Updated March 04, 2024

IRS Form 1099-OID (Original Issue Discount) is a tax form used to report the difference between a financial instrument’s value and its acquisition price. If a bond, for example, was purchased at a discount but can be redeemed at maturity for its full value, then the government taxes the difference as interest income. Brokers typically send Form 1099-OID to investors, who use its information to complete their annual tax returns.

Common Uses

Form 1099-OID is used to report an original issue discount on a bond, debenture, note, Certificate of Deposit (CD), time deposit, bonus savings plan, or other certificate with a term of more than one year.

Table of Contents |

Who Uses a 1099-OID?

Typically brokerage firms send 1099-OID forms to investors whose financial instruments they are managing.

Form 1099-OID is used to report:

- OID, or the excess of an obligation’s price at maturity over its purchase price, if it exceeds $10

- Any foreign tax that was withheld and paid on the OID

- Federal income tax that was withheld under backup withholding rules

Information reported on Form 1099-OID is used by investors to complete their annual income tax returns (Schedule B or Form 1040, depending on the amount of interest earned).

Deadlines

The deadline to send Form 1099-OID to its recipient is January 31 the year after the year the interest income was earned. Paper copies must be filed with the IRS by February 28. Electronic copies must be filed by March 31.[1]

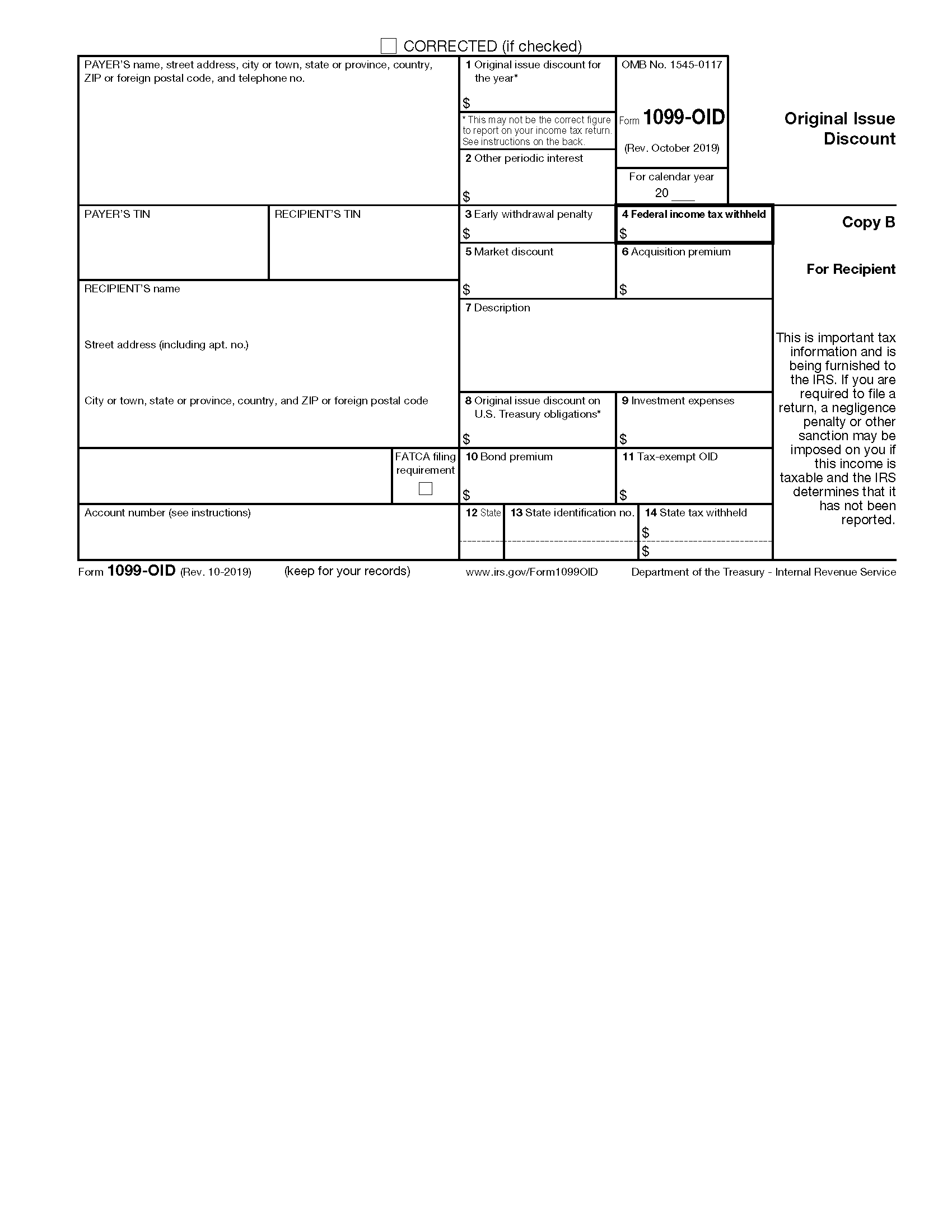

1099-OID Form Parts (19)

The 1099-OID form can vary across states but typically contains some combination of the following parts. Check the IRS instructions for further details about each input box.

1. Payer’s Information

3. Recipient’s TIN

4. Recipient’s Information

5. FATCA filing requirement

Check this box if payments are taxable under the Foreign Account Tax Compliance Act (FATCA), which deals with holdings in foreign accounts.

6. Account Number

7. 2nd TIN Notice

8. Original Issue Discount

9. Other Periodic Interest

Enter any taxable interest that was paid or credited on this obligation during the previous year.

10. Early Withdrawal Penalty

Report any penalties charged as a result of withdrawing the obligation before its date of maturity. These penalties will be deducted from the income considered taxable.

Do not reduce the amounts in boxes 1 and 2 by the penalty amount.

11. Federal Income Tax Withheld

12. Market Discount

Enter any market discount that applies to the purchased security here. Market discount can be figured by subtracting the purchase price of the instrument from the sum of the acquisition price and the amount of accrued OID.

13. Acquisition Premium

14. Description

Enter the CUSIP number, which identifies the security. If there isn’t one, enter the stock exchange, issuer, coupon rate, and year of maturity.

15. Original Issue Discount on U.S. Treasury Obligations

16. Investment Expenses

17. Bond Premium

Enter the amount of bond premium amortization that applies to the interest being reported.[4]

18. Tax-Exempt OID

Enter the OID for a tax-exempt obligation acquired after January 1, 2017.

19. Boxes 12-14

Instructions for Filers

- Collect Form W-9 from the recipient

- Complete Form 1099-OID, one for each obligation

- File Copy A with the IRS by mail, online, or using third-party software

- File Copy 1 with the state tax department

- Send Copy B to the recipient

- Keep Copy C for records

Frequently Asked Questions (FAQs)

What’s the difference between Form 1099-B and Form 1099-OID?

How is OID income taxed?

How do I report 1099-OID on Form 1040?

Take the amount reported in Box 1 of the 1099-OID and input it on Line 2b of Form 1040. If the amount of OID exceeded $1,500 for the year, then also input it on lines 1, 2, and 4 of Schedule B.

What are the penalties for not filing Form 1099-OID?

The IRS charges penalties for neglecting to file 1099 forms. Rates vary depending on how late the forms are filed or whether they are filed at all.