Updated February 28, 2024

A 1099-C form is an IRS tax document used to report the cancellation of debt for an individual debtor due to bankruptcy, foreclosure, or another change in circumstances. A creditor must file 1099-C for each debtor for whom at least $600 in debt has been canceled.

What Qualifies as Debt?

Debt is any amount owed to a creditor organization, which can include stated principal, stated interest, fees, penalties, administrative costs, and fines.

Table of Contents |

Who Must File 1099-C

Financial institutions, credit unions, government agencies, and other money-lending organizations must file 1099-C when at least $600 in debt owed to them has been canceled.[1]

A business is not considered a money-lending organization for the purposes of Form 1099-C if:[2]

- the organization had no prior year reporting requirement and its income from lending money is less than 15% of its gross income and under $5 million;

- the organization did have a prior year reporting requirement and its income from lending money is less than 10% of its gross income and under $3 million; or

- the organization is less than three years old.

When to File

A creditor must file 1099-C for each debtor for whom at least $600 in debt has been canceled as the result of an identifiable event. An “identifiable event” refers to one of the following:[3]

- Bankruptcy filed under Title 11

- Expiration of the statute of limitations for collecting the debt

- A receivership, foreclosure, or probate rendering the debt unenforceable

- Exercise of a “power of sale” by a mortgage lender or holder, in which the creditor loses the right to collect the debt

- An agreement reached between the creditor and the debtor to cancel the debt at less than full consideration (e.g., short sales)

- Debt abandonment as the result of a creditor’s established policy to stop collection activity after a certain amount of time

- Any other discharge of a debt before one of the identifiable events listed above

The creditor organization must file Form 1099-C in the year following the calendar year in which the identifiable event occurs. If a debt is canceled before an identifiable event occurs, the creditor may file 1099-C in the year of cancellation.[4]

Exceptions

When filing Form 1099-C, a creditor is not required to report certain types of canceled debt. These include:[5]

- Debt discharged in bankruptcy if the debt was not related to business or investment

- Nonprincipal amounts, including penalties, fines, fees, and administrative costs

- Debt canceled for a foreign debtor by a financial institution’s foreign branch or office

- Credit extended to customers by a business that is not a financial institution

Deadlines

The deadline to file Form 1099-C with the IRS is February 28 of the following year, or March 31 if filing electronically. If the deadline falls on a weekend or federal holiday, the deadline to file is extended to the next business day. However, the filer must furnish Copy B to the debtor on or before January 31.[6]

2024 Deadlines

- January 31, 2024 (recipient)

- February 28, 2024 (IRS–Filing by Paper)

- March 31, 2024 (IRS–Filing Electronically)

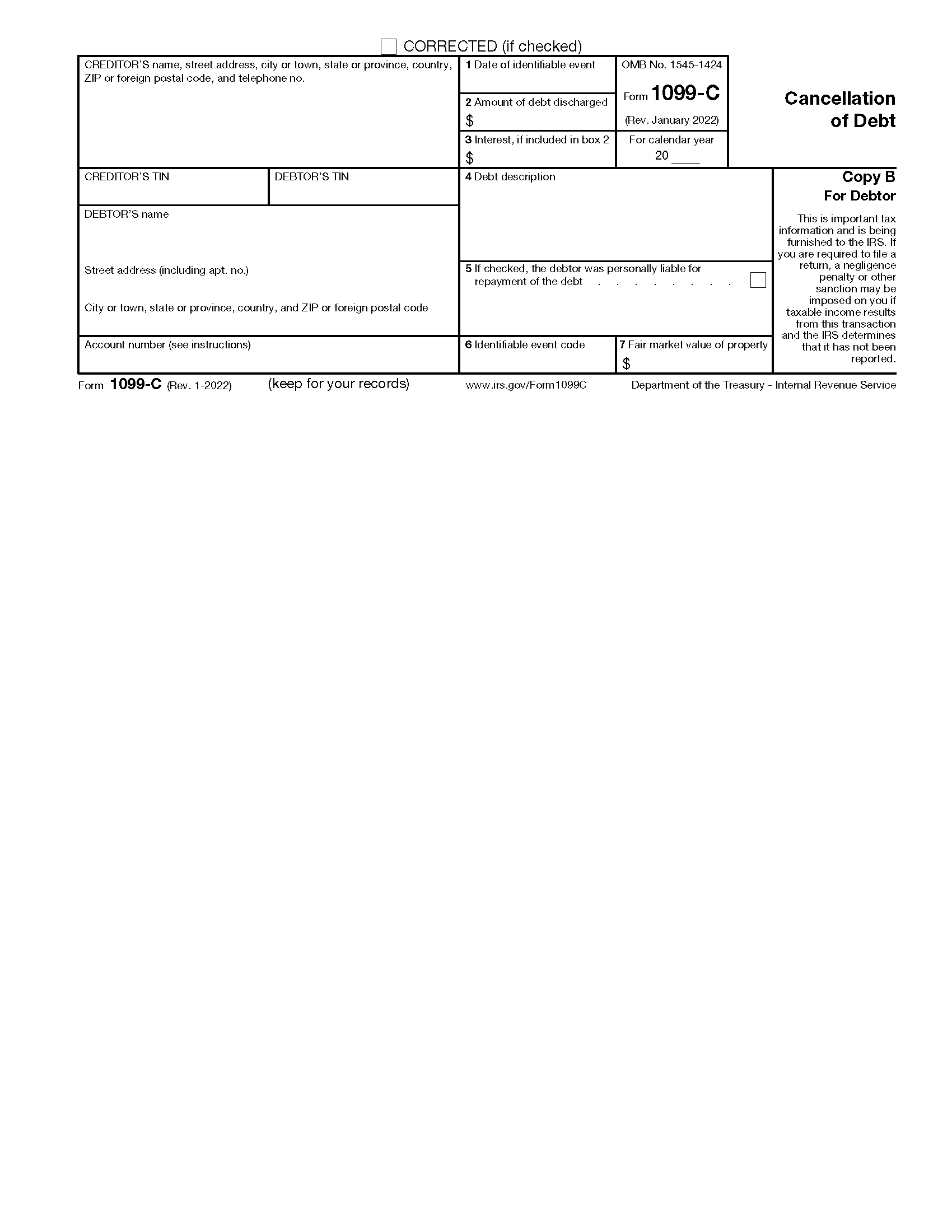

Form Parts (14)

1. Date of Identifiable Event

Enter the date of the identifiable event that triggered the cancellation of the debt. If you canceled a debt before an identifiable event and you are choosing to report that cancellation, enter the date that you actually canceled the debt.[7]

2. Amount of Debt Discharged

Enter the amount of the canceled debt.

3. Interest if Included in Box 2

Enter the amount of any interest you included in the canceled debt in box 2. You are not required to include interest in box 2, but if you did, you are required to report that interest in box 3.[8]

4. Debt Description

Enter a description of the origin of the debt, such as student loans, a mortgage, or credit card spending. Be as specific as possible.

If you are filing Form 1099-C together with 1099-A, include a description of the property as well.[9]

5. Personal Liability Checkbox

Put an “X” in this checkbox if the debtor was personally liable for repayment of the debt at the time the debt was created or when it was last modified.[10]

6. Identifiable Event Code

Enter one of the following codes to indicate the nature of the identifiable event:[11]

- A – Bankruptcy (title 11 bankruptcy case)

- B – Debt relief through a receivership, foreclosure, or similar court proceeding

- C – Expiration of statute of limitations/statutory period for deficiency judgment

- D – Foreclosure election/”power of sale” by a mortgage lender

- E – Debt relief under a probate or similar court proceeding

- F – An agreement between the creditor and debtor to cancel the debt

- G – A decision or policy of the creditor to abandon the debt

- H – Other actual discharge before an identifiable event

7. Fair Market Value (FMV) of Property

If you are filing Form 1099-C in connection with a foreclosure, execution, or similar sale, enter the FMV of the property. Generally, the gross foreclosure bid price is considered to be the FMV.[12]

If you are not filing 1099-C in connection with debt that was associated with a property, leave this box blank.

8. Identifying Information (6 Entries)

On the left side of the 1099-C, a total of 6 boxes require information that identifies the creditor and debtor, including:

- Creditor information – name, full address, and phone number

- Creditor’s TIN – taxpayer identification number

- Debtor’s TIN – normally an SSN/ITIN or EIN

- Debtor’s name – full name

- Debtor’s street address – number and street only

- Debtor’s remaining address – city/town, state/province, country, Zip/postal code

The debtor’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[13]

9. Account Number

The account number field is generally provided for the creditor’s reference and for internal recordkeeping. It is required if there are multiple accounts for a recipient who is receiving more than one 1099.

The IRS encourages you to designate an account number for all 1099-C forms that you file. Note that the account number must be unique and cannot appear anywhere else on Form 1099-C.[14]

Instructions (5 Steps)

1. Collect W9

In order to have the correct information to file the 1099-C, the creditor must first collect a W9 form from the debtor. The W9 provides information needed to fill out the form, such as:

- Name

- Mailing address

- SSN/ITIN or EIN

2. Obtain the Forms

You can obtain or file Form 1099-C in the following ways:

- Ordering copies from the IRS

- Participating in the IRS’s IRIS eFile program

- Participating in the IRS’s FIRE eFile program

If filing 1099-C by paper, the official printed version of Copy A, rather than the online version, must be used. Copies B and C are available online as fillable PDFs.

3. Copy A – IRS

If filing by paper, Copy A, along with IRS Transmittal Form 1096, must be filed with the IRS by February 28. The mailing address to which you send these paper forms will depend on the home state of the filer. If filing electronically, submit Copy A to the IRS by March 31.

4. Copy B – Debtor

Copy B must be furnished to the debtor by January 31 of each year. Use the address listed on the W9 form to send Copy B to the debtor.

5. Copy C – Keep

Keep Copy C in your records for at least four years. The IRS may request the form in the event of an audit or investigation.

Frequently Asked Questions (FAQs)

Do I need to file 1099-A along with 1099-C after a foreclosure?

No; if the debt was canceled in connection with a foreclosure or the abandonment of a property, you do not need to file both forms. You will meet your Form 1099-A requirements for the debtor by completing boxes 4, 5, and 7 on Form 1099-C.[15]

If a canceled debt is owned by multiple creditors, who needs to file 1099-C?

Each qualifying creditor must issue a Form 1099-C if that creditor’s part of the canceled debt is $600 or more.[16]

What if there are multiple debtors liable for a canceled debt?

For debts of $10,000 or more incurred after 1994 with multiple debtors liable for the debt, you must file Form 1099-C for each debtor and report the entire amount of the canceled debt on each form.[17]

Sources

- IRS 1099-C Instructions – Who Must File

- IRS – Safe Harbor Rules

- IRS – When is a Debt Canceled

- IRS – When to File 1099-C

- IRS – Exceptions

- IRS – Guide to Information Returns

- IRS – Date of Identifiable Event Box Instructions

- IRS – Interest Box Instructions

- IRS – Debt Description Box Instructions

- IRS – Personal Liability Checkbox Instructions

- IRS – Identifiable Event Code Box Instructions

- IRS – Fair Market Value Box Instructions

- IRS – Recipient TIN Format

- IRS – Account Number Box on Forms

- IRS – Coordination with Form 1099-A

- IRS – Multiple Creditors

- IRS – Multiple Debtors