Updated December 27, 2023

A 1099-R form is used by payers, trustees, and plan administrators to report designated distributions from profit-sharing and retirement plans when the distribution has a value of $10 or more. Distributions are reported by filing this form with the Internal Revenue Service (IRS) and providing a copy to the recipient of the distribution.

Important facts:

- Deadlines: Mail IRS: Feb 28, IRS online: Mar 31, Recipients: Jan 31

- Threshold: Required for distributions of $10 or more

- Filing: Online, by mail, or via filing software

- Official Copies: Paper copies for filing should not be printed at home

Table of Contents |

When to Use Form 1099-R

Generally, the payer, trustee, or plan administrator must file Form 1099-R for each person to whom a designated distribution of $10 or more has been made from certain profit-sharing, retirement, disability, and death benefits plans, including:

- individual retirement arrangements (IRAs)

- annuities

- pensions

- insurance contracts

- survivor income benefit plans

- permanent and total disability payments under life insurance contracts

- charitable gift annuities

Form 1099-R is also used to report Corrective Distributions, Distributions Under Employee Plans Compliance Resolution System (EPCRS), a loan treated as a Deemed Distribution, and Direct Rollovers. The IRS publishes a more comprehensive list of cases that require use of this form.

Deadlines for Filing

The deadline to file 1099-R with the IRS depends upon the method used to file:

- When filing a paper copy, the deadline is February 28

- Filed electronically, the deadline is March 31

- Notifying Recipients must be completed by January 31

If the deadline to file or to notify recipients falls on a Saturday, Sunday, or Federal Holiday, the deadline is extended to the next business day.[1]

When filing paper copies of this form with the IRS, official copies must be used. Do not print Copy A for IRS filing. Official copies can be ordered directly from the IRS.[2]

Extensions for Filing

An automatic extension to file with the IRS may be requested by submitting Form 8809 (electronically or by mail) before the filing deadline.[3]

To request an extension to furnish statements to recipients, a letter must be faxed to the IRS. For this type of extension, mailed requests are not permitted.[4]

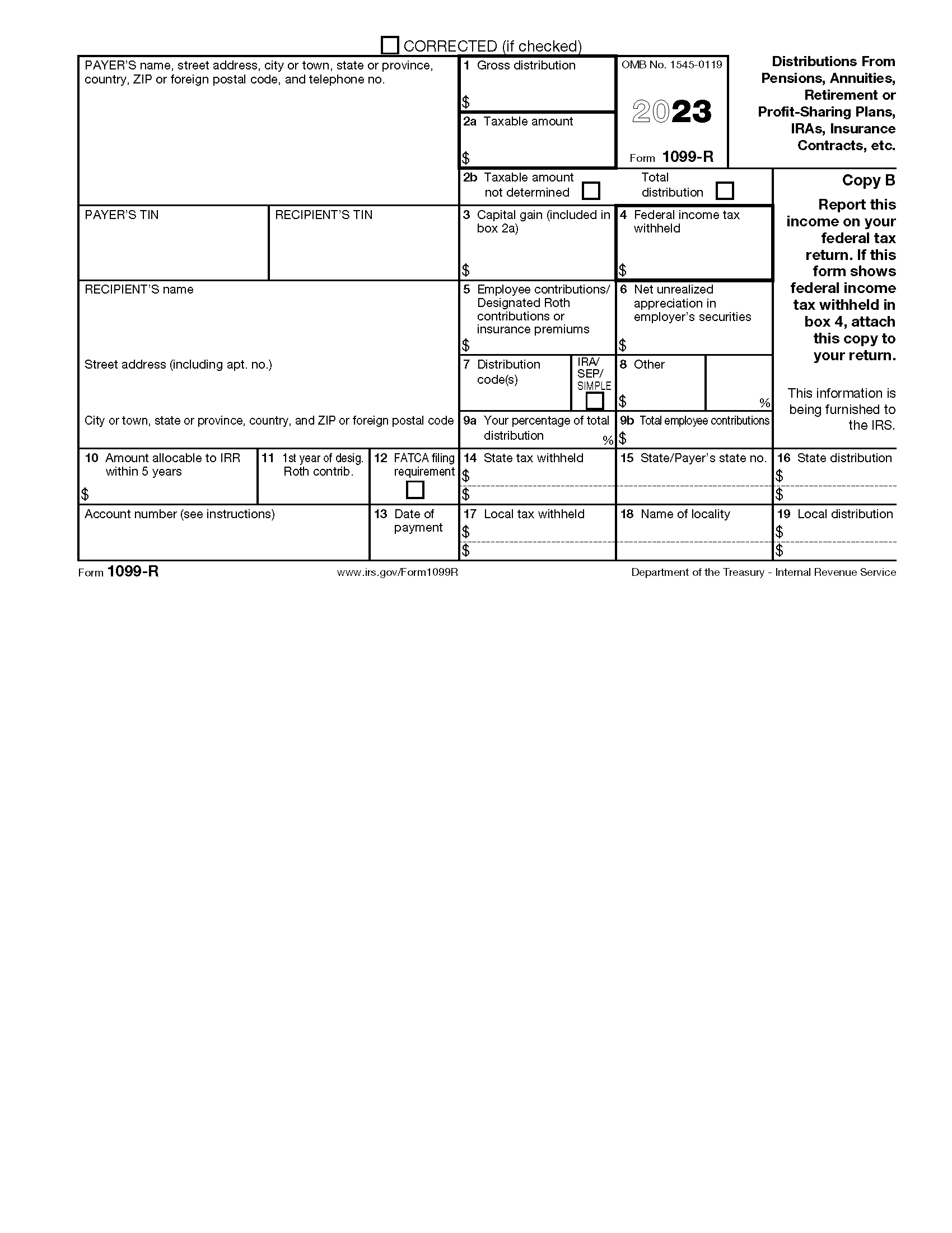

Form Parts Explained (28 items)

Identifiying Information (7 unnumbered items)

Enter the following Payer Information in the appropriate box.

- Name

- Address

- Telephone Number

- TIN/SSN

Enter the following Recipient Information in the appropriate box.

- Name

- Address

- TIN/SSN

1. Gross Distribution

2a. Taxable Amount

2b. Taxable Amount Not Determined or Total Distribution

Select one of the following options by marking the appropriate box.

- Taxable Amount Not Determined Enter an “X” in this box if you are unable to reasonably obtain the data needed to compute the taxable amount -OR- if you are an FFI reporting in box 1 to satisfy your chapter 4 reporting requirement. If you check this box, leave box 2a blank.

- Total Distribution Enter an “X” in this box only if the payment shown in box 1 is a total distribution. If periodic or installment payments are made, mark this box in the year the final payment is made.

3. Capital Gain (Included in box 2a)

- Charitable gift annuities Report in box 3 any amount from a charitable gift annuity that is taxable as a capital gain. Report in box 1 the total amount distributed during the year. Report in box 2a the taxable amount. Advise the annuity recipient of any amount in box 3 subject to the 28% rate gain for collectibles and any unrecaptured Section 1250 gain.[5] Report in box 5 any nontaxable amount. Enter Code F in box 7.

-

Special rule for participants born before January 2, 1936 (or their beneficiaries) For lump-sum distributions from qualified plans only, enter the full amount in box 2a eligible for the capital gain election. Do not complete this box for a direct rollover.

4. Federal Income Tax Withheld

5. Employee Contributions/ Designated Roth Contributions or Insurance Premiums

6. Net Unrealized Appreciation (NUA) in Employer’s Securities

- Lump-sum distribution: enter all the NUA in employer securities.

- Not lump-sum distribution: enter only the NUA attributable to employee contributions.

7. Distribution Codes

8. Other

9a. Your Percentage of Total Distribution

9b. Total Employee Contributions

You are not required to enter the total employee contributions or designated Roth contributions in box 9b. However, because this information may be helpful to the recipient, you may choose to report them.

Do not include any amounts recovered tax free in prior years. For a total distribution, report the total employee contributions or designated Roth contributions in box 5 rather than in box 9b.

10. Amount Allocable to IRR Within 5 Years

11. First Year of Designated Roth Contribution

12. FATCA Filing Requirement

- you are an FFI reporting a cash value insurance contract or annuity contract that is a U.S. account in a manner similar to that required under Section 6047(d).[7]

- you are a U.S. payer that is reporting on Form 1099-R as part of satisfying your requirement to report with respect to a U.S. account for chapter 4 purposes, as described in Regulations Section 1.1471-4(d)(2)(iii)(A).[8]

13. Date of Payment

14-19. State and Local Information

- Boxes 14 and 17 are used to report any state or local income tax withheld on this distribution.

- Box 15 is for the abbreviated name of the state and the payer’s state ID number (assigned by the state).

- Box 18 is for the name of the locality.

- Boxes 16 and 19 are for the amount of the state or local distribution.

Instructions (4 Steps)

1. Complete and File Form 1099-R

To file by paper, printed copies must be obtained directly from the IRS and completed in black ink either by hand (using block print, not script) or by printing directly onto the supplied form (using 12-point Courier font). Do not use “#”, “$”, or 0 (zero). If the answer for a box is zero, leave it blank.[10]

Once completed, the form is mailed to the IRS with an accompanying Form 1096.[11]

To file electronically, copies of this form are completed by computer or online and submitted using one of the IRS systems (FIRE and/or IRIS), or by third party software to auto-submit.

NOTE: If the filer will submit 250 or more copies of form 1099-R in a year, eFiling is required.

2. Provide Notice to Recipients

Upon filing, a copy (typically Copies B and C, as necessary) must be provided to the recipient of the distribution. The recipient may be required to submit Copy B with their tax returns. Copy C is retained for their records.Recipient copies may be sent either electronically or by mail with different rules applicable to each method of delivery.

The filer may use alternate versions of the form to notify recipients, subject to standards established by the IRS.[12]

3. Retaining Records

Copy D is retained by the filing entity (the Payer) for their records.

4. Recipient Records and State / Local Filing (if required)

Contact the applicable state and local tax department as necessary for reporting requirements and where to file. Copy 1 is used to file with state or local tax authorities and Copy 2 is provided to the recipient as a record of that filing.

Frequently Asked Questions (FAQs)

How do I correct a previously filed 1099-R?

Generally, if a mistake is discovered on a previously filed 1099-R, it must be corrected as soon as possible by filing a revised form with the “Corrected” box checked. In certain cases, the IRS imposes deadlines for filing and reporting corrections to recipients.[13]

Does the eFile requirement apply separately to originals and corrections?

Yes. Corrections are considered separate forms for purposes of the eFile requirement.[14]

How does the eFile requirement work?

If you file 250 or more information returns during the year, you must file electronically. The requirement applies separately to each type of form. For example, if you need to file 500 forms 1099-R and 100 forms 1099-A, you are required to eFile for 1099-R but not for 1099-A.

How do I get approval to eFile?

In order to eFile, you must first apply for an IRS Transmitter Control Code (TCC). As the TCC application process may take up to 45 days to process, you should apply before the filing season.

Sources

- Federal Holidays

- Order Form 1099-R From the IRS

- Request an Extension for Time to File 1099-R, Form 8809

- Request an Extension for Time to Notify Recipients

- 26 U.S. Code §1250

- 26 U.S. Code §72

- 26 U.S. Code §6047

- 26 CFR §1.1471-4

- 26 U.S. Code §6050Y

- Guidelines for Completion of Paper Copies

- Where to File Paper Copies, Form 1096

- Substitute Statements

- How to Correct Form 1099-R

- Corrections as Related to the eFile Requirement