Updated March 20, 2024

A 1099-MISC is a tax form used to report certain payments made by a business or organization. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the IRS using this form. Employee and non-employee compensation are reported separately.

1099-MISC vs. 1099-NEC

Previously, businesses used Form 1099-MISC to report payments made to freelancers, contractors, and other non-employees receiving compensation. As of 2020, non-employee compensation must instead be reported on Form 1099-NEC.

Table of Contents |

What Is It Used For?

If you make certain types of payments in the course of your trade or business, you must issue a 1099-MISC to the payment recipient and file it with the IRS. Common reportable payments include:[1]

- Royalties or broker payments ($10 or more)

- Rents ($600 or more)

- Prizes and awards ($600 or more)

- Payments to a legal services provider ($600 or more)

- Medical or health care payments ($600 or more)

- Direct sales of consumer products for resale outside of a permanent retail establishment ($5,000 or more)

If the business issued a payment outside of employee or non-employee compensation, chances are the payment is reportable on 1099-MISC. See the instructions for more details.

Trade or Business vs. Personal Payments

1099-MISC is for business use only (including for-profit businesses, non-profit organizations, and government agencies). Personal payments are not reportable.[2]

Deadlines

Taxpayers must file one 1099-MISC for each party that received a qualifying payment during the course of the tax year. Issue a copy to each recipient by January 31.

Form 1099-MISC is due to the IRS on February 28 if filed on paper, or March 31 if filed electronically.[3]

How to Fill Out

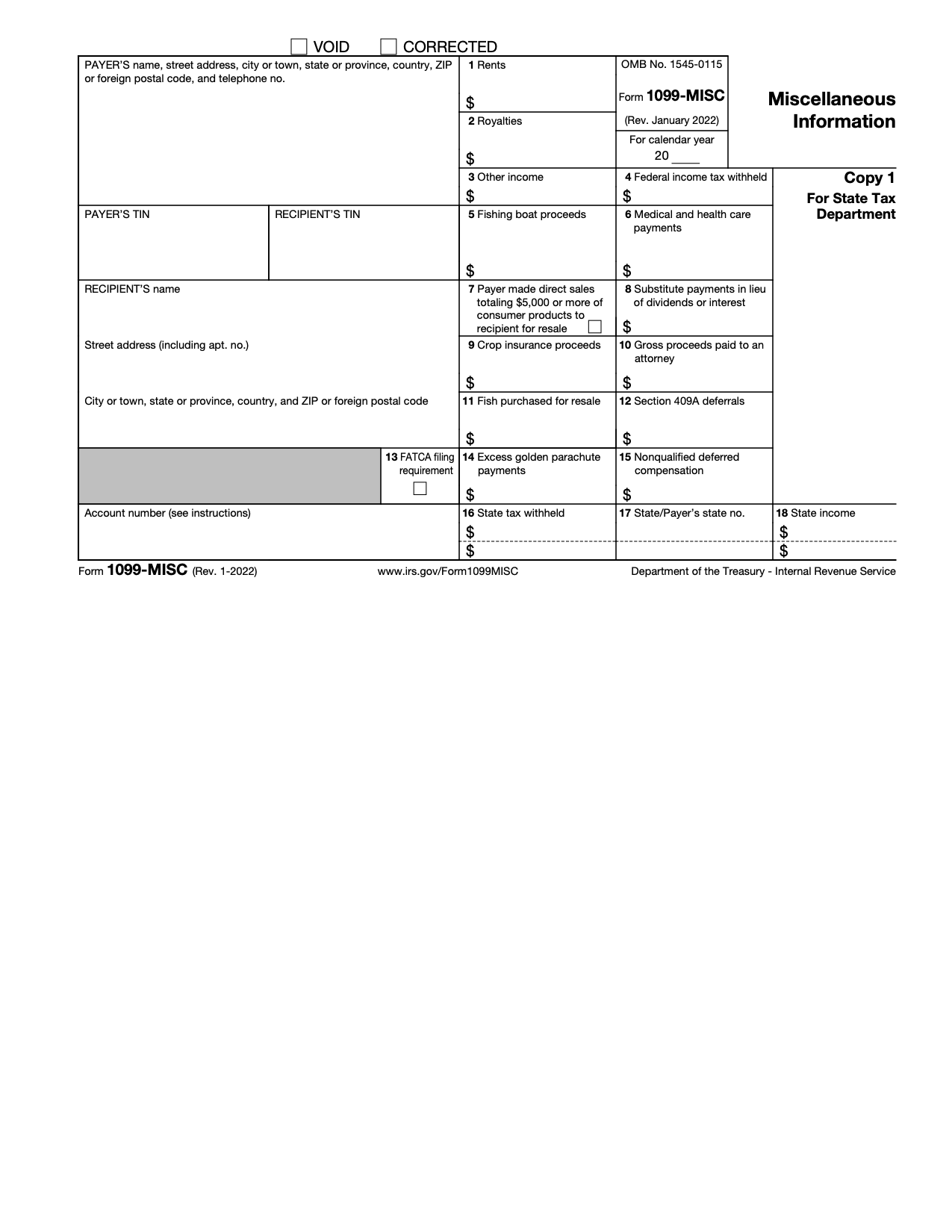

Form 1099-MISC consists of three columns with fields for general information on the left and numbered boxes on the right. The form includes multiple copies: one for the IRS, one for the recipient, one for the payer’s records, and one for the state tax department.

Payer’s Information

Taxpayer Identification Numbers (TIN)

TINs must be provided for the payer and the recipient. It’s important to use the proper formats and hyphen placements:

- Social security numbers and other individual taxpayer identification numbers: XXX-XX-XXXX

- Employer Identification Numbers: XX-XXXXXXX

Recipient’s Information

Account Number

The IRS encourages payers to designate an account number for every 1099-MISC they file. An account number is required if:

- The payer has multiple accounts with one recipient and is filing more than one 1099-MISC for them

- The FATCA Filing Requirement box is checked (see Box 13)

Box 1: Rents

Enter the amount totaling $600 or more you paid in rent for:

- Commercial real estate rentals used for office space (unless paid to a real estate agent or property manager who then pays to the owner; in this case, the agent or property manager must report the payment on their own 1099-MISC)

- Machine rentals, such as construction equipment

- Pasture rentals, such as land used for grazing

Box 2: Royalties

Enter gross royalty payments of $10 or more from properties such as:

- Intangible assets like patents, copyrights, and trademarks

- Royalties paid by a publisher to an author or non-corporation literary agent

- Oil, gas, or other minerals (except surface royalties, which should be entered in box 1)

Box 3: Other Income

Box 4: Federal Income Tax Withheld

Box 5: Fishing Boat Proceeds

Box 6: Medical and Health Care Payments

Box 7: Payer Made Direct Sales

Box 8: Substitute Payments in Lieu of Dividends or Interest

Box 9: Crop Insurance Proceeds

Box 10: Gross Proceeds Paid to an Attorney

Box 11: Fish Purchased for Resale

Box 12: Section 409A Deferrals

Box 13: FATCA Filing Requirement

Box 14: Excess Golden Parachute Payments

Box 15: Nonqualified Deferred Compensation

Boxes 16-18: State Information

How to File

If filing by mail, only submit original copies ordered from the IRS. Do not file forms you printed yourself.[7]

- Collect W-9s from each payment recipient

- Choose filing method (by mail, online, or with third-party software. If filing electronically, skip to step 6.)

- Complete Form 1096 and Copy A on official IRS documents

- Mail Form 1096 and Copy A to the appropriate IRS address

- File Copy 1 with state tax department (see filing portals by state)

- Send Copy B to recipients (printed copies suffice)

- Retain Copy C for your records

FAQs

What is the difference between 1099-MISC and 1099-NEC?

Through the 2019 tax year, 1099-MISC was familiar to freelancers, contractors, and self-employed individuals as the tax form used to report their pay. But in 2020, the IRS introduced the 1099-NEC to create a separate category for non-employee compensation.[9] The 1099-MISC is now reserved for transactions made by businesses that fall outside the category of compensation.

Do lawyers get 1099-MISC or 1099-NEC?

Payments for the services of an attorney must be reported on 1099-NEC. Other payments to an attorney or law firm totaling $600 or more, such as settlement funds, are reported on 1099-MISC.[10]

Why did I get a 1099-MISC?

If you received a 1099-MISC copy from a business or organization that issued you a payment, it means they are complying with the requirement to report that payment to the IRS.

Sources

- About Form 1099-MISC, Miscellaneous Information | IRS

- Instructions — Trade or Business Reporting Only | IRS

- Instructions — Filing Dates | IRS

- Backup Withholding | IRS

- Instructions — Payments to Attorneys | IRS

- Notice 2008-115

- Form 1099-MISC PDF

- Publication 1220

- How to Report Non-Employee Compensation | IRS

- CFR § 1.6045-5 | Cornell Legal Information Institute