Updated February 05, 2024

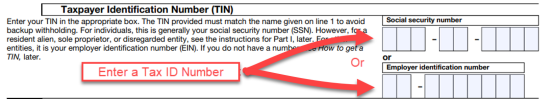

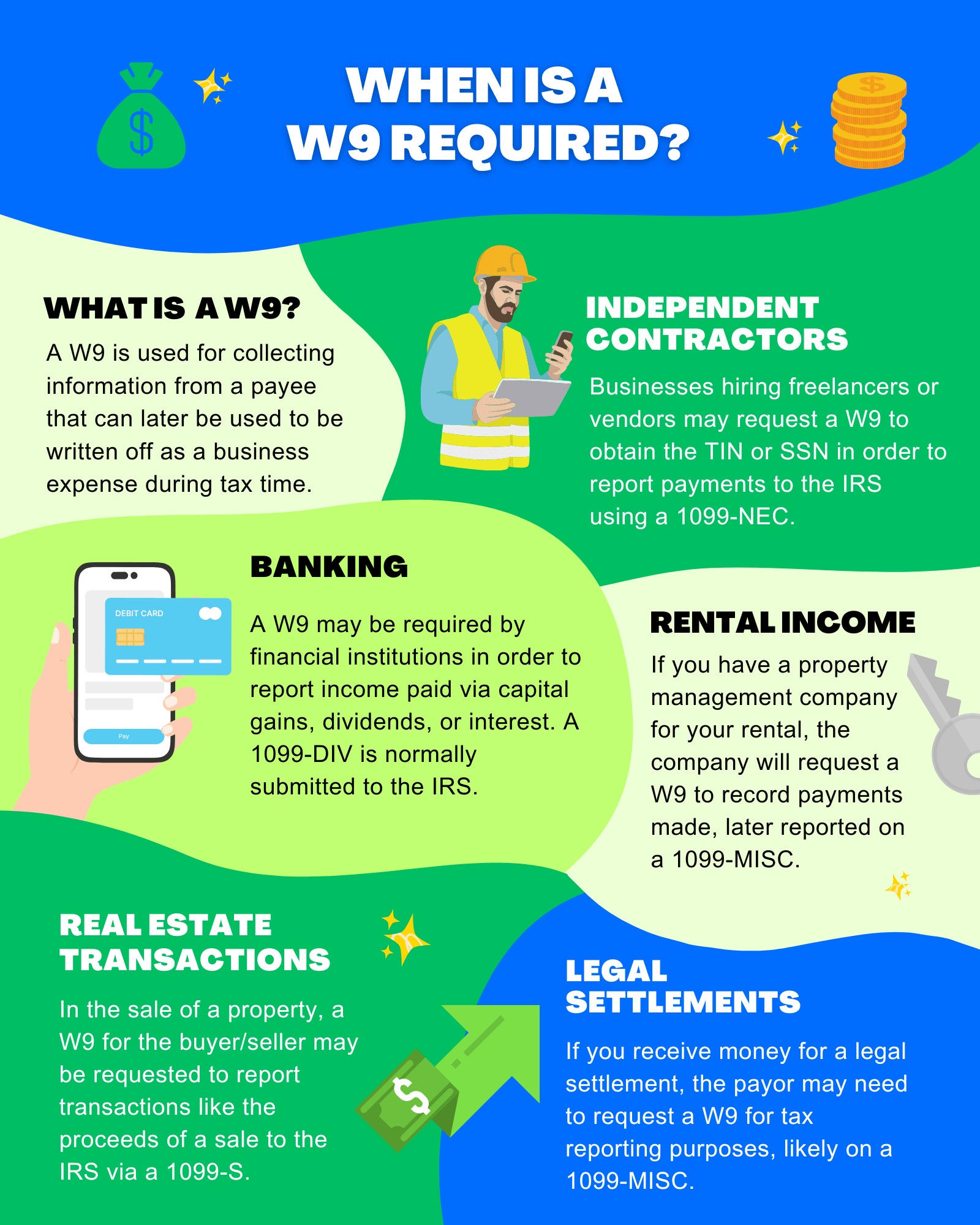

An IRS form W-9, or “Request for Taxpayer Identification Number and Certification,” is a document used to obtain the legal name and tax identification number (TIN) of an individual or business entity. It is commonly required when making a payment and withholding taxes are not being deducted.

Keep for 4 Years

A W-9 is not filed with the IRS. It is held for documentation purposes and should be kept for 4 years.[1]

How it Works (5 steps)

- Hire. Hire a non-employee to perform services.

- Request W-9. Request a W-9 to be completed by the non-employee.

- Pay. After receiving a completed and signed W-9, payment is made.

- $600 limit. If paid $600 or more per tax year, prepare 1099-NEC.

- IRS Filing. File 1099-NEC with the IRS and send a copy to the non-employee before Jan 31.

Table of Contents |

When is a W-9 Required?

A W-9 must be collected if payment is being made and withholding taxes are not being deducted. Under IRS law,[2] an employer making payments for wages is responsible for collecting withholdings from employees.

After completion and signing, a W-9 requires a payment recipient to be responsible for the tax liability incurred when accepting a payment.

W-9 Common Uses

- Independent Contractors: Businesses hiring freelancers or vendors may request a W-9 to obtain the TIN or SSN to report payments to the IRS using a 1099-NEC.

- Banking: A W-9 may be required by financial institutions to report income paid via capital gains, dividends, or interest. A 1099-DIV is normally submitted to the IRS.

- Rental Income: If you have a property management company for your rental, the company will request a W-9 to record payments made, later reported on a 1099-MISC.

- Real Estate Transactions: In the sale of a property, a W-9 for the buyer/seller may be requested to report transactions like the sale proceeds to the IRS via a 1099-S.

- Legal Settlements: If you receive money for a legal settlement, the payor may need to request a W-9 for tax reporting purposes, likely on a 1099-MISC.

When a W-9 is NOT Required

- Employees: Employee-employer relationships require information about tax withholding that is completed through a Form W-4.

- Personal Payments: Payments to friends or reimbursing someone for personal services do not usually require reporting of payments.[3]

- Tax-Exempt Organizations: Payments made to charities or qualified nonprofits typically do not require a W-9.[4]

- Under IRS Threshold: The IRS reporting threshold is different in some areas. Most commonly, businesses paying for services do not need to collect a W-9 or report income under $600.[5]

How to Fill Out a W-9 (3 parts)

- Download: PDF

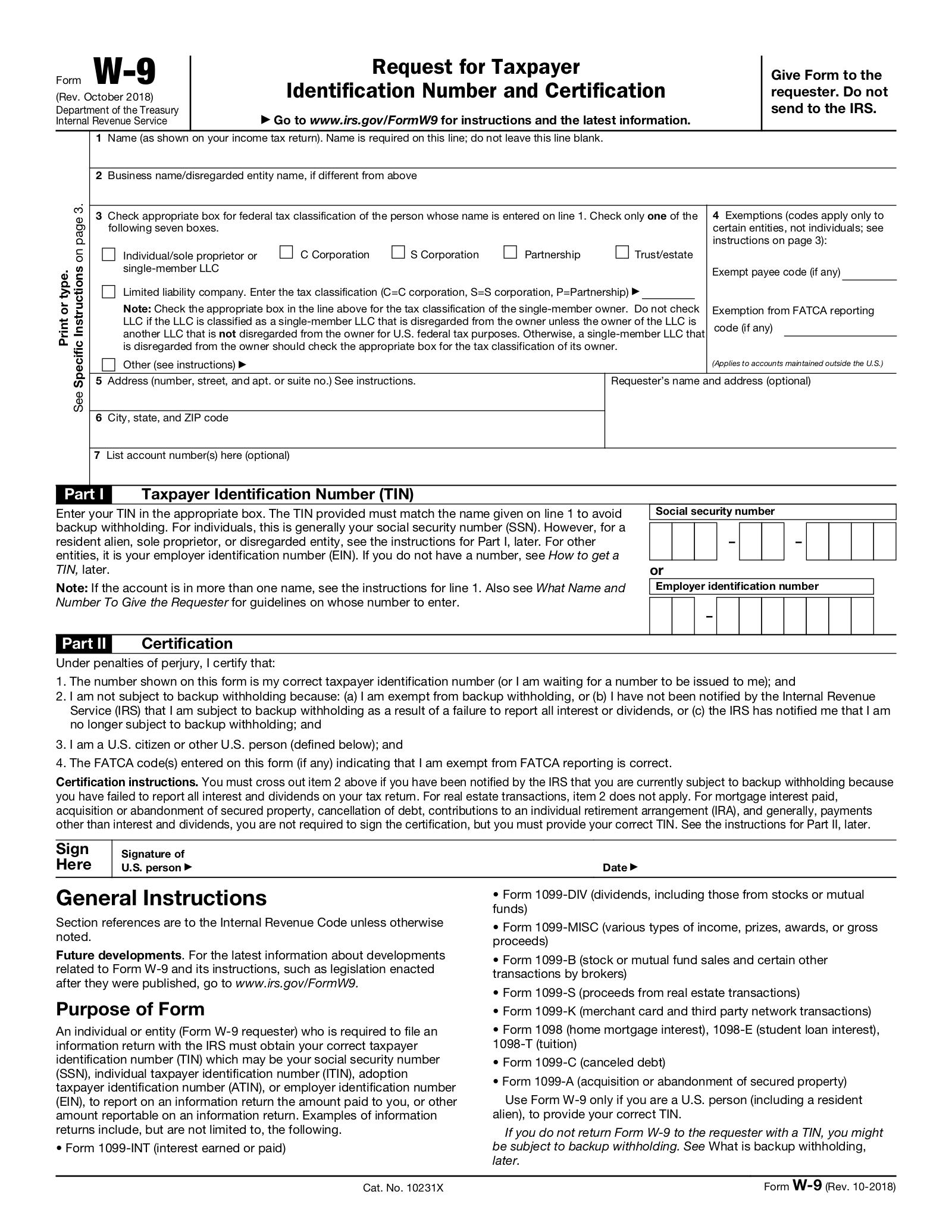

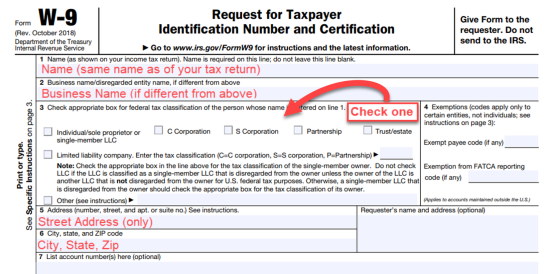

Part 1 – Identifying Information

Line 2. Business name/Disregarded entity name (if different from line 1)

Line 3. Choose tax classification.

-

- Individual/sole proprietor/single-member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/estate

- Limited liability company (LLC) and choose how it is taxed:

- C=C corporation

- S=S corporation

- P=Partnership

- Other

Line 5. Street Address (only)

Line 6. City, State, and Zip Code

Frequently Asked Questions (6)

- What is the penalty for not collecting a W-9?

- Can a W-9 be signed electronically?

- What happens if a contractor refuses to provide a W-9?

- What if a W-9 is incorrect?

- Does the IRS update Form W-9 each year?

- What happens if a W-9 is NOT collected?

1. What is the penalty for not collecting a W-9?

2. Can a W-9 be signed electronically?

3. What happens if a contractor refuses to provide a W-9?

Refusing to provide a W-9 creates compliance issues and must be handled by either:

- Backup Withholding: Invalid TINs or refusal to provide a W9 require the payor to initiate backup withholding, whereby 24% of the contractor’s payment is withheld and paid to the IRS by the payor.[8]

- Termination: The payor may terminate or suspend the vendor’s or independent contractor’s services.

4. What if a W-9 is incorrect?

6. What happens if a W-9 is NOT collected?

What is a W-9? (Video)

Sources

- www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

- 26 U.S. Code § 3402(a)(1)

- https://www.taxpayeradvocate.irs.gov/news/tas-tax-tip-use-caution-when-paying-or-receiving-payments-from-friends-or-family-members-using-cash-payment-apps/

- https://www.irs.gov/pub/irs-pdf/iw9.pdf

- https://www.irs.gov/businesses/small-businesses-self-employed/reporting-payments-to-independent-contractors

- 26 U.S. Code § 6723

- https://www.irs.gov/pub/irs-drop/a-98-27.pdf

- https://www.irs.gov/businesses/small-businesses-self-employed/backup-withholding

- https://www.irs.gov/pub/irs-pdf/p1586.pdf

- https://www.irs.gov/payments/information-return-penalties