Updated February 26, 2024

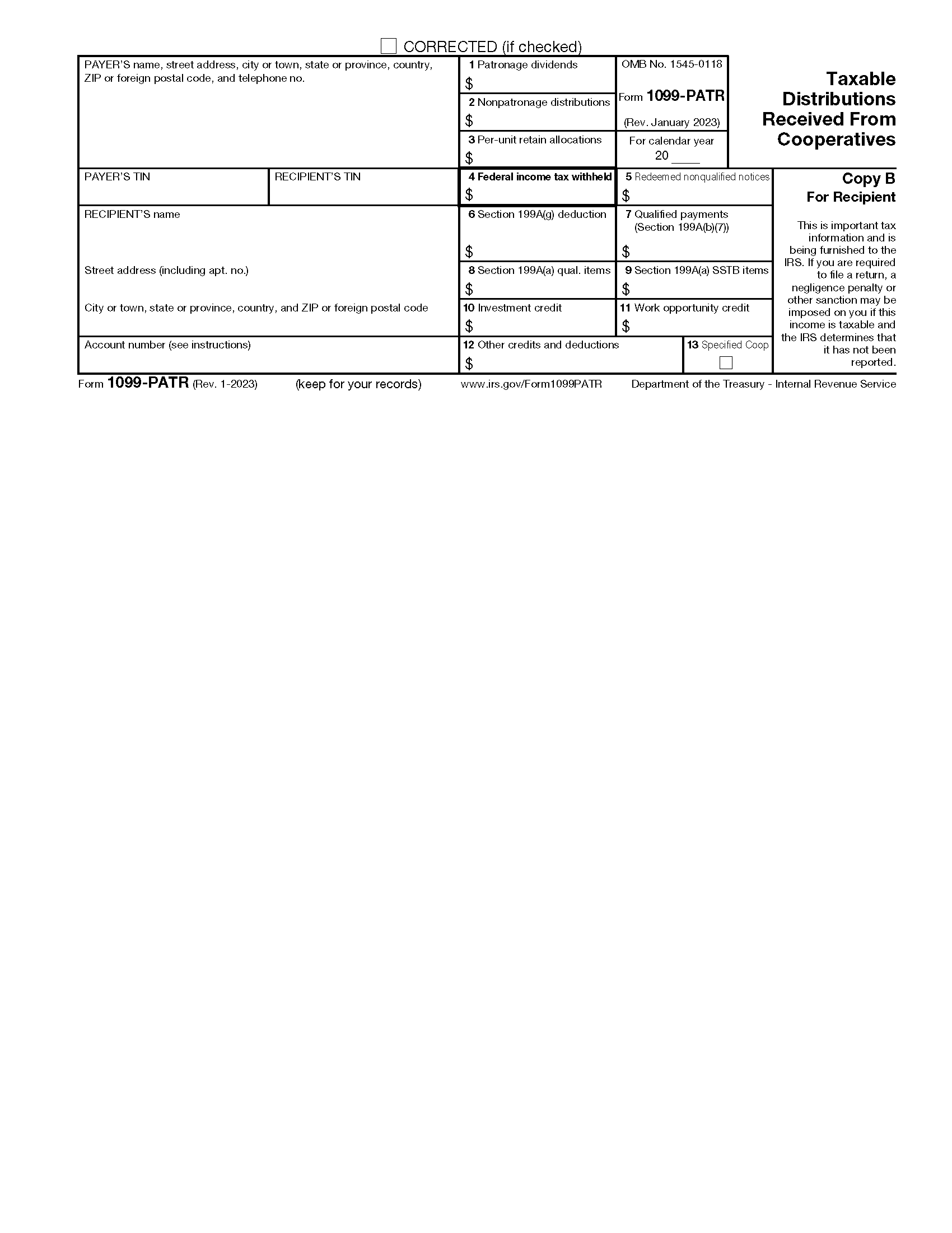

A 1099-PATR is an IRS tax document used to report distributions received from a cooperative. A cooperative is required to file Form 1099-PATR for each person to whom it has paid at least $10 in patronage dividends or other taxable distributions, or from whom it has withheld any federal income tax.

What is a Patronage Dividend?

A patronage dividend is a distribution in the form of money, allocations, or property, that a cooperative pays its members or investors based on its net earnings.

Table of Contents |

Who Gets a 1099-PATR?

Any person who receives at least $10 in patronage dividends from a cooperative must be furnished with a copy of Form 1099-PATR by that cooperative.[1] Anyone from whom a cooperative has withheld federal income tax under the backup withholding rules will also receive 1099-PATR, regardless of the amount of the payment.[2]

Generally, you are not required to file Form 1099-PATR for payments made to a corporation, a tax-exempt organization or trust, the United States, a state, or the District of Columbia.[3]

Exemption

A cooperative that primarily sells goods or services for the personal, living, or family use of members can apply for an exemption from filing Form 1099-PATR. If approved, this exemption begins on the date of the first payment made during the year of approval, and it ends after the cooperative no longer meets the qualifications for exemption.[4]

Deadlines

The deadline to file Form 1099-PATR with the IRS is February 28 of the following year, or March 31 if filing electronically. If the deadline falls on a weekend or federal holiday, the deadline to file is extended to the next business day. However, the filer must furnish Copy B to the account holder or beneficiary on or before January 31.[5]

2024 Deadlines

- January 31, 2024 (recipient)

- February 28, 2024 (IRS–Filing by Paper)

- March 31, 2024 (IRS–Filing Electronically)

Form Parts (16)

1. Patronage Dividends

Enter the patron’s share of total patronage dividends paid in any of the following ways:[6]

- Cash (including qualified or “consent” checks)

- Qualified written notices of allocation (taken at their face amount)

- Other property (excluding nonqualified written notices of allocation)

2. Nonpatronage Distributions

Enter the patron’s share of the total amount paid on a patronage basis with respect to the cooperative’s earnings from business done with the United States or a U.S. government agency, or to earnings derived from certain other nonpatronage sources. This only applies to qualifying farmers’ cooperatives that receive special tax treatment.[7]

Redemptions of nonqualified written notices of allocation that were paid on a patronage basis with respect to the cooperative’s earnings from nonpatronage sources should also be reported in box 2.

3. Per-Unit Retain Allocations

Enter the patron’s share of the total per-unit retain allocations paid in cash, qualified written notices of allocation, qualified per-unit retain certificates, or other property.[8] Do not include any nonqualified per-unit retain certificates.

4. Federal Income Tax Withheld

Enter any backup withholding on the patronage payments reported in boxes 1, 2, 3, and 5. Withholding on these payments is required for any patron who has not provided their TIN in the required manner.[9]

5. Redeemed Nonqualified Notices

Enter the amount of redeemed nonqualified written notices of allocation that were paid as a patronage dividend, as well as the amount of redeemed nonqualified per-unit retain certificates that were paid as a per-unit retain allocation.

6. Section 199A(g) Deduction

In this box, enter the patron’s share of the amount of section 199A(g) deduction claimed by the cooperative and passed through to the patron. This amount must have been designated in a written notice sent to the patron within the payment period.[10]

Do not reduce the amounts reported in box 1 or 3 by the amount entered in box 6. If yours is not an agricultural or horticultural cooperative eligible for the section 199A(g) deduction, leave this box blank.

7. Qualified Payments

For specified agricultural and horticultural cooperatives, enter the qualified payments paid to the patron. You must provide this information regardless of whether you pass any of the section 199A(g) deductions through to the patrons.[11]

If yours is not an agricultural or horticultural cooperative eligible for the section 199A(g) deduction, leave this box blank.

8. Section 199A(a) Qualified Items

Enter amounts reported to the patrons that are qualified items of income, gain, deduction, or loss from trades or business effectively connected with the conduct of a trade or business in the United States. Do not include amounts from specified service trades or businesses (SSTBs).

Qualified items include unreimbursed partnership expenses, business interest expenses, self-employment tax or health insurance deductions, and contributions to qualified retirement plans.[12] Capital gains, tax-exempt income, and income that is not tied to a business are not considered section 199A(a) qualified items.[13]

9. Section 199A(a) SSTB Items

Enter amounts reported to the patrons that are qualified items from SSTBs. An SSTB is defined by the IRS as a trade or business where the principal asset is the reputation or skill of its employees or owners.[14]

Common examples of SSTBs include services performed in fields like health, law, and accounting.[15]

10. Investment Credit

Enter the patron’s share of the total investment credit that the cooperative is claiming. A qualifying cooperative can claim the investment credit for expenditures or investments made in any of the following categories:

- Rehabilitation

- Energy

- Qualifying advanced coal projects

- Qualifying gasification projects

- Qualifying advanced energy projects

- Advanced manufacturing investment

11. Work Opportunity Credit

Enter the patron’s share of the total Work Opportunity Tax Credit (WOTC) being claimed by the cooperative. A cooperative can claim the WOTC if it has employees from certain groups facing significant barriers to employment, such as ex-felons, members of families receiving state program assistance, and summer youth employees.[16]

12. Other Credits and Deductions

Enter in this box the amount and type of each of the following applicable credits and deductions for the patron:

- The empowerment zone employment credit

- The low sulfur diesel fuel production credit

- The credit for small employer health insurance premiums

- The credit for employer differential wage payments

- The deduction for capital costs incurred by small refiner cooperatives when complying with EPA sulfur regulations

- The biodiesel, renewable diesel, or sustainable aviation fuels credit

13. Specified Cooperatives

Check this box if yours is a specified agricultural or horticultural cooperative, engaged in the manufacturing, production, growth, extraction, or marketing of agricultural or horticultural products.[17]

14. Identifying Information (6 Entries)

On the left side of the 1099-PATR, a total of 6 boxes require information that identifies the payer and recipient, including:

- Trustee/Payer information – name, full address, and phone number

- Payer’s TIN – taxpayer identification number, normally an SSN/ITIN or EIN

- Recipient’s TIN – normally an SSN/ITIN or EIN

- Recipient’s name – full name

- Recipient’s street address – number and street only

- Recipient’s remaining address – city/town, state/province, country, Zip/postal code

Both the payer’s and recipient’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[18]

15. Account Number

The account number field is generally provided for the payer’s reference and for internal recordkeeping. It is required if there are multiple accounts for a recipient who is receiving more than one 1099.

The IRS encourages you to designate an account number for all 1099-PATR forms that you file. Note that the account number must be unique and cannot appear anywhere else on Form 1099-PATR.[19]

16. 2nd TIN Notice

The payer should check the box only if they have received notices twice from the IRS within three calendar years that inform the payer that the recipient provided an incorrect TIN. If the payer receives two notices in the same calendar year, they should leave the box unchecked.[20] You can verify someone’s TIN with the IRS’s TIN validation service.

Instructions (5 Steps)

1. Collect W9

In order to have the correct information to file the 1099-PATR, the payer must first collect a W9 form from the recipient. The W9 provides information needed to fill out the form, such as:

- Name

- Mailing address

- SSN/ITIN or EIN

2. Obtain the Forms

You can obtain or file Form 1099-PATR in the following ways:

- Ordering copies from the IRS

- Participating in the IRS’s IRIS eFile program

- Participating in the IRS’s FIRE eFile program

If filing 1099-PATR by paper, the official printed version of Copy A, rather than the online version, must be used. Copies B and C are available online as fillable PDFs.

3. Copy A – IRS

If filing by paper, Copy A, along with IRS Transmittal Form 1096, must be filed with the IRS by February 28. The mailing address to which you send these paper forms will depend on the home state of the filer. If filing electronically, submit Copy A to the IRS by March 31.

4. Copy B – Recipient

Copy B must be furnished to the recipient by January 31 of each year. Use the address listed on the W9 form to send Copy B to the recipient.

5. Copy C – Keep

Keep Copy C in your records for at least four years. The IRS may request the form in the event of an audit or investigation.

Frequently Asked Questions (FAQs)

Do I have to report my 1099-PATR distributions on my tax returns?

Generally, unless certain exceptions apply, payments made to you that are reported on Form 1099-PATR must be included in your tax return as ordinary income. These payments are found in boxes 1, 2, 3, and 5.[21]

Do I report the dividends from a cooperative’s capital stock on Form 1099-PATR?

No, use Form 1099-DIV, Dividends and Distributions, to report dividends paid on a cooperative’s capital stock, rather than Form 1099-PATR.

Is the income reported on a 1099-PATR subject to the self-employment tax?

For an individual who receives 1099-PATR income from a farming cooperative, that income is generally subject to the self-employment tax unless a tax exemption applies.[22]

Sources

- IRC § 6044(e)

- IRS 1099-PATR Instructions

- IRS – Exceptions

- IRC § 1.6044-4

- IRS – Guide to Information Returns

- IRS – Patronage Dividends Box Instructions

- IRS – Nonpatronage Distributions Box Instructions

- IRC § 1388(f)

- IRS – Federal Income Tax Withheld Box Instructions

- IRS – Section 199A(g) Deduction Box Instructions

- IRS – Qualified Payments Box Instructions

- IRS – Form 8995-A Instructions

- IRS – Section 199A(a) Qualified Items Box Instructions

- IRS – Qualified Business Income Deduction FAQs

- IRS – Section 199A(a) SSTB Items Box Instructions

- IRS – Work Opportunity Tax Credit

- IRS – Specified Cooperatives Box Instructions

- IRS – Recipient TIN Format

- IRS – Account Number Box on Forms

- IRS – 2nd TIN Notice

- IRS Form 1099-PATR – Instructions for Recipient

- IRS – Instructions for Schedule F