Updated August 09, 2023

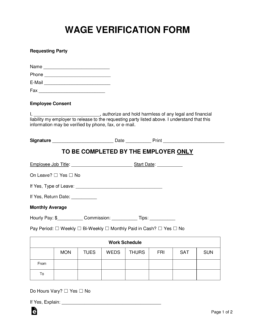

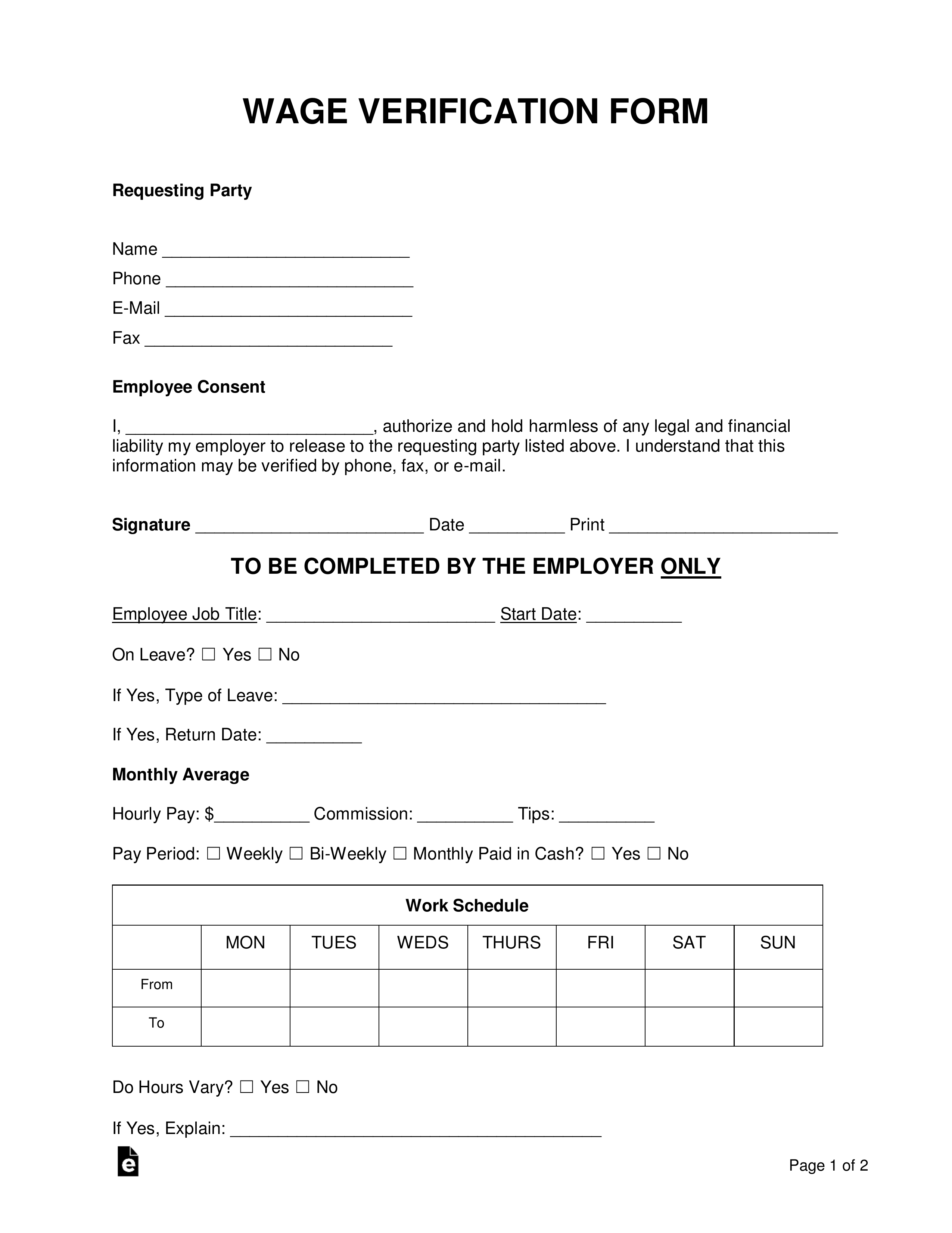

A wage verification form may be used by any private or public organization seeking the confirmation of income by an individual. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/HR) or salary, and any bonuses or tips earned. Once complete, the employer should return the form to the requestor only (not the employee).

Video

How to Write

Step 1 – Download the wage verification form in either PDF, Microsoft Word, or Open Document Text format.

Step 2 – The requesting party must begin filling in the form by entering their name, phone number, email address, and fax number.

Step 3 – In this section of the form, the employee must provide consent to the verification form by entering their name in the first field. Below that, the employee must provide their signature, date the signing, and print their name.

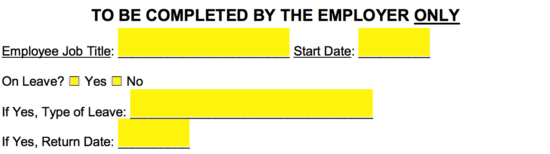

Step 4 – Here, the employer must specify the employee’s job title and start date. He/she must then specify whether or not the employee is on leave. If on leave, indicate the type of leave and the return date.

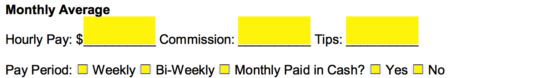

Step 5 – The employer must fill in this section of the form by entering the employee’s average monthly earnings (hourly pay, commission, tips). Following that, the employer must specify the payment frequency and select “Yes” or “No” as to whether the employee is paid in cash.

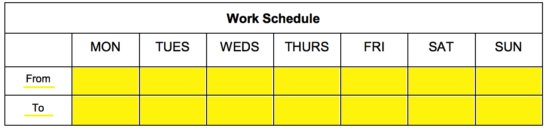

Step 6 – Regarding the employee’s work schedule, the employer must detail the employee’s working hours by entering the start time (From) and finish time (To) for each day of the week the employee works.

Step 7 – Next, the employer must specify whether or not the employee’s hours vary. If the hours vary, the employer must explain the variance.

Step 8 – The employer must continue by entering their name or company name followed by the business address (street, city, State), phone number, and email address.

Step 9 – To complete the form, the employer must provide their signature and business title before dating the document and printing their name.