Updated February 26, 2024

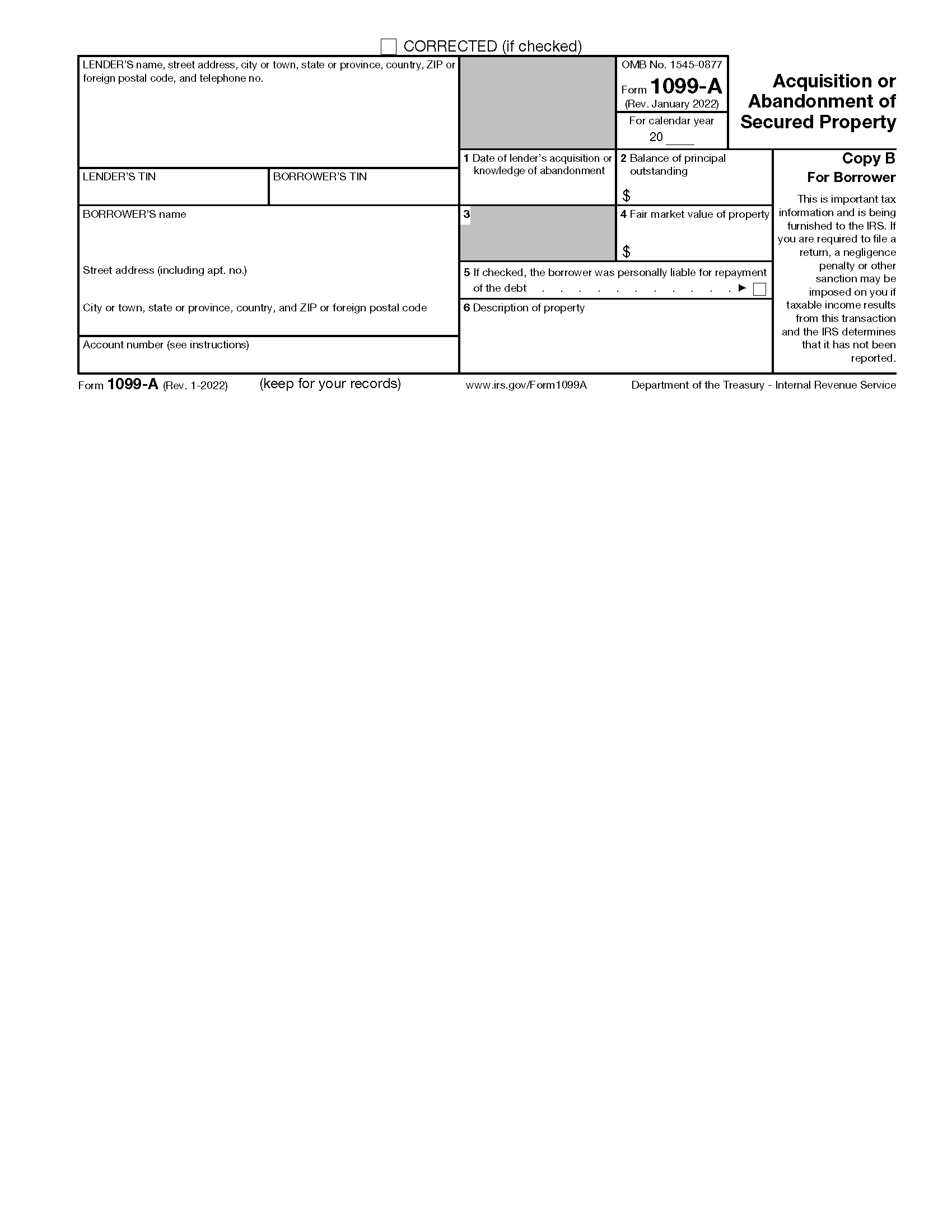

An IRS Form 1099-A (Acquisition or Abandonment of Secured Property) is a federal tax document filed by lenders to report a foreclosed or abandoned property as a result of a defaulted loan. Commonly used by banks and financial institutions, it must be filed with the IRS and provided to the borrower.

Primary Uses

- Foreclosure: The lender takes possession of the borrower’s property due to the borrower defaulting on the loan.

- Abandonment: The lender takes possession of the borrower’s property after determining that the borrower intends to or has discarded the property from use.

Table of Contents |

Who Files a 1099-A?

A 1099-A is required for any lender that acquires property as a result of the borrower defaulting on their loan, or if they discover that the secured property has been abandoned.

This includes:[1]

- Multiple owners of a single loan

- Governmental unit or subsidiary agency

- Subsequent holder

- Multiple lenders

When is a 1099-A Required?

Required:

- When a lender acquires interest in any real property, such as real estate, due to a borrower defaulting on the loan

- When the lender acquires interest in personal property, such as an automobile or a boat, used partly or fully by the borrower for business or investment purposes

- When a lender has reason to believe that the borrower intends to or has permanently discarded the property from use.

- If the lender expects to commence a foreclosure, execution, or similar sale within three months of the date the property was abandoned, reporting is required as of the date you acquire an interest in the property or a third party purchases the property

Not Required:

- If the tangible property acquired by the lender was exclusively used for the borrower’s personal use[2]

- If the property is located outside of the United States or the borrower is an exempted foreign person

- If the lender forgives a debt of $600 or more in connection with the foreclosure or abandonment, they must file a 1099-C instead[3]

Deadlines

If paper filing, the lender must submit the 1099-A to the IRS by February 28 of the year after the property was foreclosed or abandoned. If filing electronically, it must be filed by March 31.[4]

They must also send a copy of the 1099-A to the borrower by January 31.

Form Parts (6)

1. Date of Lender’s Acquisition or Knowledge of Abandonment

Enter the date you acquired the secured property or found out that the property was abandoned. If you or a third party purchased the property at a foreclosure or execution sale, use the date of the sale.

2. Balance of Principal Outstanding

Enter the balance of the outstanding debt when the property was acquired or discovered to be abandoned. Include only unpaid principal on the original debt without adding accrued interest or foreclosure costs.

3. Reserved for Future Use

Leave blank.

4. Fair Market Value (FMV) of Property

Enter the fair market value of the property, which is generally the same as the gross foreclosure bid price.[5] In the case of abandonment or voluntary conveyance, enter the appraised value of the property.

If no FMV or appraised value is available, leave this box blank.

5. Was Borrower Personally Liable for Repayment of the Debt

Enter an “X” in the checkbox if the borrower was personally liable for repaying the debt when the debt was created or last modified.

6. Description of Property

Enter a general description of the property. For real property, provide the address, section, lot, and block. For personal property, enter the applicable type, make, and model. For multiple pieces of personal property, use a category such as “Office Equipment.” For crops forfeited on Commodity Credit Corporate loans, enter “CCC.”

Instructions (5 steps)

1. Collect W9 From the Borrower

To complete the 1099-A, the lender must first collect a W9 from the borrower. The W9 provides information needed to fill out the form, such as:

- The borrower’s name/business name

- The borrower’s mailing address

- The borrower’s taxpayer identification number (TIN)

2. Obtain and Fill Out the Form

The 1099-A form can be obtained and completed in one of the following ways:

- Ordering copies from the IRS

- Participating in the IRS’s FIRE system

- Using software to auto-submit

3. File Copy A with the IRS

Copy A must be filed with the IRS. If paper filing, the lender must use an official scannable document ordered from the IRS. Form 1096 must also be included.

The deadline for paper filing is February 28, 2024. The deadline for filing the form electronically is March 31, 2024.

4. Provide Copy B to the Borrower

Copy B must be sent to the borrower by Jan. 31 of the year following the acquisition or abandonment. If there is more than one borrower, each individual must receive a copy.

To satisfy this requirement, the lender may use the 1099-A form made available online by the IRS.

5. Keep Copy C for Lender’s Records

Copy C should be kept in the lender’s business records for at least four years in case of an IRS audit or investigation.

Frequently Asked Questions (FAQs)

What is the difference between 1099-A and 1099-C?

1099-A is used when a lender acquires interest in secured property as a result of foreclosure or abandonment. If the acquisition also involves a debt cancellation of $600 or more, a 1099-C must be used. There is no need to file both forms.

Can I buy a car with a 1099-A?

No. Unlike most other 1099 forms, a 1099-A does not indicate an income. It is merely used to report a lender’s acquisition of foreclosed property or an abandonment of property. As such, it cannot be used to purchase anything.

What information from a 1099-A should be included on my tax return?

Any capital gain or loss from the sale of the foreclosed property must be included on your tax return. This can be calculated by subtracting the purchase price from the fair market value of the property at the time of the foreclosure.

Sources

- IRS: Instructions for Forms 1099-A and 1099-C (2021) – Who Must File

- IRS: Instructions for Forms 1099-A and 1099-C (2021) – Property

- IRS: Instructions for Forms 1099-A and 1099-C (2021) – Coordination With 1099-C

- IRS: 2023 General Instructions for Certain Information Returns (D. When to File)

- 26 CFR § 1.6050J-1T (A-32)