Updated April 03, 2024

A 1099-CAP form is an IRS tax document used to report a change in the control or capital structure of a corporation. A domestic corporation must file 1099-CAP following a transaction in which control is acquired by another corporation, or a substantial change in the ownership of the corporation’s assets is effected.

Who Must File 1099-CAP?

Any corporation that must file Form 8806 must also file 1099-CAP, unless the transaction involved stocks valued at less than $100 million.

Table of Contents |

Who Gets a 1099-CAP?

A corporation must file a 1099-CAP for any shareholder who receives at least $1,000 in cash, stock, or other property following the change in control or capital structure. However, if the corporation makes the consent election on Form 8806, then it is not required to file 1099-CAP for shareholders that are clearing organizations.[1]

Exempt Recipients

A corporation is not required to file 1099-CAP for certain exempt organizations or shareholders, such as brokers, tax-exempt organizations, and foreign governments. See the IRS instructions for the full list of exempt recipients.

Deadlines

The deadline to file Form 1099-CAP with the IRS is February 28 of the following year, or March 31 if filing electronically. The filer must furnish Copy B to the shareholder on or before January 31. If the corporation is filing for a clearing organization, then it must furnish Copy B to the clearing organization by January 5.[2]

2024 Deadlines

- January 5, 2024 (clearing organization)

- January 31, 2024 (recipient)

- February 28, 2024 (IRS – Filing by Paper)

- March 31, 2024 (IRS – Filing Electronically)

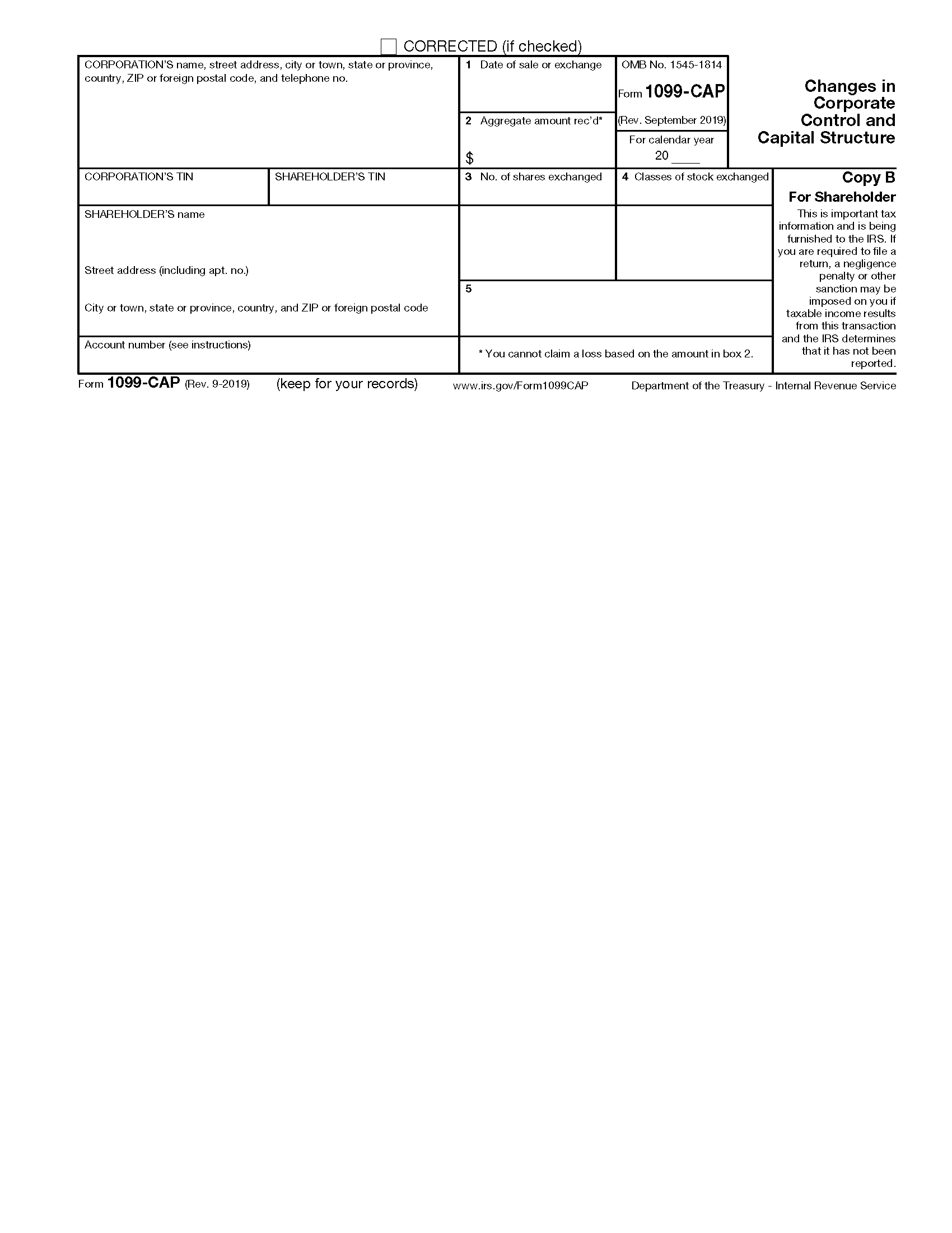

Form Parts (12)

Box 1: Date of Sale or Exchange

In this box, enter the trade date of the sale or exchange of the shareholder’s stock in the reporting corporation.[3]

Box 2: Aggregate Amount Received

Enter the aggregate amount of cash, stock, and other property received by the shareholder in exchange for the stock they held in the reporting corporation. Use the fair market value of the received stock or property to calculate this amount.[4]

Box 3: Number of Shares Exchanged

Enter the number of shares of the corporation’s stock held by the shareholder that were exchanged in the transaction.[5]

Box 4: Classes of Stock Exchanged

Enter the class or classes of the shareholder’s stocks that were exchanged. Use an abbreviated title for each class (e.g., “C” for common stock, “P” for preferred, and “O” for other). If you are entering any subclasses of stock, abbreviate these as well.[6]

Box 5: Blank

Leave this box blank.

Identifying Information (6 Entries)

On the left side of the 1099-CAP, a total of 6 boxes require information that identifies the corporation and the shareholder, including:

- Corporation information – name, full address, and phone number

- Corporation’s TIN – taxpayer identification number

- Shareholder’s TIN – normally an SSN/ITIN or EIN

- Shareholder’s name – full name

- Shareholder’s street address – number and street only

- Shareholder’s remaining address – city/town, state/province, country, Zip/postal code

The shareholder’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[7]

Account Number

The account number field is generally provided for the corporation’s reference and for internal recordkeeping. It is required if there are multiple accounts for a recipient who is receiving more than one 1099.

The IRS encourages you to designate an account number for all 1099-CAP forms that you file. Note that the account number must be unique and cannot appear anywhere else on Form 1099-CAP.[8]

How to File

1099-CAP can be filed electronically or with paper copies printed from the IRS website.

- Collect W-9s from each shareholder

- Choose a filing method (by mail, online with IRIS or FIRE, or with third-party software. Skip to step 5 if you are filing electronically.)

- Complete Form 1096 along with Copy A if filing by mail

- Mail Form 1096 and Copy A to the appropriate IRS address

- Send Copy B to the shareholders

- Retain Copy C for your records

Frequently Asked Questions (FAQs)

Is a broker required to file 1099-CAP?

No, a broker who holds shares in a corporation on behalf of a customer must file 1099-B in the event that the corporation engages in a transaction of acquisition of control or substantial change in capital structure.[1]

What is the consent election?

A corporation filing Form 8806 can elect to consent to the IRS publication of information about the relevant transaction, including the date of the transaction and a description of the affected shares. A corporation that makes the consent election is not required to file 1099-CAP on the behalf of clearing organizations.[1]

What is the penalty for failing to file 1099-CAP?

For the purposes of the penalty for failure to file, Form 8806 and all Forms 1099-CAP are treated as one return. The penalty for failing to file 1099-CAP is thus the same as the penalty for failing to file Form 8806, which is a fine of $500 per day.[9]

Sources

- IRS – Who Must File

- IRS – Guide to Information Returns

- IRS – Date of Sale or Exchange Box Instructions

- IRS – Aggregate Amount Received Box Instructions

- IRS – Number of Shares Exchanged Box Instructions

- IRS – Classes of Stock Exchanged Box Instructions

- IRS – Shareholder TIN Format

- IRS – Account Number Box on Forms

- IRS – Penalties for Failure to File