Updated December 04, 2023

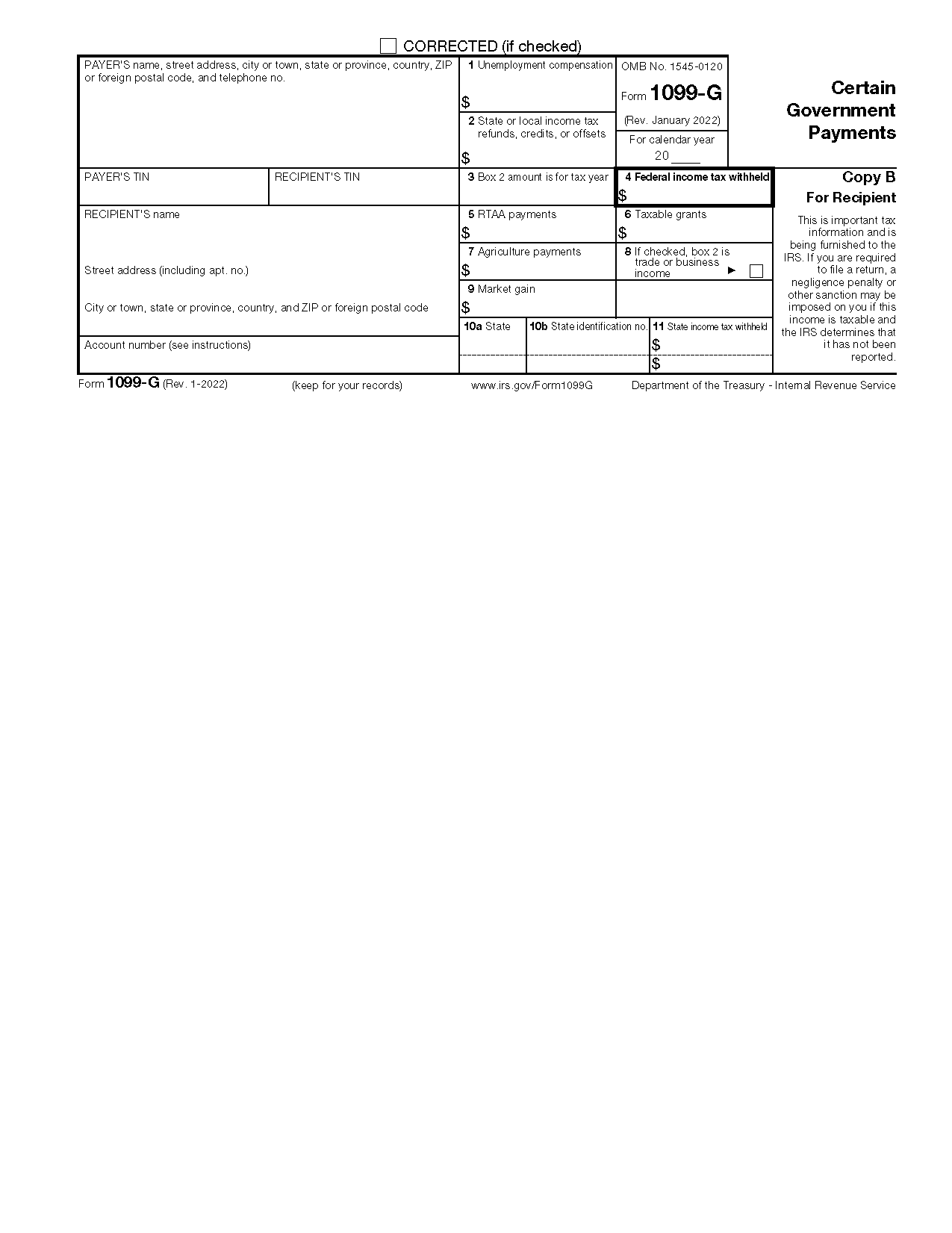

IRS Form 1099-G, also known as a Certain Government Payments form, is a tax document that a government agency uses to report subsidy payments, such as unemployment compensation, made to a taxpayer in the previous year. Copies of the 1099-G are filed with the IRS and sent to the taxpayer.

Common Uses

The 1099-G is commonly used to report:

- Unemployment compensation

- Tax refunds (state and local)

- Tax credits or offsets (state and local)

- Reemployment trade adjustment assistance (RTAA) payments

- Taxable grants

- Agricultural payments

- Commodity Credit Corporation (CCC) loans

Table of Contents |

Who Uses a 1099-G?

An officer or employee of a federal, state, or local government agency completes and files Form 1099-G, then sends copies of the completed form to the IRS and the taxpayer whose income is being reported.

The taxpayer uses Form 1099-G to fill out their annual income tax return, or Form 1040.

Deadlines

The deadline for sending Form 1099-G to a taxpayer is January 31 the year after the payments were made. Completed forms must be filed with the IRS by February 28, and by March 31 if filed electronically.[1]

1099-G vs. 1099-MISC vs. 1099-NEC

There’s a whole suite of 1099 forms, which are means of reporting certain types of income. Whereas the W2 form tracks income earned by full- or part-time employees, 1099 forms record other types of income, such as rent and contract-based payments.

1099-MISC: Used to report miscellaneous payments such as rent, royalties, prizes, fishing boat and crop insurance proceeds, awards, and more.

1099-NEC: Used to report nonemployee compensation, or payments over $600 made to independent contractors, freelancers, consultants, and other service providers.

1099-G Form Parts (15)

Bear in mind that states can issue their versions of the 1099-G, so not all forms look identical. Below are parts most Certain Government Payments forms include.

1. Payer’s Information

2. Recipient’s Information

3. Account Number

4. Box 1

5. Box 2

6. Box 3

7. Box 4

8. Box 5

9. Box 6

10. Box 7

11. Box 8

Check this box if the income tax refunds, credits, or offsets noted in Box 2 constitute trade or business income.

12. Box 9

This box records any market gain associated with the repayment of a CCC loan.[5]

13. Box 10a

In Box 10a, input the abbreviation for the state reporting payments.

14. Box 10b

Here, include the state’s identification number, which is also the filer’s identification number.

15. Box 11

Instructions for Filers (4 Steps)

1. Obtain the Form

2. Furnish a Copy to the Recipient

3. File with the IRS

4. Retain a Copy

Frequently Asked Questions (FAQs)

Where do I get my 1099-G?

Taxpayers who received unemployment compensation or another type of income covered by a 1099-G during the previous year will receive a completed form in the mail. For a duplicate copy, contact a state unemployment agency or the agency that paid the benefits during the tax year.

Will I get caught if I don’t report the income documented on a 1099-G?

It’s certainly possible. The IRS will compare the amount declared by the state agency that filed the 1099-G against the income claimed on a taxpayer’s annual tax return. If the figures don’t match, the taxpayer could be retroactively charged penalties and interest.

What do I do if I receive a 1099-G containing false information?

Scammers have figured out how to steal an identity and use it to file false claims for unemployment checks from the government. This means that a taxpayer could receive a 1099-G form documenting the amount paid to them that year even if they did not receive any payments.

Check any 1099-G form received in the mail carefully. If the number in Box 1 looks fishy, contact the agency that issued the form, such as a state unemployment agency, to report the fraud and request another form showing $0 in Box 1. This will be filed with the IRS as well.

This is a strong indicator that there has been an identity theft. For more information, visit Identity Theft Central, an online guide to tax fraud.[7]