Updated March 13, 2024

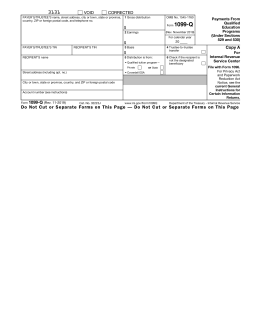

An IRS form 1099-Q (Payments From Qualified Education Programs) is a tax document sent to individuals who receive distributions from a qualified education program, such as the state-run qualified tuition program or the Coverdell education savings account. These programs allow designated funds to grow tax-exempt as long as they are used for the beneficiary’s qualified education expenses.

What is a Qualified Education Program?

A qualified education program (under Sections 529 and 530) allows individuals to contribute funding into a tax-advantaged account for the future educational use of a designated beneficiary.

Table of Contents |

Who Receives a 1099-Q?

Anyone who receives a distribution from a Coverdell education savings account (Coverdell ESA) or a qualified tuition program (QTP) will receive a 1099-Q. The recipient may be the designated beneficiary if the distributions are made directly to them. If the account holder receives distributions on behalf of the beneficiary, they should be listed as the recipient.

Coverdell ESA vs. Qualified Tuition Program

A Coverdell education savings account (Coverdell ESA) is a trust or custodial account that allows an individual to contribute funds for the qualified education expenses for the designated beneficiary. When the account is established, the designated beneficiary must be under the age of 18 or have special needs.[1]

A qualified tuition program (QTP), also known to as a 529 plan, is a state-run program that allows an individual to prepay a beneficiary’s qualified higher education expenses at an eligible educational institution or to contribute to an account for paying those expenses.[2]

Qualified Education Expenses

An individual who receives the 1099-Q is only required to report it on their tax return if any part of the distributed fund is used for anything other than qualified education expenses.

Qualified education expenses include:[3]

- Tuition and fees for college, university, vocational/trade school, elementary or secondary school

- Books, supplies, and equipment

- Computer equipment and software

- Special needs services

- Room and board for students enrolled at least half-time

Note: While the QTP only covers tuition for elementary and secondary school, Coverdell ESA counts all associated elementary and secondary school costs as qualified education expenses.[4]

Deadlines

The 1099-Q must be submitted to the IRS by February 28, 2024 if filing by paper. If filing electronically, the deadline to file is March 31, 2024.[5]

A copy of the document must also be sent to the recipient by January 31, 2024.

Form Parts (9)

Payer’s info (TIN, address)

For QTP: Enter the name and the Employer Identification Number (EIN) of the QTP. For a program that uses the EIN of the state, enter the name of the state on the first name line and the name of the program on the second name line.

For Coverdell ESA: Enter the name and EIN of the trustee.

Recipient’s info (TIN, address)

For QTP: List the designated beneficiary as the recipient if the distribution is made directly to them or to the school. Otherwise, list the account owner as the recipient. Enter the TIN and address of the recipient.

For Coverdell ESA: Enter the name and TIN of the designated beneficiary as the recipient.

Account Number

The account number is required if the recipient has more than one account for which a 1099-Q is filed.

Box 1. Gross Distribution

This field indicates the total amount distributed to the recipient in the tax year. This includes amounts for tuition credits or certificates, payment vouchers, tuition waivers, as well as refunds to the account owner or the designated beneficiary, or to the beneficiary upon death or disability.

If earnings and basis are not reported for Coverdell ESA distributions, leave boxes 2 and 3 blank. Do not enter zero.

Box 2. Earnings

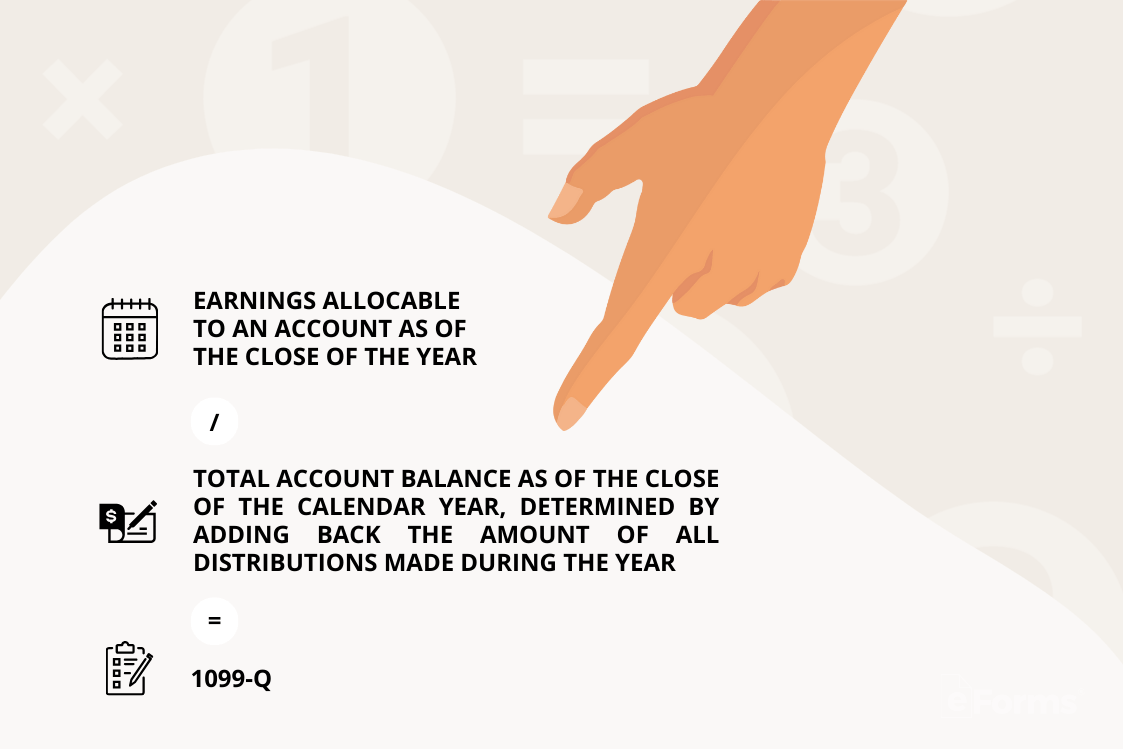

To determine the earnings (or loss) on the gross distribution reported in Box 1, use the earnings ratio.[6]

Per the IRS, the earnings ratio is equal to the earnings allocable to an account as of the close of the year divided by the total account balance as of the close of the calendar year, determined by adding back the amount of all distributions made during the year.

Enter the earnings in box 2. If there is a loss and this is not the final year for distributions, or there are no earnings, enter zero in Box 2. Enter a loss in Box 2 only if this is the final year for distributions from the account.

If the amount in box 2 includes earnings on excess contributions, enter distribution code 2 or 3 (as applicable) in the box below Boxes 5 and 6.[8]

For Coverdell ESAs:

If you are reporting earnings on a distribution of excess contributions, use the legal method of determining the net income attributable to IRA contributions that are distributed as a returned contribution.[7]

If you are reporting a distribution from a Coverdell ESA that includes a returned contribution plus earnings, you should file two Forms 1099-Q, one to report the returned contribution plus earnings, and the other to report the distribution.

Box 3. Basis

Enter the basis included in the gross distribution reported in Box 1. Subtract the amount in Box 2 from the amount in Box 1 to determine the basis. The value for the basis cannot be less than 0.

Box 4. Trustee-to-Trustee Transfer Checkbox

Check this box if the distribution was made directly (trustee-to-trustee transfer) from one QTP to another, or from a QTP to an ABLE account. For a Coverdell ESA, check this box if the distribution was made directly to another Coverdell ESA or to a QTP.

Box 5. Checkbox

Check the “Private” box if the distribution is from a QTP established by one or more private eligible educational institutions, or check the “State” box if the distribution is from a QTP established by a state. Otherwise, check the “Coverdell ESA” box.

Box 6. Designated Beneficiary Checkbox

Check the box if the recipient is not the designated beneficiary under a QTP or a Coverdell ESA.[9]

How to File (5 steps)

- Collect a W-9 from the recipient.

- Complete the fillable 1099-Q on the IRS website.

- File Copy A with the IRS electronically or on paper.*

- Send Copy B to the recipient.

- Keep Copy C for your own records.

*If paper filing the 1099-Q, submit it along with a completed Form 1096.

Frequently Asked Questions (FAQs)

Do I need to report 1099-Q?

You only need to report the information from a 1099-Q if you are the recipient of the distribution and any amount was used for purposes outside of qualified education expenses.

Who reports 1099-Q: parent or student?

It depends. The 1099-Q must be reported by the recipient of the distribution. If the student (beneficiary) directly receives the funds, they are responsible for reporting the 1099-Q on their tax return. If the parent is the recipient on the student’s behalf, they must report it on their 1099-Q.

Who files 1099-Q?

For Coverdell ESA, the trustee of the account must file 1099-Q to report the distributions made from the account.

For QTPs, the designated officer or employee in charge of the program established by a state or eligible educational institution must file the 1099-Q.[10]

Sources

- IRS – Topic No. 310, Coverdell Education Savings Accounts

- IRS – Topic No. 313, Qualified Tuition Programs (QTPs)

- 26 U.S. Code § 529

- 26 U.S. Code § 530

- IRS – General Instructions for Certain Information Returns (2023) (C. When to File)

- Internal Revenue Bulletin No. 2001–81

- 26 CFR § 1.408-11

- IRS Notice 2003-53

- 26 U.S. Code § 529(e)(1)

- IRS – Instructions for Form 1099-Q (11/2019) — Specific Instructions