Updated November 06, 2023

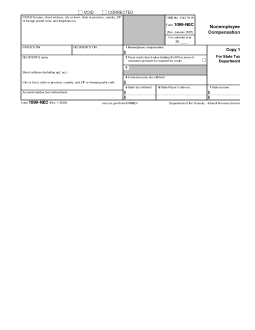

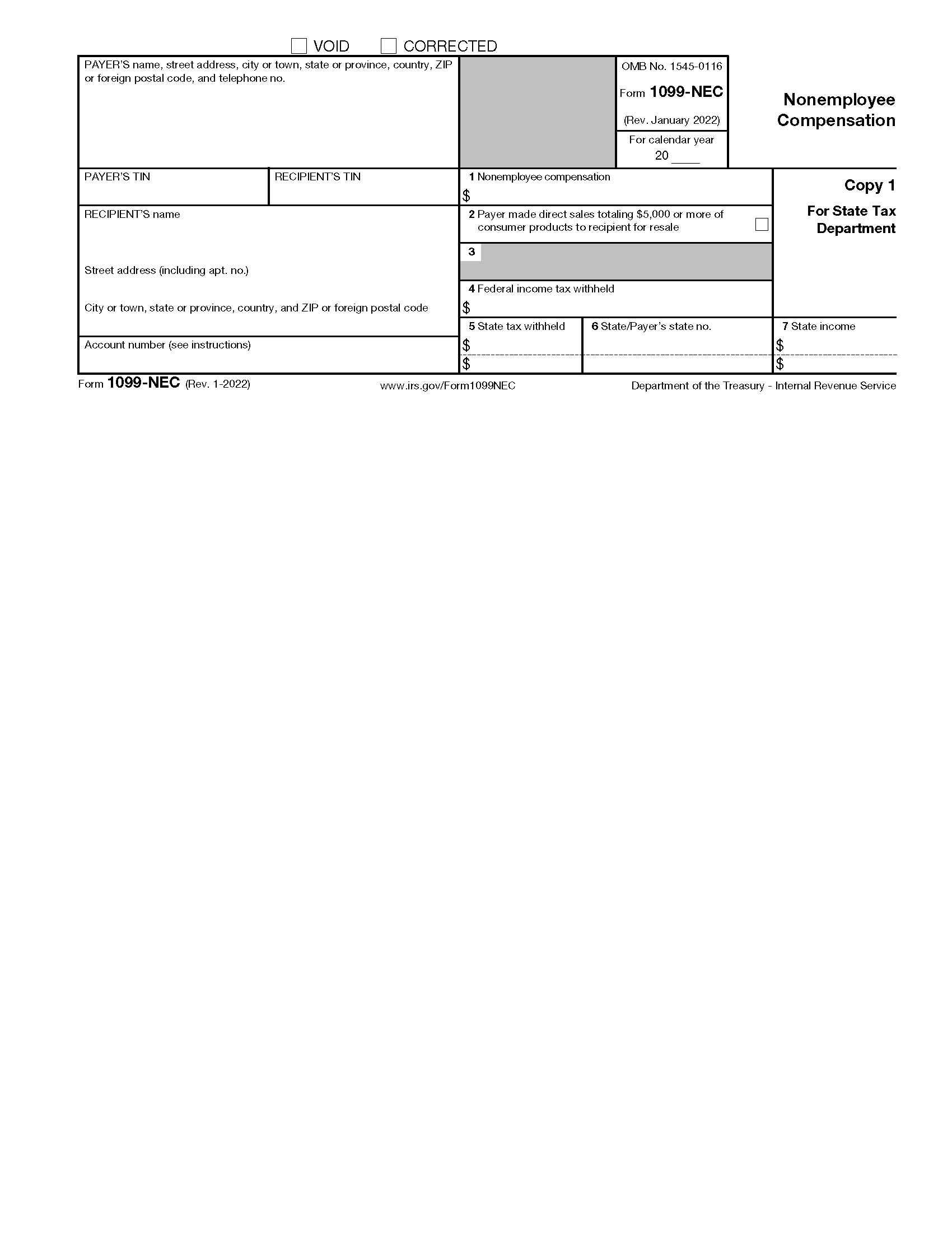

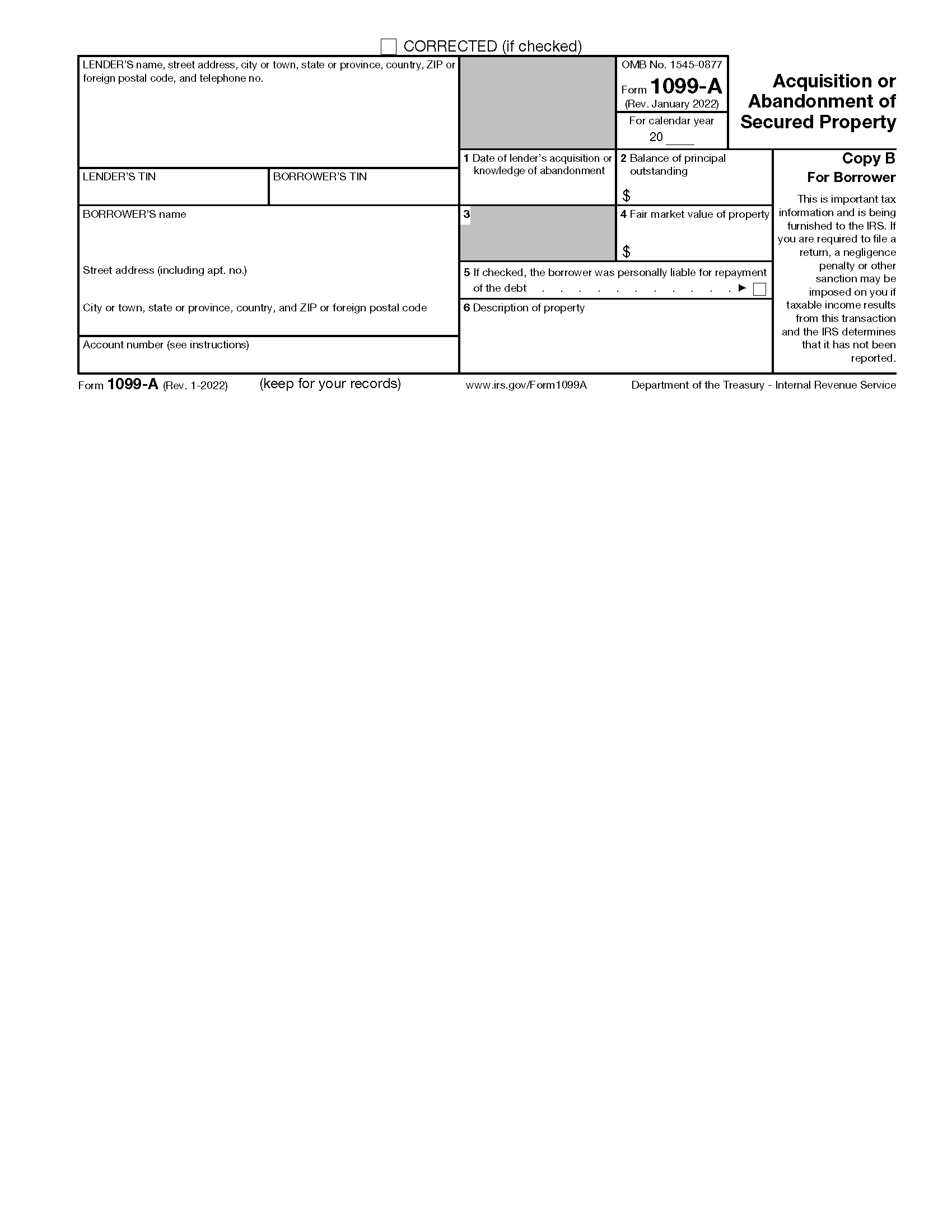

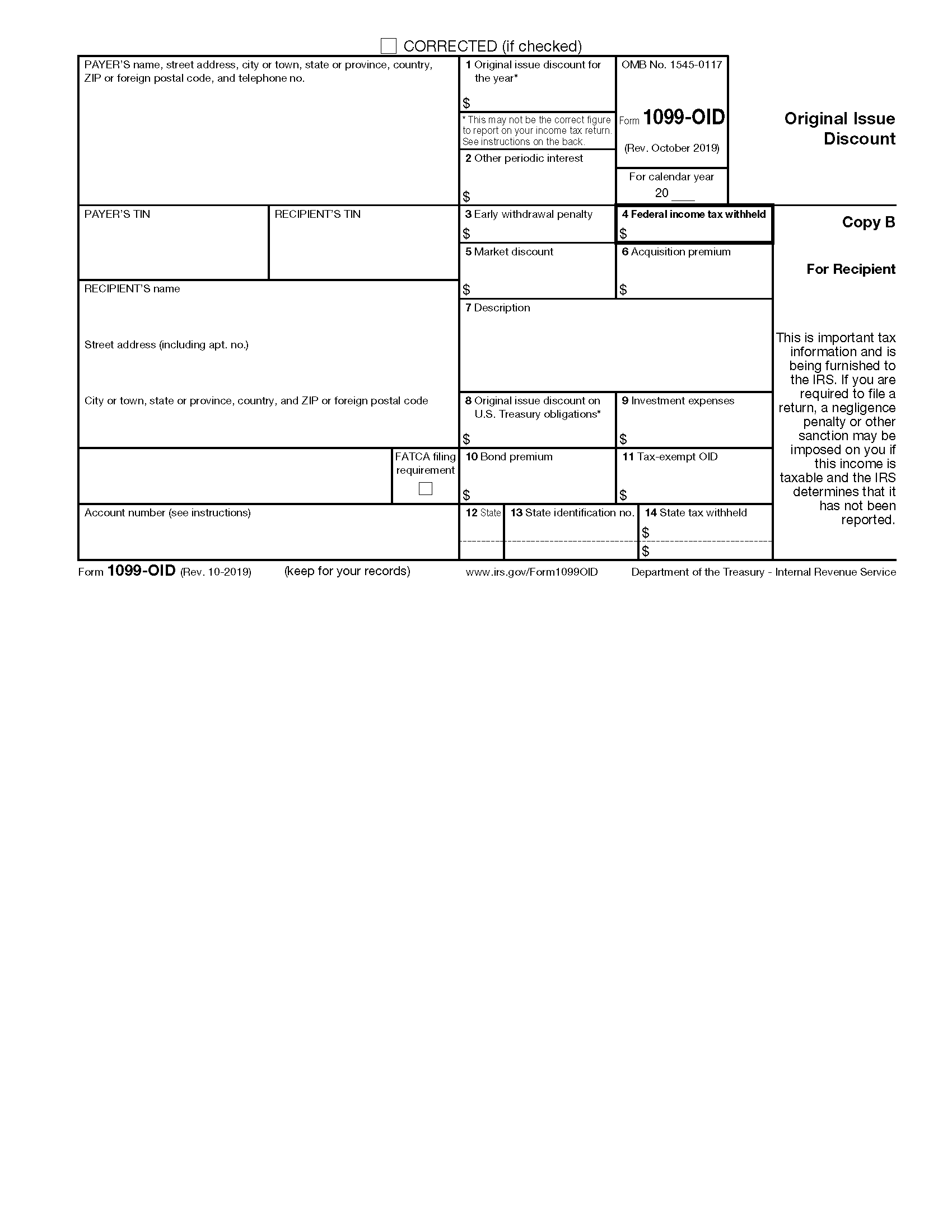

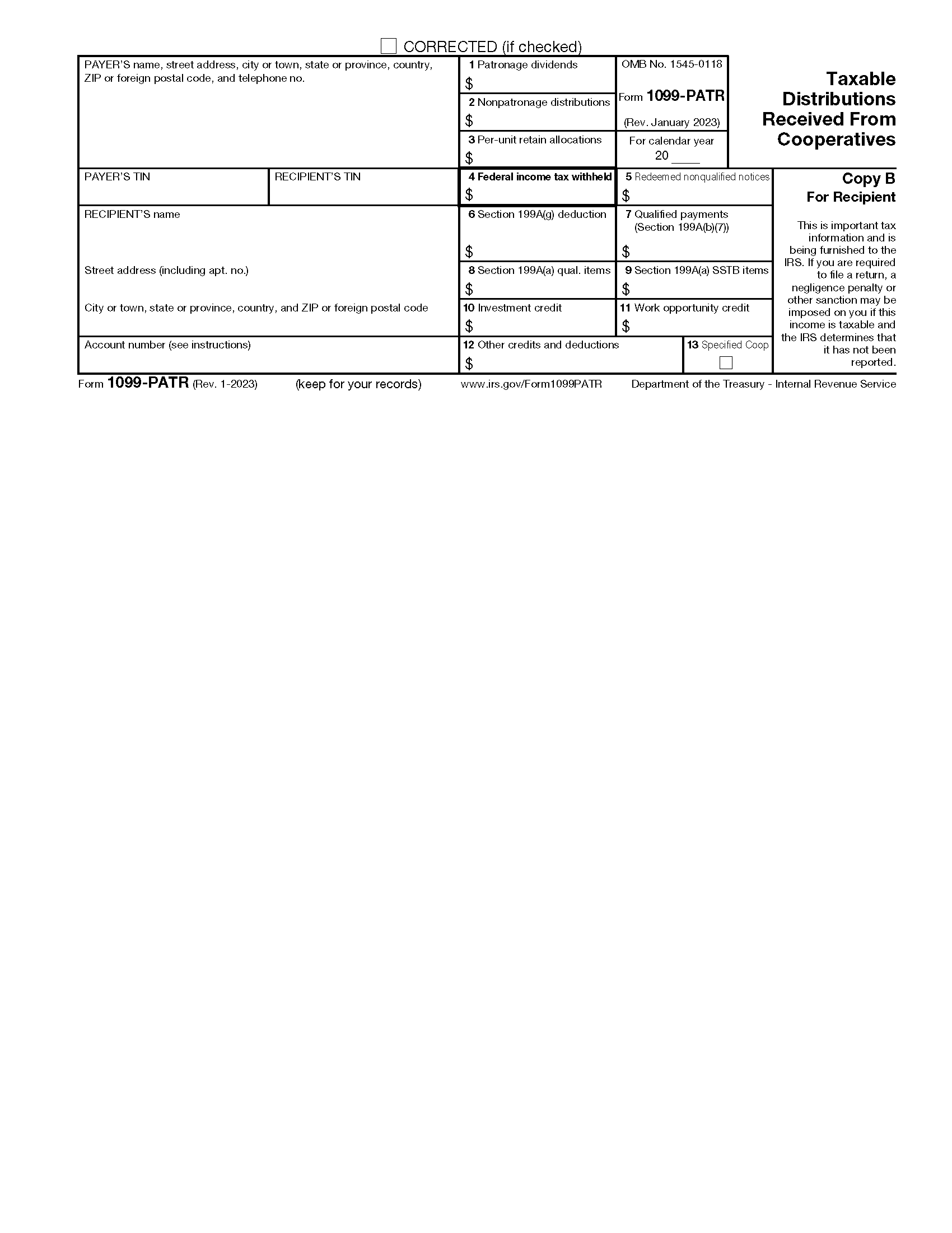

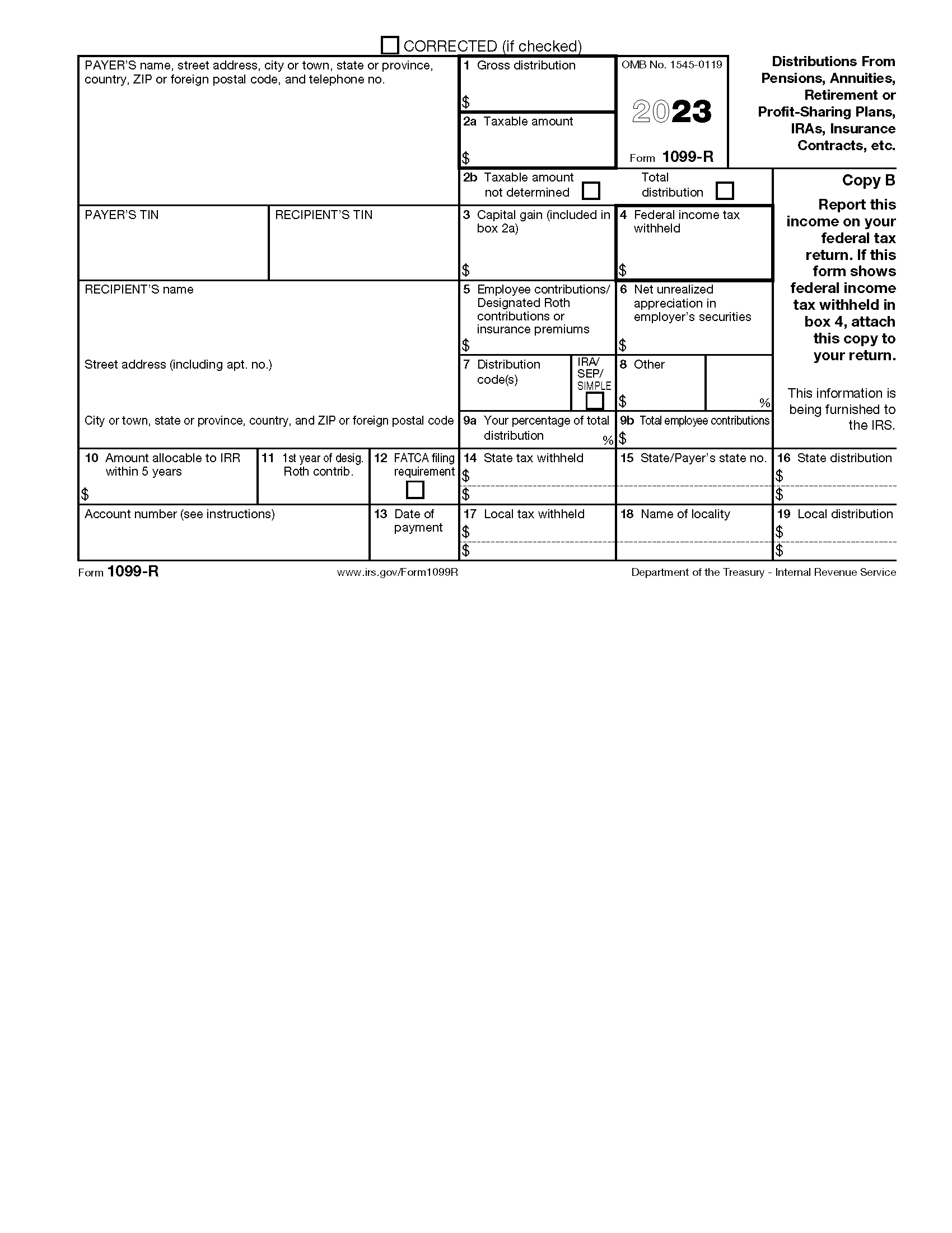

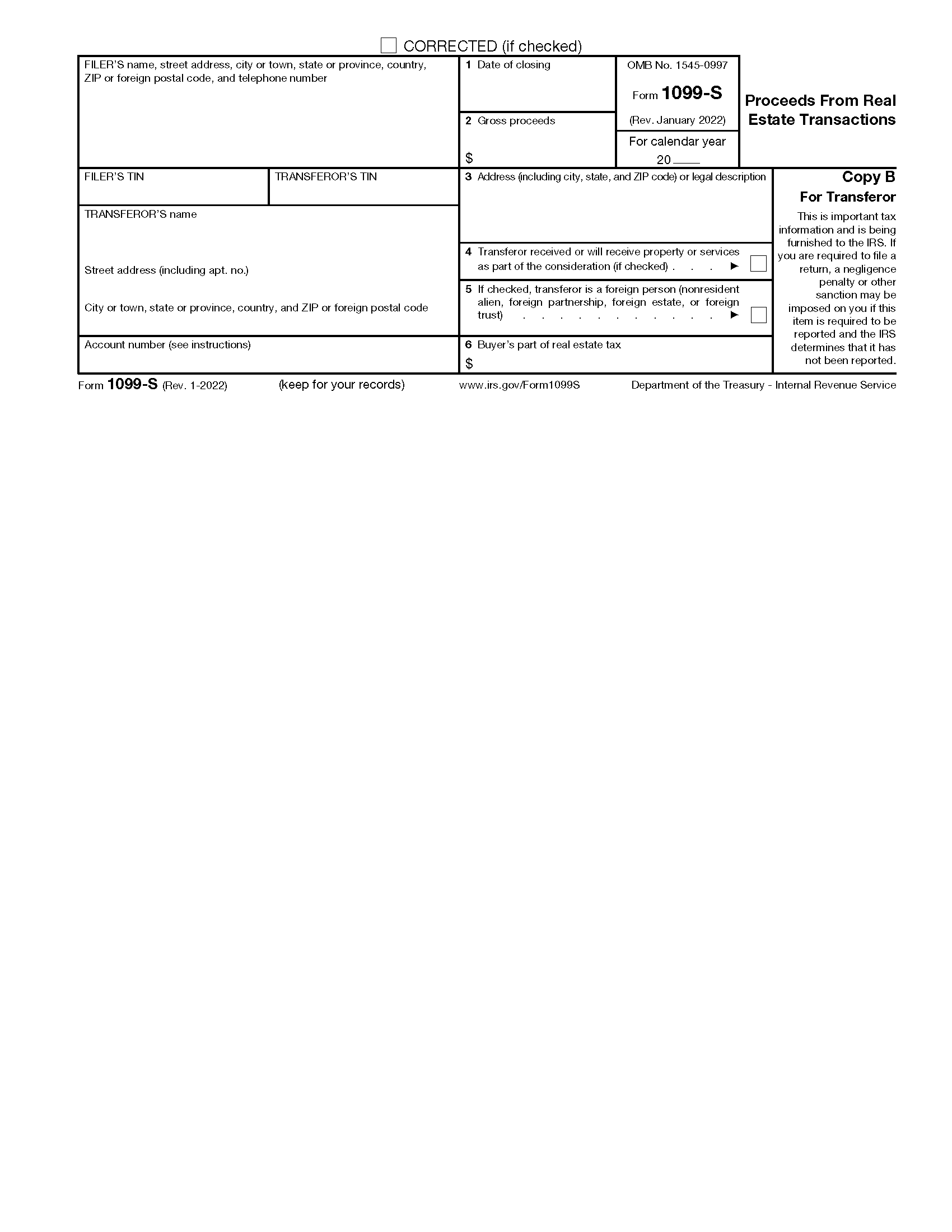

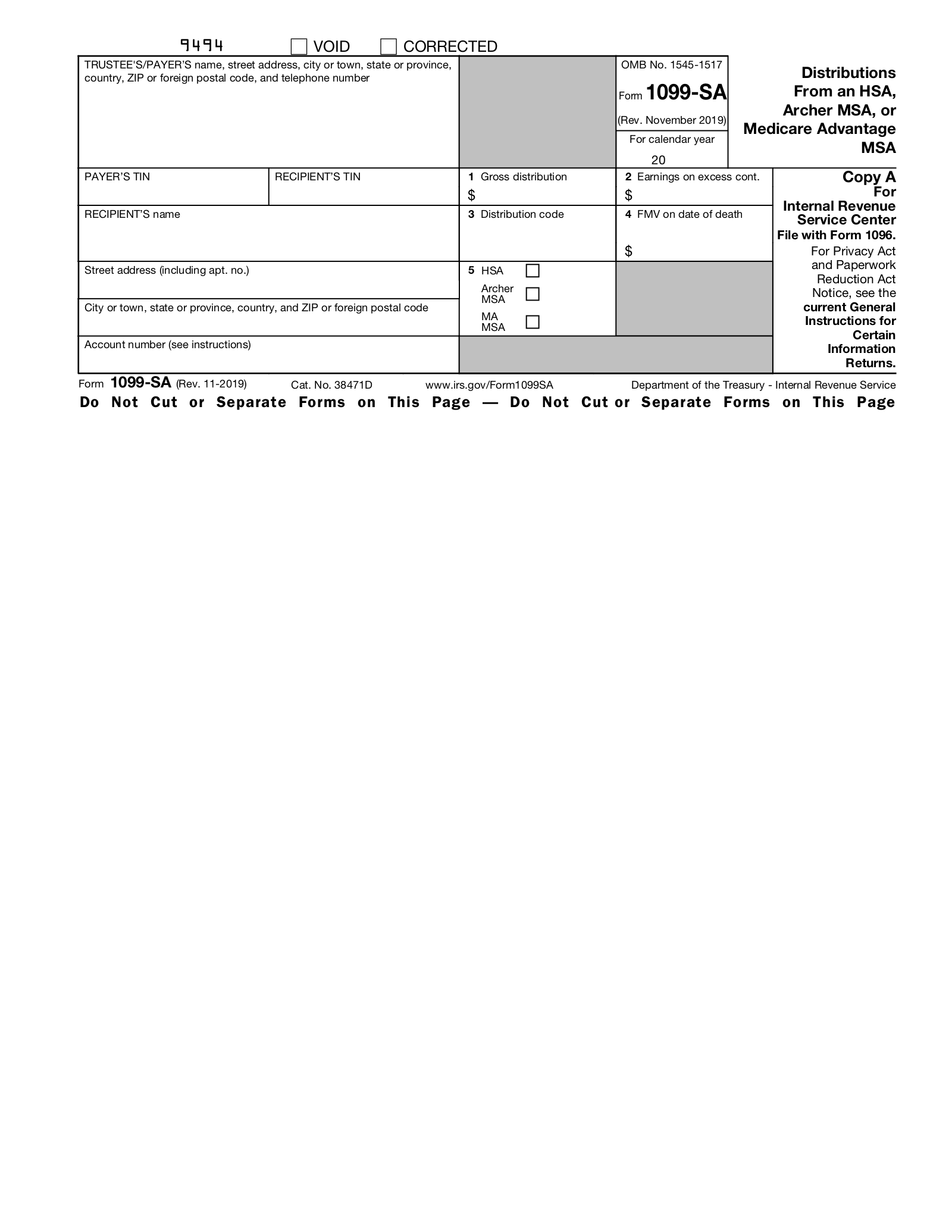

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. There are 20 active types of 1099 forms used for various income types. 1099s fall into a group of tax documents called information returns because they notify the IRS that taxable payments were made.

Who Gets a 1099?

A 1099 form is used to report income other than W-2 (standard employment) wages, salaries, and tips. Businesses and individuals making payments to other businesses or individuals may be required to issue a 1099 so that those payments are reported to the IRS.[1] Before issuing the 1099, a W9 from the payee is usually needed so that the payer has the information required to fill out the form.[2]

1099 Required

- Independent Contractors: Payments over $600 to a non-corporate business or individual who is not your employee, attorney or legal payments, and more (1099-NEC).

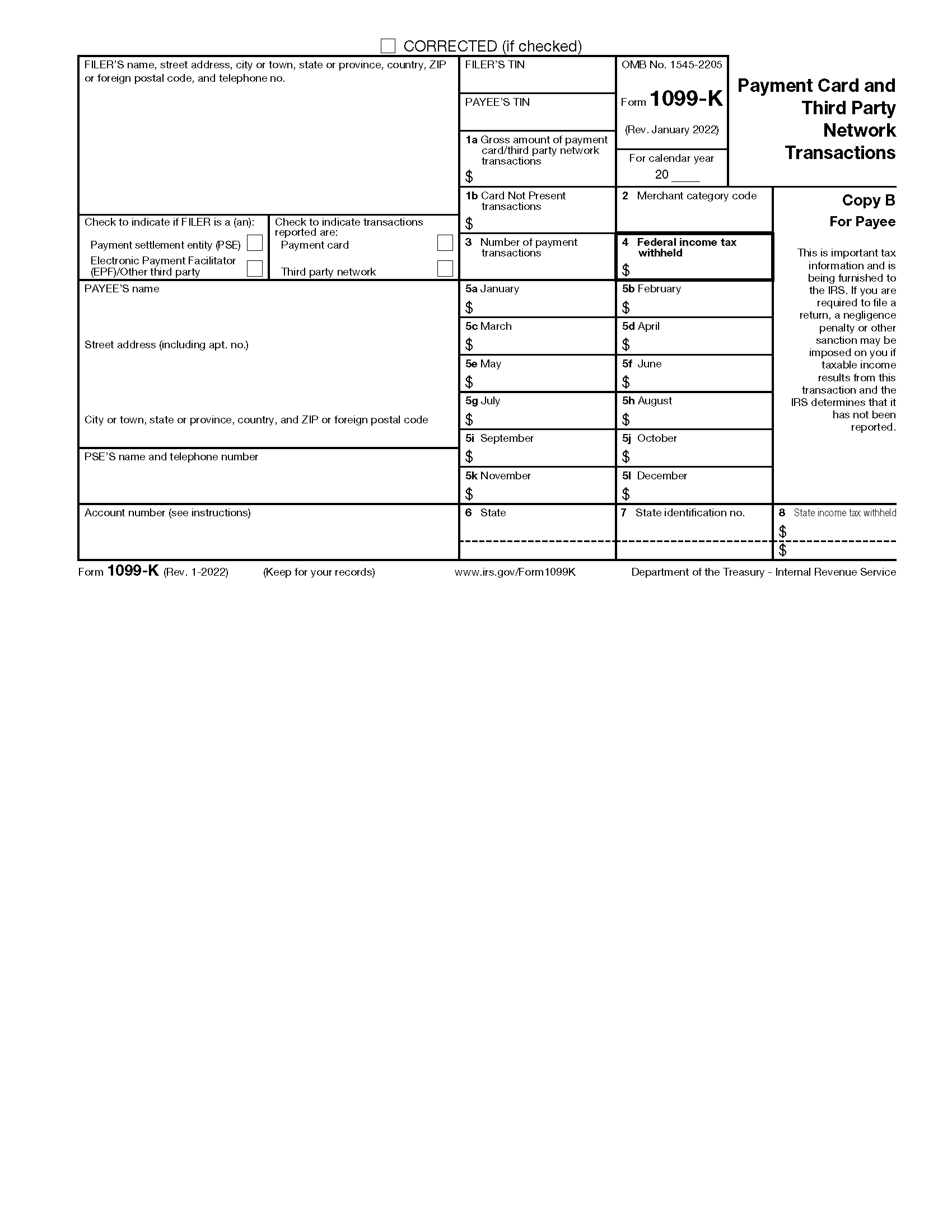

- Rental Income: Property management services collecting rent on owners’ behalf (typically 1099-MISC). Payment processors like Zelle, Venmo, and PayPal may issue forms to landlords receiving funds through these processors when payments exceed $600 beginning in 2024 (1099-K).

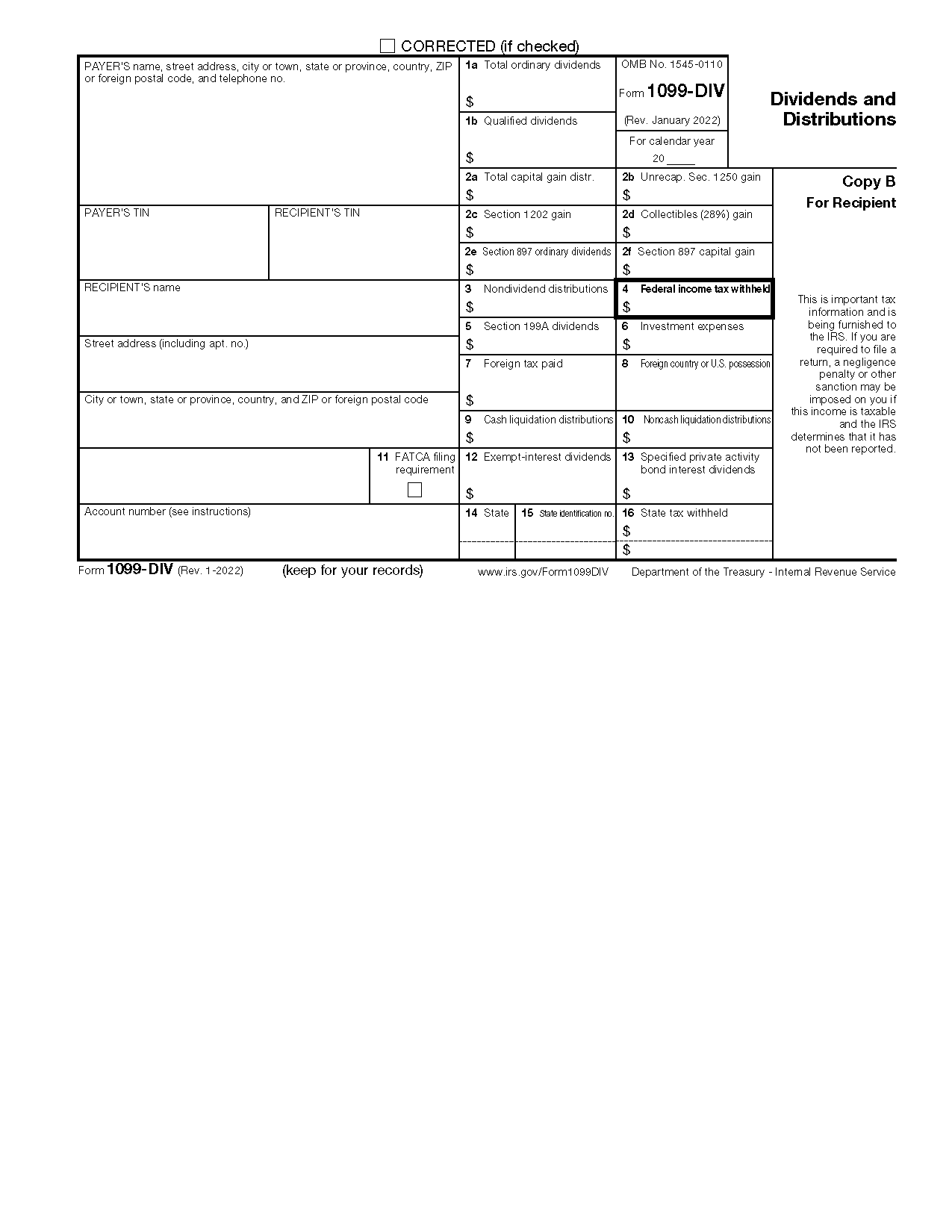

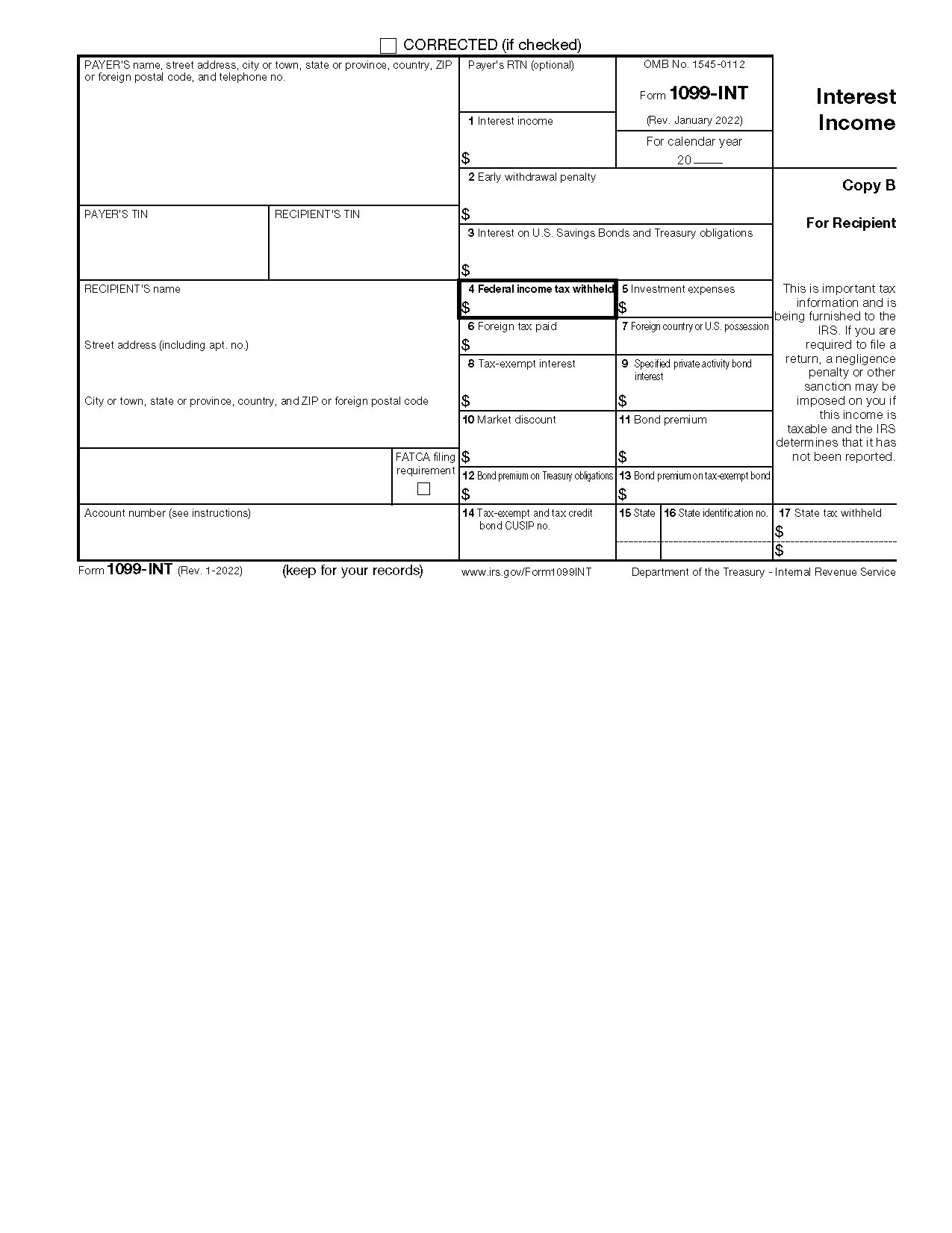

- Interest and Dividends: Interest earned on accounts with financial institutions (1099-INT), and Dividends collected by investors, corporations, mutual funds, or entities (1099-DIV). Both forms will be issued if payments total $10 or more.

- Broker and Barter Exchange Transactions: Individuals engaging in the sale of stocks, bonds, mutual funds, or other securities over $600 or barter exchanges for goods/services without using money and with a value of over $600 (1099-B).

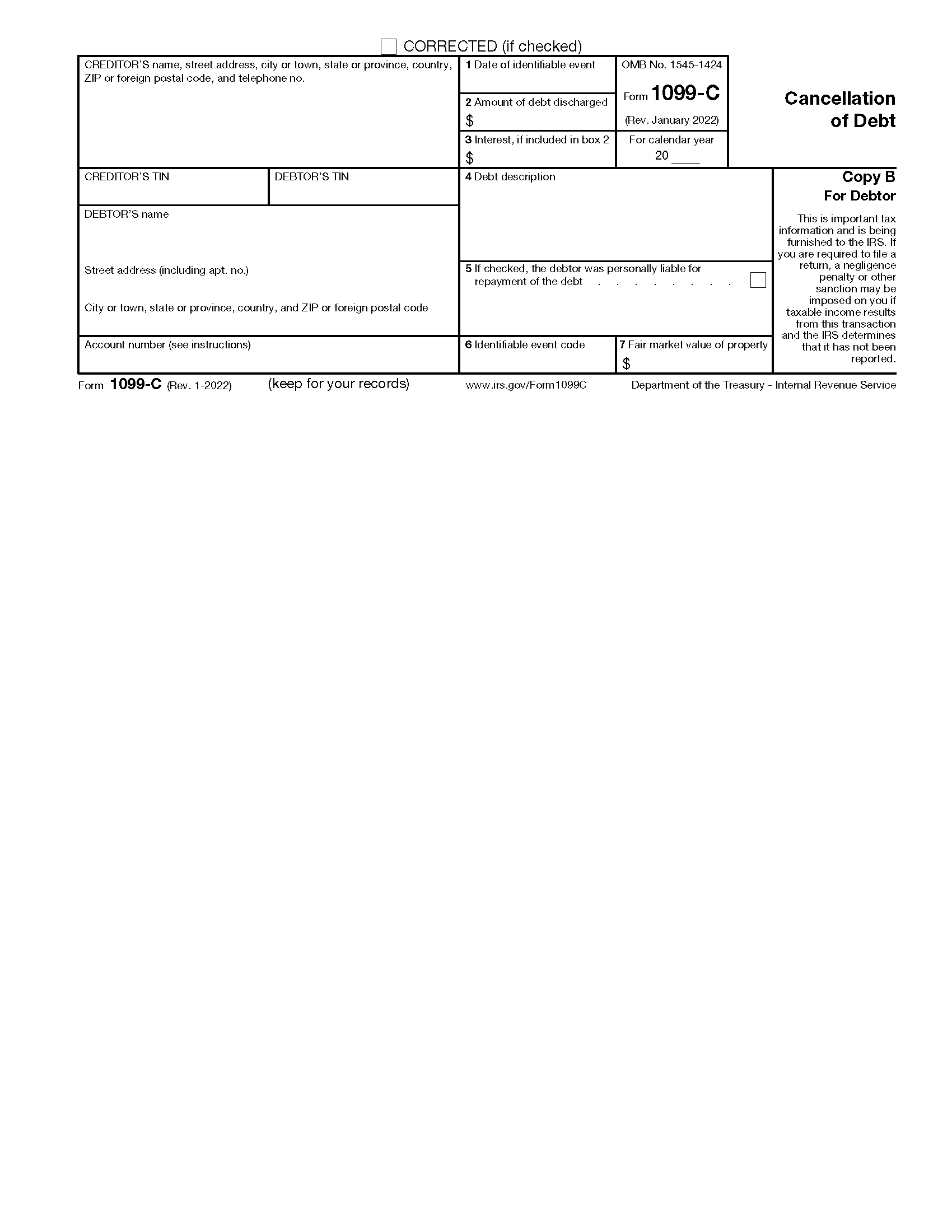

- Cancellation of Debt: Creditors canceling a debt must issue a form to the debtor if the value of the debt is over $600 (1099-C).

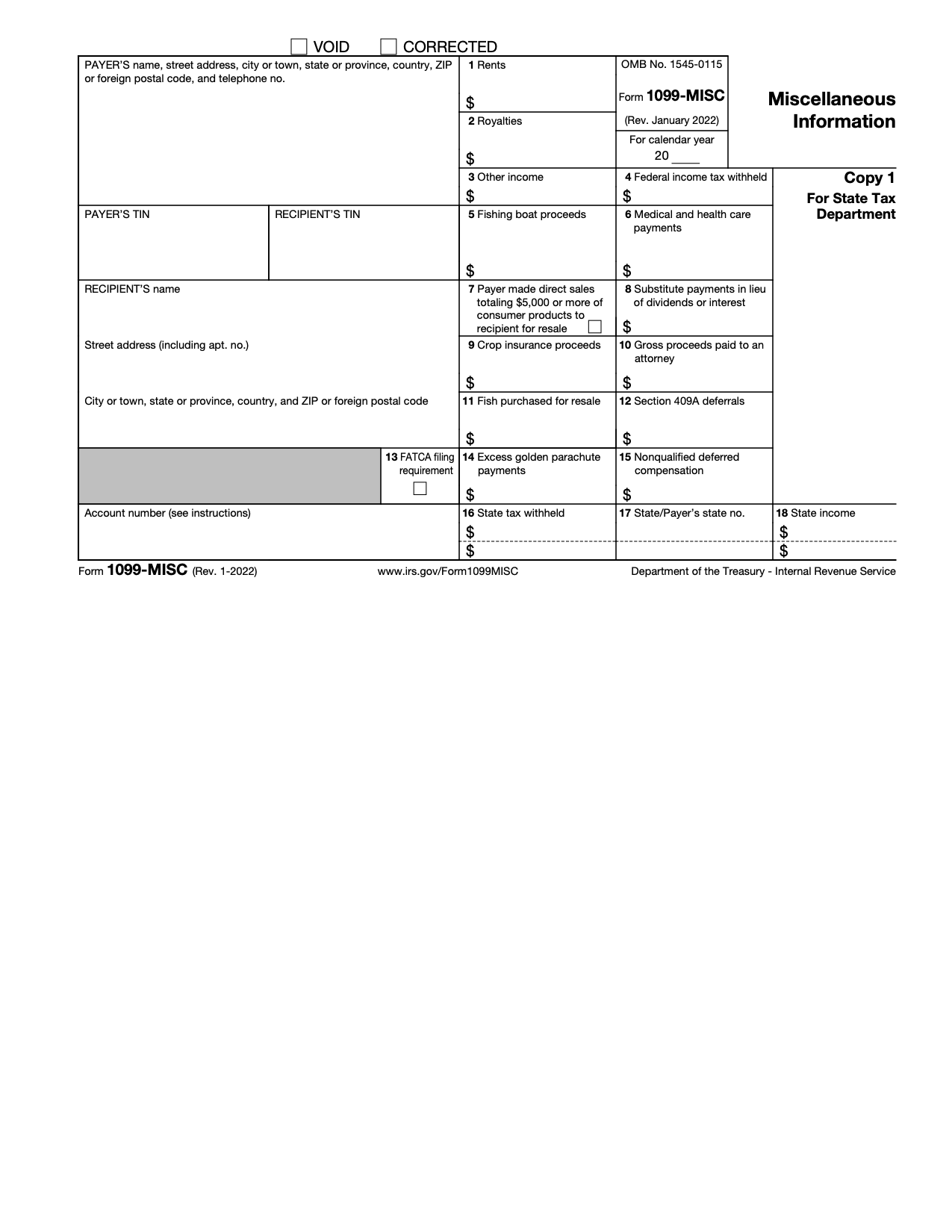

- Miscellaneous Income: Many other income types must be reported via a 1099. Access the IRS’s full list of miscellaneous income (1099-MISC).

Exempt from 1099

- Corporations: Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099 (Form 1120 for C corporations or Form 1120-S for S corporations).

- Employees: Employers would issue a W-2 form to all qualified workers, which is then used to report income to the IRS in an individual tax return (Form 1040)

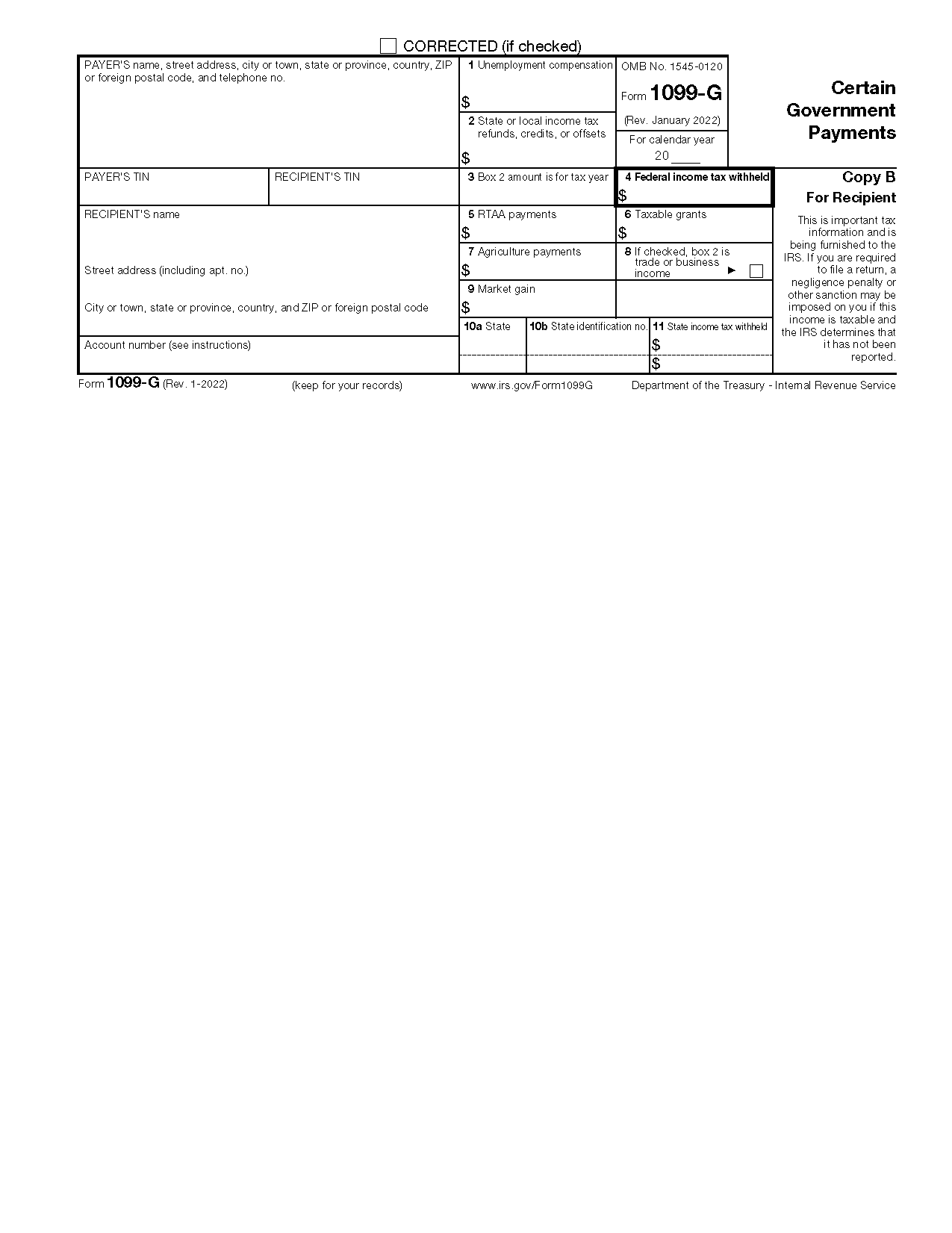

- Government Agencies: Generally, funds received by government agencies are considered non-taxable, and most government entities are classified as tax-exempt institutions.[3]

- Payments for Merchandise and Telecommunications: Merchandise involves goods rather than services, and telecommunications are generally regarded as a utility expense.[4]

- Healthcare: Healthcare providers and medical institutions already have their own healthcare-specific tax reporting requirements.

- Under Reporting Threshold: If payments are below the threshold ($600 for most cases), a 1099 need not be issued.[5]

Filing Deadline

Most 1099s have a deadline to submit to both the IRS and the recipient by January 31st. Some forms require the 1099 to be sent to the recipient by January 31st and a further deadline for paper filers with the IRS of February 28th. Electronic filers have until March 31st.

Check individual forms for filing requirements.

How to Get Paper Copies

Many forms provided as PDF files on the IRS website, including the 1099 series, are intended as ‘information only’ copies and should not be printed at home for paper filing with the IRS. The official versions have been designed as ‘machine-readable’ documents and are printed using special paper and ink. Taxpayers may be fined for filing printed pdf versions of this form.[6][

When filing a paper copy with the IRS, an official version must be used. However, printed pdf versions may be used to notify recipients and for the taxpayer’s personal records.

Official copies can be ordered directly from the IRS.

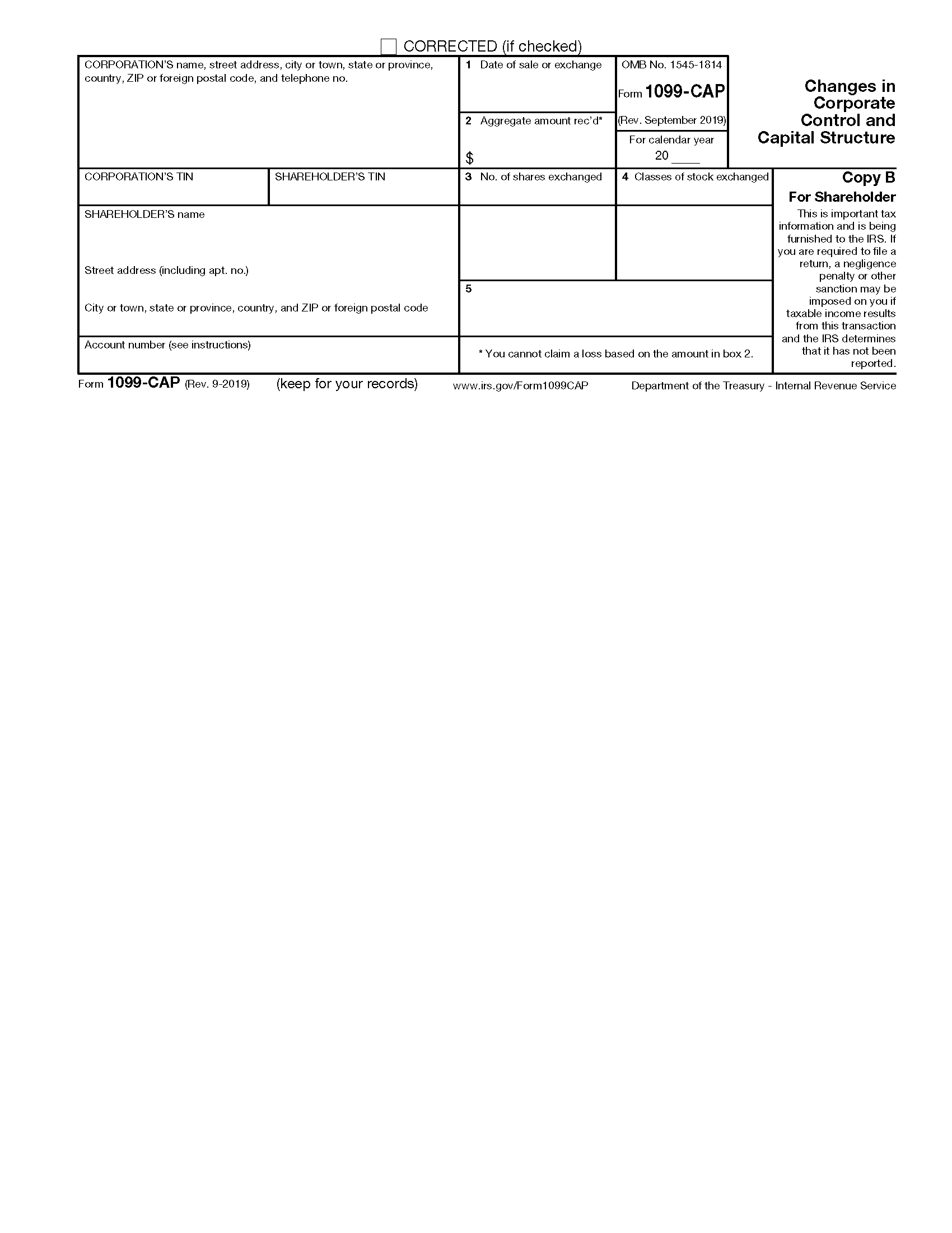

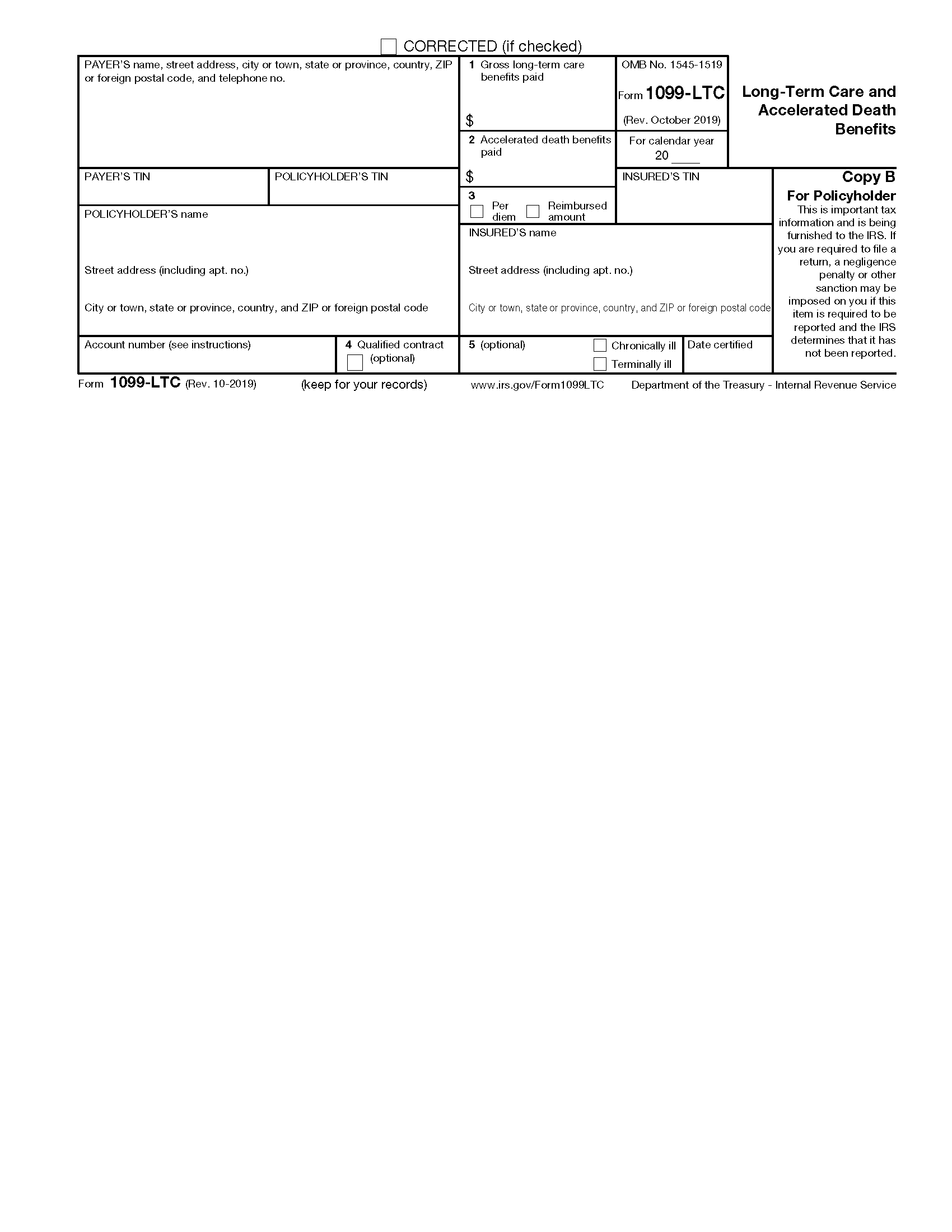

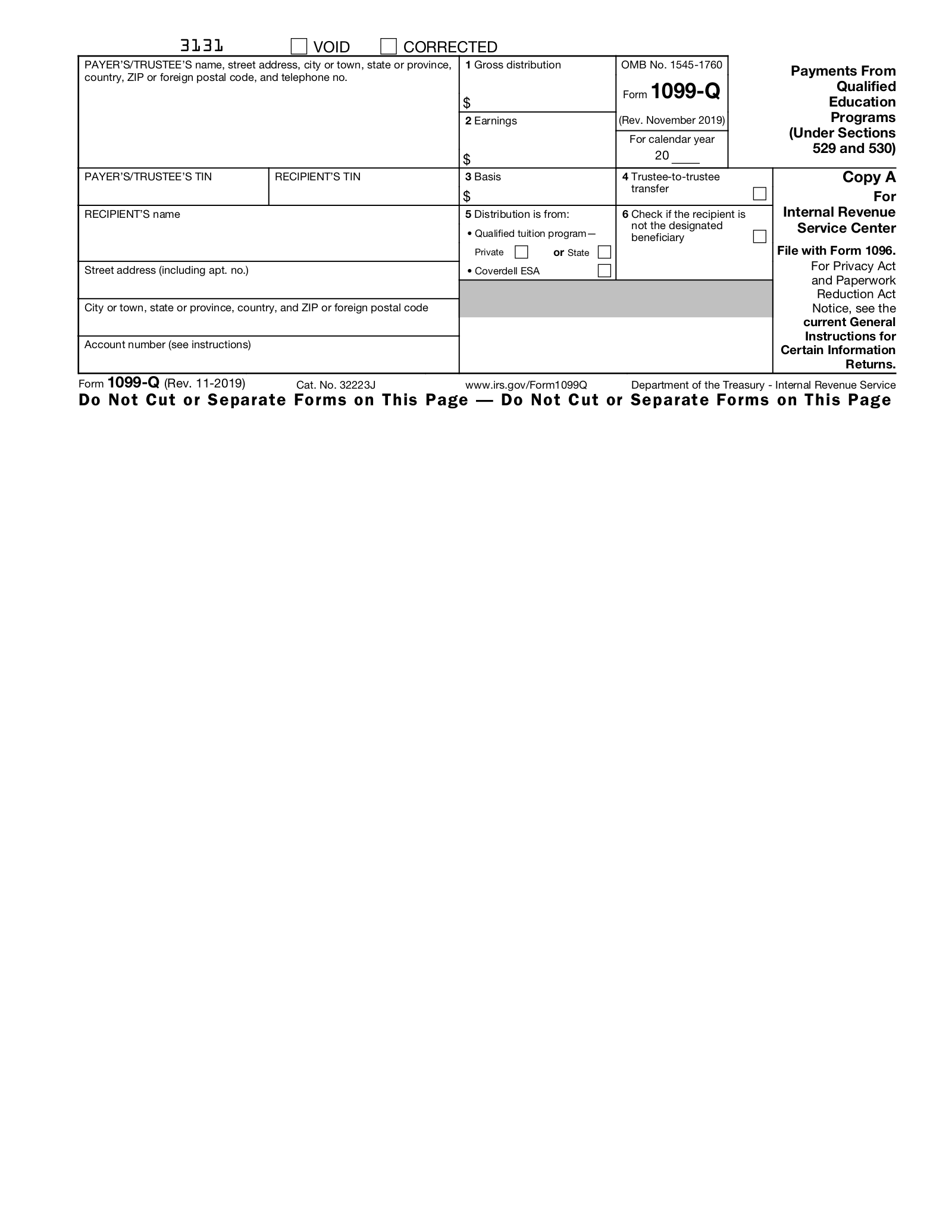

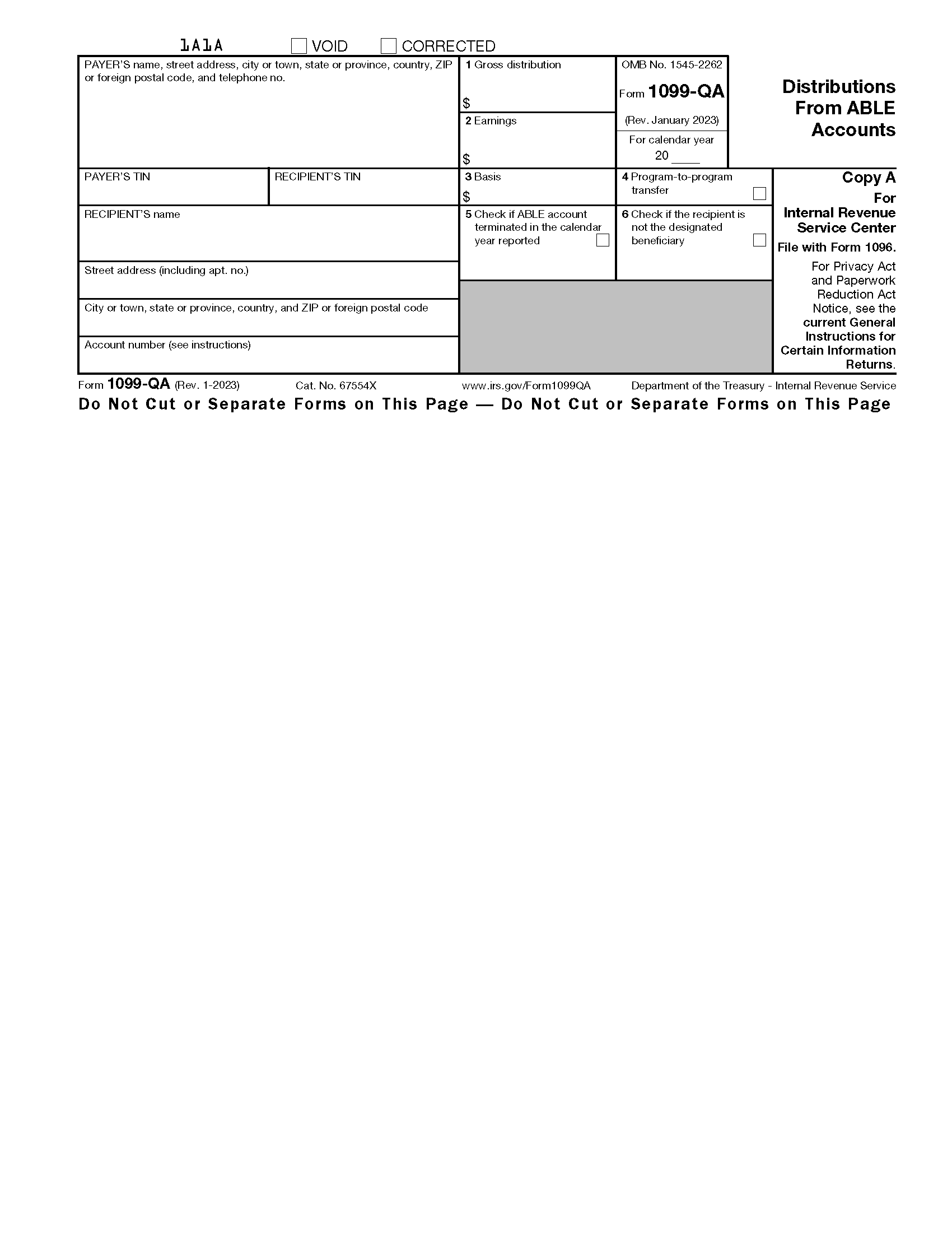

If you are filing any of these forms (1097-BTC, 1098-C, 1098-MA, 1098-Q, 1099-CAP, 1099-LTC, 1099-Q, 1099-QA, 1099-SA, 3922, 5498-ESA, 5498-QA, and 5498-SA) on paper due to a low volume of recipients (fewer than 100), for these forms only, you may file a black-and-white Copy A that you print from the IRS website with Form 1096.[7]

How to File (5 Steps)

***Starting in 2023, the IRS requires filers processing 10 or more information returns (1099s included) to be filed electronically.[8]

2. Obtain Correct 1099 Form

3. Complete Form

The 1099 can be completed in one of three ways:

- By hand

- Through qualified online submission services

- Through the IRS’s IRIS e-filing system

If you’re completing by hand and submitting documents by mail, you must fill out ALL copies and send each form to the appropriate recipients.

4. Submit Copies to Recipients

If sending by mail:

- COPY A must be sent to the IRS

- COPY B must be sent to the RECIPIENT

- COPY C should be retained for your records

Electronic services will usually ask for all necessary information and will send both electronic (by email) and paper copies to the recipient. Depending on the provider, more or less options may be available to the sender.