Updated March 04, 2024

IRS Form 1099-DIV (Dividends and Distributions) is a tax form documenting dividends or earnings from investments worth more than $10. The form is also used to report earnings of $600 or more from the sale of liquidated assets. Brokerage firms send 1099-DIV forms to investors, who are required to report the information contained on their annual income tax returns.

Common Uses

Form 1099-DIV is commonly used to report:

- Dividends

- Capital gains

- Collectibles gains

- Cash or non-cash liquidation distributions

Table of Contents |

Who Uses a 1099-DIV?

Banks, brokerage firms, and other financial institutions send Form 1099-DIV to taxpayers who earned dividends on their investments the previous year. Copies are also filed with the IRS.

Recipients of 1099-DIV forms use the information they contain to complete their annual income tax returns.

Deadlines

Form 1099-DIV must be sent to taxpayers by January 31. The form must be filed on paper with the IRS by March 1, and by March 31 if e-filed.

1099-DIV vs. 1099-R vs. 1099-INT

Form 1099-DIV is used to report dividends made on investments. There are a few other forms with which it gets easily confused, most notably Form 1099-R, which reports dividends from life insurance contracts and employee stock ownership plans, and Form 1099-INT, which reports earnings from interest, including interest issued by credit unions and mutual savings banks.

1099-R: Used to report distributions from retirement benefits such as pensions and annuities.

1099-INT: Used to report interest earned on accounts or securities.

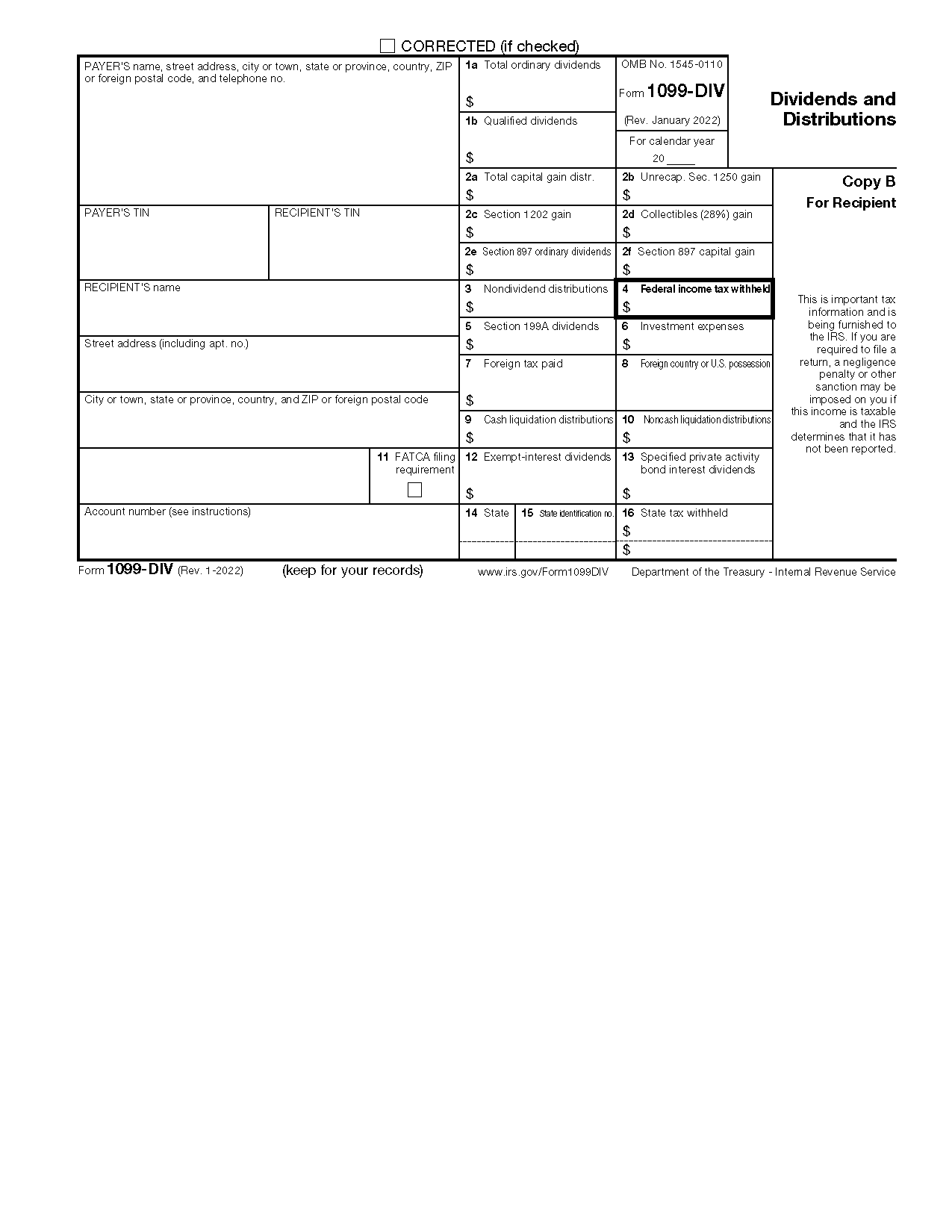

1099-DIV Form Parts (26)

The 1099-DIV form can vary across states but generally contains the following parts. Check the IRS instructions for further details about each input box.

1. Payer’s Information

3. Recipient’s TIN

4. Recipient’s Information

5. Account Number

6. 2nd TIN not.

7. Total Ordinary Dividends

8. Qualified Dividends

9. Total Capital Gain Distribution

10. Unrecap. Sec 1250 Gain

11. Section 1202 Gain

12. Collectibles (28%) Gain

13. Section 897 Ordinary Dividends

14. Section 897 Capital Gain

15. Nondividend Distributions

16. Federal Income Tax Withheld

17. Section 199A Dividends

18. Investment Expenses

19. Foreign Tax Paid

20. Foreign Country or U.S. Possession

21. Cash Liquidation Distributions

22. Noncash Liquidation Distributions

23. FATCA filing requirement

24. Exempt-Interest Dividends

25. Specified Private Activity Bond Interest Dividends

Enter exempt-interest dividends paid by a RIC on specified private activity bonds that is attributable to interest on the bonds received. A “specified private activity bond” means any private activity bond defined in section 141.[9] These are subject to the alternative minimum tax.

26. Boxes 14-17

Instructions for Filers (6 Steps)

1. Collect W-9

2. Obtain 1099-DIV

3. Complete 1099-DIV

4. Send to Recipient

5. Send to the State Tax Department

6. File with IRS

Frequently Asked Questions (FAQs)

I received a 1099-DIV. What do I do?

Use the information that appears on your 1099-DIV to complete Form 1040, or your annual income tax return. If the total dividends for the year being reported exceed $1,500, then you also have to file Schedule B (Form 1040), Interest and Ordinary Dividends.

What if I don’t report the dividends on a 1099-DIV on my tax return?

Any Form 1099-DIV you receive contains your taxpayer identification number, meaning the IRS will know about a discrepancy between any 1099-DIV issued to you and what gets reported in your tax return. To avoid paying penalties and interest, make sure the numbers match.

Should I issue a 1099-DIV for dividends from retirement accounts?

Form 1099-DIV should not be issued to report individual retirement accounts (IRAs), money purchase pension plans, profit-sharing plans, and other retirement accounts. Those should be reported on Form 1099-R.