Updated November 27, 2023

A 1099-NEC form (non-employee compensation) is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non-employees during a calendar year. The paying party must issue a 1099-NEC if payments during the year exceed $600, and the recipient must use the form to report their income when filing taxes.

Important facts:

- IRS Form W-9: Use to collect information needed for a 1099-NEC.

- Deadline: Must be submitted to recipients and IRS by January 31st.

- Threshold: Only contractors paid $600 or more need a 1099-NEC.

- Filing: Forms can be filed online, by mail if less than 10, or through software.

- Official Copies: If mailing, only file official copies with the IRS (don’t download)

Table of Contents |

Who Gets a 1099-NEC?

1099-NECs are issued to non-employees paid $600 or more in a calendar year. Non-employees are non-W-2 individuals or businesses such as:

- independent contractors

- attorneys

- freelancers

- consultants

- service providers

Previous Versions

Used for the 2021 tax year only.

Download: PDF

*The featured form (2022 version) is the current version for all succeeding years.

1099-NEC vs. 1099-MISC

1099-NECs were first introduced by the IRS for the 2020 tax year. Before 2020, a 1099-MISC was used to report all non-employee compensation in addition to other types of payments, such as royalties and proceeds.[1]

The IRS moved to categorize non-employment income into its own form to make payments easier for taxpayers to report and for the IRS to track.

1099-MISC: Used to report miscellaneous payments like rents, royalties, prizes, fishing boat and crop insurance proceeds, awards, and more.

Deadlines

The deadline to file 1099-NEC with the IRS and send Copy B to the recipient is January 31st of every year. If the deadline falls on a weekend, the deadline to send to the IRS is extended to the next business day.[2]

2024 Deadline

January 31, 2024 (IRS and recipient)

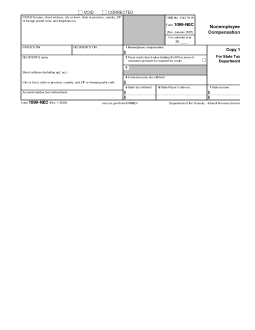

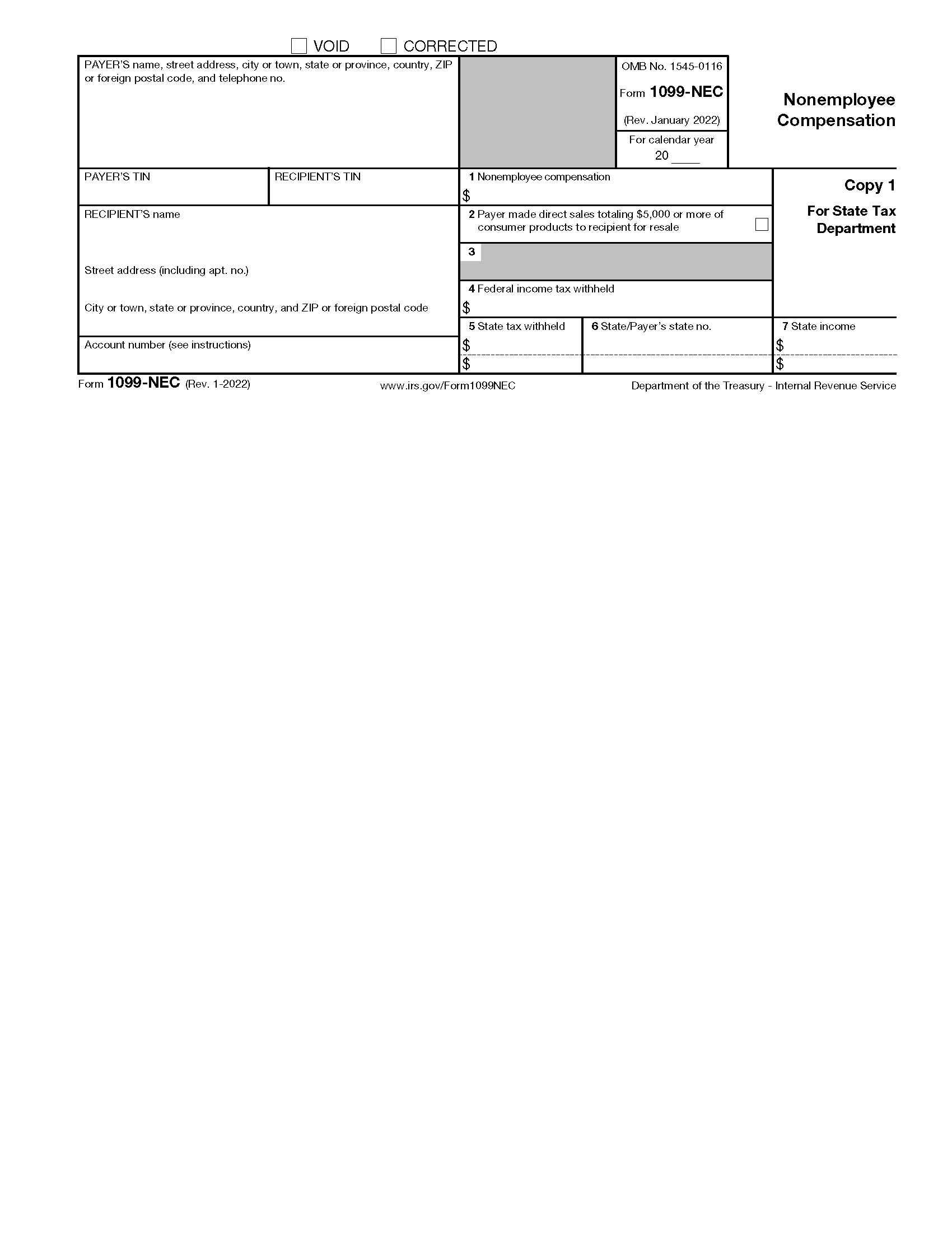

Form Parts (14)

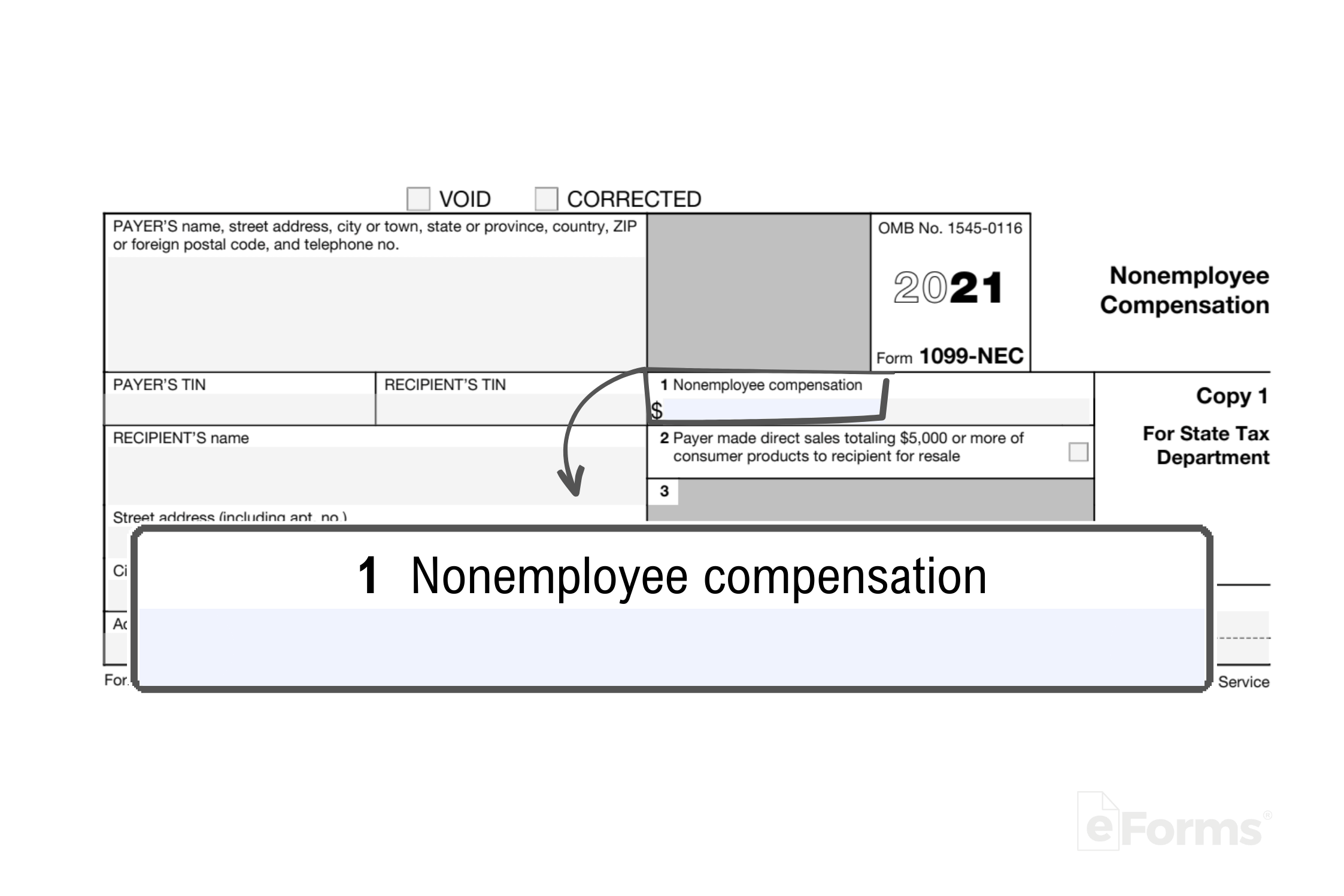

1. Nonemployee Compensation

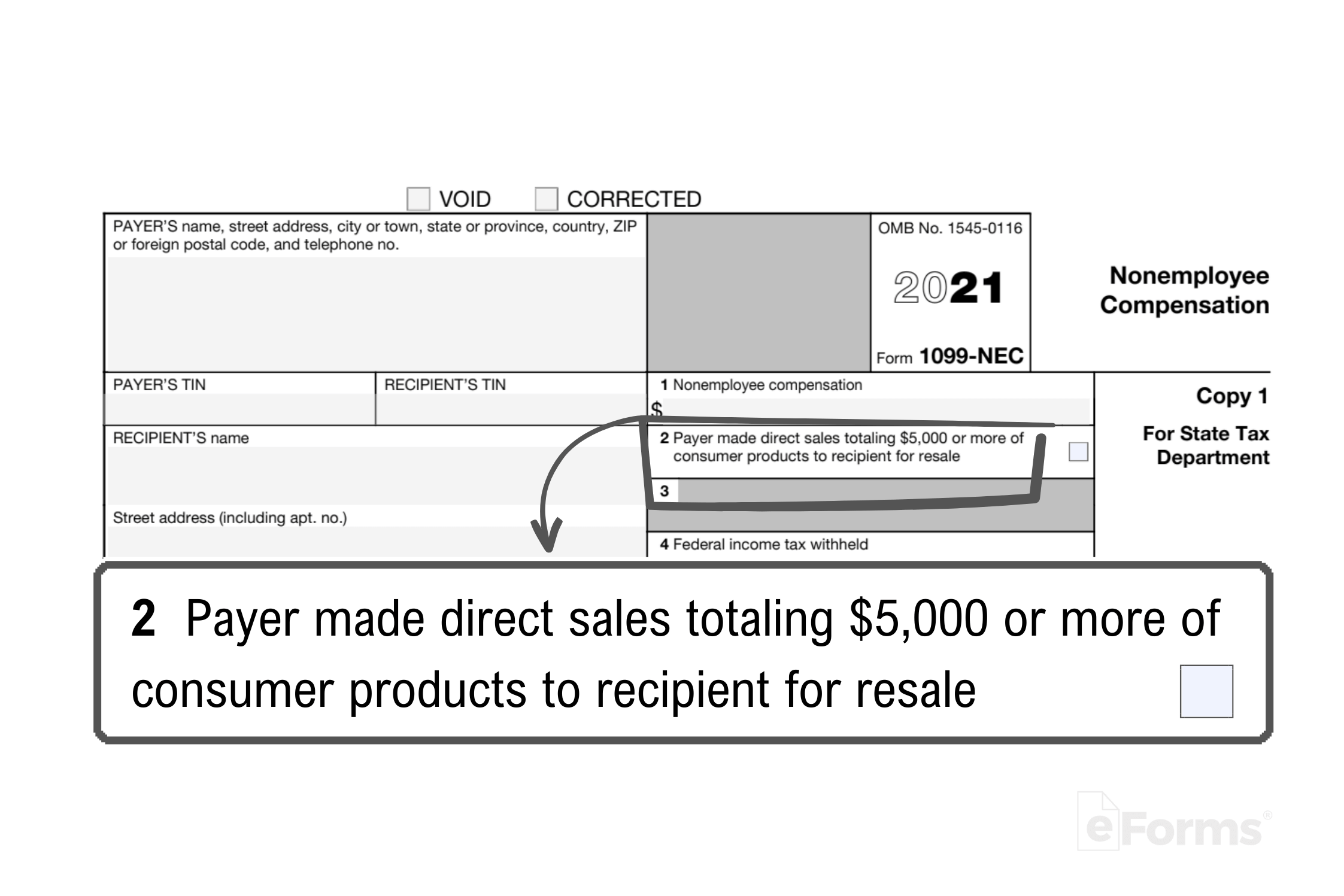

2. Consumer Products

The IRS asks if any consumer products was sold to someone on a commission basis for resale. For box 2, do the following:

- Check the box with an “X” if you sold consumer products to someone on a commission basis (i.e., buy-sell, deposit-commission, or similar) for resale.

- Only check this box if the total sales you made in this manner to that person amounted to $5,000 or more during the tax year.

- Do not enter a specific dollar amount in this box. Just mark it with an “X” if the conditions above apply.[3]

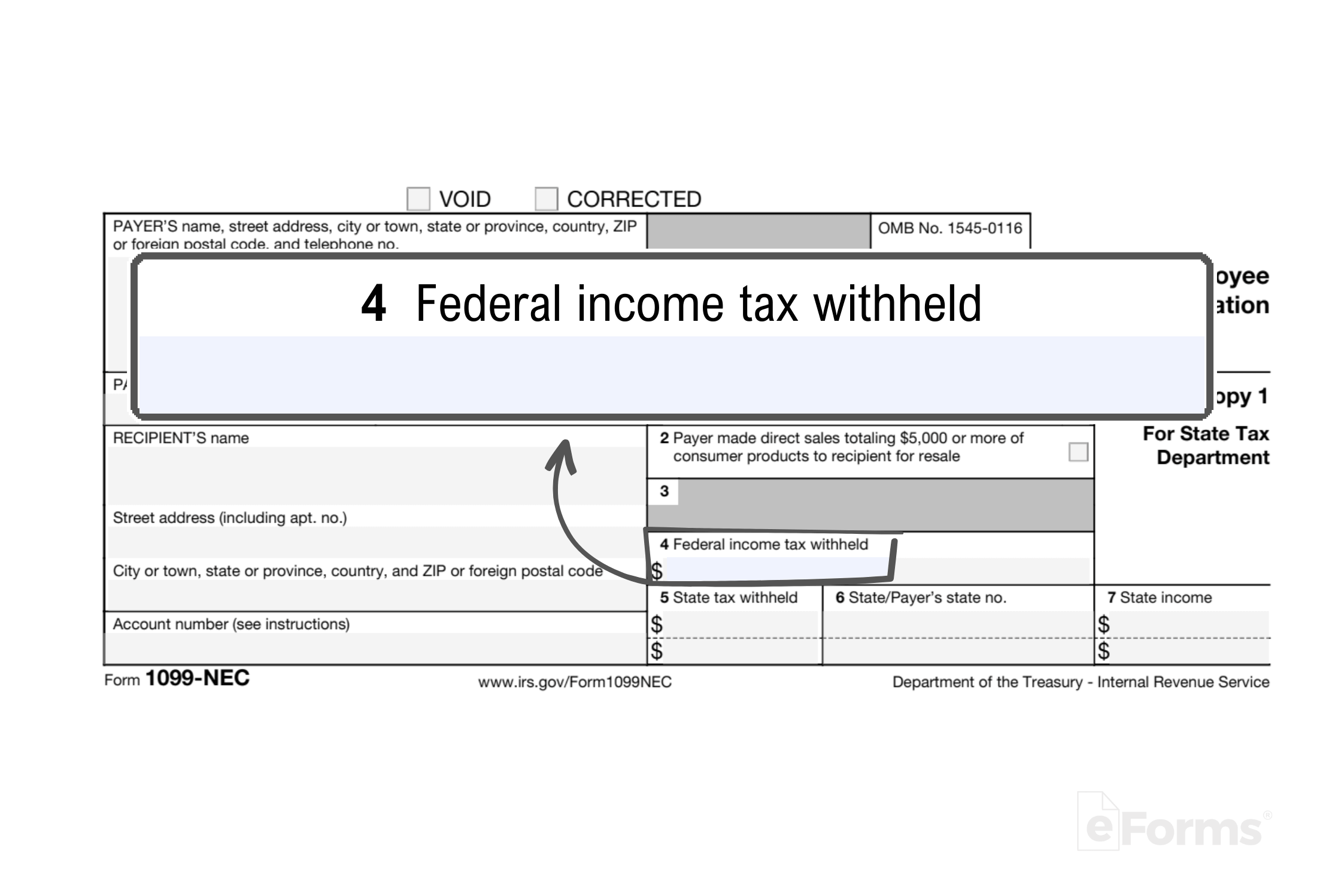

4. Federal Income Tax Withheld

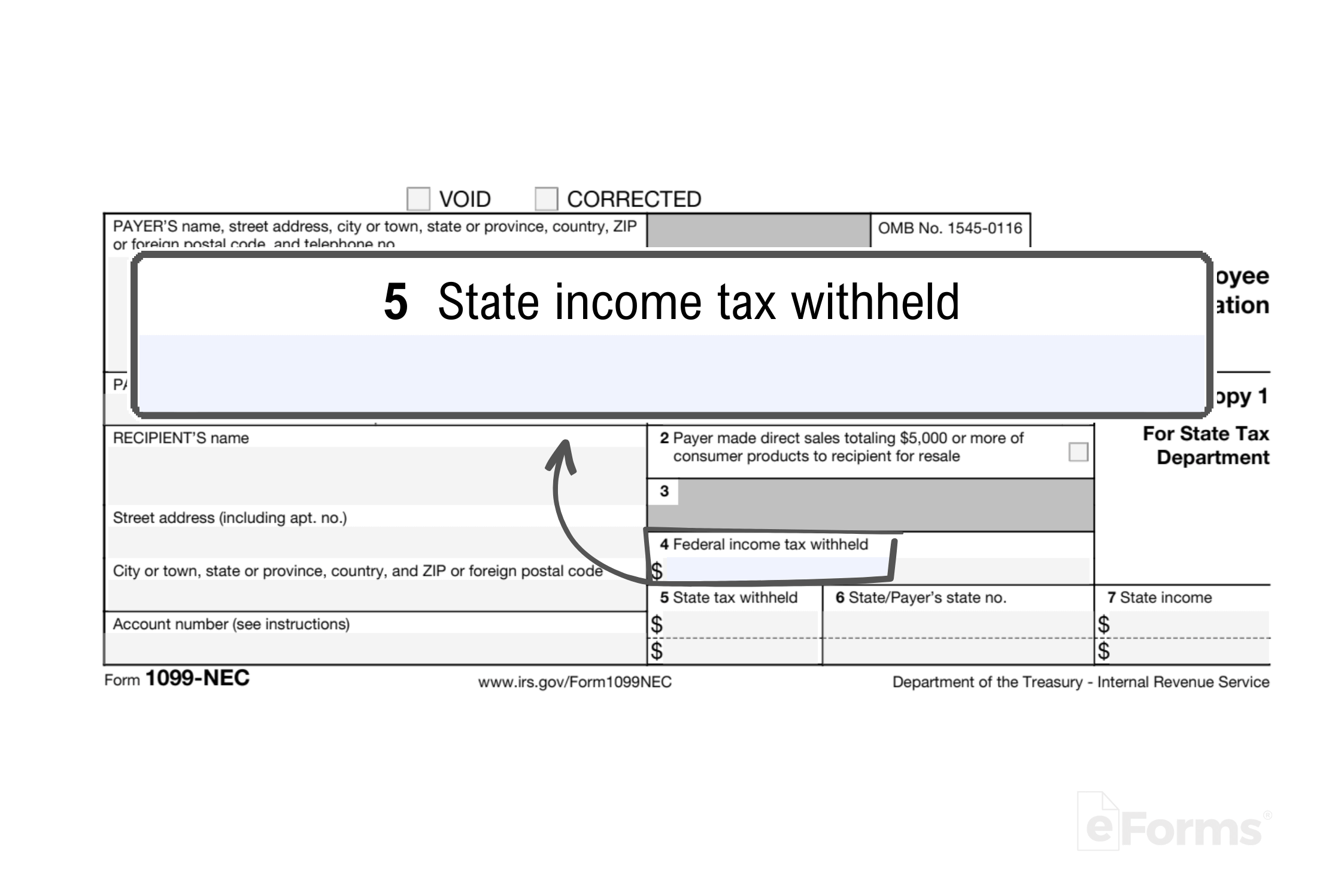

5. State Income Tax Withheld

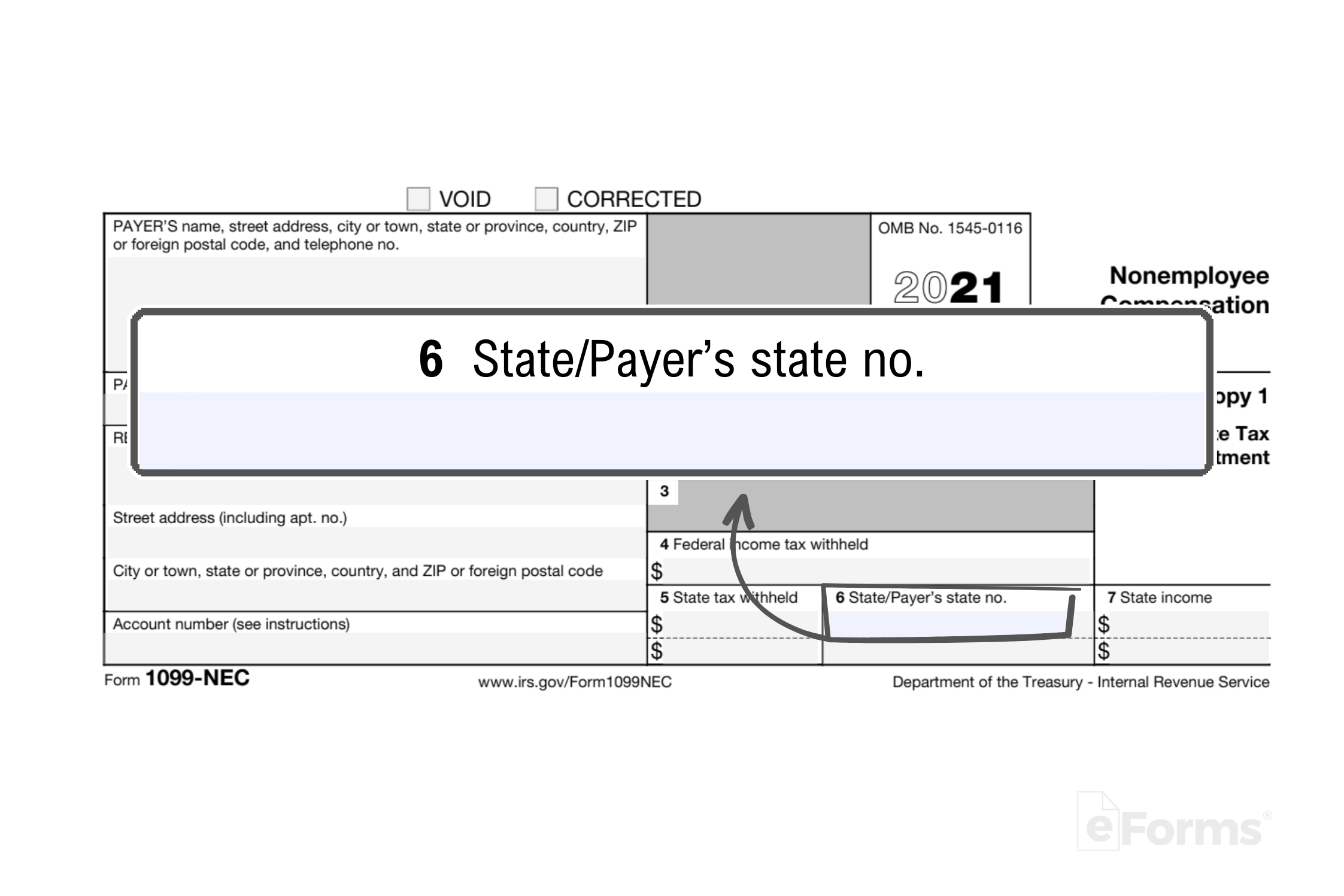

6. State/Payer’s State No

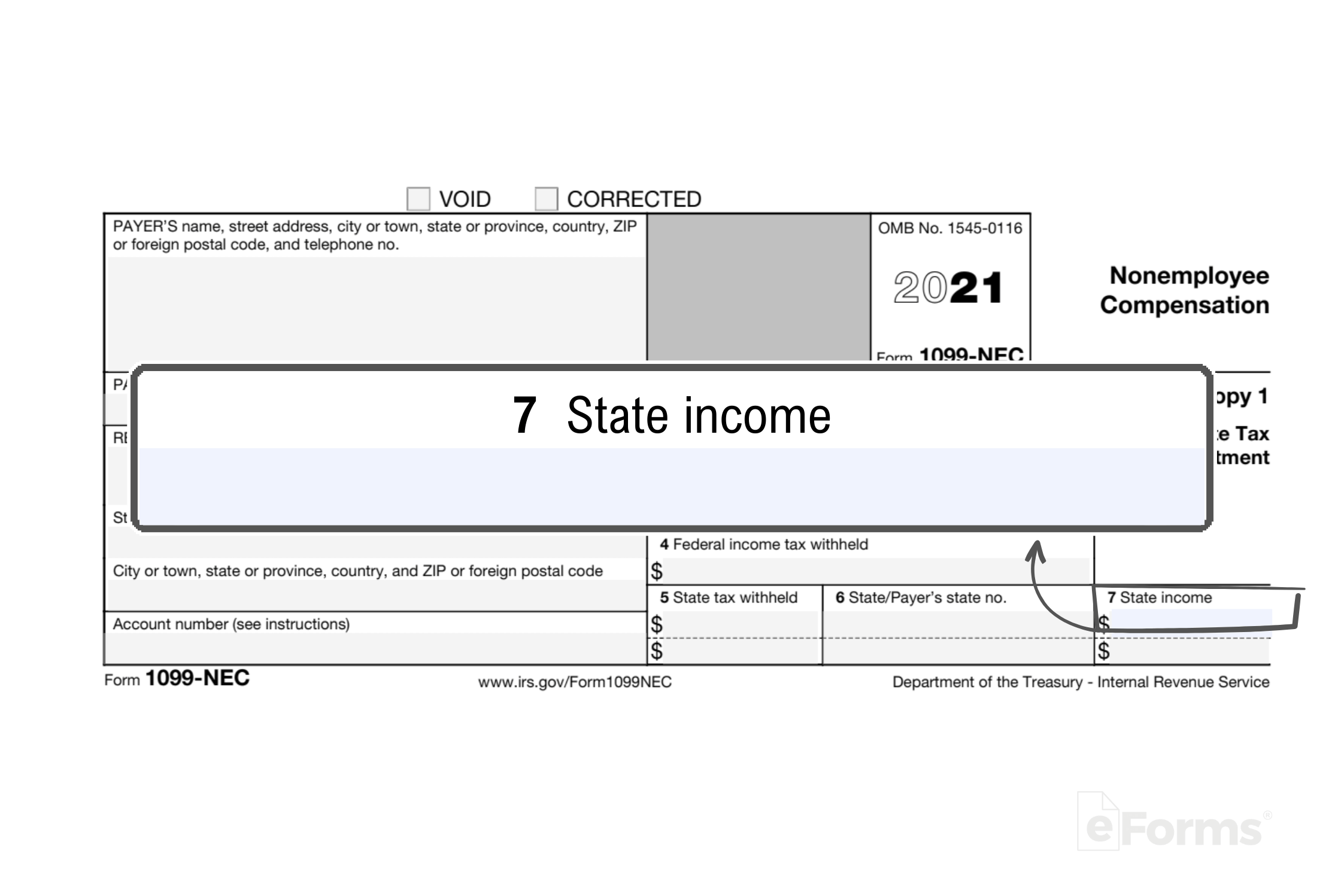

7. State Income

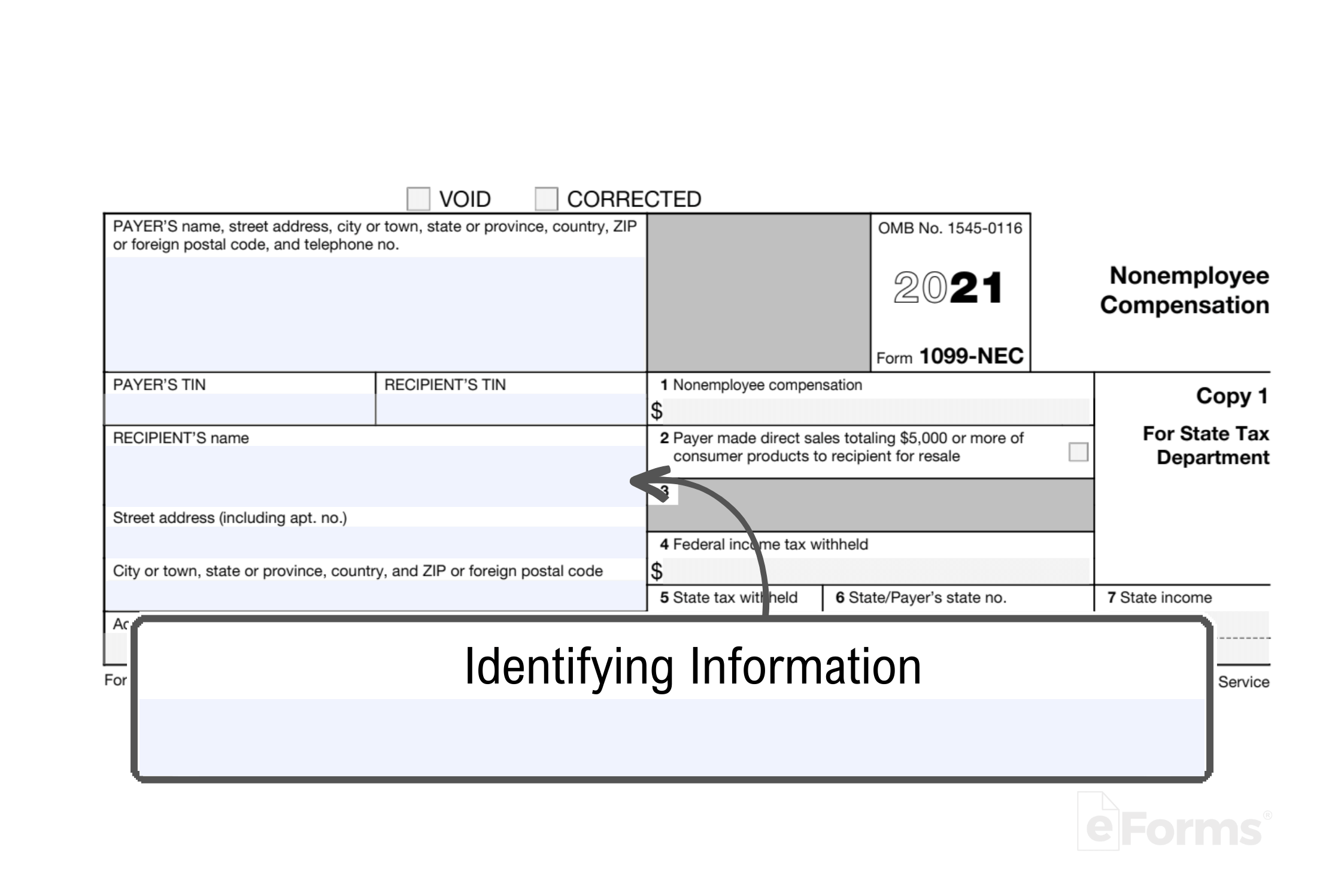

8. Identifying Information (6 entries)

On the left side of the 1099-NEC, a total of 6 boxes require information that identifies the payer and recipient, including:

- Payer information – name, full address, and phone number

- Payer’s TIN – taxpayer identification number

- Recipient’s TIN – normally an SSN/ITIN or EIN

- Recipient’s name – full name

- Recipient’s street address – number and street only

- Recipient’s remaining address – city/town, state/province, country, Zip/postal code

The recipient’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format.[5]

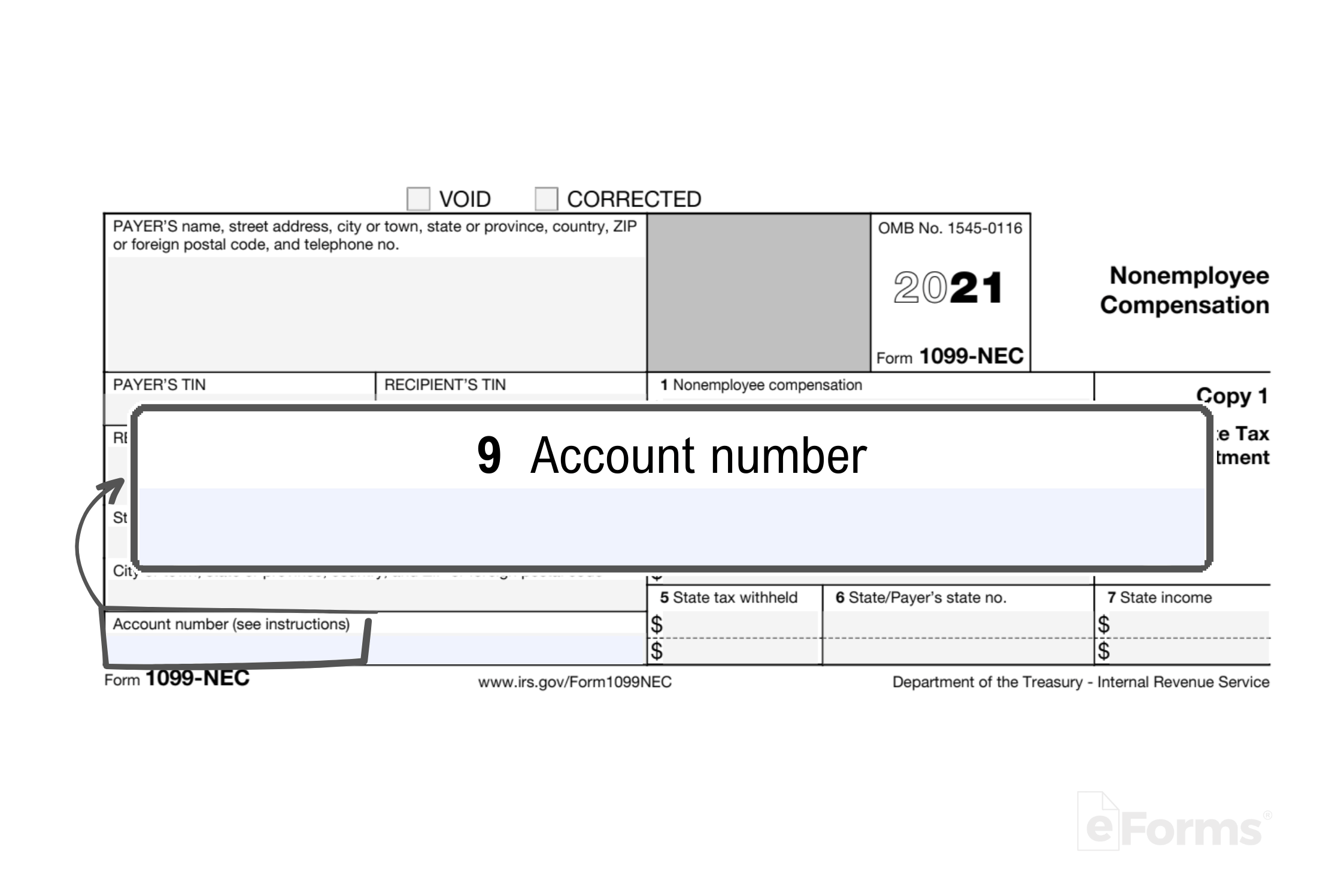

9. Account Number

The account number field is generally provided for the payer’s reference and for internal recordkeeping. It is required if there are multiple accounts for a recipient who is receiving more than one 1099. Some reasons an account number would be used are:

- Multiple accounts – If payments are made to a payee for multiple service types or from different accounts in a company, an account number helps separate payments.

- Vendor identification – Some businesses use account numbers to identify their vendors in accounting/payment systems to maintain consistency

Most of the time, an account number will not be entered. If there is no account number, leave the field blank.[6]

10. 2nd TIN Notice

Instructions (7 Steps)

1. Collect W9

In order to have to correct information to file the 1099-NEC, the payer must first collect a W9 form from the service provider. The W9 provides information needed to fill out the form, such as:

- Name/business name

- Mailing address

- SSN/ITIN or EIN

2. Determine Who Needs a 1099-NEC

3. Obtain Forms

Forms can be obtained or filled out in the following ways:

- Ordering copies from the IRS

- Participating in the IRS’s IRIS eFile program

- Using software to auto-submit

If you’re submitting more than ten 1099 forms, they must be submitted electronically, whether through the IRIS program or another eFile provider.

4. Copy A – IRS

If filing by paper, Copy A, along with IRS Transmittal Form 1096, must be filed with the IRS. Both forms must be official versions printed by the IRS. Do not use printed pdf copies for IRS filing.[8] You may, however, use printed PDF copies to notify recipients and for your own records (Copy B and C).

The deadline for paper filing is January 31st. The mailing address for the 2023 tax year for Form 1099-NEC will depend on the home state of the filer.

5. Copy B – Recipient

6. Copy C – Keep

7. Copy 1 – State

Some states require a Copy 1 of 1099-NEC. Certain states are in CF/SF, the Combined Federal / State Filing program, and are automatically forwarded 1099s when submitted to the IRS.

The states currently in the CF/SF program are: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, and Wisconsin.[9]

States where no 1099-NEC is required to be filed: Alaska, Florida, Illinois, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming.

If you live in a different state than those mentioned, you should review the Quickbooks state-by-state 1099 filing portal list.

Frequently Asked Questions (FAQs)

What do I do if I receive a 1099 and I’m not self-employed?

If you receive a 1099-NEC and you’re not self-employed, it’s important to contact the payer. The payer must take the appropriate steps to void the 1099-NEC and issue the correct form. If the payer refuses to do so, the payee can contact the IRS at 1-800-829-1040.

How do I CORRECT a 1099-NEC?

- Mark the new 1099-NEC as Corrected.

- Enter the correct information if the 1099 is being corrected. If the 1099-NEC was submitted by mistake and the contractor received no payments, enter all zeroes.

- Submit the corrected 1099-NEC to the IRS.

Do you need to withhold taxes for contractors?

Taxes for payments to contractors and non-employees are responsible for being paid to federal and state agencies by the contractors, not by the issuing individual or business.

Are there different versions every year?

1099-NECs are entirely new forms introduced by the IRS in 2021. As such, there are only two versions in existence:

- 2021: for tax year 2021 only

- January 2022 revision: For tax year 2022 and all thereafter

Sources

- IRS – 1099-NEC Introduction and Redesigned 1099-MISC

- IRS – 1099-NEC Filing Deadlines

- IRS – Consumer Products Box Instructions

- IRS – State Boxes

- IRS – Recipient TIN Format

- IRS – Account Number

- IRS – 2nd TIN Notice

- IRS – “Information Only” Forms

- IRS – Publication 1220