Updated February 08, 2024

A 1099-K form (payment card and third-party network transactions) is an IRS document that reports payments received for goods and services via credit/debit cards, gift cards, payment apps, or online marketplaces. As of 2023, payment card companies and third-party platforms are required to file this form with the IRS if the accountholder receives payments exceeding a total of $600 for the tax year.

Important Note:

Gifts and reimbursements of personal expenses from friends and family are not reported on a 1099-K. Only goods and services sold, including personal items, must be reported on the form.

Table of Contents |

Who Gets a 1099-K?

Anyone who sells goods or services and receives payment via credit/debit card, gift card, payment app, or online marketplace will receive a 1099-K from the payment issuer.[1]

A 1099-K will only be issued if the total payments received for the year reach over $600.

Those who may receive a 1099-K include:

- Business owners

- Freelancers

- Online merchants

- Resellers (clothing, antiques, tickets, etc.)

- Property managers

- Airbnb hosts

Who Issues a 1099-K?

Payment settlement entities and payment platforms, such as card processors or third-party apps, must file a 1099-K with the IRS and send a copy to the account holder.[2]

Common issuers of a 1099-K include:

- Merchant banks: Chase, Citigroup

- Credit/debit card processors: Square, Stripe

- E-commerce platforms: Shopify

- Online payment platforms: PayPal

- Peer-to-peer payment apps: Venmo, Cash App

- Online marketplaces: eBay, Etsy

- Freelance marketplaces: Fiverr

- Real estate marketplaces: Airbnb

- Ticket exchange/resale sites: Ticketmaster

Deadlines

The issuer must file the 1099-K with the IRS by February 28 if filing by paper and by March 31 if filing electronically.[3]

They must also send a copy of the 1099-K to the account holder by January 31.

Filing by Mail

Those filing by mail must order official copies. Forms should not be downloaded online and sent to the IRS.

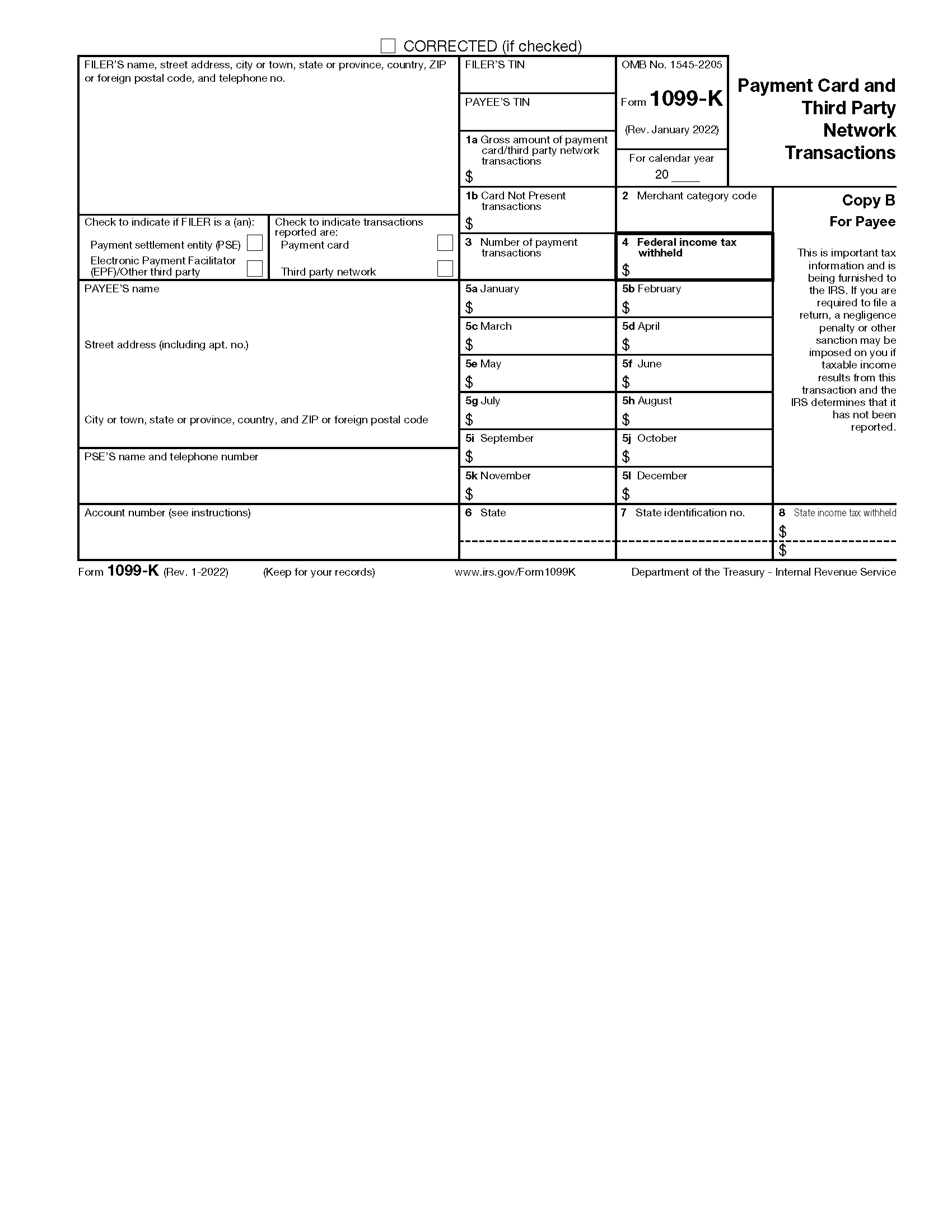

Form Parts

- Filer’s Information: Shows the name, address, and phone number of the party filing the 1099-K.

- PSE / EPF: Shows whether the filer is a payment settlement entity (PSE) or an electronic payment facilitator (EPF). If the filer is a PSE, it directly facilitates the payments made via payment cards to the payee. If the filer is an EPF, it is a third-party platform contractually obliged to pay the payee on the PSE’s behalf.

- Transactions Reported: Shows whether the reported transactions were made using payment cards or via a third-party network. If the filer reports both types of transactions made to the same payee, a separate 1099-K must be filed.[4]

- Payee’s Information: Shows the name and address of the party who received the reported payments.

- PSE’s Contact Info: If the entity with the filing requirement (payer) is an EPF or other third party, they must enter the PSE’s name and telephone number in this box.

- Filer and Payee TIN: Shows the Taxpayer Identification Numbers (TIN) for the filer and the payee.

- Account Number: The account number is required if the filer has multiple accounts for a payee for whom they are filing multiple 1099-K.

- 2nd TIN: Enter an “X” if the filer was notified by the IRS twice within three calendar years that the payee provided an incorrect TIN.

- Box 1a. Gross Amount of Payments: Shows the total amount of payment card/third-party network transactions made to the payee through the PSE during the calendar year without adjusting for fees, credits, cash equivalents, discount amounts, refunded amounts, or any other amounts.

- Box 1b. Card Not Present: Shows the total amount of all reportable payment transactions made without a card present at the time of the transaction without adjusting for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts. This is most commonly used for online sales, phone sales, or catalogue sales. This box does not apply to third-party network transactions.

- Box 2. Merchant Category Code: Shows the merchant category code used for payment card/third-party network transactions (if available) reported on this form.[5]

- Box 3. Number of Payment Transactions: Shows the number of payment transactions (not including refund transactions) processed through the payment card/third-party network.

- Box 4. Federal Income Tax Withheld: Shows backup withholding on the total amount paid. Generally, a payer must backup withhold if the payee did not provide a TIN.

- Boxes 5a-5l. January – December: Show the gross amount of payment card/third-party network transactions made to the payee for each month of the calendar year.

- Boxes 6-8. State: Shows state and local income tax withheld from the payments made to the payee.

Instructions for Filing

- Collect a W9 from the payee to obtain their TIN.

- Choose a filing method (by mail, online, or with third-party software).

- Copy A must be submitted to the IRS.

- Copy 1 must be submitted to the filer’s state tax department.

- Copy B must be sent to the payee for their records.

- Copy 2 must be provided to the payee to be attached to their state income tax return if required.

- Copy C can be kept by the filer for their own records.

Frequently Asked Questions (FAQs)

Do I have to report 1099-K income?

Yes. All income you earn must be reported on your tax return. The amount on your 1099-K will likely be taxed if you made a profit.

What’s the difference between a 1099-K and 1099-NEC?

A 1099-K is specifically used for payments over $600 made via debit/credit cards or a payment app. On the other hand, a 1099-NEC is usually filed by employers of independent contractors or freelancers to whom they made any kind of payment totaling $600.

How do I report a loss on the sale of a personal item?

If you sell a personal item at a loss, this can be indicated on your tax return:

- Form 1040, Schedule 1, Part I – Line 8z, Other Income

- Form 1040, Schedule 1, Part II – Line 24z, Other Adjustments

You do not have to list the exact amount of the loss because a personal loss is not deductible.[6]

Sources

- IRS – Understanding Your Form 1099-K: Who Gets Form 1099-K

- IRS – Understanding Your Form 1099-K: Who Sends Form 1099-K

- IRS – Form 1099-K Frequently Asked Questions: Reporting

- IRS – Instructions for Form 1099-K (01/2022): Transactions Reported

- IRS – Internal Revenue Bulletin: 2004-31: Merchant Category Codes

- IRS – Form 1099-K Frequently Asked Questions: General