Updated April 15, 2024

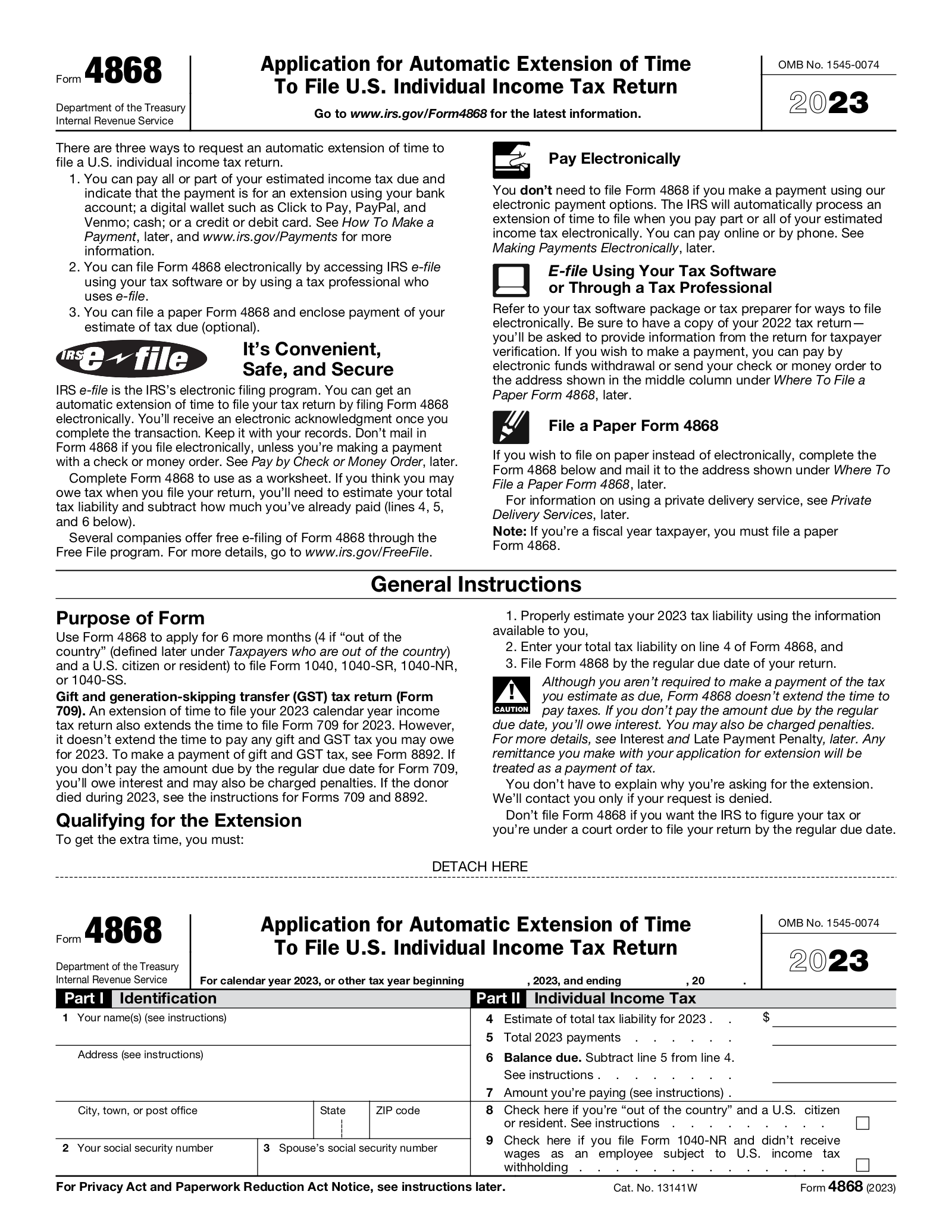

IRS Form 4868, also called the “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,” is used by those that need more time to file their federal income tax return. Submission of the form allows for an automatic six-month extension to file taxes.

- Payment deadlines: Taxpayers with an extension still must pay taxes owed by tax day. An extension to file is not an extension of payment.

- Eligibility: Any individual tax filer, regardless of income, can electronically request an automatic extension for filing taxes using IRS free file.

Table of Contents |

Extension Deadlines

The deadline to file taxes annually is normally April 15th, but it can change if the 15th lands on a weekend (April 18th in 2023).[1] The tax return deadline for US citizens and foreigners out of the country or living abroad is automatically extended by two months until June 15th. Filing Form 4868 for a federal tax filing extension allows all taxpayers to postpone filing their taxes until October 16th, 2023.[2]

Even if you don’t owe taxes, you may still be required to file a tax return. If you can’t file your return by the deadline, filing an extension can help you avoid failure to file penalties.

Previous extension deadlines:

Payment deadlines

Payment of taxes is generally not allowed to be deferred. Taxes are still due by the April deadline, even if an extension to file is granted. US citizens or residents that are out of the country on the April tax filing deadline may automatically defer filing and payment by two months, but interest on the late payment will accrue.[6]

Business vs. Individual Extensions

Businesses and individuals can both request extensions on federal returns, but businesses will use Form 7004. For business and individual tax return extensions, the automatic extension of six months applies only to the tax return itself and not to the payment of any taxes owed.

Form Parts

Form 4868 has two parts — the taxpayer’s identifying information and the tax liability owed.

Part 1 – Identifying Information

The IRS will need the taxpayer’s name(s) (two names for joint returns), address, and social security number(s).

Part 2 – Income Tax Estimation

The IRS asks for an estimation of annual taxes due in addition to the amount already paid, the balance due, and the additional amount being paid.

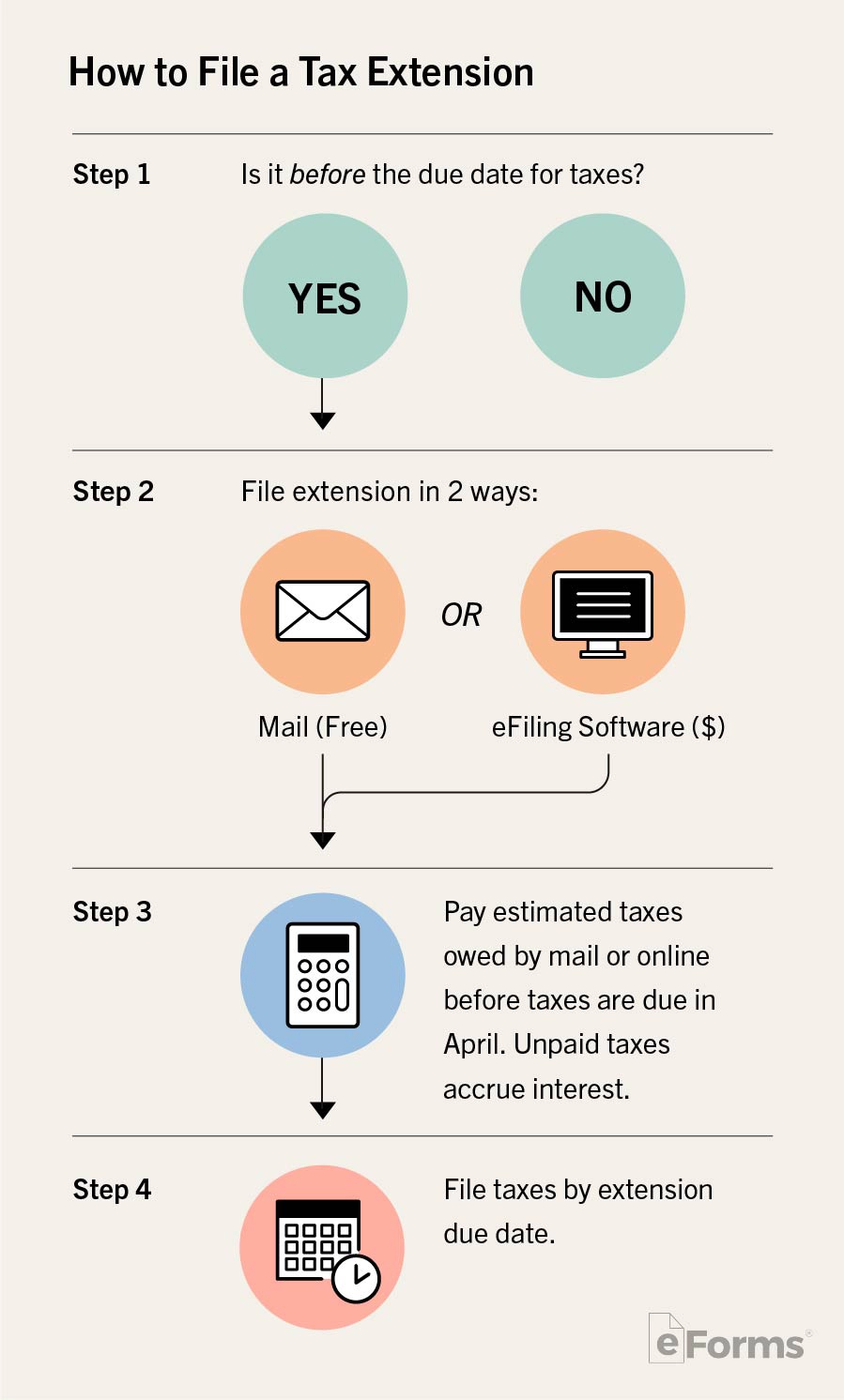

How to File

Filing Form 4868 can be filed by mail or electronically through certain services. Mail filing is free, and the address to send the form depends on the state in which the taxpayer lives and whether or not payment is sent with the form.

By Mail

The process for filing an automatic tax extension by mail depends on the state in which you live.

View the IRS Form 4868 Page 4 for a list of addresses to send the form by state.

eFiling

Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. There is no income limit to using the IRS’s extension software through Free File. Other automatic eFiling software, which typically has an associated cost, include:

FAQs

Does a tax extension mean I get an extension on payment?

No, the IRS still requires payments to be made on time. Payments can be estimated from previous tax returns.

Is the form the same as previous years?

No, here are the previous versions:

What about filing an extension for joint returns?

When entering identifying information, enter both spouses’ names in the order in which they will appear when taxes are filed. On line 2, enter the social that would show first, and on line 3, enter the second ssn.

Does Form 4868 include state taxes?

No, state tax extensions must be requested separately.

What if the deadline has passed?

Form 4868 cannot be used if the filing deadline has already passed. Those who want to ask for an extension to file after the deadline has passed must contact the IRS by phone at 800-829-1040, M – F, 7 a.m. – 7 p.m.

What if I’m out of the country?

U.S. residents or citizen taxpayers out of the country on the date the return is due are allowed an automatic 2-month extension for a tax return due date of June 15th on both filing time and payment without the need to file any request. Interest will still be charged on the two months of nonpayment.

If the taxpayer needs an additional four months of extension, Form 4868 should be filed and box 8 should be checked.