Updated January 23, 2024

A Maryland lease agreement is a contract between a landlord and tenant for the renting of commercial or residential property. The agreement specifies rent amount and each party’s responsibilities during the lease. The landlord will typically run a credit report and verify the tenant’s employment before the parties sign.

Table of Contents |

Agreement Types (7)

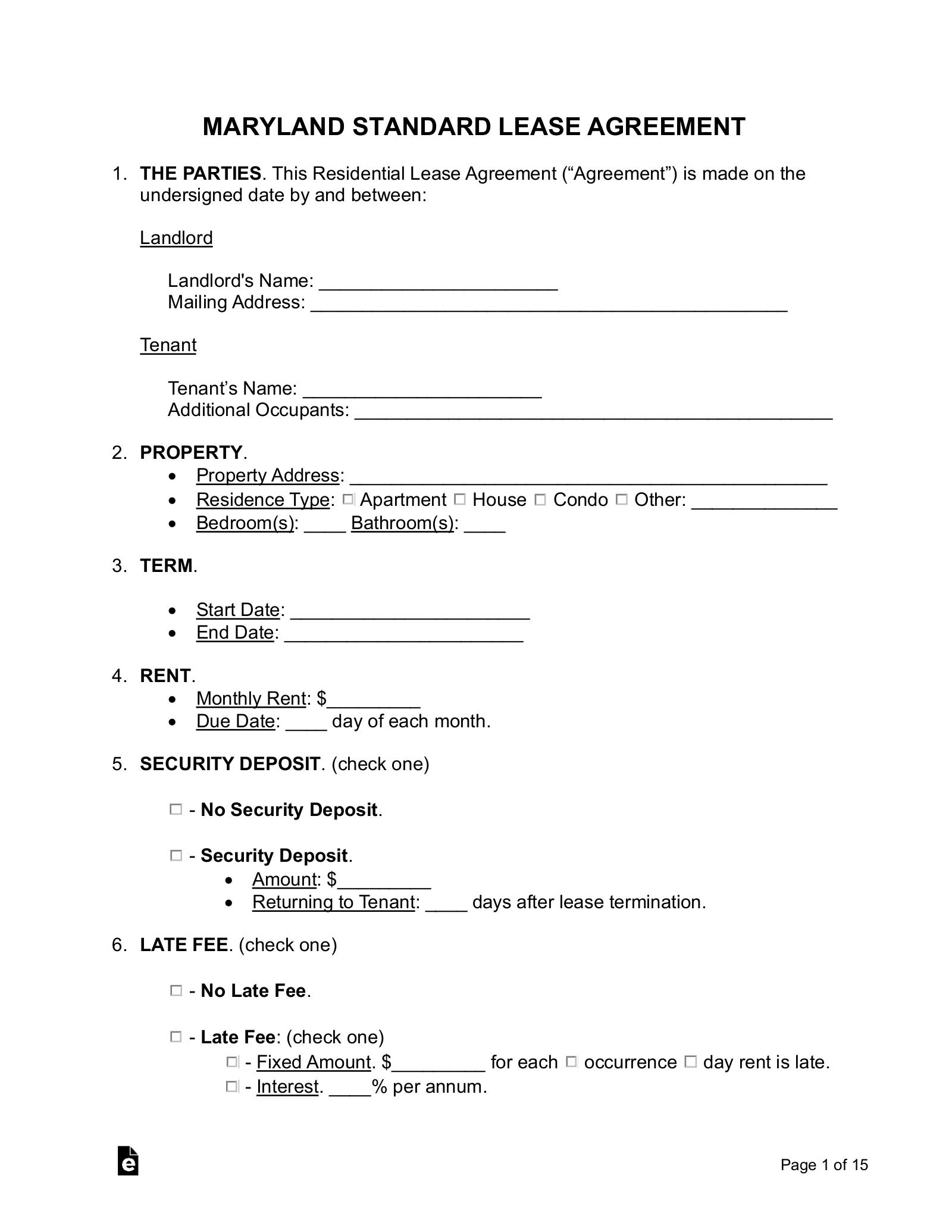

Standard Residential Lease Agreement – To be used for residential tenancies with a start and end date. Standard Residential Lease Agreement – To be used for residential tenancies with a start and end date.

Download: PDF, MS Word, OpenDocument |

Association of Realtors Lease Agreement – For a residential property where a licensed Realtor s facilitating the transaction between a landlord and tenant. Association of Realtors Lease Agreement – For a residential property where a licensed Realtor s facilitating the transaction between a landlord and tenant.

Download: PDF |

Commercial Lease Agreement – For the purpose of a business use such as storage, retail (store), industrial, office, and any other commercial type. Commercial Lease Agreement – For the purpose of a business use such as storage, retail (store), industrial, office, and any other commercial type.

Download: PDF, MS Word, OpenDocument |

Month-to-Month Lease Agreement – Also known as a “tenancy at will,” has a commencement date and must be ended with at least one month’s notice, according to § 8-402. Month-to-Month Lease Agreement – Also known as a “tenancy at will,” has a commencement date and must be ended with at least one month’s notice, according to § 8-402.

Download: PDF, MS Word, OpenDocument |

Rent-to-Own Lease Agreement – Typical residential contract which also has a provision that includes an option to purchase the property. Rent-to-Own Lease Agreement – Typical residential contract which also has a provision that includes an option to purchase the property.

Download: PDF, MS Word, OpenDocument |

Room Rental (Roommate) Agreement – For the individuals in a shared housing arrangement so that they may be able to set parameters around the payment of bills and the usage of common areas. Room Rental (Roommate) Agreement – For the individuals in a shared housing arrangement so that they may be able to set parameters around the payment of bills and the usage of common areas.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – For a tenant seeking to have someone else pay rent in return for letting them live in a residential space for a part of the remainder of their lease term. Sublease Agreement – For a tenant seeking to have someone else pay rent in return for letting them live in a residential space for a part of the remainder of their lease term.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (6)

- Agent/Landlord Identification – The name, address, and number of the landlord and/or the landlord’s authorized agent must be disclosed in the lease or on a posted sign.[1]

- Lead-Based Paint Disclosure – If the residence was built prior to 1978, the landlord must inform the tenant of the potential for dangerous lead within the walls and ceiling.

- Security Deposit Receipt – The landlord must provide the tenant with a receipt for their security deposit.[2] The receipt must also disclose certain rights of the tenant and obligations of the landlord.[3]

- Move-in/Move-out Checklist – The deposit receipt must disclose the tenant’s right to have the unit inspected by the landlord in their presence both at the beginning and the end of their tenancy for the purpose of creating a list of known damages to the unit and determining if any damage was done to the premises by the tenant.[4]

- Habitability – The lease agreement must state that the property will be in a condition that permits habitation and list the tenant’s responsibilities as to heat, electricity, gas, water, and any necessary repairs.[5]

- Ratio Utility Billing System (RUBS) Disclosure (conditional) – If the landlord uses a ratio utility billing system to bill the tenant for one or more utilities, the landlord must provide a written statement that identifies the relevant utilities and provides the average monthly utility bill for all units in the property.[6]

Security Deposits

Maximum Amount – The landlord may ask for a maximum of two months’ rent from a new tenant.[7]

Receipt – The landlord must provide the tenant with a receipt for the security deposit.[2]

Collecting Interest – The landlord is required to hold the security deposit in an interest-bearing account devoted exclusively to security deposits.[8]

Returning – The landlord must return all funds, including interest that the security deposit has accrued, to the tenant within 45 days of the tenancy’s end date.[9]

- Itemized List – If the landlord retains any amount of the security deposit to cover the costs of damages, they must provide an itemized list of damages to the tenant by first-class mail to their last known address within 45 days.[10]

When is Rent Due?

Grace Period – There is no Maryland state law that establishes a grace period for late rent payments. If rent is not paid on the due date established in the lease agreement, the landlord may give a 10-day notice to quit to the tenant.[11]

Maximum Late Fee – The landlord may set a late fee of up to 5% of the monthly rent amount.[12] For weekly rentals, the penalty can be no more than $3 per week or $12 per month.[13]

NSF Fee – $35 is the maximum service fee that can be charged for a dishonored check.[14]

Withholding Rent – If there are defects to a rental unit that pose a serious threat to the life, health, or safety of the tenant, then the tenant may bring an action of rent escrow to pay rent to the court until the defects have been repaired.[15]

Right to Enter (Landlord)

Maryland has no statutes regarding the right of entry by the landlord. However, it is recommended that the landlord give 24 to 48 hours’ written notice to the tenant prior to entry, and schedule their entry to be during regular business hours.

Abandonment

Absence – Maryland state law does not specify the length of time that a tenant must be absent for a rental unit to be considered abandoned.

Breaking the Lease – If the tenant prematurely terminates the lease, the landlord has a duty to mitigate damages resulting from the termination.[16] The landlord may sublet the rental unit, but the original tenant will be secondarily liable for rent for the remainder of the original lease term.[17]

Tenant’s Utility Shutoff – If the tenant’s failure to pay for utilities constitutes a breach of the lease agreement, then the landlord may give 30 days’ notice to the tenant of the landlord’s intention to repossess the property and begin eviction proceedings in the local District Court.[18]

Unclaimed Property – Maryland state law does not require the landlord to store personal property abandoned by the tenant following the termination of the lease.