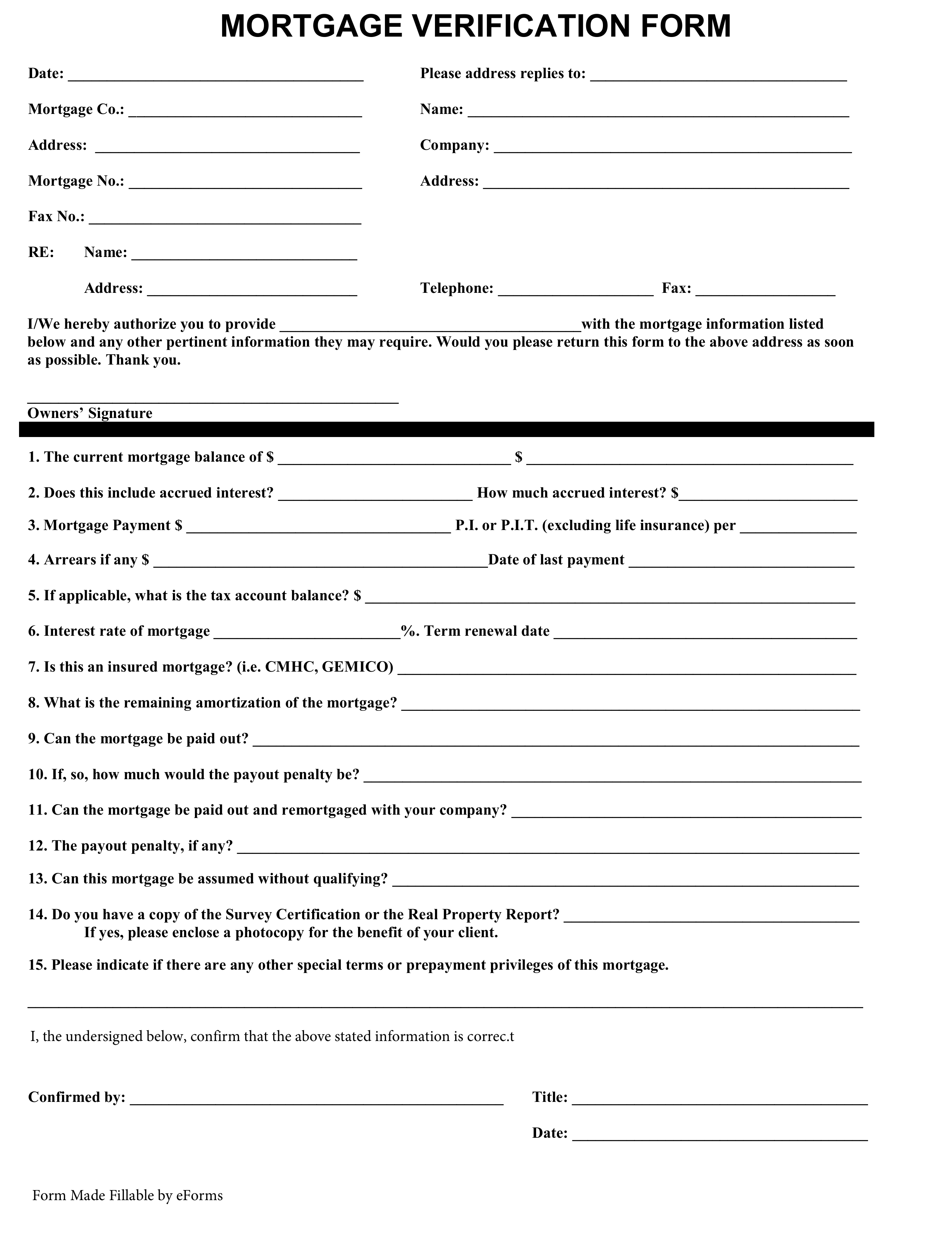

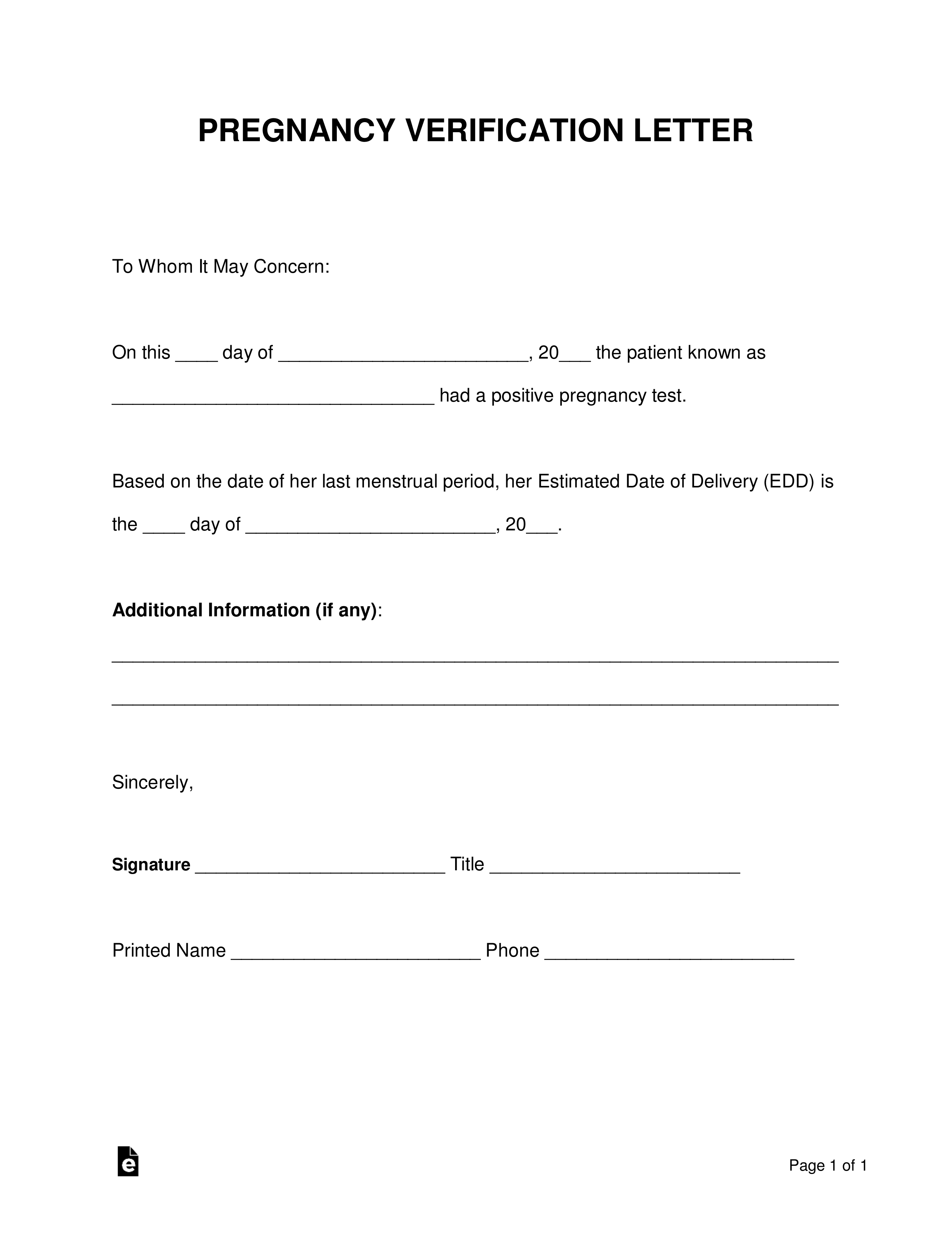

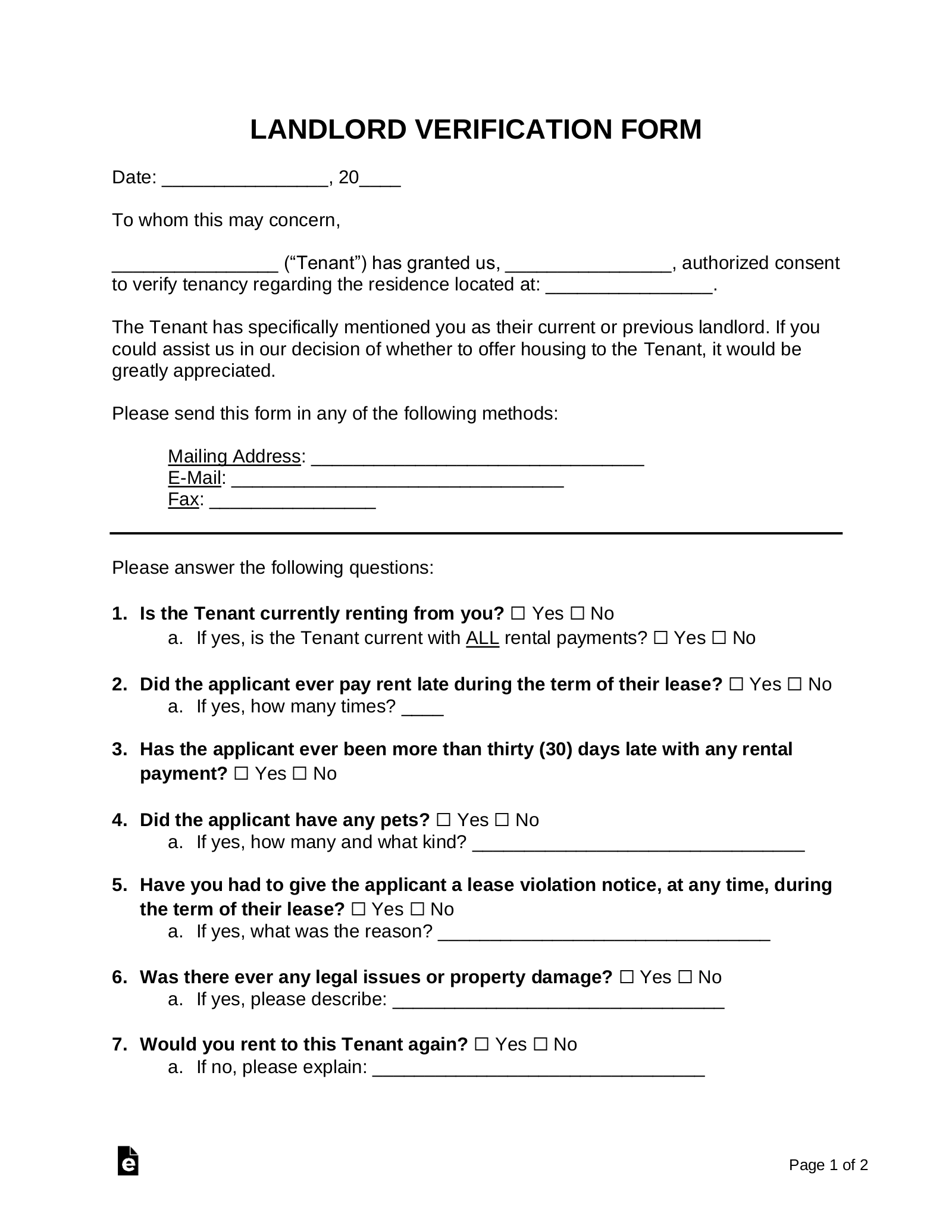

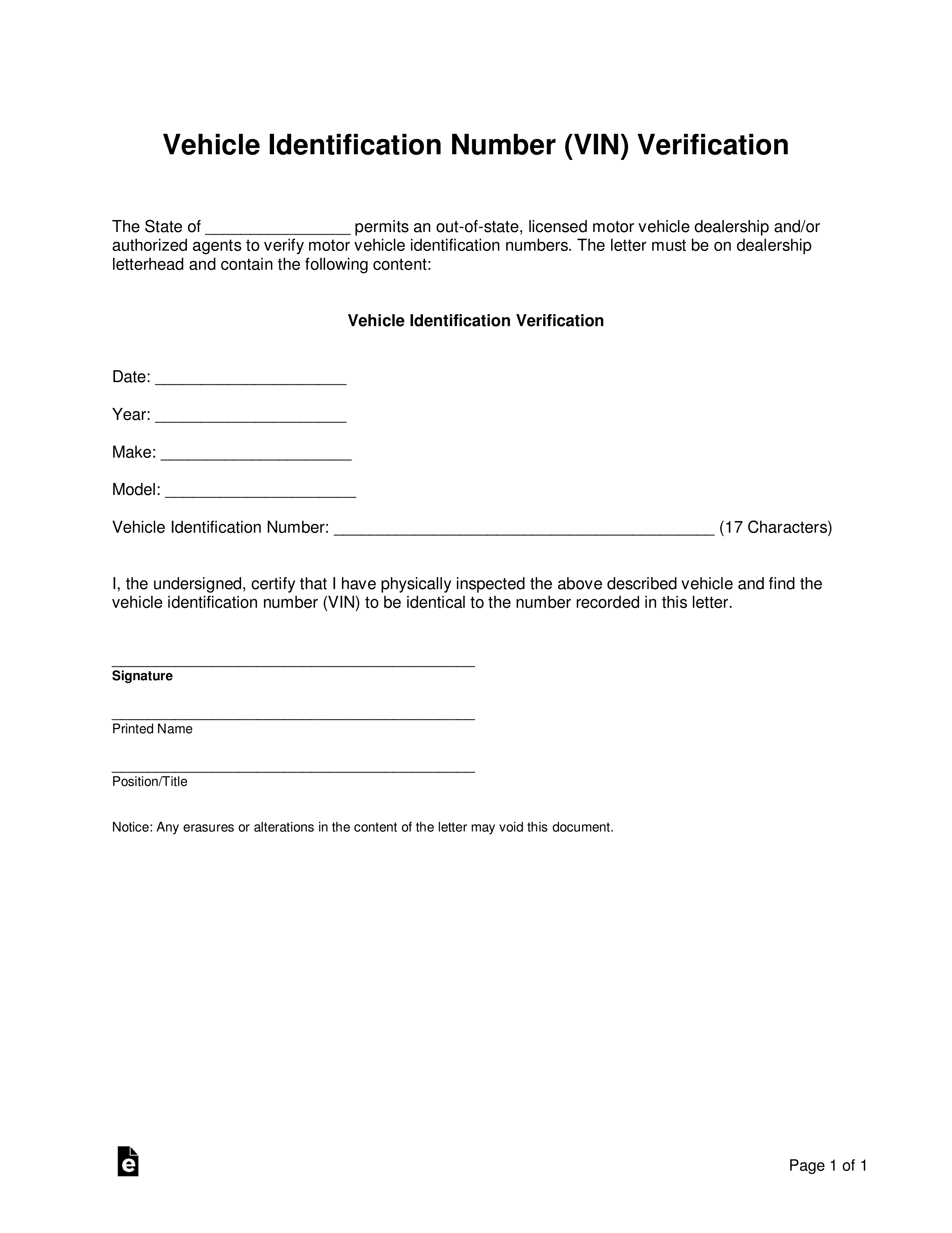

By Type (9)

Why is Verification Important?

Due to the mass amount of attempted fraud and misinformation that can be presented in harmful ways, especially now in the information age of the 21st century, when needing valid information from an individual or company, you must check and most importantly verify.

The more technology advances, the more we see verification playing a bigger role in our daily lives. Take Twitter or Facebook, for example; if we see a blue checkmark next to a person’s Twitter handle or Facebook name, we trust that the account is authentic. Long before social media came along, the business world has been and continues to practice verification in many ways.

The areas we most commonly see verification requested are in:

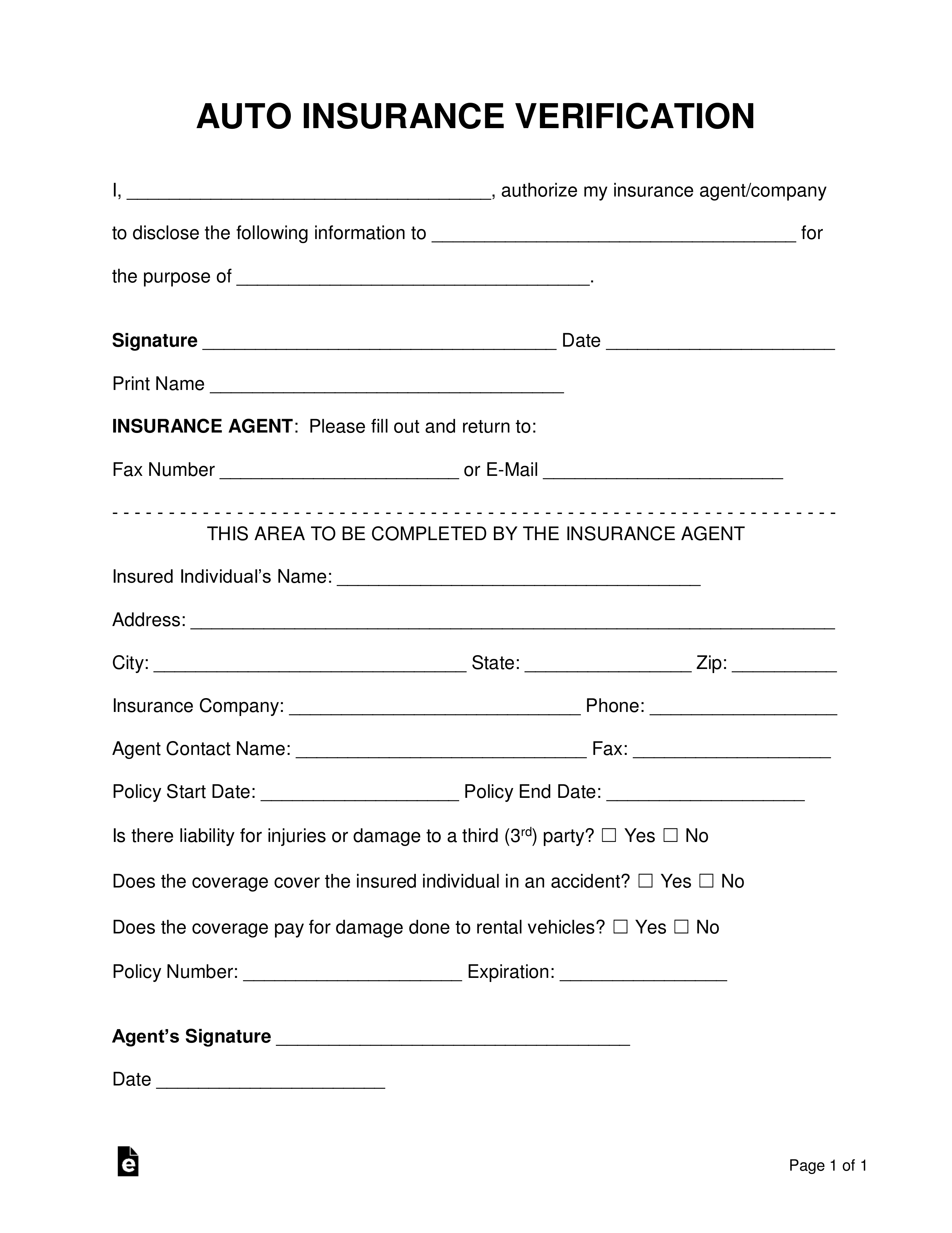

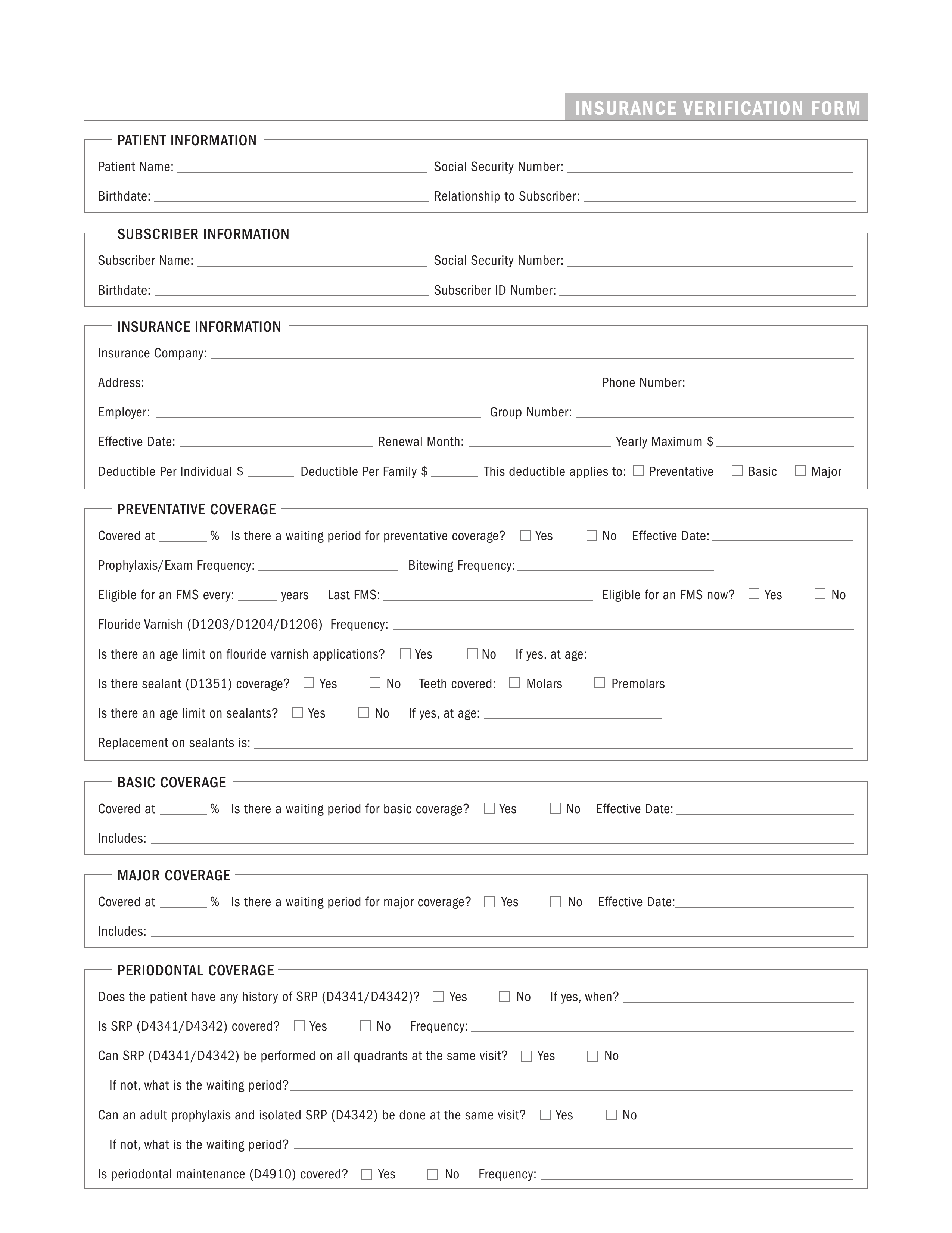

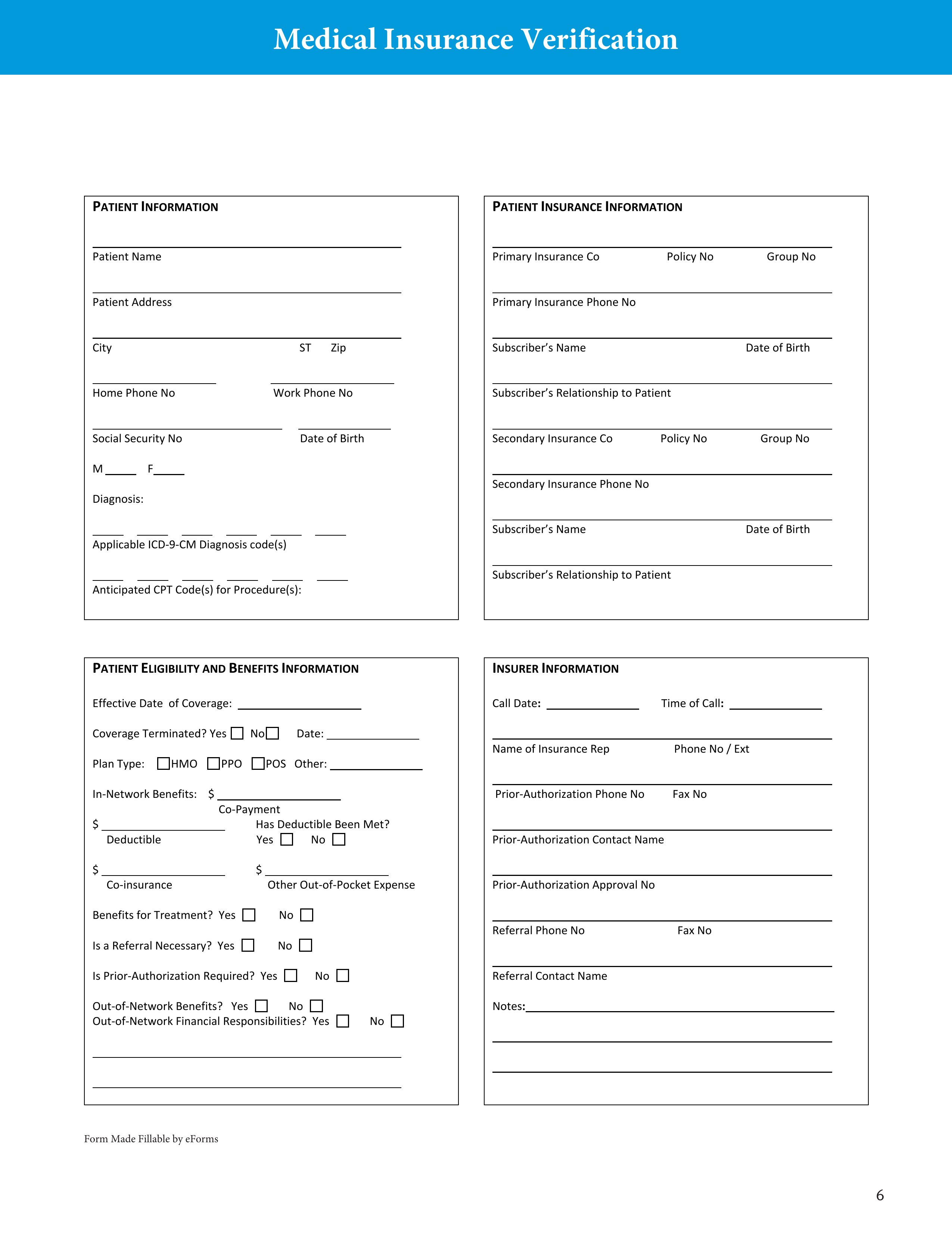

- Insurance

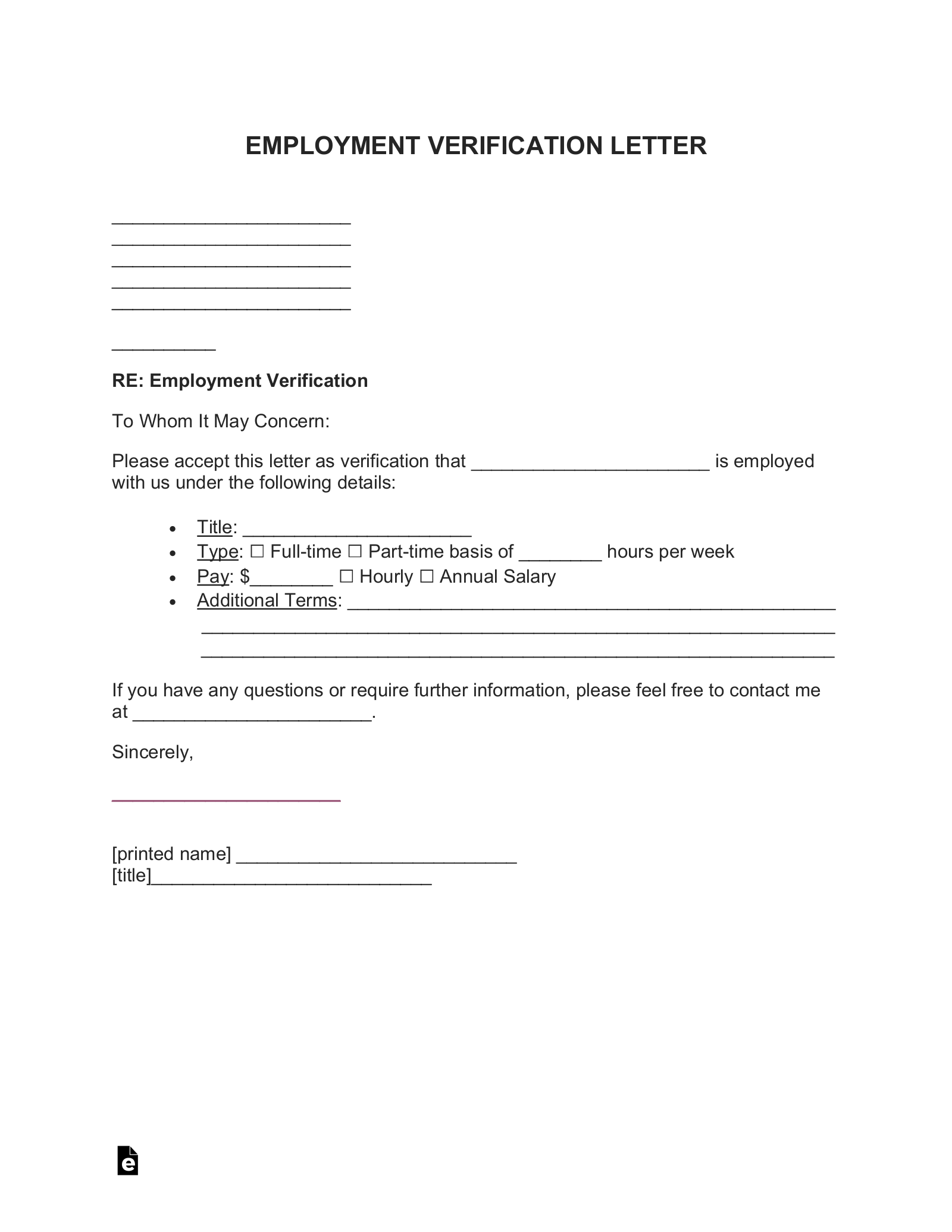

- Employment

- Medical

- Housing

How to Use a Verification

There are many types of businesses that go about verifying information differently. Verifying an individual’s identity is easier than identifying the rental history of a potential tenant. Therefore, the path to obtaining information is dependent on the situation. In most cases, when verification from an individual is requested, there is a form that is used to obtain the proper information called a Verification Form/Letter.

In the following example, a person walks into a bank looking for a loan to buy a house. The individual explains to the banking specialist that they have enough money for a 20% downpayment and a job that pays well.

Step 1 – Identity

The first step above all, no matter what you are verifying, requires proper identification. Needed in this case is a State or Federal ID such as a Driver’s License or Passport, a Social Security Number, and a proof of address such as a utility bill. Make copies of the documents before returning the items to the customer. If this person already has an account affiliated with your bank, you should already have this information.

Step 2 – Supporting Information

You always want to request the easiest information to obtain first and leave the more challenging aspects for the end, when you know you have a qualified customer. The customer implies that they have enough to make a 20% downpayment on a loan. To know whether or not that is true, a request for proper proof such as the customer’s bank statements is needed.

Step 3 – Income Verification

The customer looks qualified to initiate the last step until this point. We want to know everything about their current job history with their employer.

- How much is their salary?

- For how long have they held their job with the company?

We can answer these questions by requesting an employment verification letter from their employer. The longer a person has been working with a company, the better chance for a home mortgage approval. To take it a step further, check with your local state’s Secretary of States Office to verify that the company by which the customer is employed is legitimate.