Updated August 09, 2023

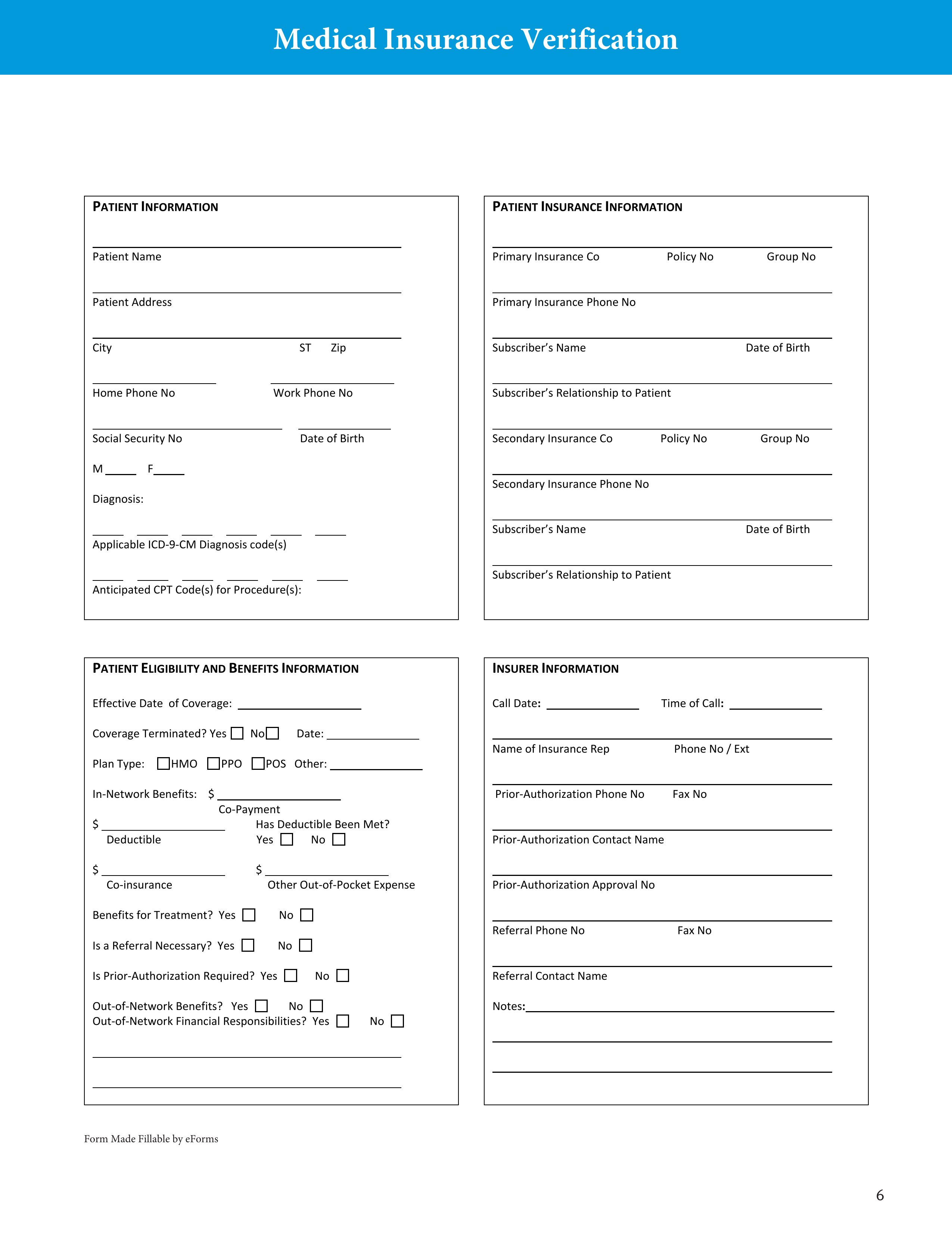

A medical insurance verification form is a document that a medical facility will use when verifying a patient’s medical coverage. An employee of the medical facility will be required to send the form to the patient’s insurance provider so that an agent may fill in the form with the patient’s personal and insurance information. After the form has been completed by an agent and delivered back to the medical office, the medical staff will be able to determine what type of medication or care is covered by the patient’s insurance policy.

How to Write

Step 1 – Start by downloading the form in PDF format.

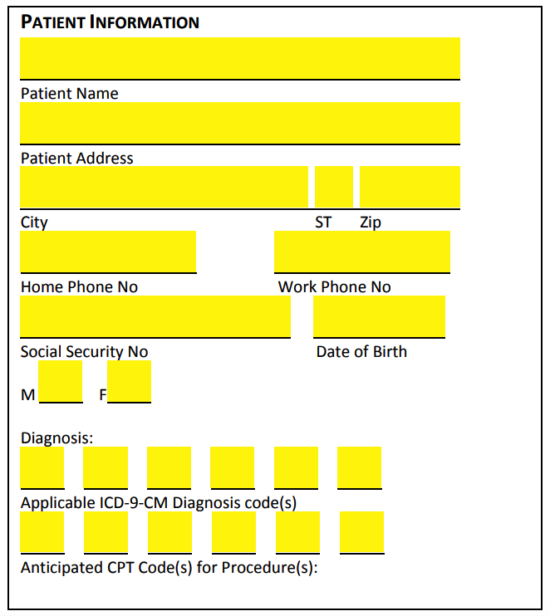

Step 2 – In the “Patient Information” portion of the form, specify the patient’s personal information by entering the following:

- Name

- Address (street)

- City

- State

- Zip

- Home phone #

- Work phone #

- SSN

- Date of birth

- Sex (M/F)

- Applicable ICD-9-CM diagnosis code(s)

- Anticipated CPT code(s) for procedure(s)

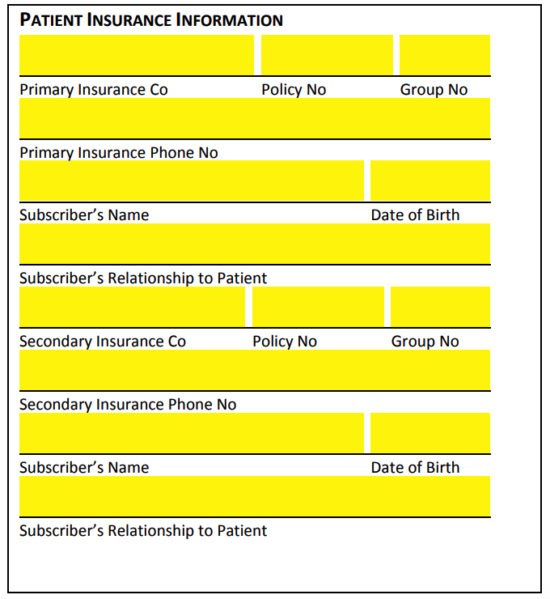

Step 3 – Next, in the “Patient Insurance Information” window, describe the patient’s insurance details by specifying the following

- Primary insurance company name

- Primary insurance company policy #

- Primary insurance company group #

- Primary insurance company phone #

- Subscriber’s name

- Subscriber’s date of birth

- Subscriber’s relationship to patient

- Secondary insurance company name

- Secondary insurance company policy #

- Secondary insurance company group #

- Secondary insurance company phone #

- Subscriber’s name

- Subscriber’s date of birth

- Subscriber’s relationship to patient

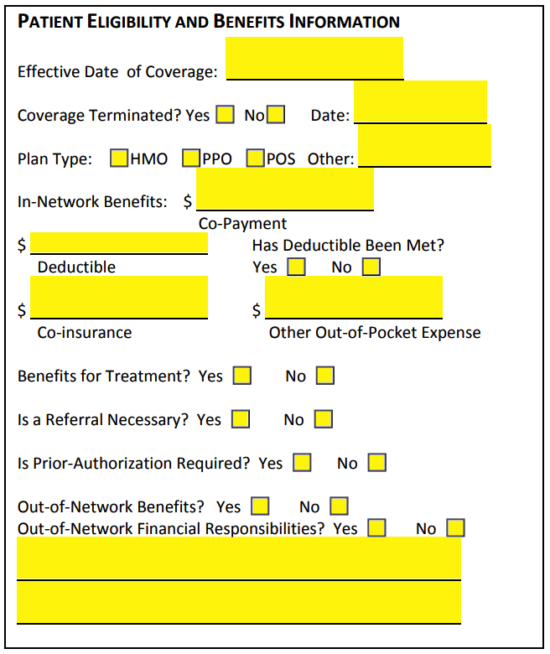

Step 4 – Continue on to “Patient Eligibility and Benefits Information” and specify the following details in the spaces provided:

- Effective date of coverage

- Coverage terminated?

- If yes, what date?

- Plan type (HMO, PPO, POS, other)

- In-network benefits (co-payment amount)

- Deductible amount

- Has deductible been met?

- Co-insurance amount

- Other out-of-pocket expense

- Benefits for treatment?

- Is a referral necessary?

- Is prior-authorization necessary?

- Out-of-network benefits?

- Out-of-network financial responsibilities?

- Additional information

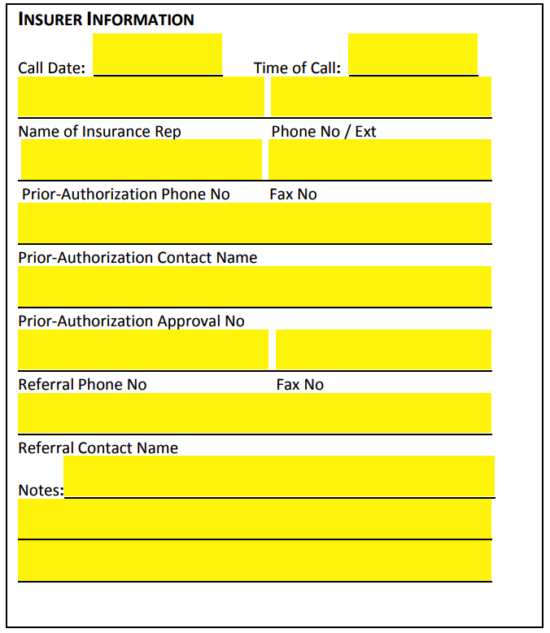

Step 5 – Lastly, in “Insurer Information,” describe the insurer’s details by supplying the following:

- Call date

- Time of call

- Name of insurance representative

- Phone # of insurer

- Prior-authorization phone #

- Prior-authorization fax #

- Prior-authorization contact name

- Prior-authorization approval #

- Referral phone #

- Referral fax #

- Referral contact name

- Additional notes