Updated December 15, 2023

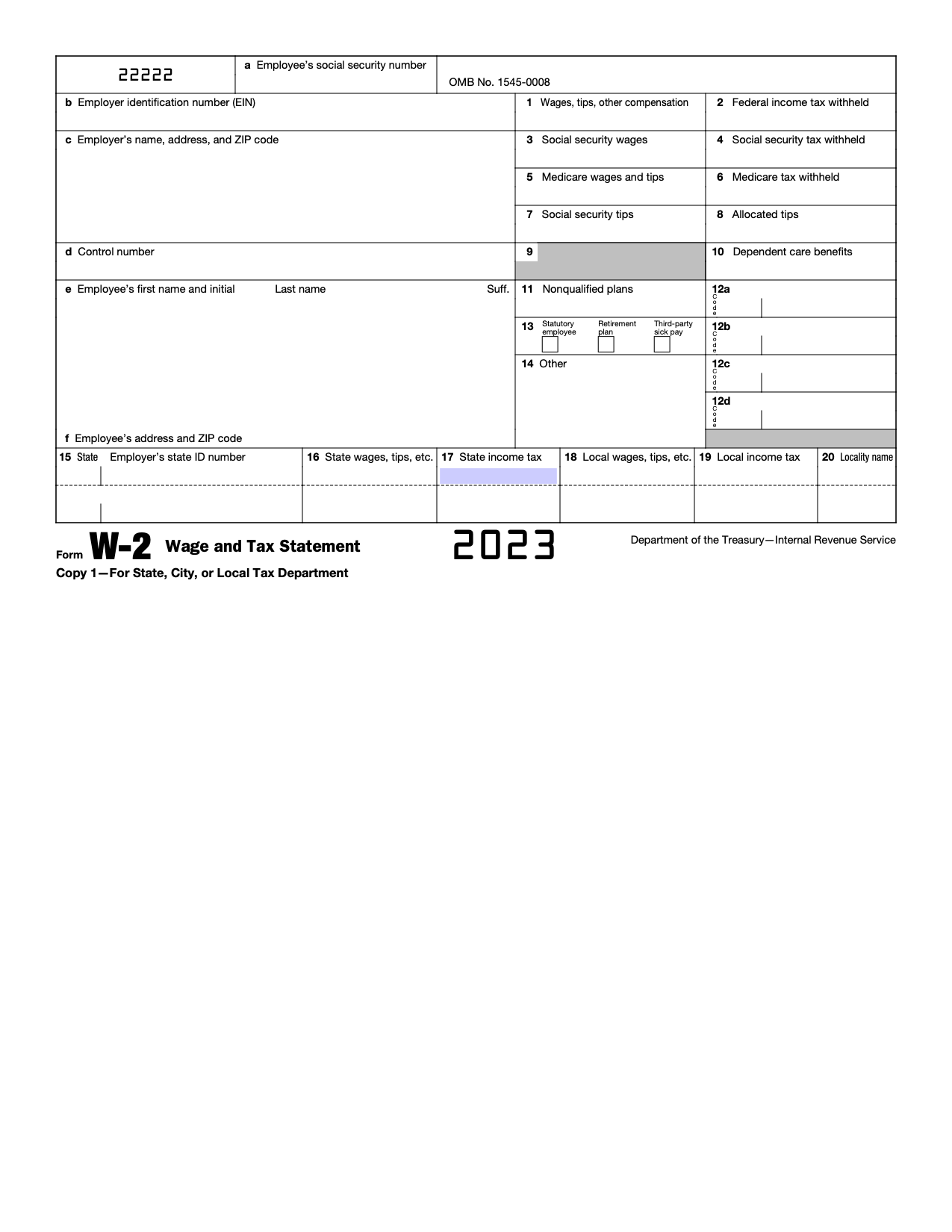

A W-2 form, also known as a Wage and Tax Statement, is an IRS document used by an employer to report an employee’s annual wages in a calendar year and the amount of taxes withheld from their paycheck. Forms are submitted to the SSA (Social Security Administration) and the information is shared with the IRS. Employees use the information in the W2 to file their annual tax returns.

Table of Contents |

Previous Versions

Used for payments made to the employees in 2022.

Download: PDF

Important Facts and Deadlines

W-2s are information returns filled out by an employer and submitted to the Social Security Administration and employees. They provide an official record of an employee’s wages and federal, state, and local taxes paid throughout the calendar year.[1] Employers can submit a W-2 online through the SSA or by mail. Employers may file by mail only if they have less than ten filings.[2]

- SSA deadline: January 31

- Employee submission deadline: January 31

Employers may request one 30-day extension to file with the SSA by using Form 8809.

Form Parts (28)

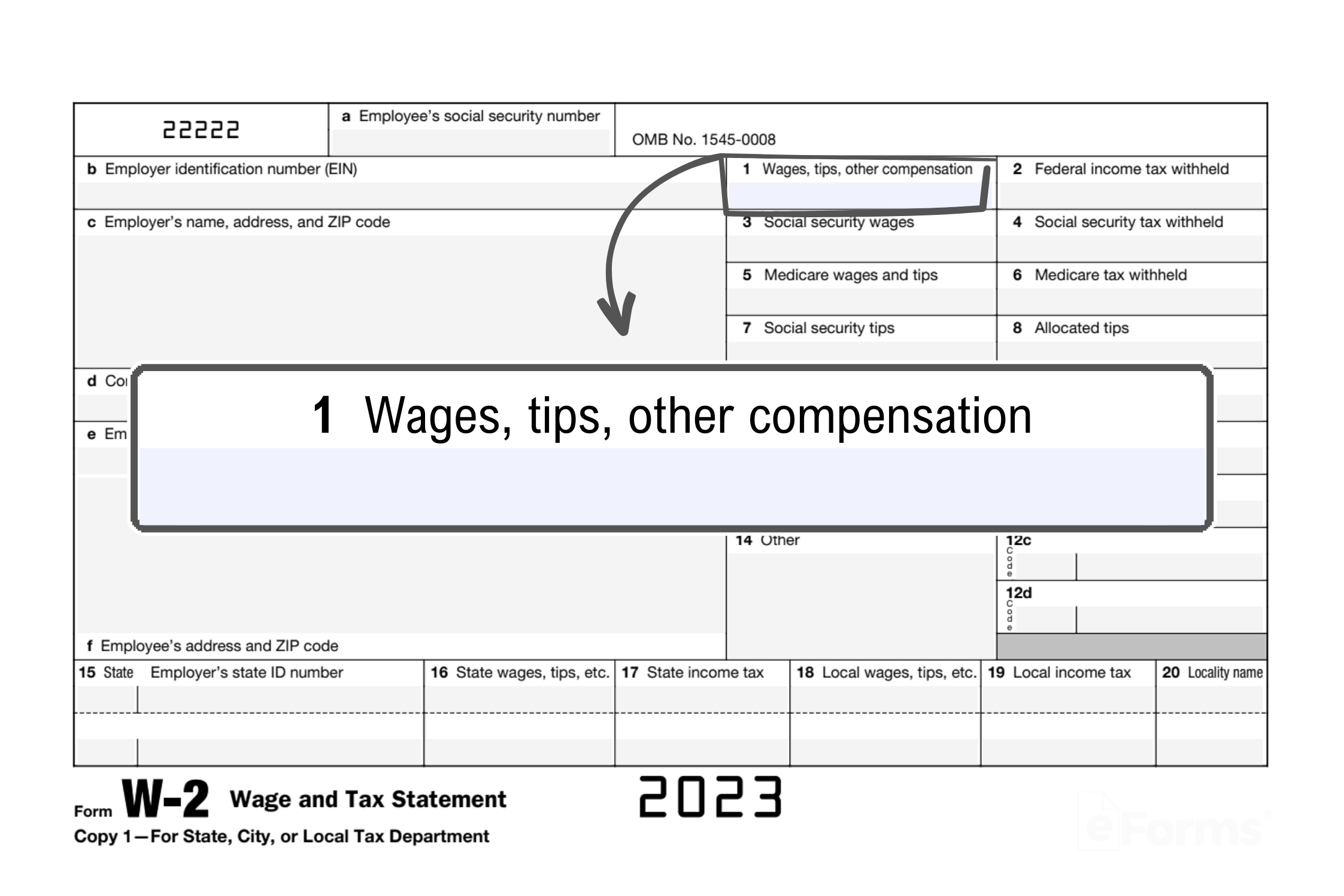

Box 1. Wages, Tips, and Other Compensation

The total wages and other types of compensation over the calendar year are totaled and recorded. Compensation can include:

- Salary and regular wages

- Bonuses

- Commissions

- Overtime

- Tips (including cash tips)[3]

- Non-cash payments

- Certain scholarship and fellowship grants

Elective deferrals (employee contributions to retirement accounts) should NOT be included. Moreover, the employer’s matching contributions for retirement plans are not included in any wages on the W-2.[4]

For an inclusive compensation list, visit IRS Box 1 compensation requirements.

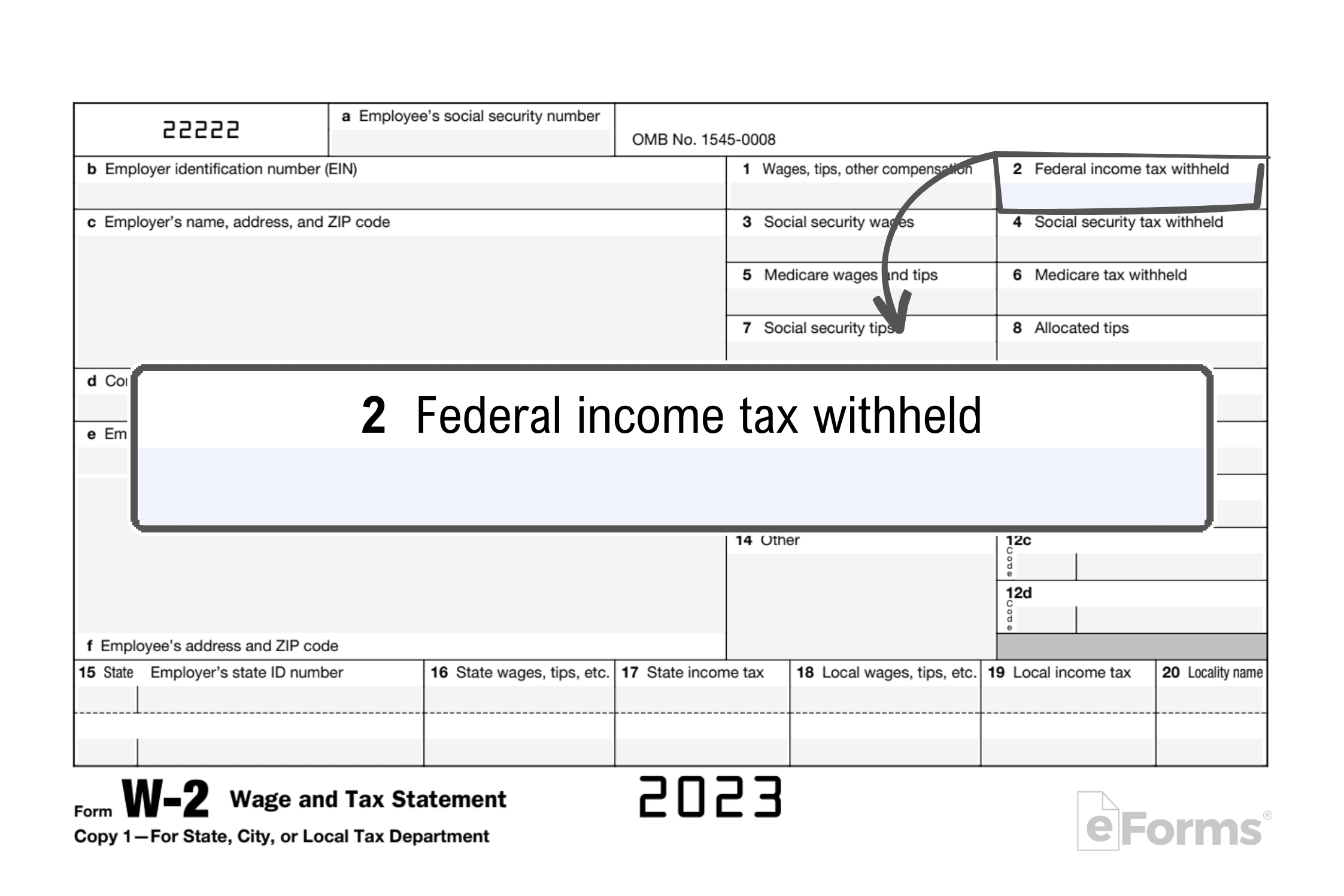

Box 2. Federal Income Tax Withheld

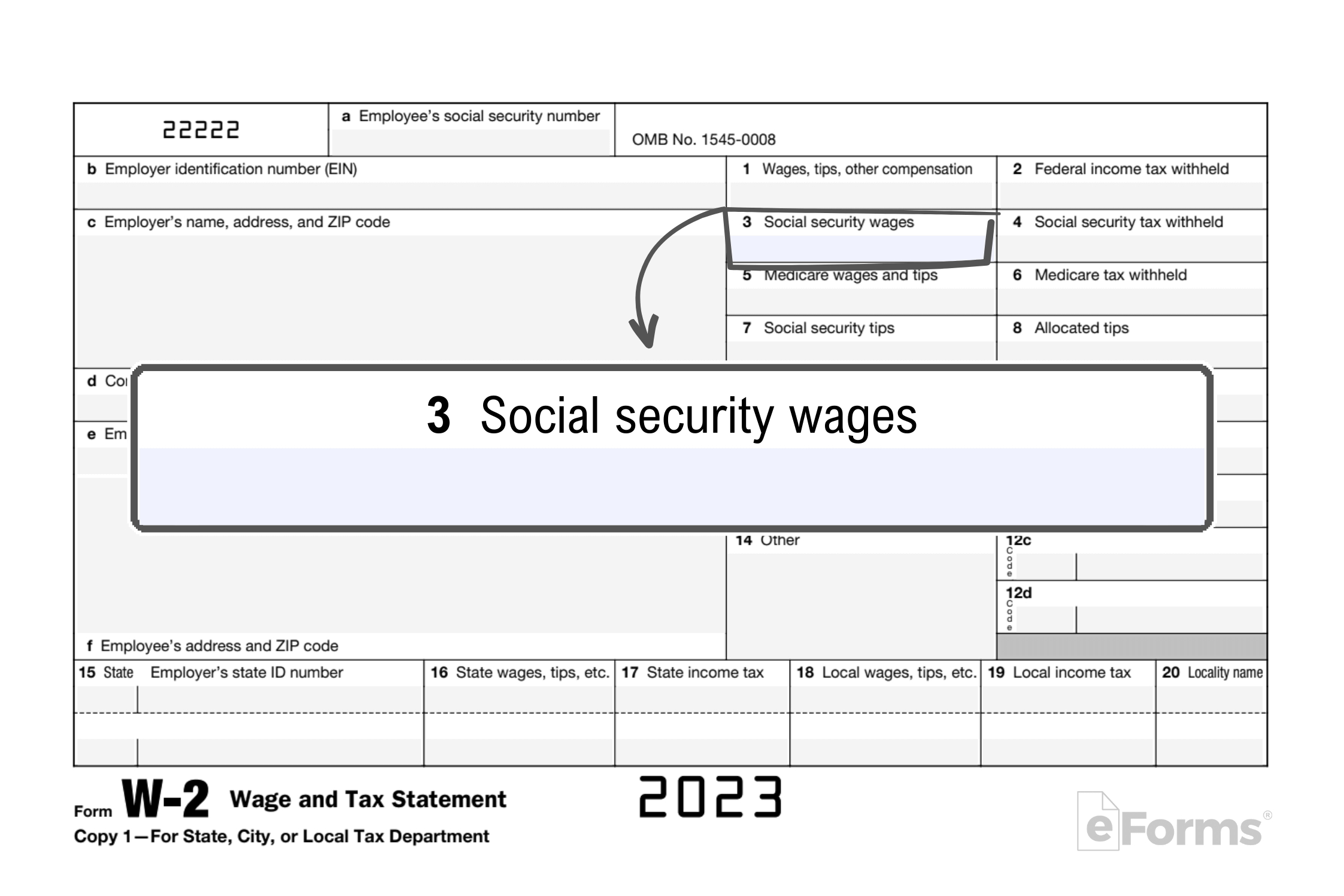

Box 3: Social Security Wages

The total wages subject to Social Security tax, including regular salary and wages, bonuses, commissions, overtime pay, and some other types of compensation is given. Tips should NOT be included in this box. Pay that is generally excluded from this section is:

- health insurance premiums

- expense reimbursements

- tips

Pre-tax retirement contributions are often included in Social Security wages.

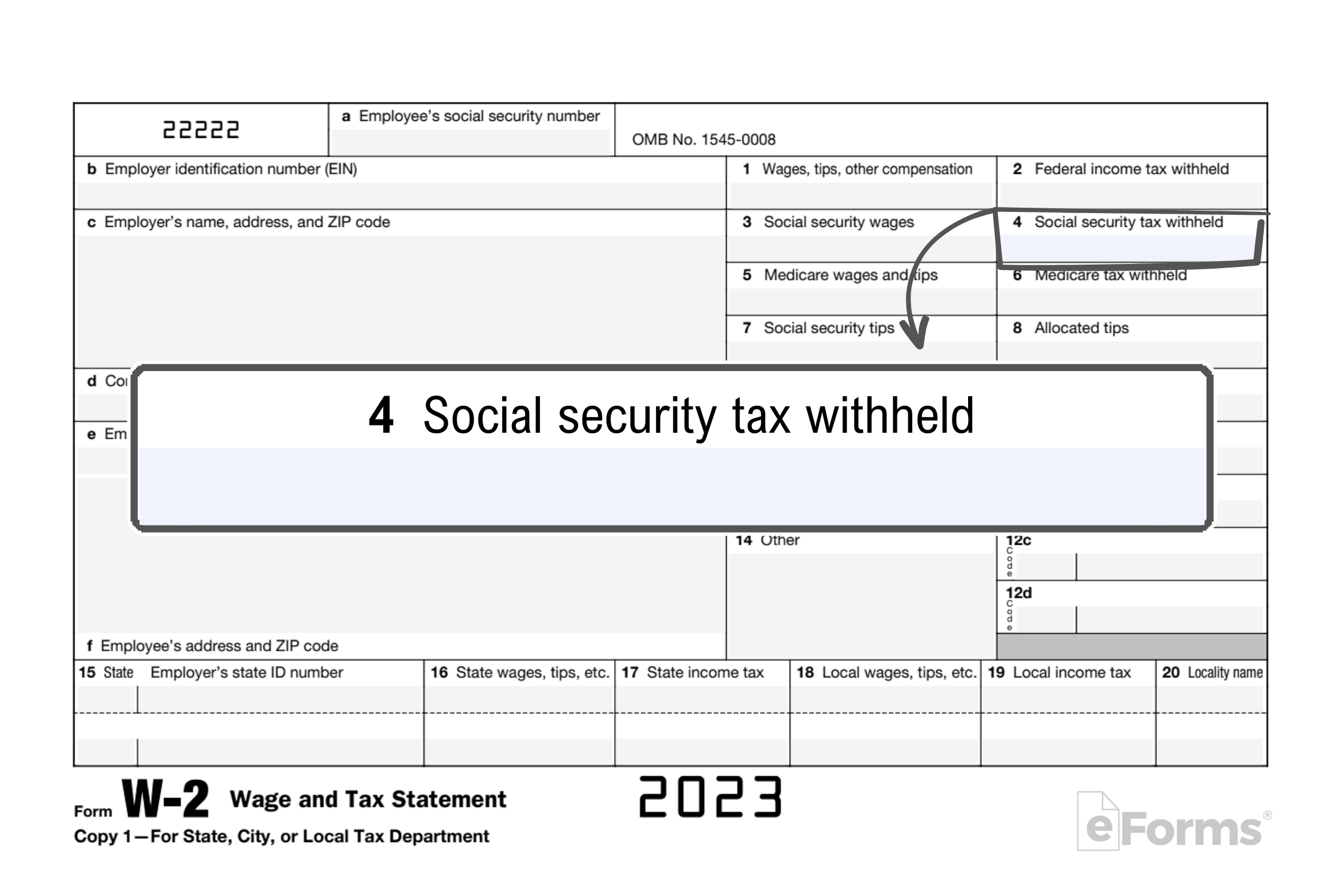

Box 4: Social Security Tax Withheld

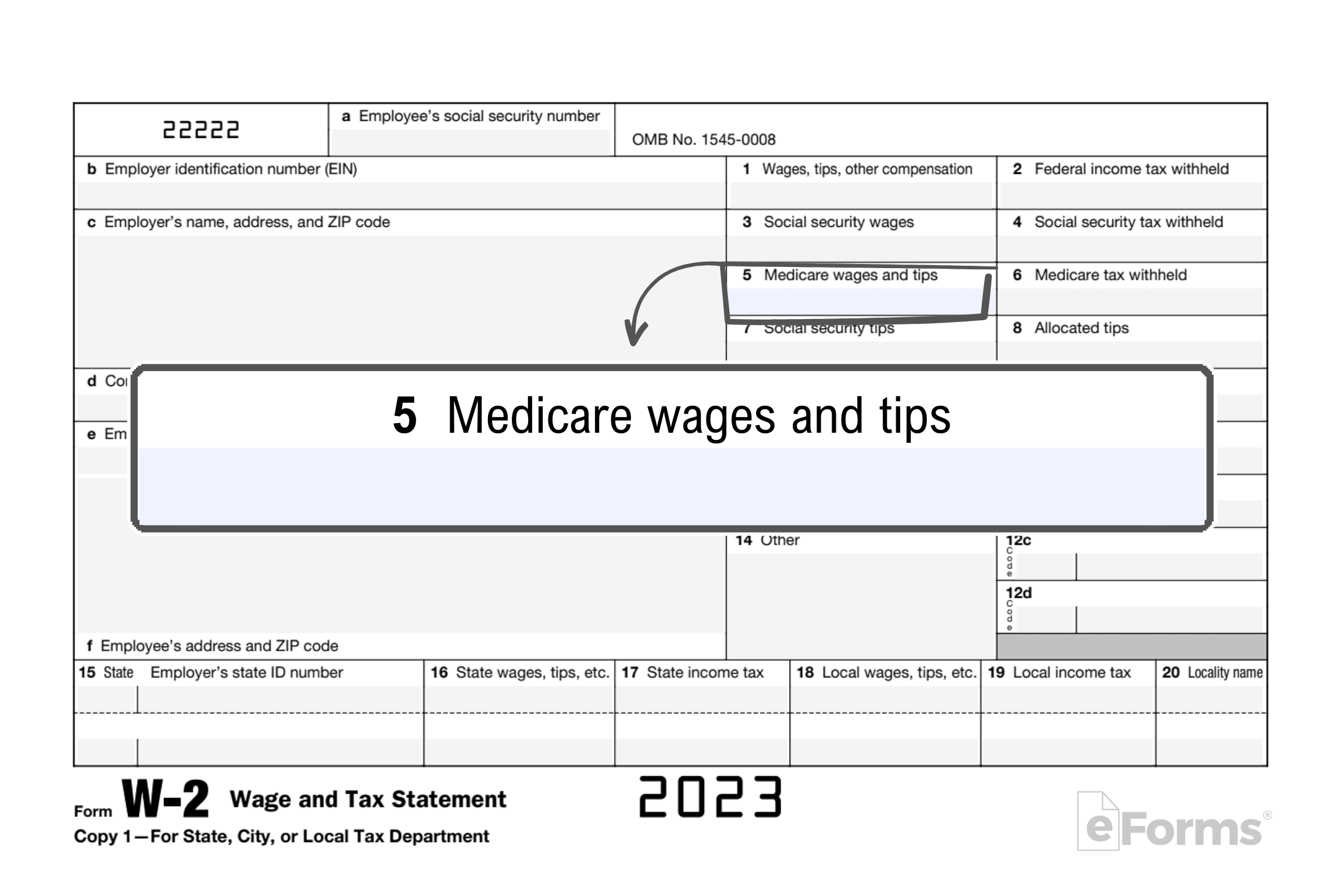

Box 5: Medicare Wages and Tips

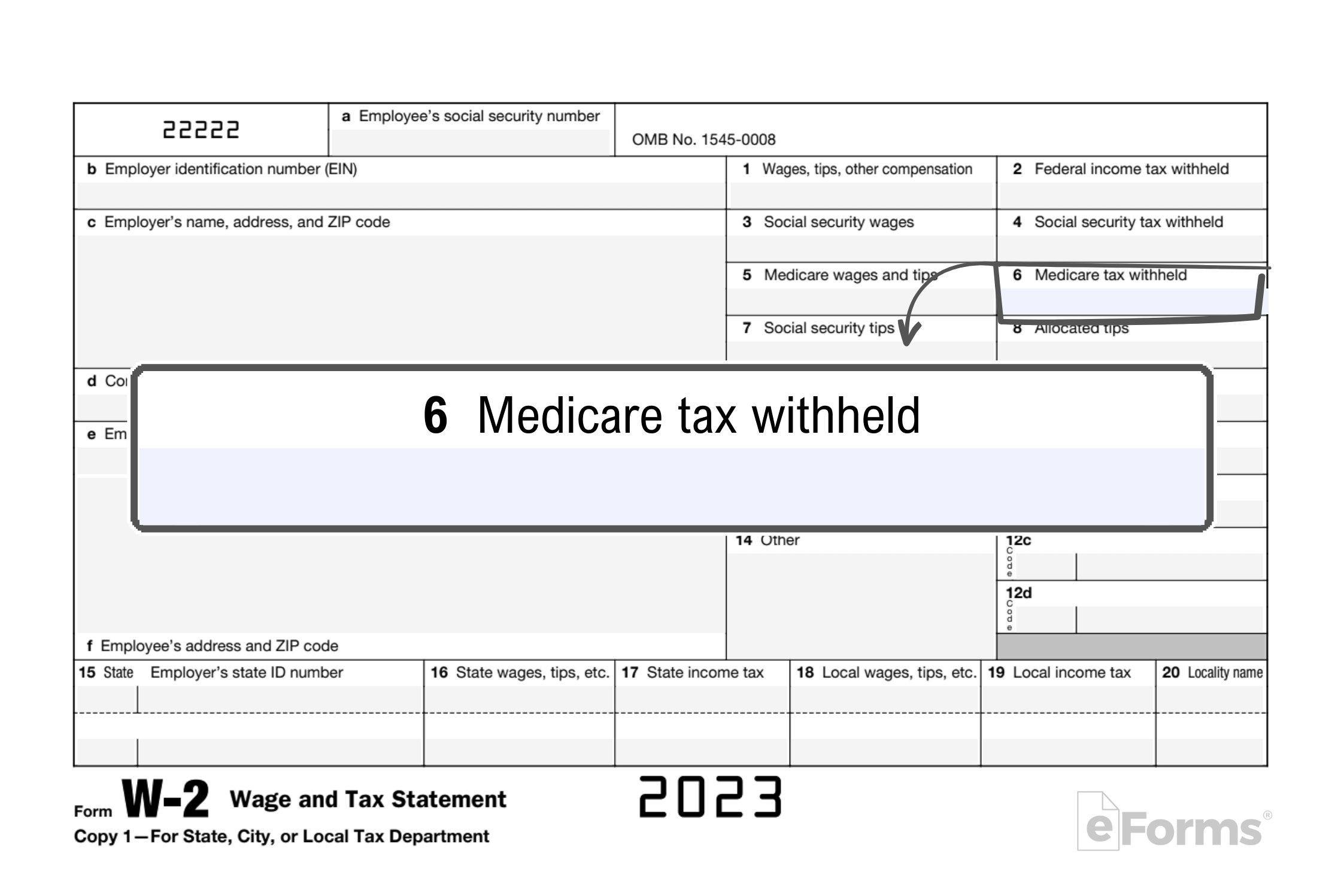

Box 6: Medicare Tax Withheld

The total amount of Medicare tax withheld from the employee’s pay during the calendar year. The Medicare tax rate in 2023 is 1.45% for the employee and 1.45% for the employer.

Over $200K: For wages in excess of $200,000, employers are responsible for withholding an additional 0.9% of Medicare taxes.

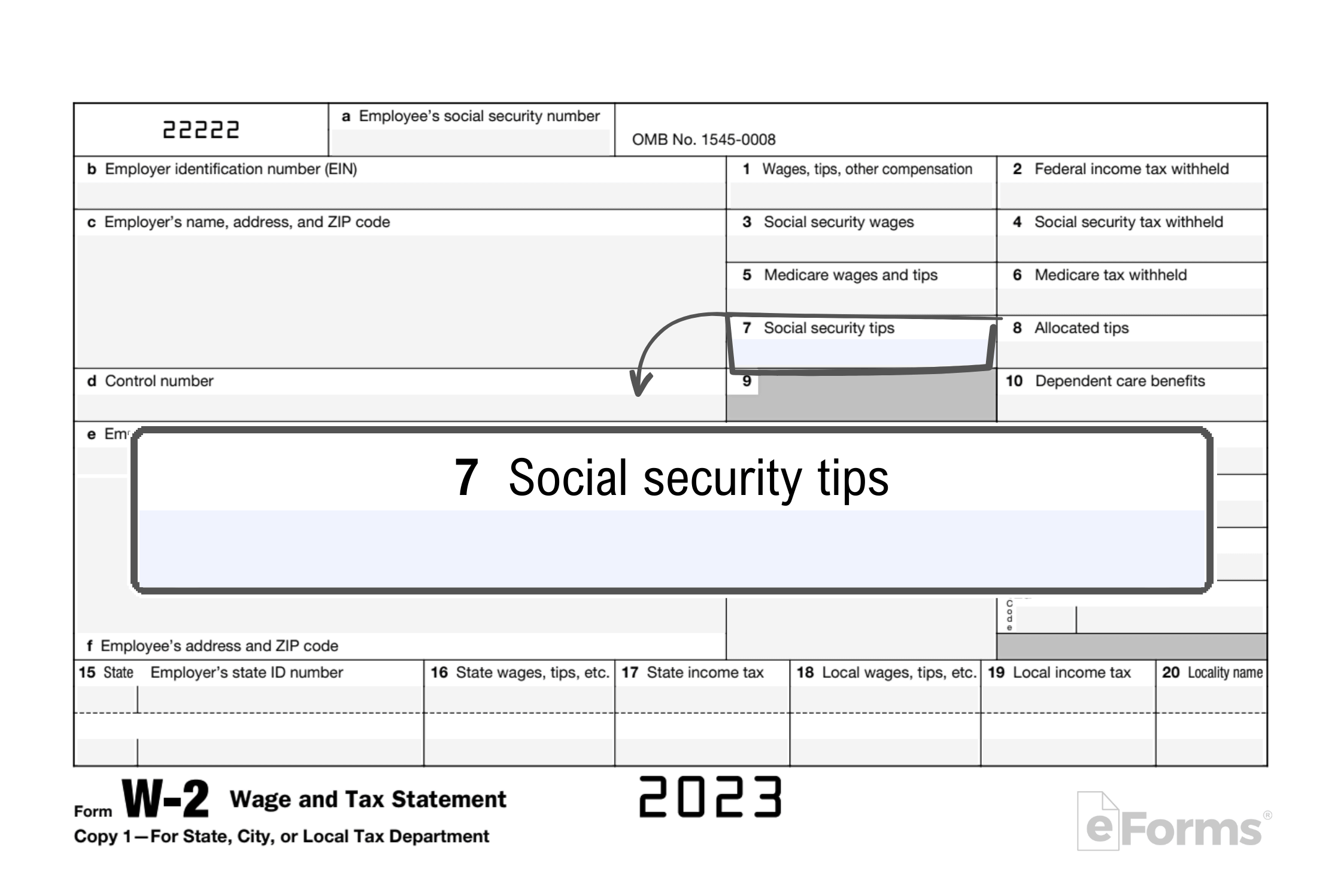

Box 7: Social Security Tips

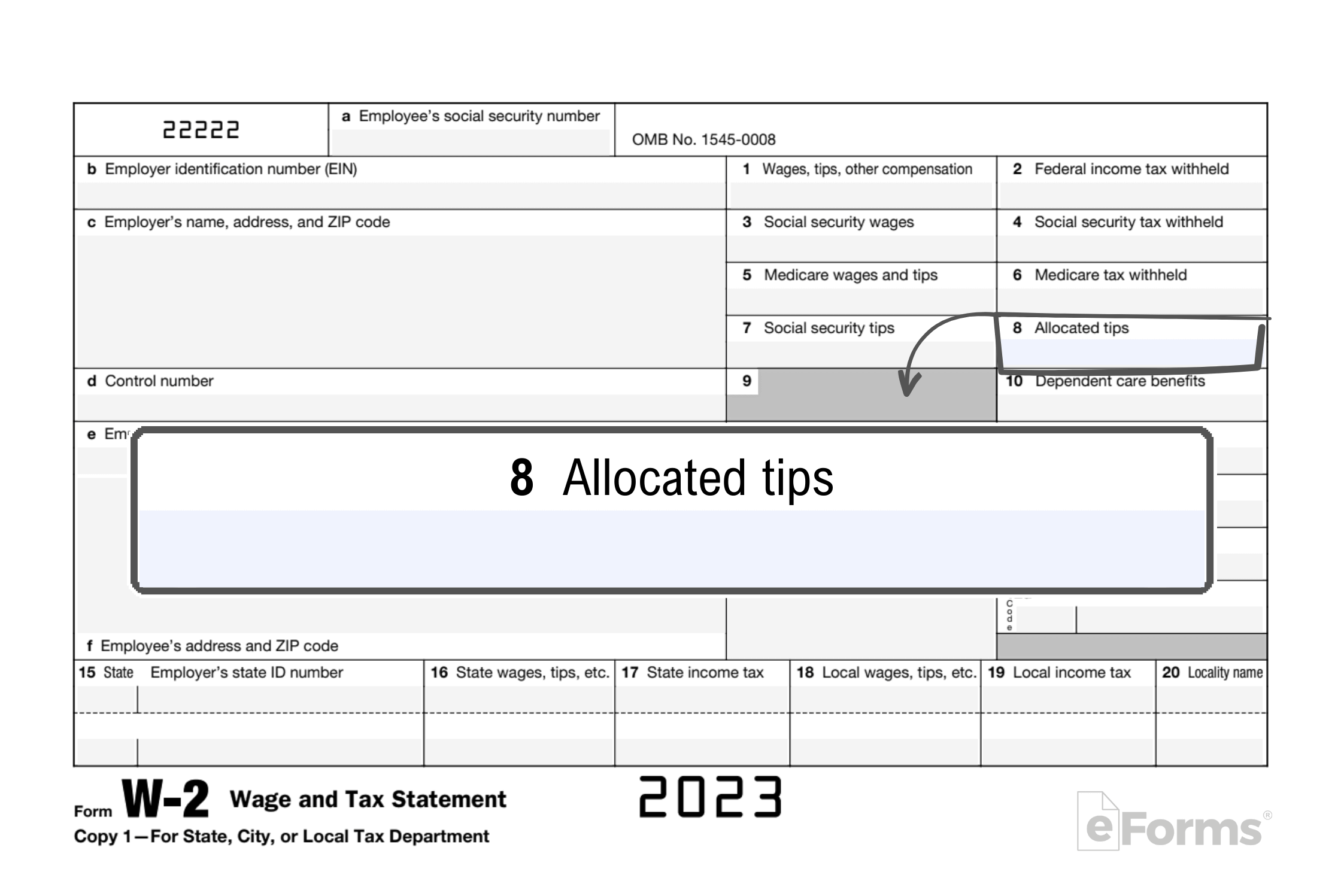

Box 8: Allocated Tips

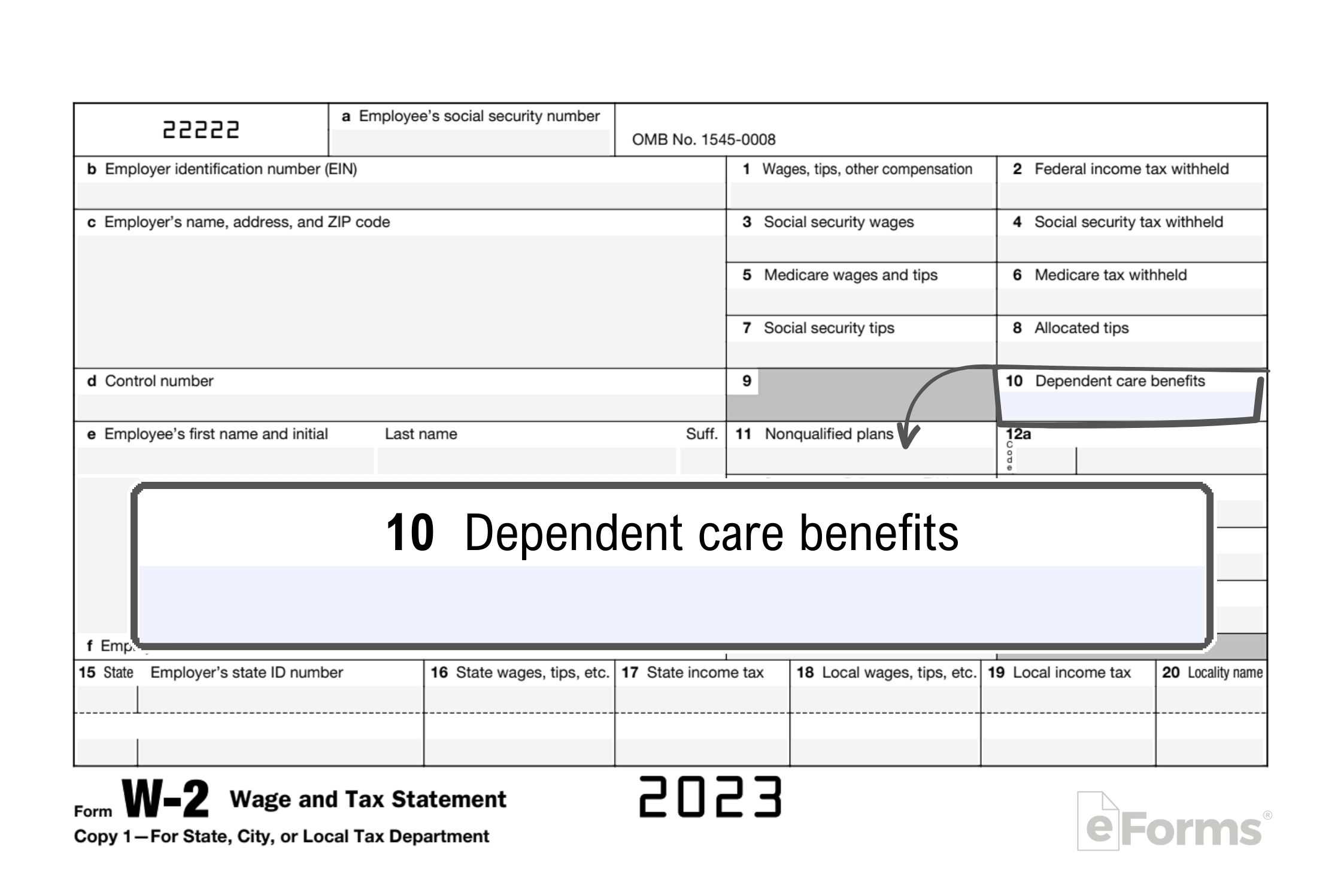

Box 10: Dependent Care Benefits

In Box 10, the employer reports the total amount of dependent care benefits that were provided to the employee during the tax year. This could include payments made by employers directly to providers or reimbursements for eligible expenses involving:

- Childcare

- Elderly care

- Disabled dependent care

- Specialized care services

- Other types of dependent care

The amount reported in this box is generally not included in the employee’s annual taxable income.

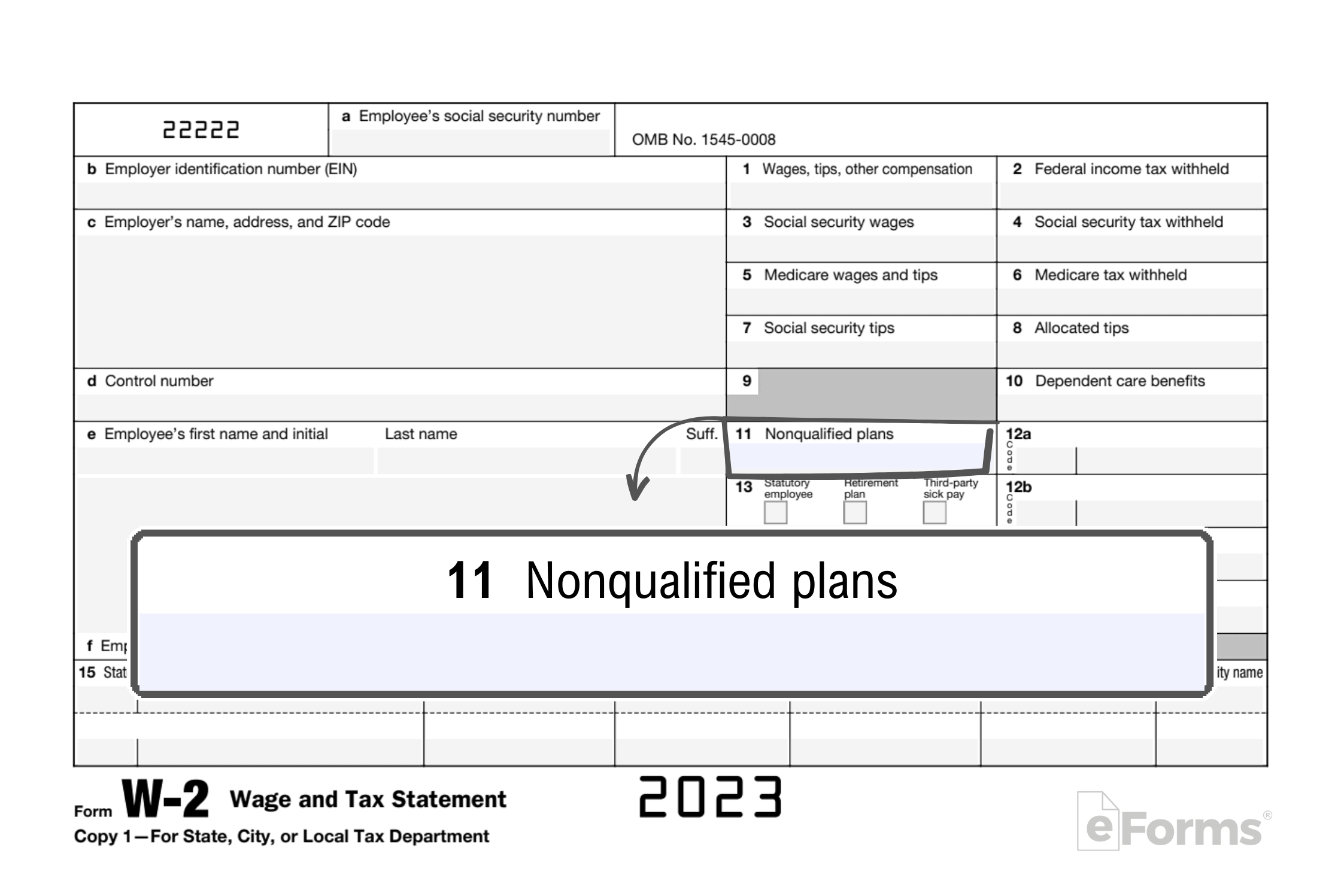

Box 11: Nonqualified Plans

The employer reports the total amount of distributions related to nonqualified (taxable) deferred compensation plans. NQDCs include but are not limited to:

- 403(b)

- 457

- IRAs (Traditional, SEPs, SIMPLEs)

- Deferred compensation plans

- Incentive stock options (ISOs)

- Nonqualified stock options (NQSOs)

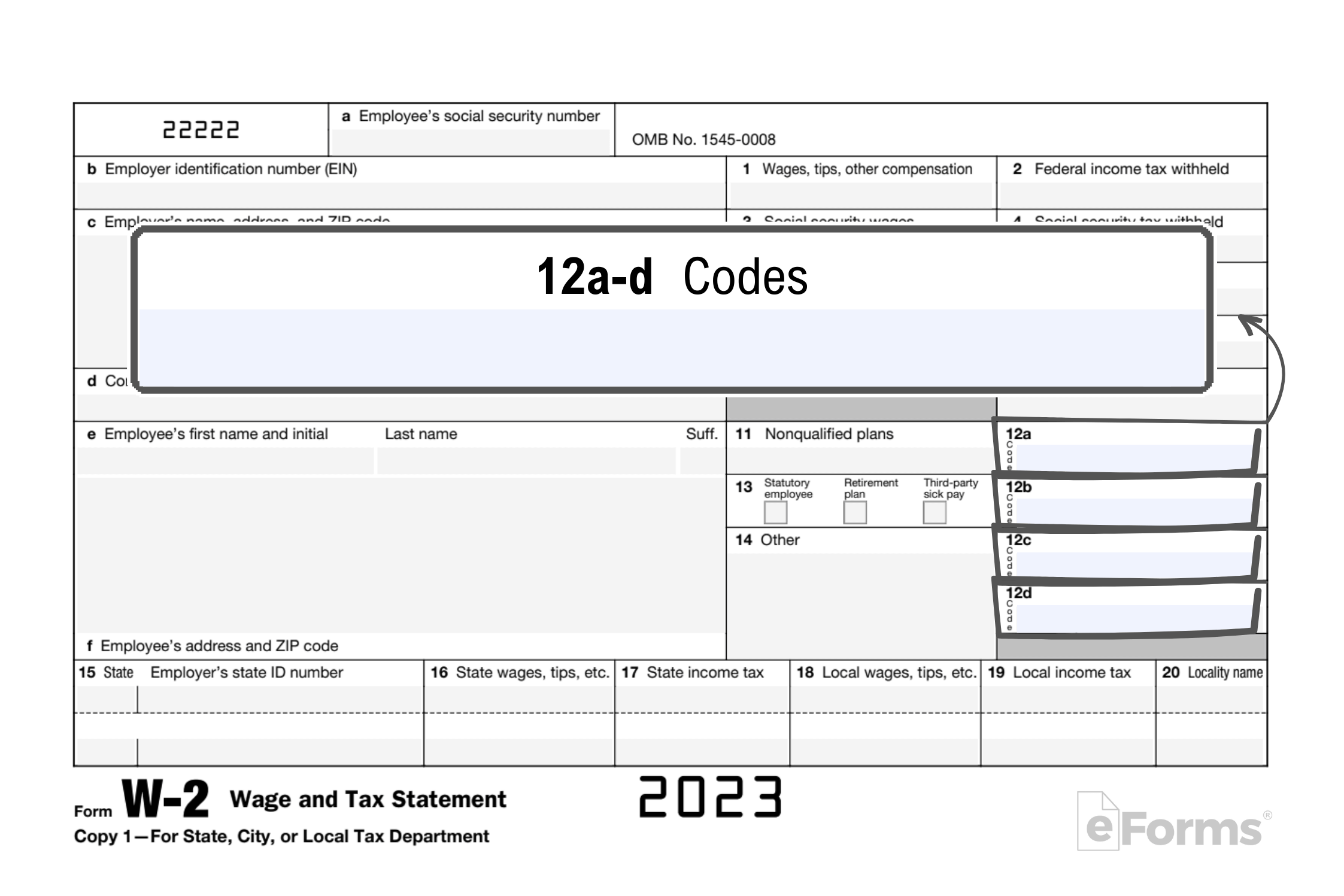

Box 12a-d: Codes

Box 12 encompasses four boxes labeled a-d, each showing the word “code” and a divider. The left section on each box allows employers to place one of 29 different types of codes (if any apply to the employee). On the right-hand side, the employer will place the associated amount ($). Codes range from nontaxable sick pay to excise tax to adoption benefits and more. Employers should review Box 12 codes on the IRS W-2 publication for applicabilities.

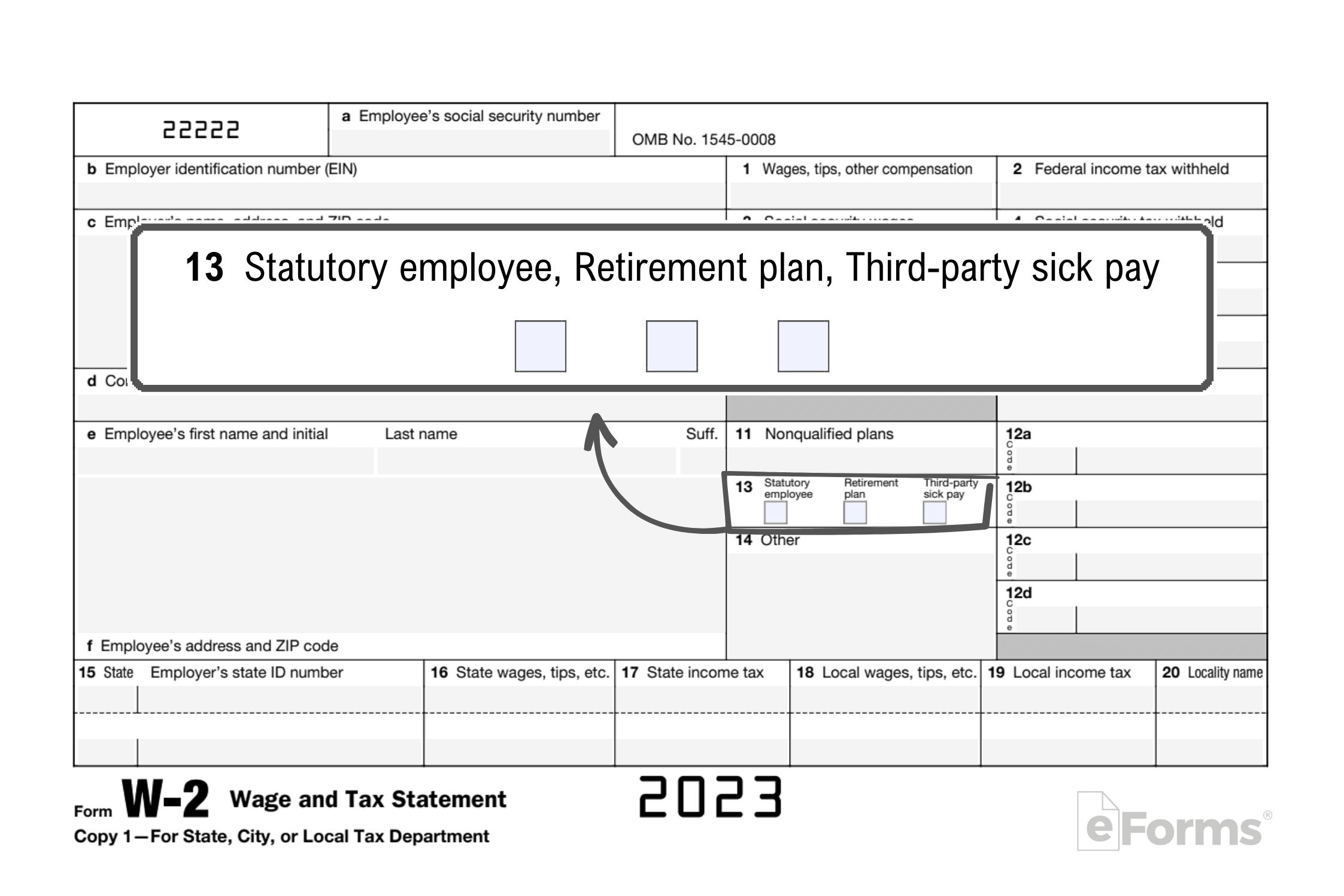

Box 13:

There are three checkbox selections available if applicable:

- Statutory employee: Check if an independent contractor is treated as an employee for tax withholding purposes. Certain rules apply.

- Retirement plan: Check if the employee actively participated (contributed to) in a retirement plan, profit sharing, pension, or stock-bonus plan.

- Third-Party Sick Pay: Check if an employee received third-party sick pay benefits during the tax year.

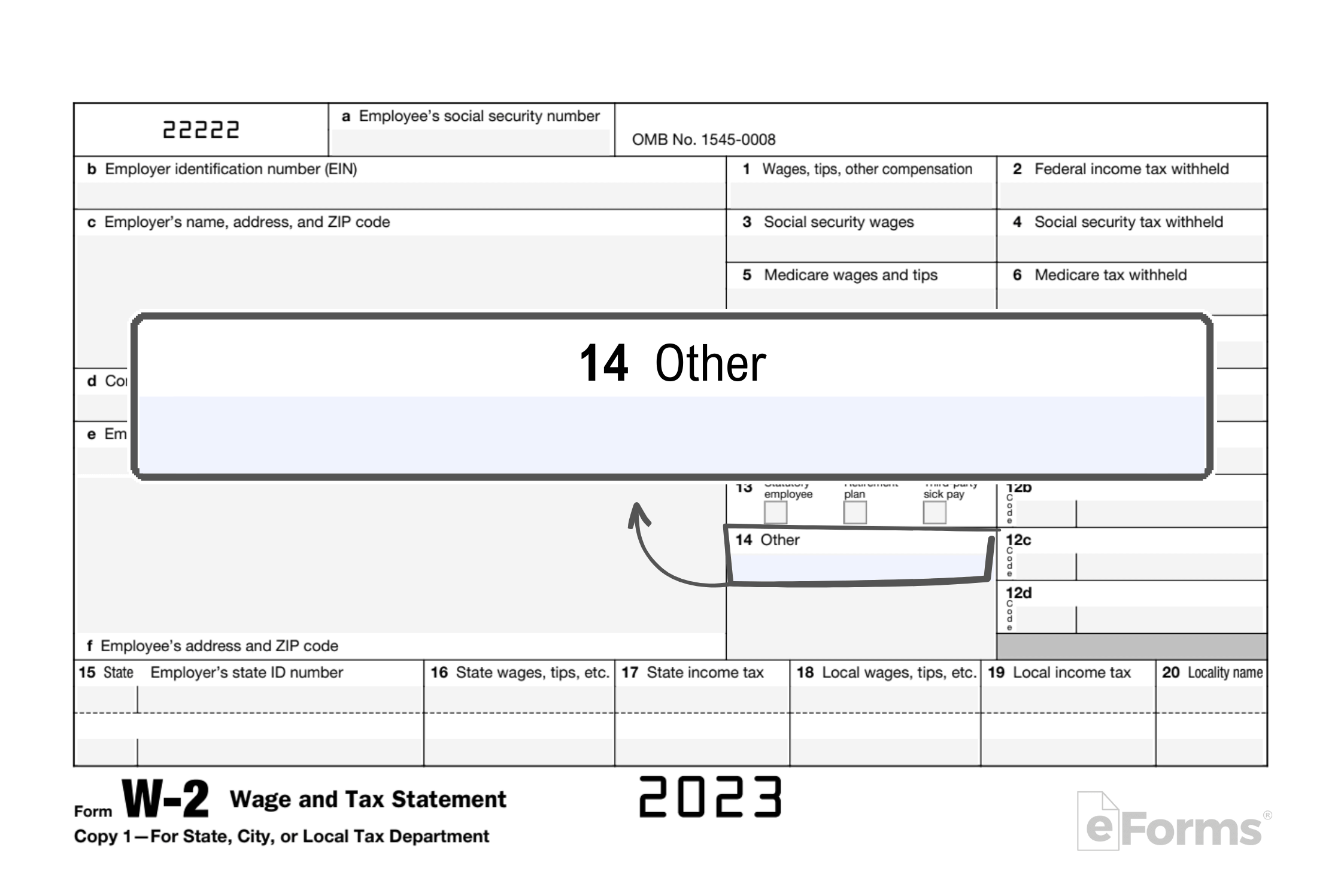

Box 14: Other

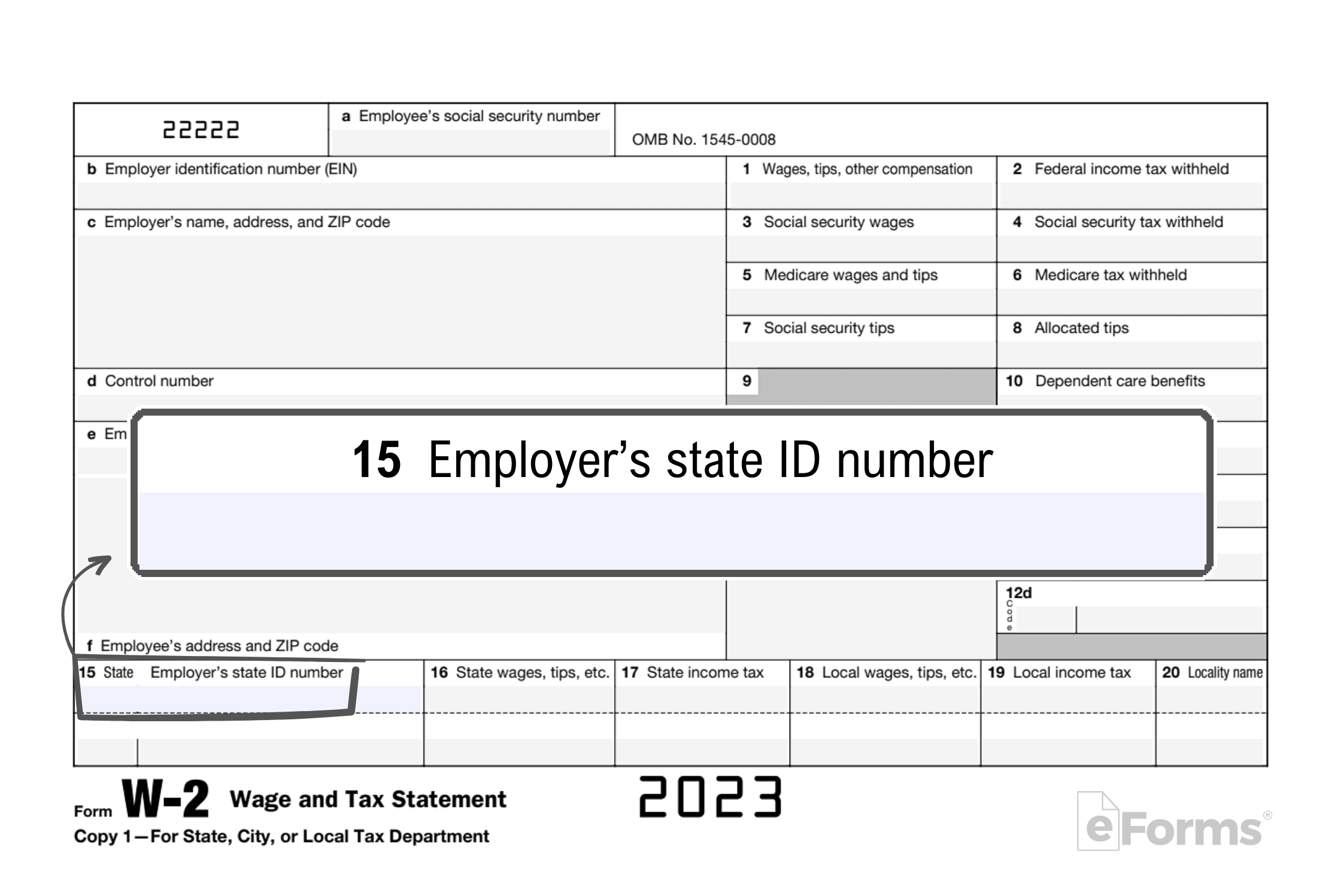

Box 15: State/Employer State ID

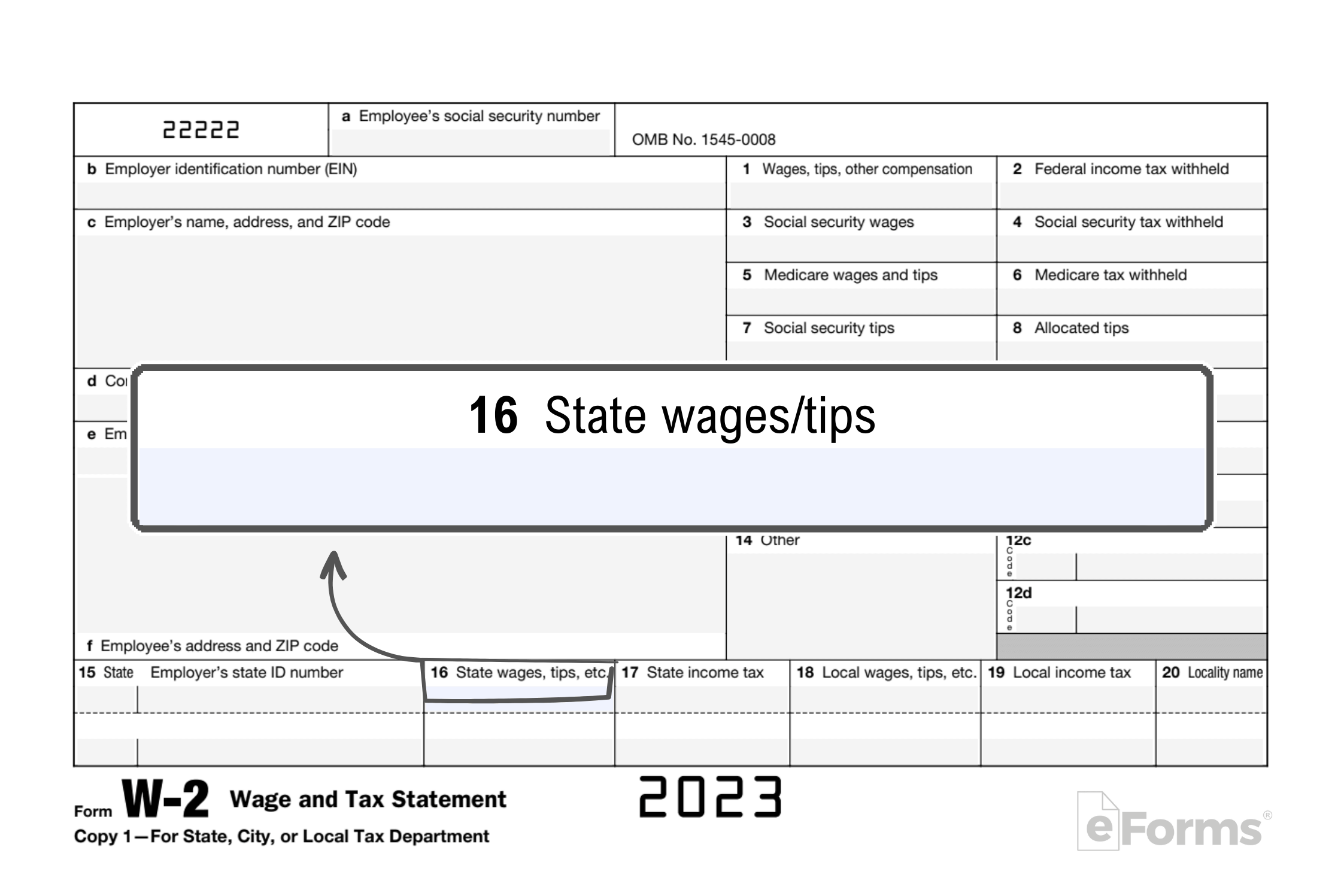

Box 16: State Wages/Tips

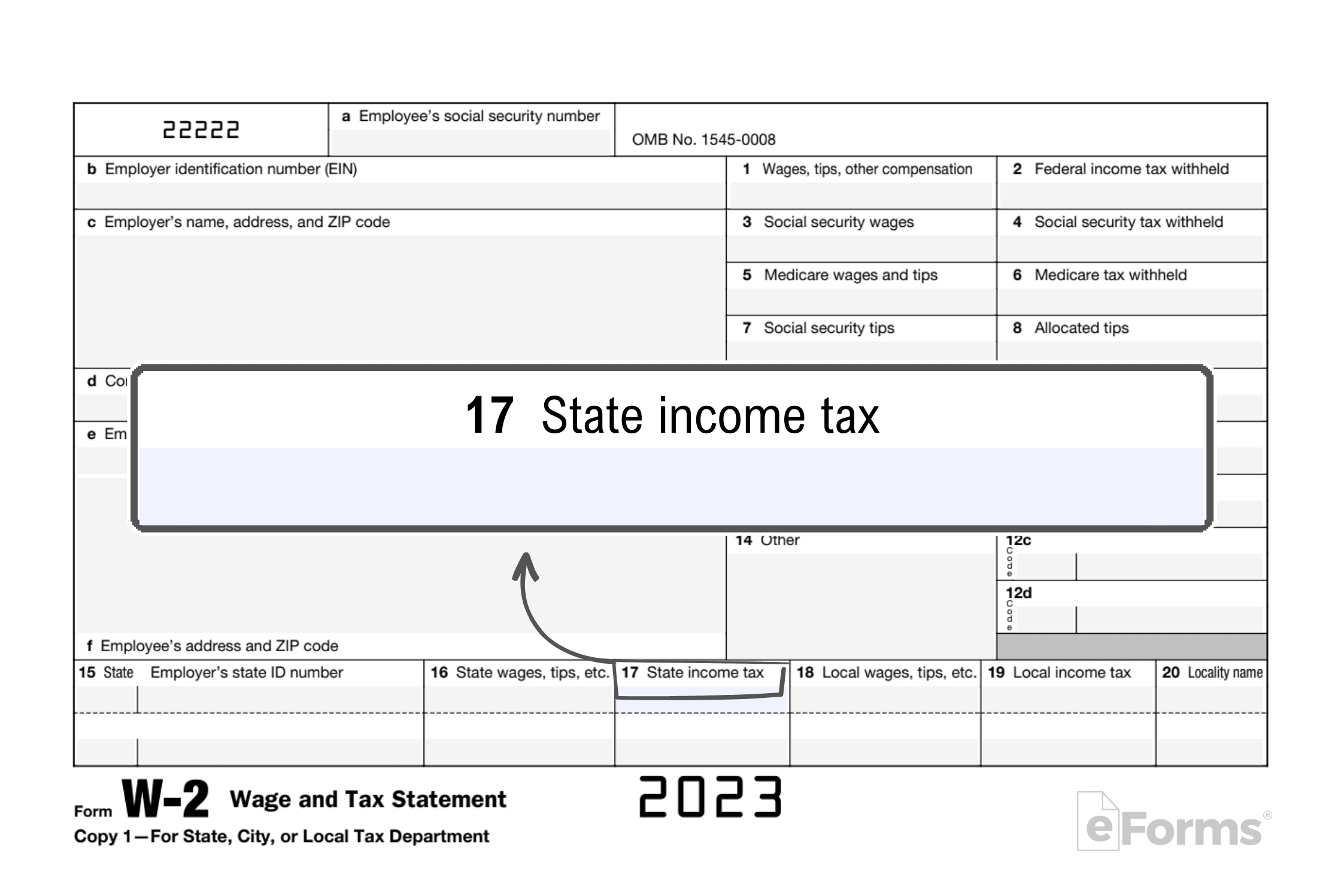

Box 17: State Income Tax

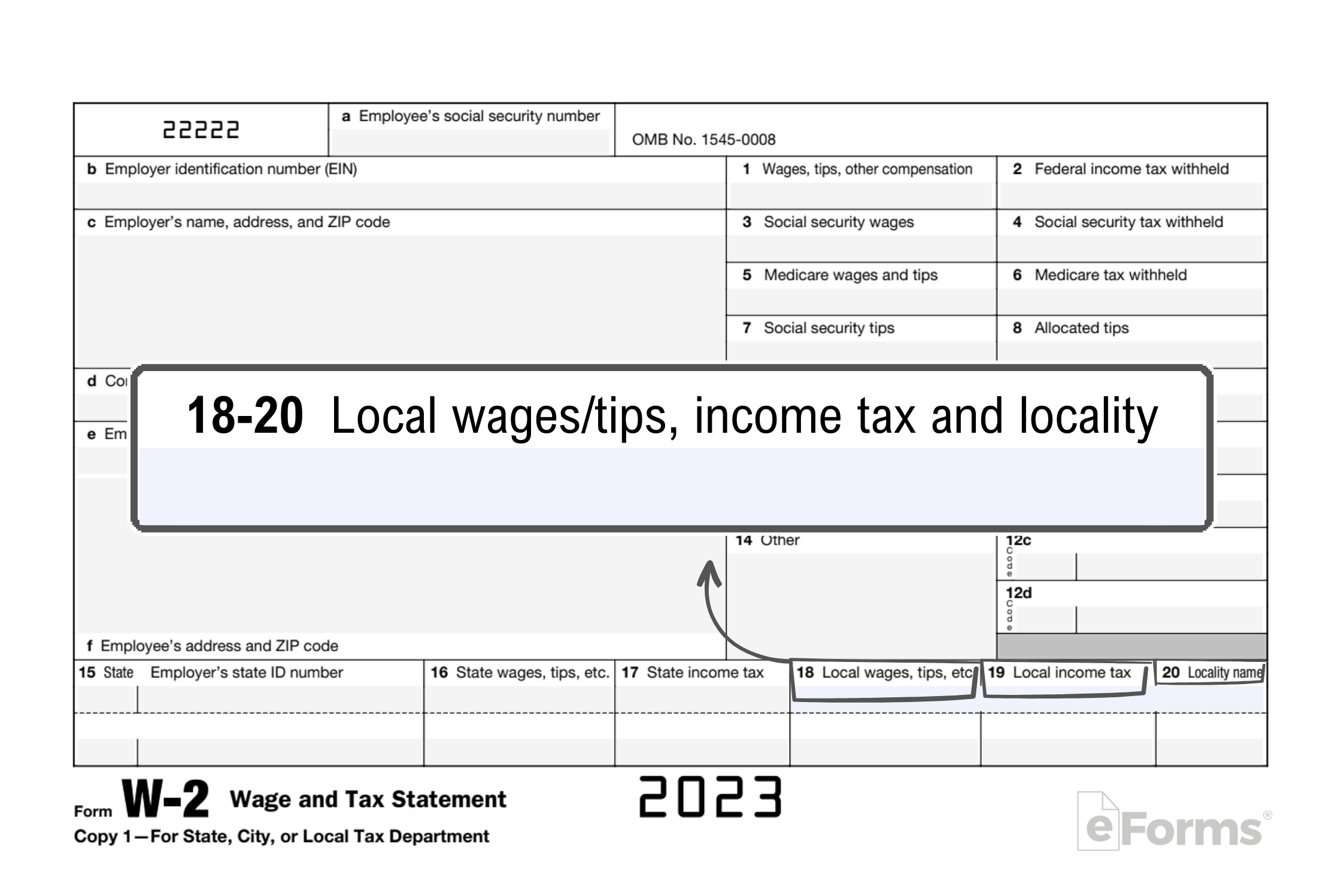

Box 18-20: Local Wages/Tips

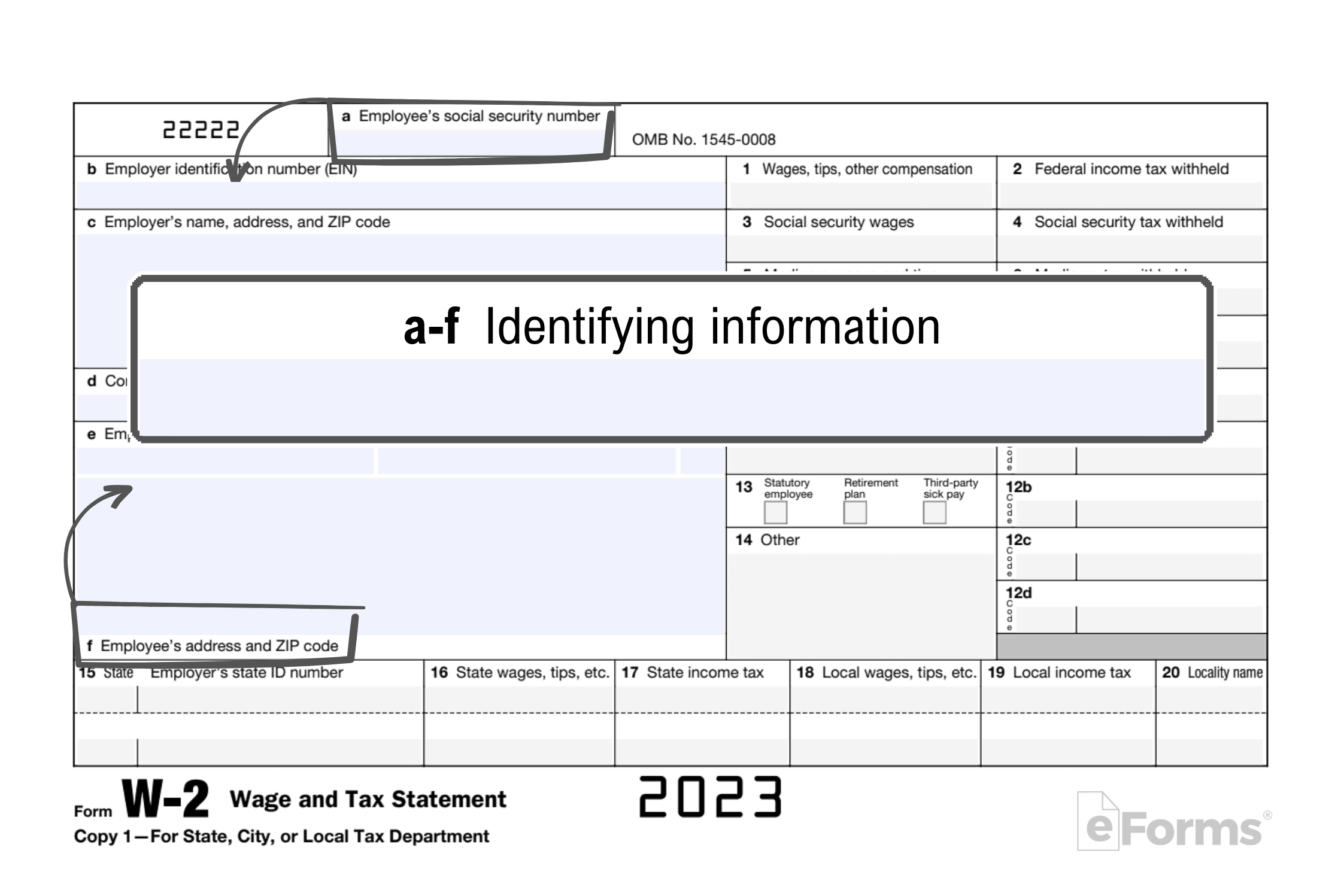

Box a-f: Identifying Information

W2 vs. 1099

A W-2 form is an information return submitted to the Social Security Administration and employees that reports income paid and taxes withheld to a particular employee. The SSA indirectly shares the information on the form with the IRS. A 1099 is also a type of information return, but it reports types of non-employment income. There are many different 1099s used to report varying payments made to taxpayers.

A 1099-NEC reports non-employee (freelance/contractor) payments made to contractors. Like a W-2 form, contractors use their 1099-NECs to file their taxes.

W-2 vs. W-4

A Form W-4 is filled out when an employee starts a new job or wants to change their withholding allowances. W-2s, on the other hand, are sent to an employee by the 31st of January every calendar year so that they may file their taxes.

How to Submit

W-2 forms come with six copies, and each copy must be either retained, sent to the employee, or filed with a government entity.

1. Using a W-3

To transmit any official W-2 copies to the Social Security Administration, Form W-3, Transmittal of Wage and Tax Statements must be used. Employers must fill out Form W-3 with the total number of W-2s being transmitted and applicable information for total wages and taxes withheld. A W-3 acts as a cover sheet for all of an employer’s annual W-2s. Form W-3 should NOT be used if W-2s are submitted electronically through the SSA.

2. Copy A

Employers submit Copy A, which is outlined in red, to the Social Security Administration. Official W-2 forms should not be folded, cut, or stapled. Employers submitting more than ten W-2s must submit them electronically. Copy A should be:

- Typed if possible or filled out in black ink

- error-free

- free of erasures, white-outs, or crossed-out lines

Copy A can be mailed by U.S. Postal Service to:[7]

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

When using private delivery services, such as FedEx or UPS, the address to file is:

Social Security Administration

Direct Operations Center

Attn: W-2 Process

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

3. Copy 1

4. Copy 2, B and C

Send Copies B, C, and 2 to the employee by no later than January 31 of each calendar year following the respective tax year. The form must be marked as mailed before the due date.

- Copy B is used by the employee to file their federal tax return with the IRS

- Copy C is for the employee’s records

- Copy 2 is used by the employee to file their state taxes

5. Copy D

Frequently Asked Questions (FAQs)

How do I get my W2 forms?

If you’re an employee trying to obtain current or previous W2 documents from an employer, contact the employer or company payroll department to request the form.

If the employer refuses to provide the document, you can contact the IRS for assistance at 1-800-829-1040. The IRS will then contact your employer. Form 4868 may be used to file a tax extension if employees are delayed in receiving their W-2s.

Can you print a W2 form?

W2 forms are typically printed and mailed to employees. Some online programs allow employers to auto-mail W-2 forms to employees.

Where do you submit a W2?

Though the form is created by the IRS, Copy A of W2 forms are submitted by employers to the Social Security Administration. The information is then shared with the IRS for tax enforcement purposes.

Sources

- IRS – General W-2 Instructions

- IRS – W-2 Filing Updated Limits

- IRS – Reporting Tips

- IRS – Employer Retirement Contributions

- IRS – Social Security Wage Base Limit

- IRS – Medicare Withholding Exclusions

- SSA – Mailing Address

- IRS – Employment Tax Recordkeeping